Navia Weekly Roundup (SEP 02 – SEP 06, 2024)

Week in the Review

NIFTY and SENSEX closed in the red in three out of five sessions. Benchmark indices halted their three-week winning run, settling lower by around 1.5% this week. Indian stock markets were influenced by global trends due to lack of domestic triggers.

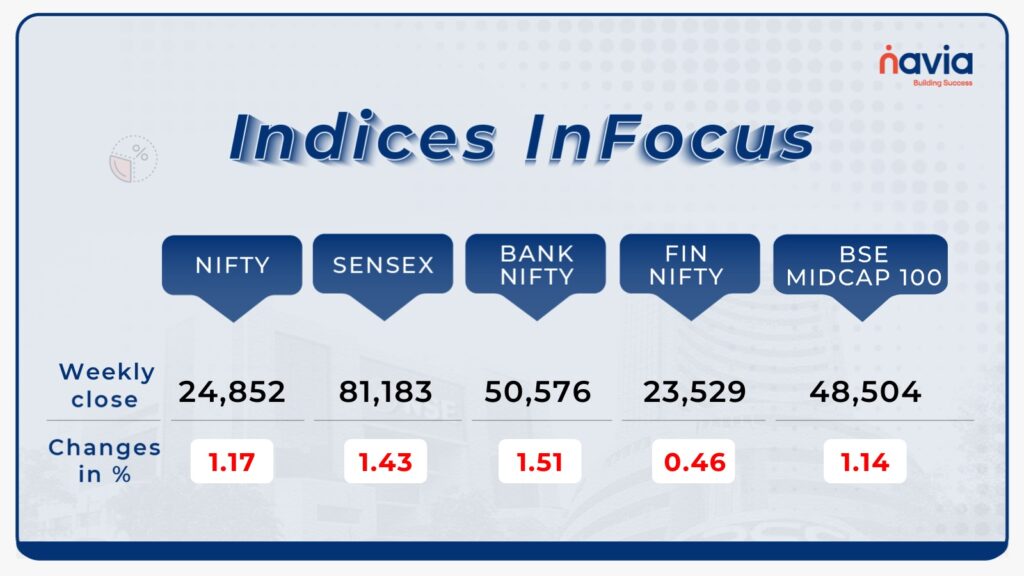

Indices Analysis

Indian markets ended lower for the third consecutive session on September 6, with Nifty falling near 24,800 while the Sensex broke 81,000 mark ahead of the US jobs data, set to be released later today. At close, the Sensex was down 1.43 percent at 81,183, and the Nifty was down 1.17 percent at 24,852.

Interactive Zone!

Last week’s poll:

Q) The feature of shares in primary markets that makes it very easy to sell recently issued securities is known as____.

a) Large fund

b) Liquidity increase

c) Reduction in liquidity

d) The flow of money

Last week’s poll Answer: b) Liquidity increase

Poll for the week: _________ is the National Securities Exchange’s promoter.

