November Market Recap: Top Trends of the Month

This November, the stock market buzzed with action, and Navia was right in the thick of it! From market movers to key trends shaping the game, we’ve wrapped up all the highlights you need to stay ahead. Ready to dive into the numbers and insights that matter?

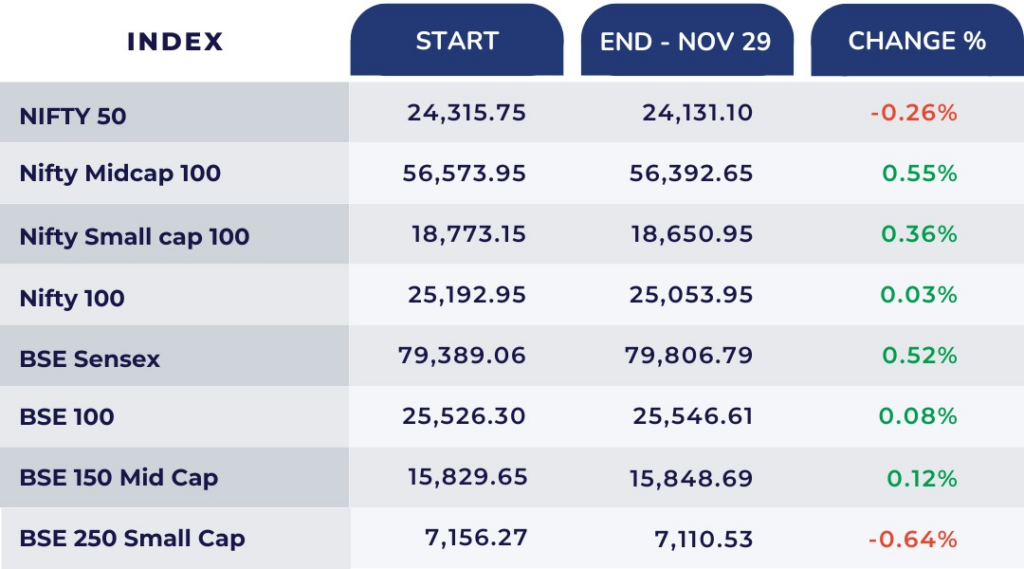

Nifty 50 Performance in November

November Market Roundup: Key Highlights

1. Flat Market Performance:

The Nifty ended November nearly flat, down less than 1%, amid persistent volatility.

2. Key Drivers of Volatility:

🠖 Global Factors: Donald Trump’s election win fueled concerns over trade tensions, a stronger dollar, and global asset reallocation.

🠖 FII Selling: Heavy outflows from Foreign Institutional Investors (FIIs) due to global shifts and rising U.S. bond yields

🠖 Earnings Disappointment: India Inc’s Q2FY25 earnings showed the slowest profit growth since June 2020, dampening investor sentiment.

3. Overvaluation Concerns:

A mismatch between high valuations and subdued earnings growth, combined with geopolitical tensions, pushed markets into bearish territory.

4. Adani Group Impact:

Recent corporate setbacks, including the Adani chairman’s indictment, further weighed on sentiment.

5. U.S. Policy Shifts and Impact:

Trump’s policies are expected to prioritize U.S. growth, attracting investments to the U.S. and posing challenges for India’s export-driven sectors.

6. Weakening Rupee:

The Indian rupee hit a record low of 84.4 against the U.S. dollar, complicating inflation control and accelerating FII outflows.

