Union Budget 2024: A New Dawn for Investors

Introduction

The Union Budget 2024 has ushered in optimism and fresh opportunities for investors, marking a significant step toward the vision of New India. With strategic allocations and policy reforms, the budget unveils various avenues for investors to refine their strategies and capitalize on emerging sectors. Here’s a simplified breakdown of the key areas of focus for investors post-budget 2024:

Agricultural Sector

The agricultural sector remains a cornerstone of India’s economy. Innovations in agricultural technologies, sustainable farming practices, and supply chain efficiencies are set to drive growth. Investors should explore agritech startups and companies focusing on enhancing productivity and reducing wastage. The government’s emphasis on rural development and support for farmers is likely to spur demand and innovation in this sector.

Infrastructure Development

A major highlight of the 2024 budget is the allocation of ₹26,000 crores for infrastructure development in Bihar. This investment is expected to enhance the state’s connectivity, industrial growth, and overall economic development. Investors can look into construction companies, infrastructure development firms, and related industries poised to benefit from this substantial funding.

Healthcare Sector

The healthcare sector receives a boost with the budget’s focus on medicines, medical equipment, and exemptions on three critical medicines for cancer patients. This opens up opportunities for investors in pharmaceutical companies, medical equipment manufacturers, and biotech firms. The push for affordable and accessible healthcare is likely to drive innovation and expansion in this sector.

Gold and Silver Investments

The budget has reduced the customs duty on gold and silver from 15% to 6%, making these precious metals more attractive for investors. This reduction is expected to spur demand and investment in gold and silver stocks, ETFs, and related financial instruments. Investors looking to diversify their portfolios should consider adding precious metals to hedge against market volatility and inflation.

Key Tax Changes Affecting Investors

Buyback Gains: No Longer Tax-Free

A significant change introduced in the Union Budget 2024 pertains to the taxation of buyback gains. Previously tax-exempt, buyback proceeds will now be subject to income tax as per the applicable tax slab. Additionally, the cost of shares bought back will no longer be considered a capital loss for tax purposes. Investors need to factor in these changes for overall tax planning and portfolio management.

