Unlock Market Opportunities with Pay Later (MTF) – Amplify Your Returns in Momentum Markets!

Did you know that in the past 45 trading days, the NIFTY 50 index delivered more than 1% returns on 7 separate occasions? For a smart investor, these high-momentum days present incredible opportunities to maximize gains—and that’s where Margin Trading Facility (MTF), also known as Pay Later, comes into play.

| Date | Daily Return % |

| 08-Apr-25 | 1.7 |

| 11-Apr-25 | 1.9 |

| 15-Apr-25 | 2.2 |

| 17-Apr-25 | 1.8 |

| 21-Apr-25 | 1.1 |

| 28-Apr-25 | 1.2 |

| 12-May-25 | 3.8 |

Why Let Limited Capital Hold You Back?

With the Navia Pay Later (MTF) facility, you can unlock up to 65% funding instantly on over 1000+ stocks. And the best part? Interest rates start as low as 14.99% per annum (just Rs. 20 per day for every Rs. 50K).

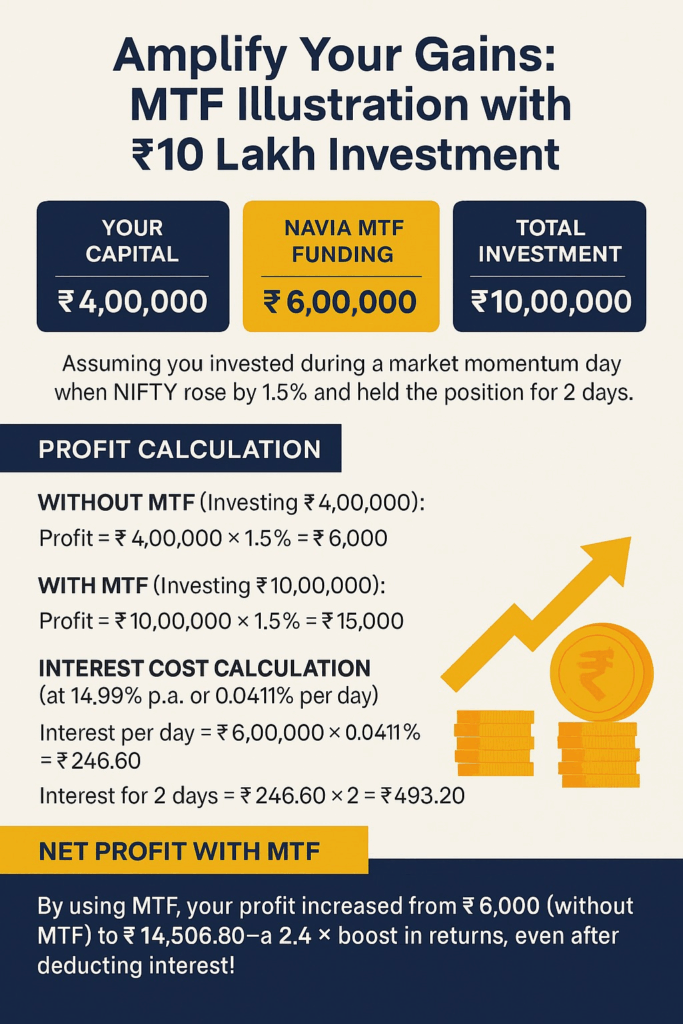

Amplify Your Gains: MTF Illustration with ₹10 Lakh Investment

● Your Capital: ₹4,00,000

● Navia MTF Funding: ₹6,00,000

● Total Investment: ₹10,00,000

Assuming you invested during a market momentum day when NIFTY rose by 1.5% and held the position for 2 days.

Profit Calculation

● Without MTF (Investing ₹4,00,000):

Profit = ₹4,00,000 × 1.5% = ₹6,000

● With MTF (Investing ₹10,00,000):

Profit = ₹10,00,000 × 1.5% = ₹15,000

● Interest Cost Calculation (at 14.99% p.a. or 0.0411% per day)

🠖 Interest per day = ₹6,00,000 × 0.0411% = ₹246.60

🠖 Interest for 2 days = ₹246.60 × 2 = ₹493.20

● Net Profit with MTF

Net Profit = ₹15,000 – ₹493.20 = ₹14,506.80

Result

By using MTF, your profit increased from ₹6,000 (without MTF) to ₹14,506.80—a 2.4x boost in returns, even after deducting interest!

Why Choose Navia Pay Later (MTF)?

🠖 Instant funding with no upfront fees and zero brokerage

🠖 Hold investments as long as you want—unlimited holding period

🠖 One of the lowest interest rates in the industry

🠖 Use pledged shares for ₹0 capital MTF orders

🠖 100% transparency with an MTF ledger

Ready to Supercharge Your Trades?

Take advantage of every market momentum. Start trading smarter, not harder—with Navia Pay Later (MTF).

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.