Navia Weekly Roundup (SEP 16 – SEP 20, 2024)

Week in the Review

Market hits a new record high following the Fed’s decision; the rupee remains strong.

The Indian market continued its upward trend, reaching a fresh record high in the week ending September 20, driven by investor optimism following the Fed’s unexpected 50 bps interest rate cut. A decline in jobless claims, strong FII inflows, and anticipation that the RBI may mirror the Fed’s decision in its upcoming monetary policy meeting further bolstered investor sentiment.

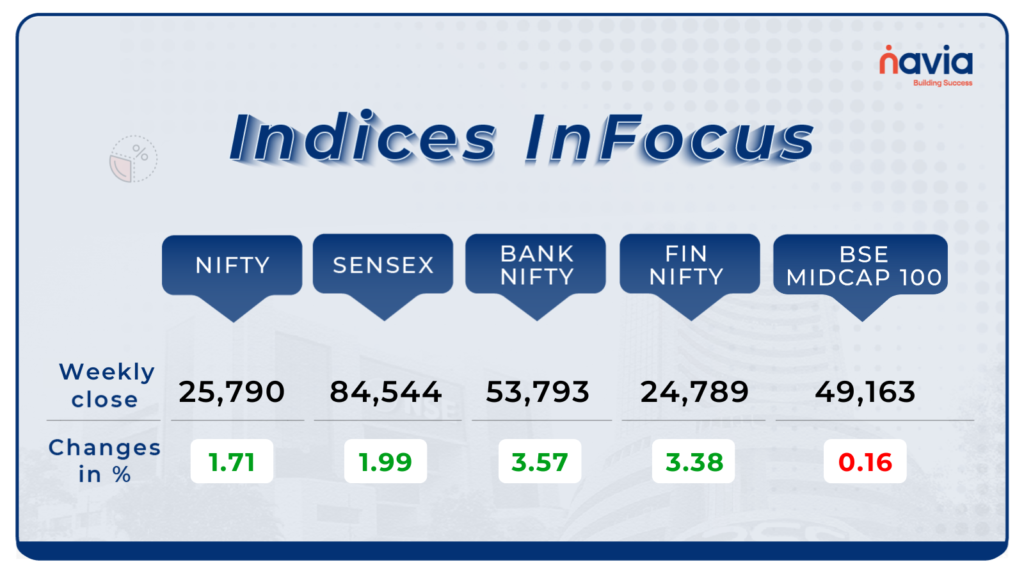

Indices Analysis

This week, BSE Sensex surged 1.99 percent to end at 84,544. while the Nifty50 index added 1.71 percent to finish at 25,790. On September 20, the BSE Sensex and Nifty hits fresh high of 84,694.46 and 25,849.25, respectively.

BSE Mid-cap Index ended on a flat note after hitting a record high of 49506.01. Gainers included Max Healthcare Institute, Torrent Power, PB Fintech, Samvardhana Motherson International, UNO Minda, ICICI Securities, Supreme Industries, Tube Investments of India. Shriram Finance, while losers were Vodafone Idea, LIC Housing Finance, Laurus Labs, Glenmark Pharma, Oracle Financial Services Software, Container Corporation of India, GlaxoSmithKline Pharmaceuticals, Piramal Enterprises, IDBI Bank.

Interactive Zone!

Last week’s poll:

Q) The worth of a derivative contract ____ throughout the term of the contract

a) Increases

b) Decreases

c) Varies in accordance with the price of the contract’s “underlying” worth.

d) None of the above.

Last week’s poll Answer: c) Varies in accordance with the price of the contract’s “underlying” worth.

Poll for the week: Which of the below statements regarding the Securities and Exchange Board of India (SEBI) is not correct?