New Tax Structure

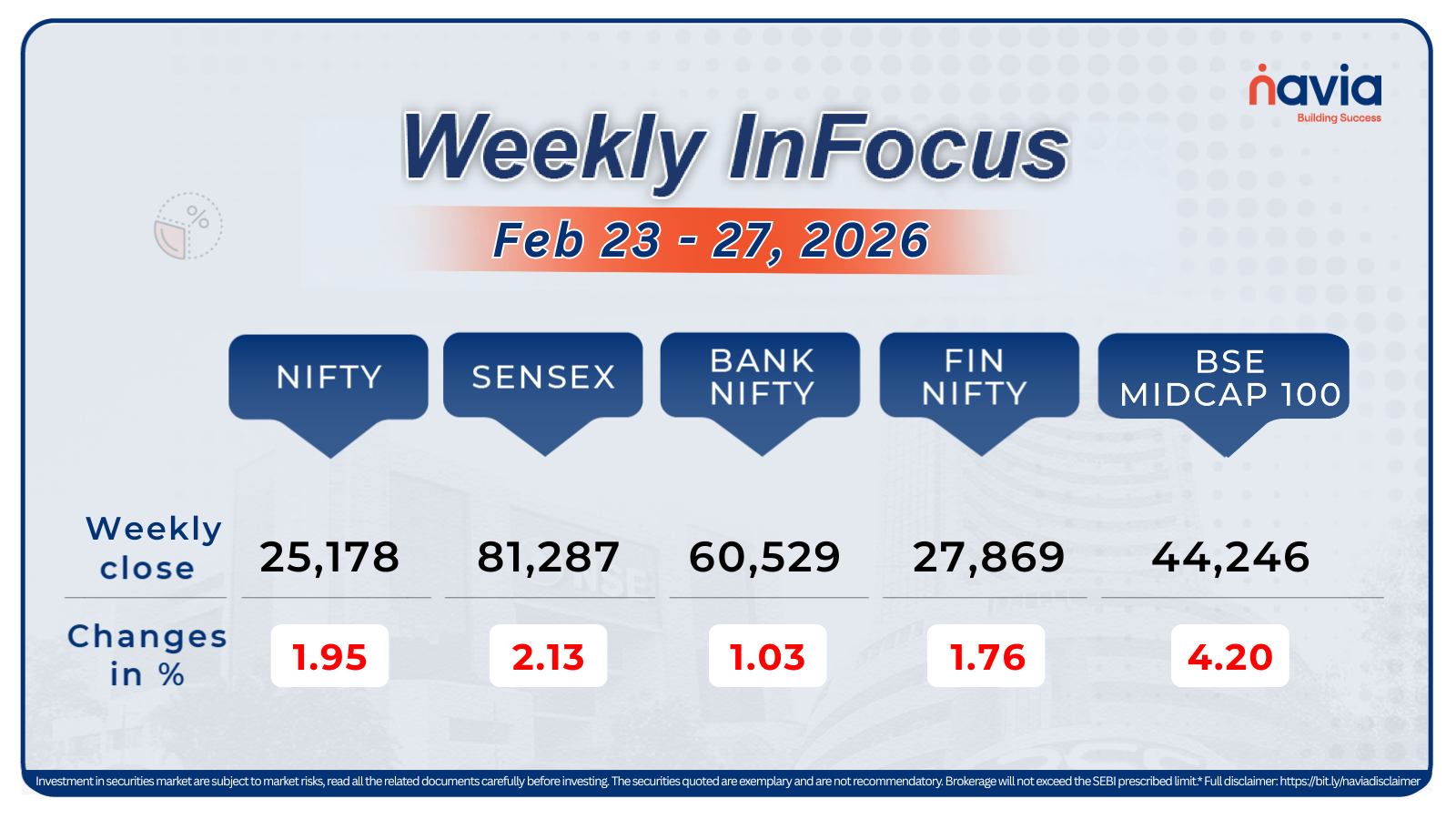

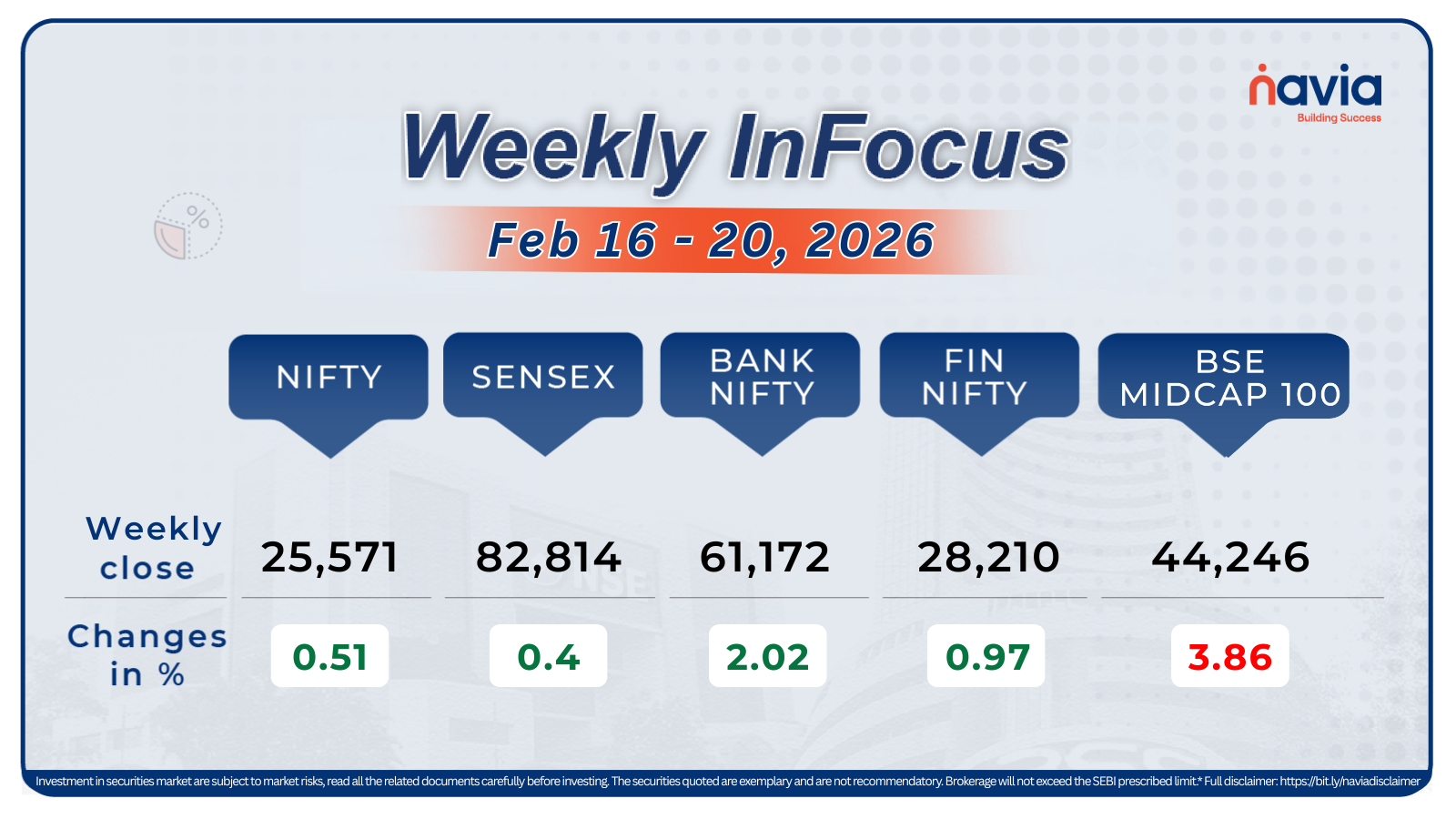

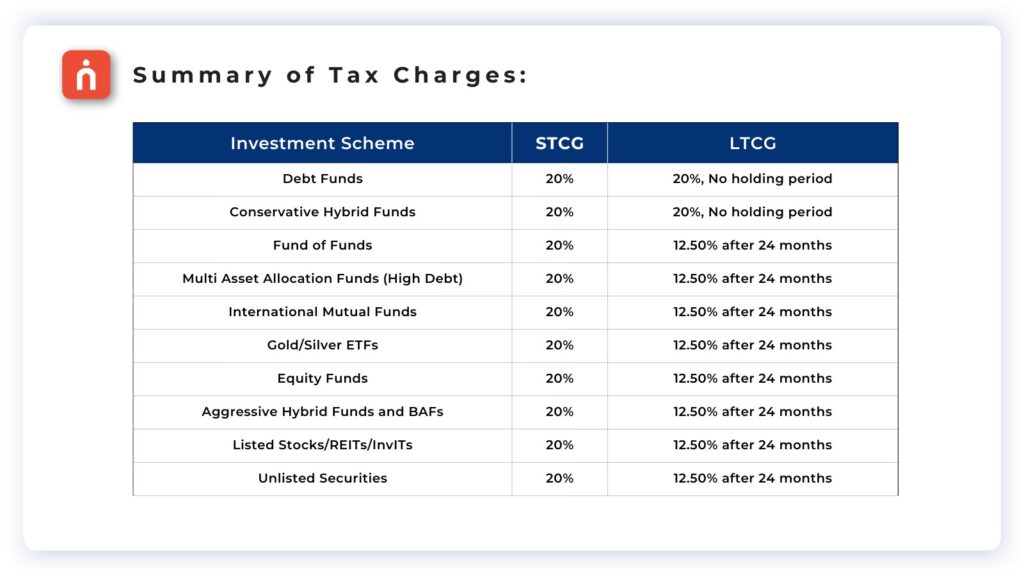

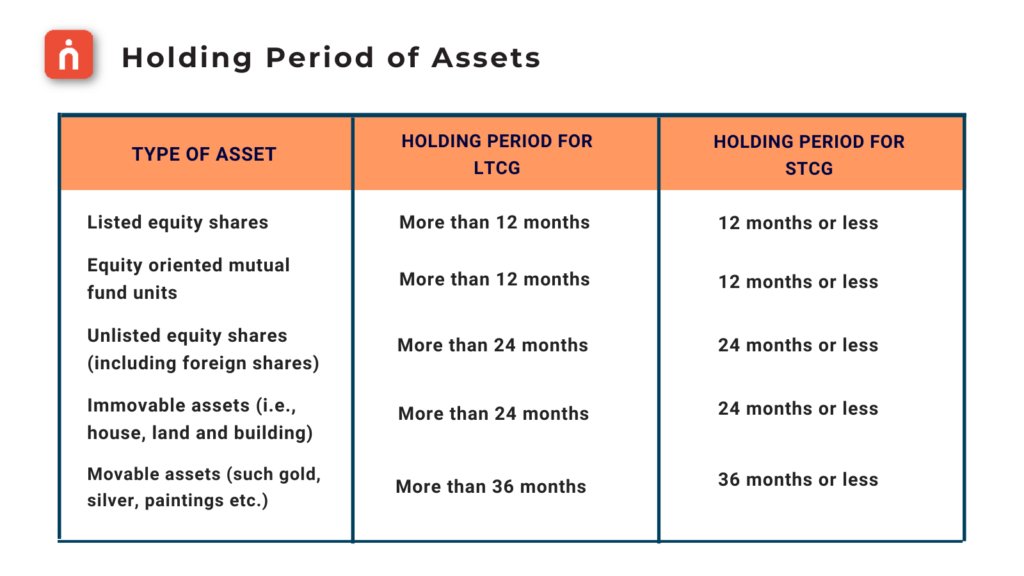

The budget has brought significant changes to short-term capital gains (STCG) and long-term capital gains (LTCG) for various investment schemes. Here’s a quick overview of the new tax structure:

The budget proposes only two holding periods, 12 months and 24 months, to determine whether capital gains are short-term or long-term. This simplifies the capital gains taxation system and aligns holding periods across various asset classes.

Capital Gains Tax: A New Era

The Union Budget 2024 has significantly revamped the capital gains tax landscape with a standardized holding period structure:

🔹 Listed securities: 12 months for LTCG.

🔹 All other assets (including unlisted shares, immovable property, gold): 24 months for LTCG.

