The Bullish Brigade: Charging into Rallies with the Three White Soldiers Pattern

- What is the Three White Soldiers Pattern?

- Anatomy of the Three White Soldiers Pattern

- Psychology of the Three White Soldiers Candlestick Pattern

- Execution of the Three White Soldiers Pattern

- Conclusion: Rallying with Confidence

- Frequently Asked Questions

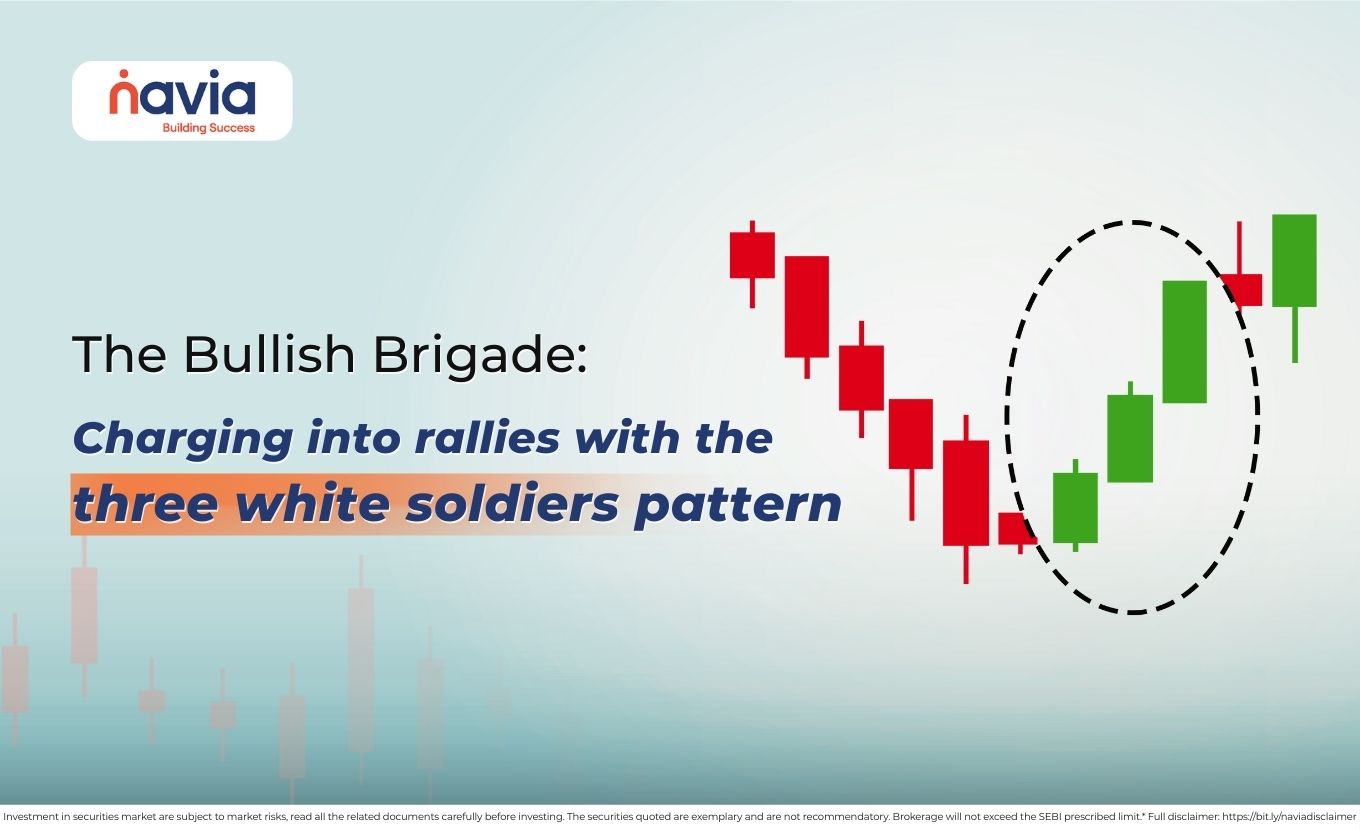

In this era, traders are looking for definitive proof that a market trend is changing direction. After a period of decline, few signals are as robust and visually commanding as the three white soldiers pattern. It is like a market announcement that tells the bears have retreated and sustained period of buying strength has begun. For the investors who looks to enter the market near the bottom or the traders who seeks confirmation of a trend reversal, recognizing the three white soldiers pattern is crucial.

This guide will breakdown the three white soldiers candlestick pattern, detailing its formation, explaining the market psychology and outlining a strategic approach to trading this highly reliable bullish signal.

What is the Three White Soldiers Pattern?

The three white soldiers pattern is a reliable bullish reversal signal, this three-candle pattern that forms primarily at the bottom of an established downtrend or after a period of consolidation. The pattern signals a major shift in market control, indicated the buyers have taken command of the price action and are successfully driving prices higher for three consecutive periods.

This strong visual confirmation informs that the market is transitioning from bearishness to a renewed uptrend. The 3 white soldiers pattern considered a valid and highly effective confirmation of bullish reversal of the market. If this pattern appears mid-trend, its significance as a reversal signal is diminished.