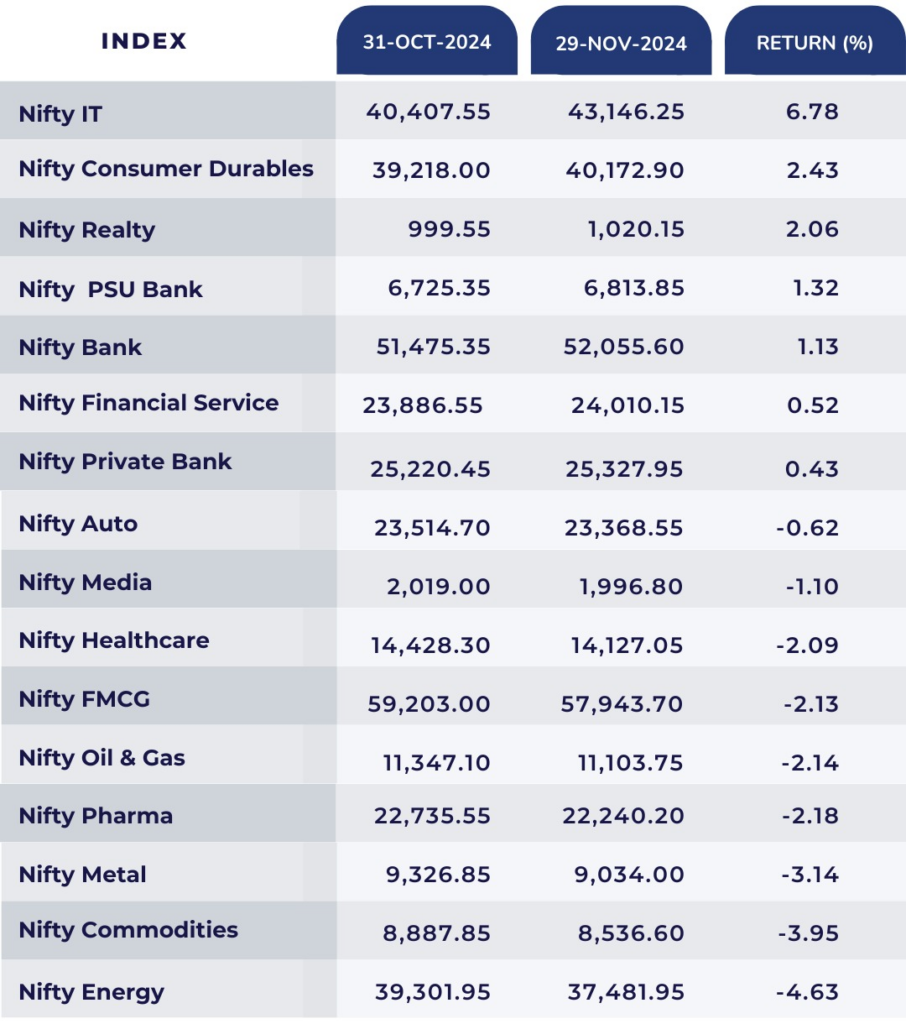

Sectoral Movements

Nifty IT and Nifty Consumer Durables were among the best-performing sectors, while Pharma, Metals, Commodities, and Energy were the worst-performing sectors.