This unified approach aims to streamline the tax calculation process. However, the indexation benefit, which allowed taxpayers to adjust the purchase price of an asset for inflation, has been removed for all assets, impacting the overall tax liability on long-term gains.

New vs. Old Tax Regime: Which is Better for You?

The Union Budget 2024 introduced a revamped tax regime with simplified tax slabs and increased standard deductions. The decision to opt for the new regime depends on individual circumstances:

🔸 Income Level: The new regime is generally more advantageous for individuals with lower to moderate incomes. However, high-income earners might find the old regime more beneficial due to the availability of deductions.

🔸 Deductions and Exemptions: If you claim significant deductions such as home loan interest, HRA, or other tax-saving investments, the old regime might be more tax-efficient.

🔸 Financial Planning: Analyze your income, expenses, and tax-saving options to determine which regime aligns better with your financial goals.

The government has provided an option to choose between the new and old tax regimes for the financial year 2024-25. Consulting with a tax professional can provide valuable guidance in navigating the new tax regime.

Wrapping Up

The Union Budget 2024 has set the stage for a prosperous India. Investors who align their strategies with the government’s vision, focusing on sectors like agriculture, infrastructure, healthcare, and precious metals, can capitalize on the emerging opportunities. The new tax regime demands careful planning and expert advice to maximize returns while minimizing tax liabilities. As the economic landscape evolves, investors must stay informed and adaptable to navigate the complexities and seize the rewards of this promising era.

We’d Love to Hear from you