Unlocking the Potential of REITs: A Gateway to Income-Generating Real Estate in India and Beyond

Real Estate Investment Trusts (REITs) offer investors an opportunity to invest in income-generating real estate without directly owning property. They are structured as companies that own, manage, or finance properties and distribute the rental or mortgage income to their shareholders.

What is a REIT?

A REIT is a special legal entity that owns and manages real estate assets. These assets can include commercial properties like office buildings, shopping malls, warehouses, and even hospitals. REITs were first introduced in the United States in 1960 to enable individual investors to invest in real estate portfolios. Over the course of the following 60-plus years, the U.S. REIT model has encouraged broad-based real estate investment. Today, 150 million Americans, or 45% of American households, have REIT investments.

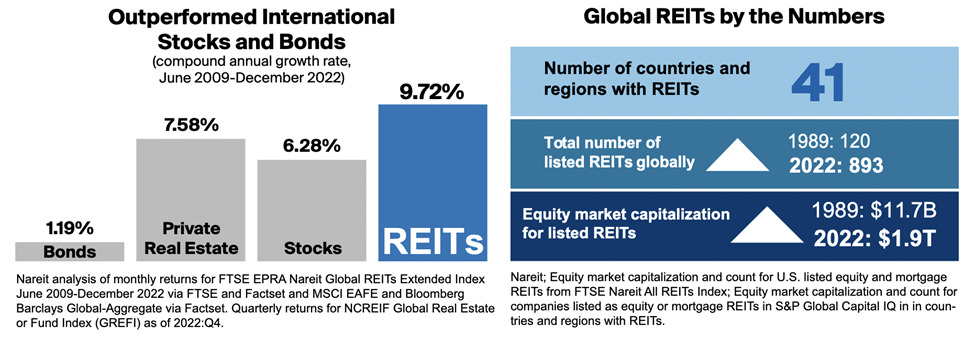

Today, REITs are available in at least 41 countries, including India which introduced REIT in 2016, where they contribute to economic growth and infrastructure development.

REITs operate with certain rules:

Investment Focus: At least 80% of a REIT’s assets must be in income-producing real estate.

Income Generation: They must generate at least 75% of their income from rent or mortgage payments.

Dividend Distribution: REITs are required to distribute at least 90% of their income to investors as dividends.

In exchange for following these rules, REITs pay no corporate tax, and instead, shareholders are taxed on the dividends they receive.

REITs in India

The Securities and Exchange Board of India (SEBI) and the Ministry of Finance guide the Indian REITs Association, a non-profit organization that oversees REITs in India. SEBI also regulates small and medium REITs in India

India’s REIT market is relatively new, with the first REIT, Embassy Office Parks, being listed in 2019. Here are some of the basic rules for REITs in India:

🔶 Investment: At least 80% of a REIT’s investments must be in rent-generating properties, and up to 20% can be in stocks, bonds, or under-construction commercial property.

🔶 Distribution: 90% of the rental income must be distributed to unitholders every six months.

🔶 Listing Requirement: REITs must be listed on stock exchanges.

🔶 Asset Base: A REIT must have a minimum asset base of ₹500 crores.

🔶 NAV: Net Asset Values (NAVs) must be updated twice a year.

🔶 Governance: The sponsor, manager, and trustee must be separate entities with no connections to each other.

🔶 REIT taxation: REIT units are taxed at 10% for long-term capital gains and 15% for short-term capital gains.

India’s REIT market has grown steadily, and here are some of the prominent REITs listed

1. Embassy Office Parks REIT

This was the first listed REIT in India and focuses primarily on commercial office spaces. It owns a portfolio of office parks and buildings spread across cities like Bengaluru, Mumbai, Pune, and NCR.

2. Mindspace Business Parks REIT

Launched in 2020, Mindspace REIT owns and operates office spaces, including business parks across major urban centers in India. It is known for its high-quality office properties in cities like Mumbai, Pune, Hyderabad, and Chennai.

3. Brookfield India Real Estate Trust

This REIT was listed in 2021 and focuses on commercial properties. It owns office spaces in major cities, including Mumbai, Gurugram, and Kolkata.

The Global REIT Industry- REIT.com

Types of REITs Internationally

REITs across the world tend to specialize in specific types of real estate. Here are the main types:

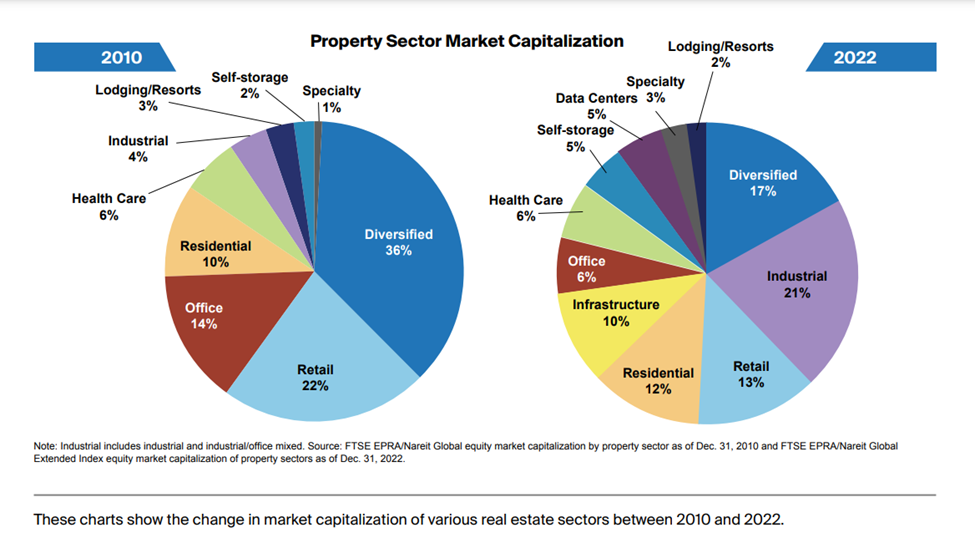

1. Industrial REITs

These REITs invest in industrial facilities, mainly warehouses and distribution centers. With the growth of e-commerce, industrial REITs have seen significant demand, as they cater to logistics and supply chain needs. For example, Prologis, the world’s largest REIT by market cap, invests in modern distribution centers globally.

2. Residential REITs

These REITs focus on residential properties like apartment buildings, single-family homes, and student housing. They are particularly sensitive to population and economic trends.

3. Retail REITs

Retail REITs operate shopping malls, outlets, and other retail spaces. Although they have been affected by the rise of e-commerce, they remain a large part of the REIT sector in many countries.

4. Office REITs

Office REITs invest in commercial real estate, like office buildings in urban centers. They have been impacted by the work-from-home trend but still hold significant value in prime locations.

5. Healthcare REITs

These REITs invest in healthcare facilities like hospitals, clinics, and senior living communities. With increasing healthcare spending and long-term leases, this sector has been relatively stable.

6. Hotel and Resort REITs

These REITs invest in properties catering to tourists and business travelers. Their performance varies based on the assets they own, and they are sensitive to global travel trends.

7. Specialized REITs

Some REITs focus on niche real estate sectors, such as:

🔸Data Center REITs: Benefiting from the growth of cloud computing and AI, data center REITs like Equinix and Digital Realty Trust are becoming increasingly popular.

🔸Telecommunication REITs: These REITs own the infrastructure for communication networks, including cell towers.

🔸Self-Storage REITs: These are known for being lucrative due to low operating costs and high rental demand.

🔸Timberland, Casinos, and Infrastructure REITs: Other specialized REITs focus on industries like timber, entertainment, pipelines, and infrastructure development.

8. Diversified REITs

As the name suggests, diversified REITs invest in a variety of property types. While some REITs focus on a single type of real estate, diversified REITs spread their investments across different sectors to balance risk and returns.

| Pros | Cons |

| Regular Income | Market Risk |

| REITs typically pay high dividends, providing a steady income stream. | REIT prices can fluctuate based on market conditions, affecting returns. |

| Diversification | Interest Rate Sensitivity |

| Investing in REITs allows for exposure to a diversified real estate portfolio without direct ownership. | REITs can be sensitive to interest rate changes, impacting their performance. |

| Liquidity | Management Fees |

| REITs are traded on stock exchanges, making them easier to buy and sell compared to physical properties. | Many REITs have management fees that can reduce overall returns. |

| Professional Management | Sector-Specific Risks |

| REITs are managed by professionals with expertise in real estate, reducing the burden on individual investors. | Different types of REITs (e.g., retail, office) may face unique challenges, impacting performance. |

| Inflation Hedge | Regulatory Risks |

| REITs may provide a hedge against inflation as property values and rents typically rise over time. | Changes in regulations can impact REIT operations and profitability. |

Why Invest in REITs?

REITs offer investors several benefits, especially in a low-interest-rate environment:

🔷 Regular Income: REITs are required to distribute at least 90% of their income as dividends, making them an attractive option for investors seeking steady cash flow.

🔷 Diversification: Investing in REITs allows investors to diversify their portfolio by gaining exposure to real estate without directly owning physical property.

🔷 Liquidity: Unlike real estate properties, which can be illiquid, REITs are traded on stock exchanges, making them easy to buy and sell.

As interest rates trend lower, REITs become an attractive option for investors looking for higher returns than those offered by bonds or money market funds. With India’s growing urbanization and real estate development, REITs are poised to play a significant role in the country’s economic growth.

In conclusion, REITs provide a gateway for investors to tap into the real estate sector while enjoying regular income and capital appreciation. Whether you’re looking at the Indian REIT market or exploring international options, there’s a REIT for every type of investor.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.