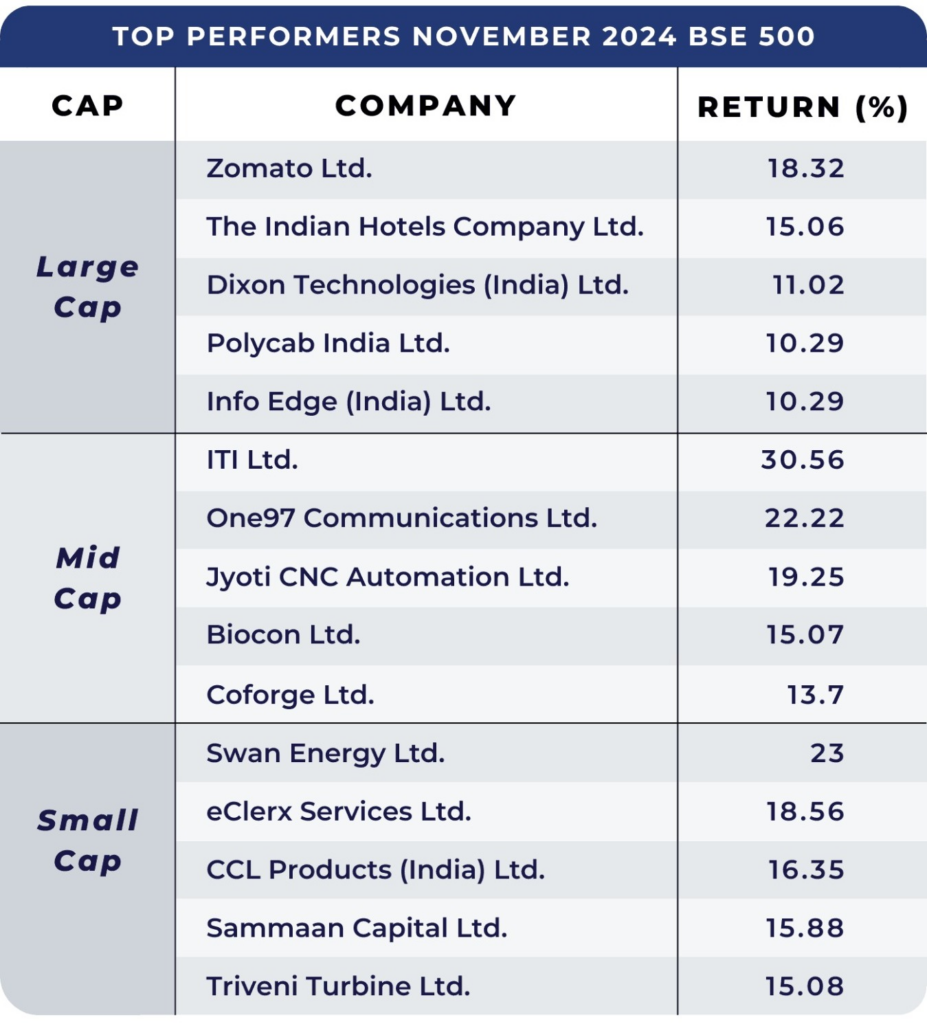

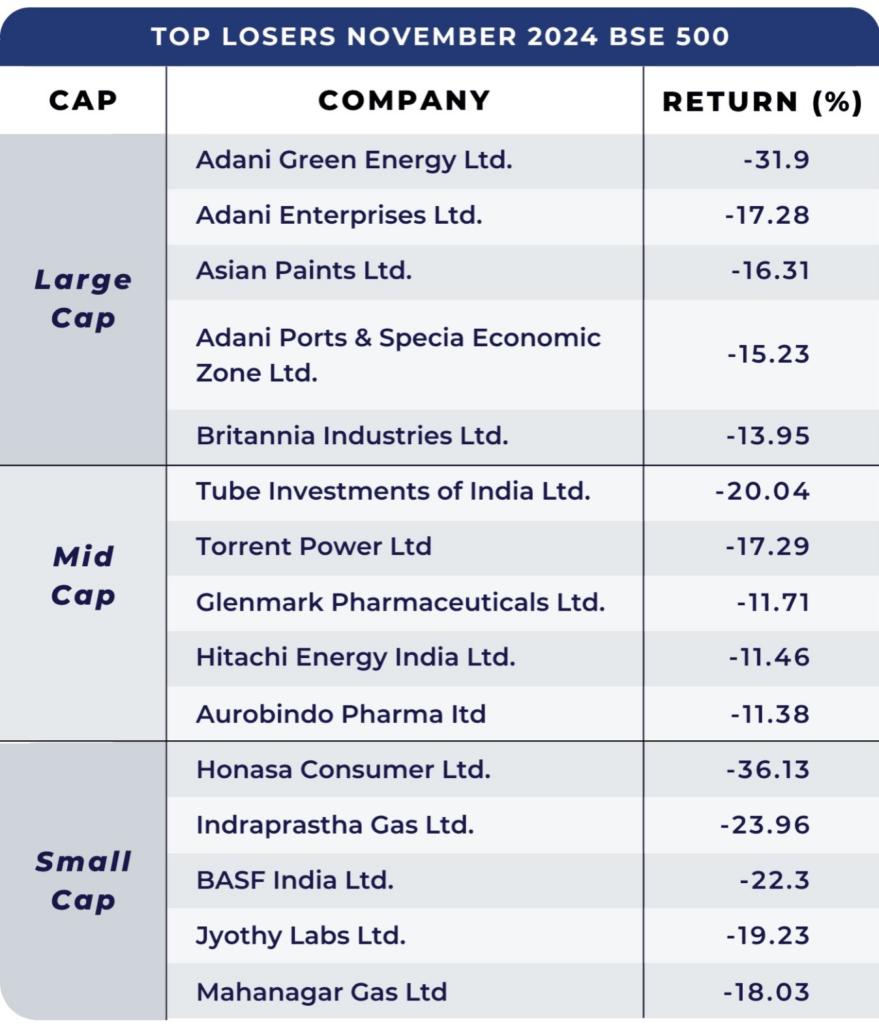

Company Performance

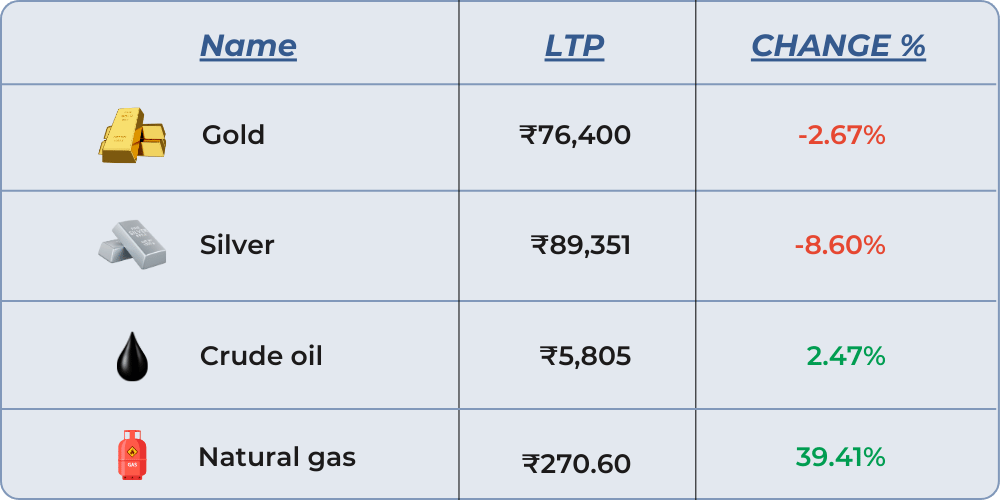

Commodities Month’s Change

IPO Performance – November

November’s IPO market featured 8 listings, with 5 delivering gains and 3 seeing minor losses, showcasing strong momentum and making it a successful month for IPOs.

New NFO’s open

🔸 Hdfc Nifty India Digital Index Fund Direct – (G) 22 Nov – 06 Dec 2024

🔸 Axis Momentum Fund – Direct plan – (G) 22 Nov – 06 Dec 2024

🔸 Kotak Transporation & Logistics Fund – Direct Plan- (G) 25 Nov – 09 Dec 2024

🔸 Groww Multicap Fund – Direct (G) 26 Nov – 10 Dec 2024

🔸 Motilal Oswal Nifty Capital Market Index Fund-Dir (G) 26 Nov – 10 Dec 2024

🔸 DSP Business Cycle Fund – Direct (G) 27 Nov – 11 Dec 2024

Top Blogs – Navia

1. Understanding the Flag Pattern in Technical Analysis

2. Understanding the Inverse Head and Shoulders Chart Pattern: A Comprehensive Guide

3. Understanding the Rectangle Pattern in Technical Analysis

4. A Comprehensive Guide to Investing in JUNIOR BEES ETF

5. A Comprehensive Guide to Investing in Nifty Midcap 150 BeES ETF

6. Debunking Stock Market Myths: Separating Fact from Fiction

7. Simplifying NRI Repatriation of Funds – A Comprehensive Guide

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.