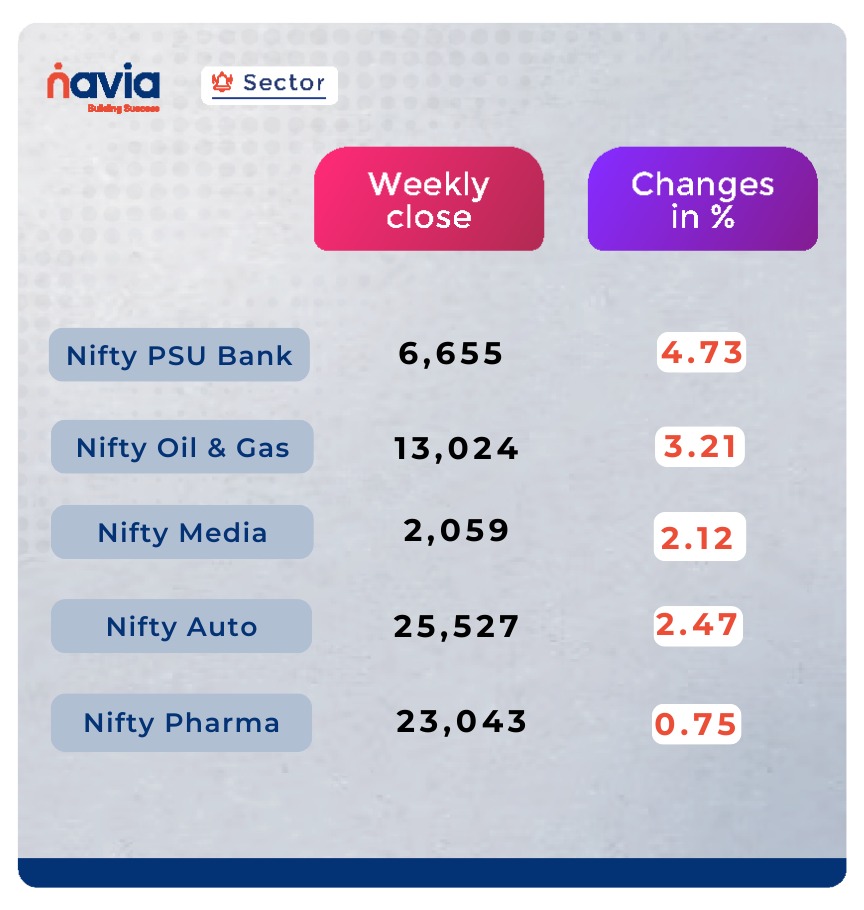

Sector Spotlight

All the NIFTY sectoral indices closed in the red with PSU Bank declining the most by 4.73%. NIFTY Oil & Gas declined 3.12%, Media by 2.12%, and Auto by 2.47%. and Pharma indices also declined up to 0.75%.

Explore Our Features!

Discover step-by-step instructions and tips to navigate the Navia app smoothly. Ensure you never miss out on important buyback opportunities. Watch now and take control of your investment journey today!

