The Reversal Powerhouse: Mastering the Three Outside Up Pattern

- What is the Three Outside Up Candlestick Pattern?

- The Psychology: Why It Works

- The Bearish Counterpart: Three Outside Down Candlestick Pattern

- Trading Strategies for Maximum Gains with Three Outside Up Candlestick Pattern

- Difference Between Three Outside Up and Three Inside Up

- Common Mistakes to Avoid

- Conclusion

- Frequently Asked Questions

All the traders who are always looking for signals that move beyond mere “hints” and provide actual confirmation. So, many start their trading journey with basic patterns like Engulfing candle, but the experienced participants in 2026 know that the real edge lies in multi-candle formations.

Let’s see the most potent weapons of trader to spot the end of a bearish trend is the three outside up candle pattern. This formation is a high-conviction signal that doesn’t suggest only a bounce; it provides the bulls have physically overwhelmed the bears. This blog will help you understand the pattern that will guide your journey.

What is the Three Outside Up Candlestick Pattern?

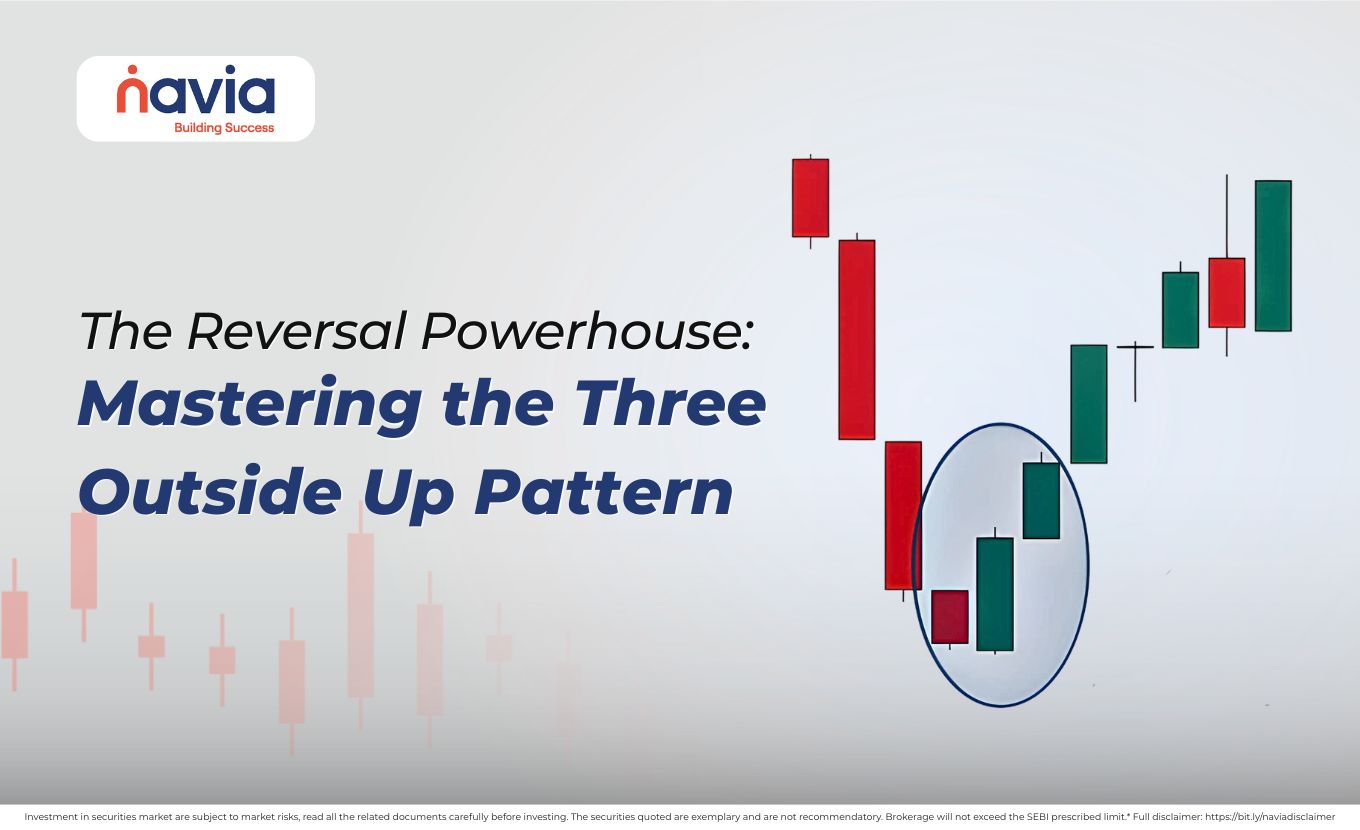

The three outside up candlestick pattern is a three-candle bullish reversal formation that typically marks the “V-shaped” bottom of a downtrend. It considered an extension and a confirmation of the classic Bullish Engulfing pattern.

Identifying this pattern is a little bit difficult; you need to observe three distinct phases to identify a valid three outside candlestick pattern.

| The Bearish Tail-End | The first candle is a small bearish (red/black) candle that appears at the end of a downtrend. It represents the last gasps of the selling pressure. |

| The Bullish Engulfing | The second candle is a large bullish (green/white) candle that completely “engulfs” the body of the first candle. This shows a massive surge in buying volumes. |

| The Confirmation | The third candle is another bullish candle that closes higher than the second candle. This confirms that the momentum is sustainable and not just a “dead cat bounce.” |

The Psychology: Why It Works

The journey with the three outside up candlestick pattern lies in the story it tells about market participants.

On the Day 1, the bears are in control, but their power is fading

On Day 2, the bulls staged a massive coup. By opening lower but closing significantly higher than the previous day’s opening, the bulls have effectively “trapped” everyone who was shorting the stock.