Anatomy of the Three White Soldiers Pattern

The structure of the three white soldiers pattern is a simple, yet highly precise. That consists of three successive long-bodies bullish candlestick (white or green), each has the following characteristics:

| Three Consecutive Bullish Candles | The pattern is defined by three long-bodied bullish candles. It means the closing price is higher than the open price for each period. |

| Progressively Higher Closes | Each of the three bullish candles must close progressively higher than the previous day’s close. It shows upward pressure and increasing bullish conviction across all three sessions. |

| Opens Within the Previous Real Body | Each candle opens within the real body of the preceding candle. It’s a critical sign that indicates that any attempt by the sellers to push the price lower at the start of the session was quickly overwhelmed by buyers. |

| Small or Non-Existent Wicks | These candles have small or non-existent upper and lower wicks. That signifies the buying pressure dominated the entire session, pushing the price from the open near the low straight up to the close near the high. |

Psychology of the Three White Soldiers Candlestick Pattern

The sequence of the three white soldiers candlestick pattern tells a compelling psychological story of the market’s complete turnaround:

First Soldier (The Stand)

After a downtrend, a strong bullish candle forms here. It is the first signal that buyers are stepping in with conviction, perhaps covering short positions. Sellers may dismiss this as a temporary blip or short covering.

Second Soldier (The Advance)

The second bullish candle closes higher than the first, here is the momentum begins to build. Institutional money often enters here, recognizing the end of the selling phase. This confirms that the reversal is serious.

Third Soldier (The Victory)

It removes all remaining doubt; buyers aggressively push the price up and resulting in a strong close. This overwhelming price action causes any remaining bearish traders to capitulate, fueling the rally even further.

This effect of the three strong candles, continuous buying days signifies that the momentum has shifted, establishing a strong base for a new uptrend.

Execution of the Three White Soldiers Pattern

The 3 white soldiers pattern is a reliable signal but to execute it to your trading journey requires precise entry and strict risk management.

| Context and Confirmation | Locate the three-candle three white soldiers pattern that following a clear downtrend. Since the pattern is very strong, the primary confirmation lies in the fourth candle continuing the bullish momentum. |

| Entry and Stop-Loss | Entry: Enter a long (buy) position when the price breaks and closes above the high of the third soldier. Stop-Loss: Place your stop-loss order slightly below the low of the first soldier. This point represents the lowest price reached during the reversal phase; if the price falls below this, the entire bullish signal is invalidated, and the downtrend may resume. Take Profit: Target the nearest significant resistance level from prior price action to ride the potential uptrend for maximum profit. |

Conclusion: Rallying with Confidence

The three white soldiers pattern is more than just a visual formation, it’s clear narrative of aggressive buyer dominance taking root after a period of market pain. By identifying the 3 white soldiers pattern, confirming its strength with volume and price action and apply your risk management plan will help yourself to identifying and capitalizing on major market reversals.

Let the bullish brigade leads your portfolio to new highs!

Do You Find This Interesting?

Frequently Asked Questions

What is the pattern of the three white soldiers?

The Three White Soldiers pattern is a strong bullish reversal signal consisting of three consecutive long-bodied bullish (green or white) candlesticks. Each candle must meet three specific criteria:

➤ Each candle closes progressively higher than the previous day’s close.

➤ Each candle opens within the real body of the preceding candle.

➤ The candles have small or non-existent wicks, indicating strong buyer control throughout each session.

What is the psychology behind 3 white soldiers?

The psychology behind the 3 white soldiers reflects a complete market capitulation by sellers and a confident takeover by buyers:

Day 1: Shows the first sign of strength, often short-covering or value buying after a downtrend.

Day 2: Confirms institutional buying, as the price is strongly rejected at the open and pushed higher, signaling a serious reversal.

Day 3: Represents the final victory, where remaining bearish traders give up (capitulate), leading to a high-conviction rally and the establishment of a new uptrend.

What is the difference between 3 white soldiers and 3 black crows?

The Three White Soldiers and Three Black Crows patterns are exact opposites, signaling reversals in different contexts:

| Feature | Three White Soldiers (Bullish) | Three Black Crows (Bearish) |

| Market Context | Forms at the bottom of a downtrend. | Forms at the top of an uptrend. |

| Candle Color | Three consecutive Bullish (Green/White) candles. | Three consecutive Bearish (Red/Black) candles. |

| Signal | Strong Buying Reversal. | Strong Selling Reversal. |

What timeframe is best for three white soldiers?

The Three White Soldiers pattern is most reliable when viewed on longer timeframes, such as the Daily or Weekly charts. On these longer charts, the pattern carries more weight, as it represents three full periods of sustained, committed buying pressure.

What is the success rate of the three white soldiers pattern?

The Three White Soldiers pattern is one of the most highly rated and high-reliability reversal patterns in technical analysis. While specific success rates vary, its reliability is considered very high, especially when it is confirmed by high trading volume and forms at a major support level.

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.