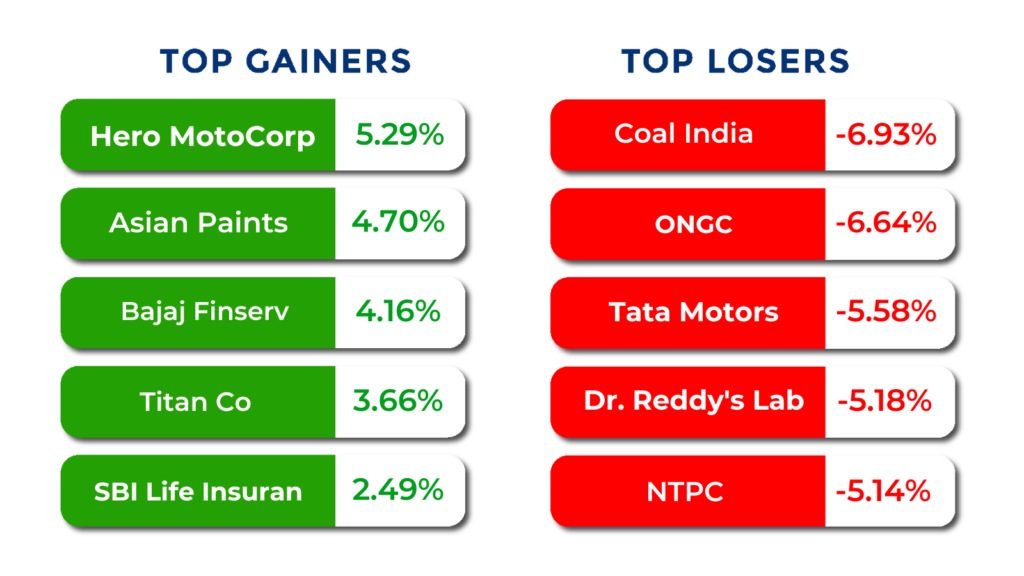

Top Gainers and Losers

Currency Chronicles

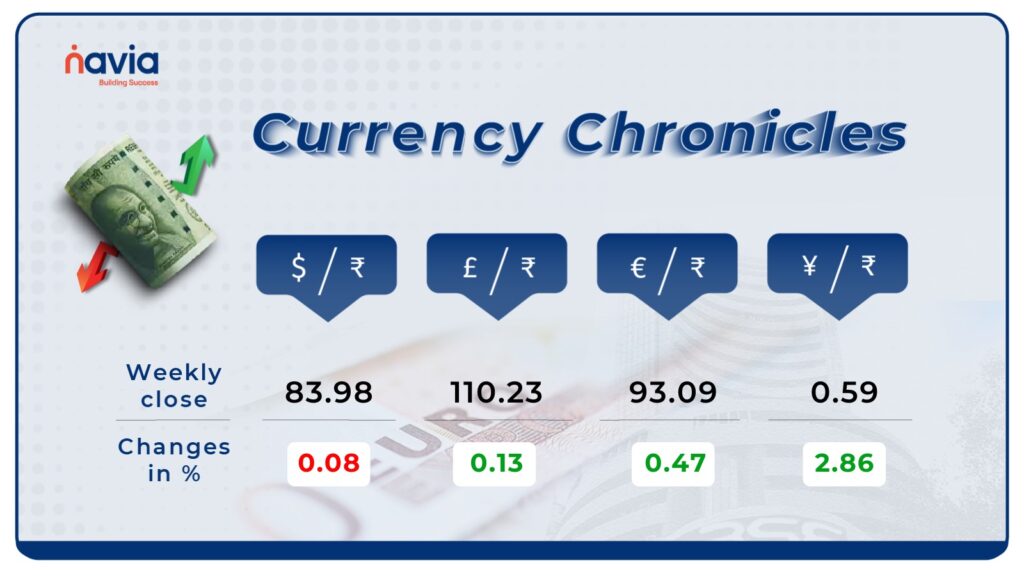

USD/INR:

The EUR/INR exchange rate increased by 0.47% this week, finishing at ₹93.09. This upward movement reflects a strengthening of the euro against the Indian rupee. The market sentiment remains bullish, indicating continued confidence among investors despite the relatively modest increase.

EUR/INR:

The JPY/INR exchange rate saw a significant rise of 2.86% for the week, closing at ₹0.59. This substantial gain highlights a strong performance of the yen against the rupee. The bullish sentiment in the market suggests that this trend could persist, driven by favorable conditions and investor optimism.

JPY/INR:

The USD/INR exchange rate experienced a slight increase of 0.08%, ending the week at ₹83.98. While the movement is modest, the overall sentiment in the market remains bullish. This indicates a stable outlook for the rupee, with continued investor confidence in its performance against the US dollar.

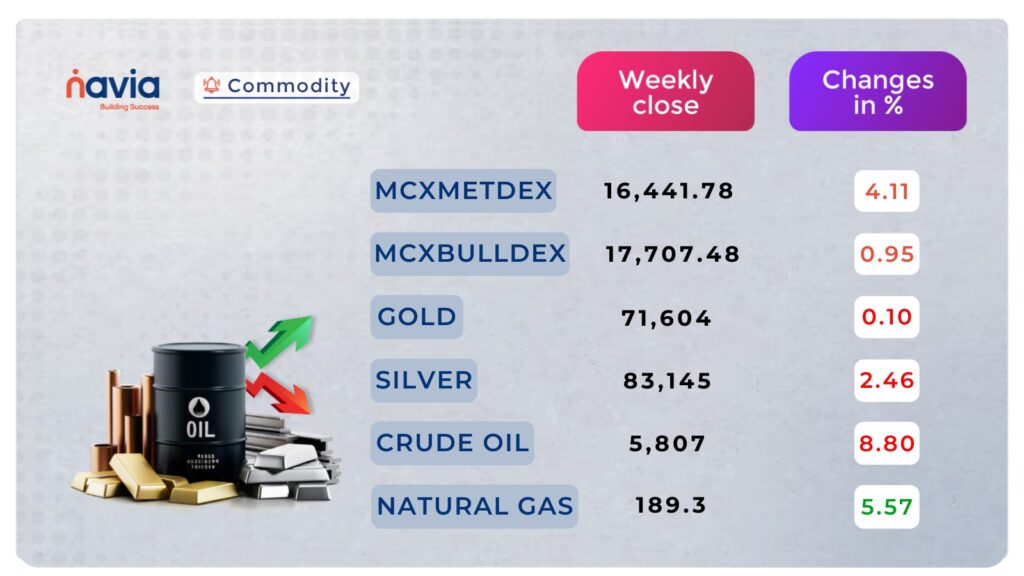

Commodity Corner

Crude oil is showing negative momentum, declining sharply over the week due to demand concerns from major oil markets. Recent data from China and the US revealed weakness in their manufacturing sectors, heightening fears of slowing demand. The current resistance level (R1) is placed at 6,042, and the support level (S1) is placed at 5,608.

Currently, Gold is showing signs that could strengthen expectations for a substantial interest rate cut by the Federal Reserve. Lower interest rates could reduce the opportunity cost of holding non-yielding gold. The current resistance level (R1) is at 72,641 and the support level (S1) is at 71392.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

5 Simple Tools to Master Option Analysis Like a Pro!

Unlock the secrets to mastering options trading! Check out our latest blog to discover 5 essential tools that can elevate your option analysis game. Dive in and start trading like a pro today!

SilverBees ETF: A Sparkling Investment Prospect

Ready to add some shine to your portfolio? Dive into our blog to see why the SILVERBEES ETF could be your next brilliant investment choice! Read more in the blog!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?