By Day 3, when the price closes even higher, those trapped shorts are forced to buy back their positions to cover losses, while “momentum buyers” jump in. It creates a feedback loop of buying pressure that often leads to a sustained rally.

The Bearish Counterpart: Three Outside Down Candlestick Pattern

If you want to be a balanced trader, you must recognize when the trend is about to collapse. The mirror images of the bullish signal are the three outside candlestick patterns. This will appear at the peak of an uptrend and signals a major trend reversal to the downside:

🔸Candle 1: A small bullish candle

🔸Candle 2: A large bearish candle that engulfs the first

🔸Candle 3: A third bearish candle that closes lower than the second, confirming the new downtrend.

Spotting this three outside down candlestick pattern can protect your profits, that tells you that the “smart money” is dumping shares and the upward momentum has officially broken.

Trading Strategies for Maximum Gains with Three Outside Up Candlestick Pattern

To successfully trade the three outside up candle pattern, you need a disciplined approach, here is how professional traders execute the signal (educational purpose only):

| Look for Confluence | A three outside candlestick pattern is strong, but it is “God-tier” when it occurs at a major support level, a Fibonacci retracement level, or near the Anchored VWAP. If the pattern forms where the average buyer’s cost basis is already being defended, the probability of success skyrockets. |

| Volume is the Secret Sauce | The second candle (the engulfing one) should ideally be backed by a significant spike in volume. High volume on the “engulfing” day proves that institutional “whales” are the ones doing the buying, not just retail traders. |

| Entry and Stop-Loss | Entry: Place your “Buy Stop” slightly above the top of the third candle. Stop-Loss: To protect your capital, place a stop-loss just below the low of the second (large engulfing) candle. |

Difference Between Three Outside Up and Three Inside Up

| Features | Three Inside Up | Three Outside Up |

|---|---|---|

| Core Pattern | Built on a Bullish Harami (Day 2 is “inside” Day 1). | Built on Bullish Engulfing (Day 2 “outside” Day 1). |

| Candle Size | The second candle is smaller than the first bearish candle. | The second candle is larger than the first bearish candle. |

| Psychology | Represents a pause or halt in the downtrend; selling simply stops. | Represents a dominant takeover; buyers aggressively overwhelm sellers. |

| Momentum | A more conservative, gradual reversal signal. | A more aggressive, high-momentum reversal signal. |

| Visual Shape | Day 2 looks “tucked away” within the range of Day 1. | Day 2 “swallows” or covers the entire range of Day 1. |

Common Mistakes to Avoid

✔ This pattern is a reversal signal. If the market is moving sideways, the “engulfing” action is often just random price noise and doesn’t lead to a sustained breakout.

✔ The “Outside Up” name requires the third candle to close above the second. Many traders enter as soon as they see the Day 2 engulfing candle, only to see Day 3 reverse back down. Never skip the confirmation.

✔ A true institutional reversal usually shows a significant “volume swell” on the second or third day. If the pattern forms at very low volume, it is likely a “bull trap” caused by a lack of sellers rather than an influx of strong buyers.

✔ A 15-minute Three Outside Up might look great, but if the Daily chart is in a massive crash, that small reversal will likely fail. Always ensure the pattern isn’t fighting against a much larger overhead resistance.

✔ No pattern is 100% accurate. Always use a stop-loss to ensure a single bad trade doesn’t wipe out your account.

Conclusion

The three outside up candle pattern is the most visually clear and psychologically sound pattern in technical analysis. So, understanding the shift from bear exhaustion to bull dominance, you can enter trades with a level of confidence that signal-candle patterns simply cannot provide.

If you are looking for long-term investments or quick swing trades, keep an eye out for the “outside” engulfing move. It is often the first signal of a new bull market beginning.

Do You Find This Interesting?

Frequently Asked Questions

What does the three outside candlestick pattern mean?

The three outside candlestick pattern (specifically the “Three Outside Up”) is a bullish reversal signal that confirms a shift in momentum. It consists of a small bearish candle, followed by a large bullish candle that “engulfs” the first, and a third bullish candle that closes higher than the second. It means that buyers have not only stopped the decline but have aggressively overwhelmed the sellers, signaling the start of a new uptrend.

What is the three upward candlestick pattern?

While “three upward” is a general term, it usually refers to the Three White Soldiers. This is a bullish reversal pattern consisting of three consecutive long-bodied green candles that each open within the previous candle’s body and close higher than the previous high. It represents a steady, powerful takeover by the bulls with very little resistance from sellers.

How to trade three inside up candlestick patterns?

To trade this pattern effectively, follow these three steps:

➣ Identification: Wait for a small green candle to form inside the range of a large red candle at the bottom of a downtrend.

➣ Entry: Place a buy order only when the third candle closes above the high of the first (large red) candle.

➣ Risk Management: Place your stop-loss just below the low of the first candle in the pattern to protect against a trend of continuation.

What is the 3 candle rule in trading?

The 3-candle rule is a discipline-based strategy used to avoid “fakeouts.” It states that a trader should wait for three consecutive candles to close in the direction of a breakout or reversal before entering a position.

☆ Candle 1: The breakout/signal candle.

☆ Candle 2: The “hold” candle that stays above the breakout level.

☆ Candle 3: The “confirmation” candle that proves the move is sustainable.

What does a triple top candle mean?

A triple top is a bearish reversal pattern that looks like three nearly equal peaks. It means that the price has reached a “ceiling” (resistance level) three times and failed to break through. It signals that buyers are exhausted and that the “smart money” is likely starting to sell, often leading to a significant price drop once the “neckline” (the low point between the peaks) is broken.

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.