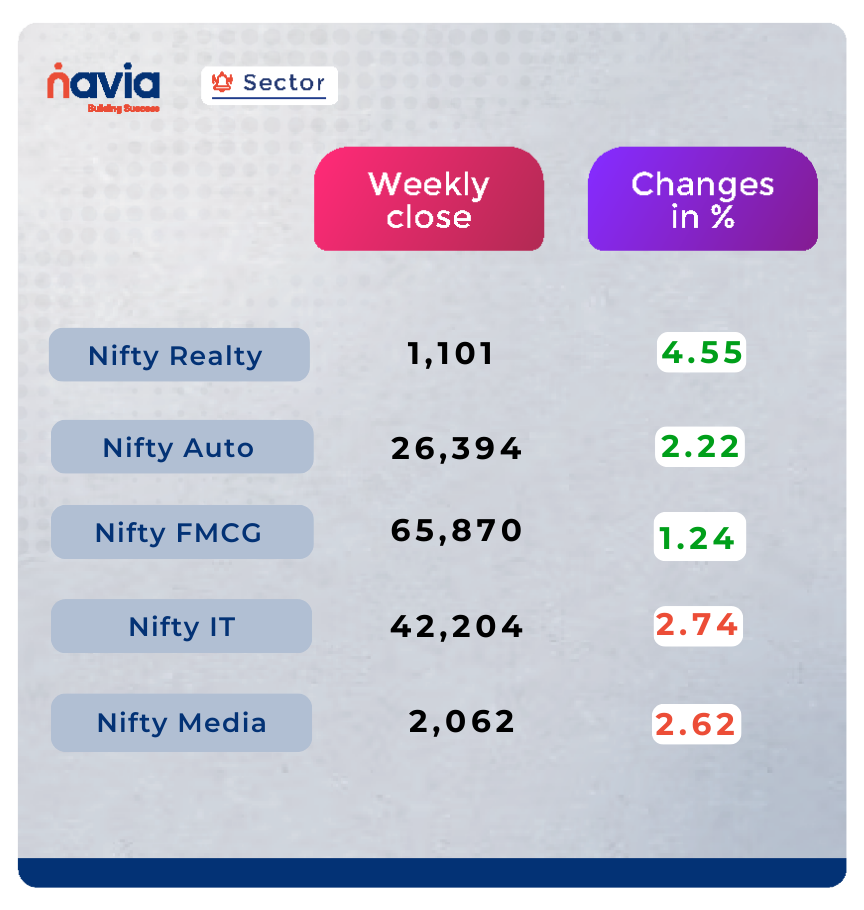

Sector Spotlight

Among sectors, Nifty Realty index surged 4.55 percent, Nifty Auto index up 2.22 percent, Nifty FMCG index gained 1.24 percent. However, Nifty Information Technology index shed 2.74 percent, and Nifty Media index down 2.6 percent.

Explore Our Features!

Check Securities in Ban Easily with Navia App

Stay informed about market restrictions! Learn how to quickly check which securities are under a ban using the Navia app.

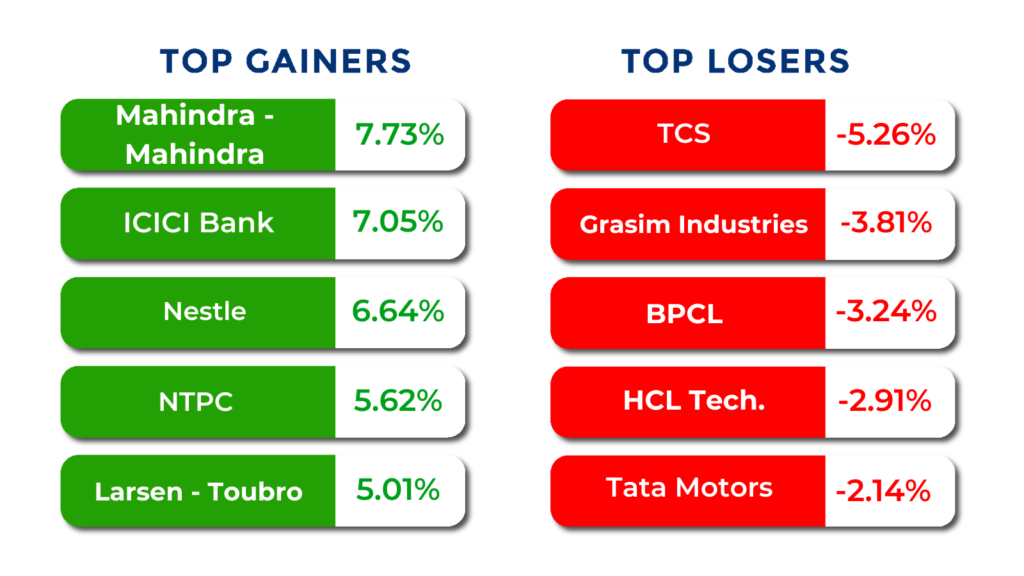

Top Gainers and Losers

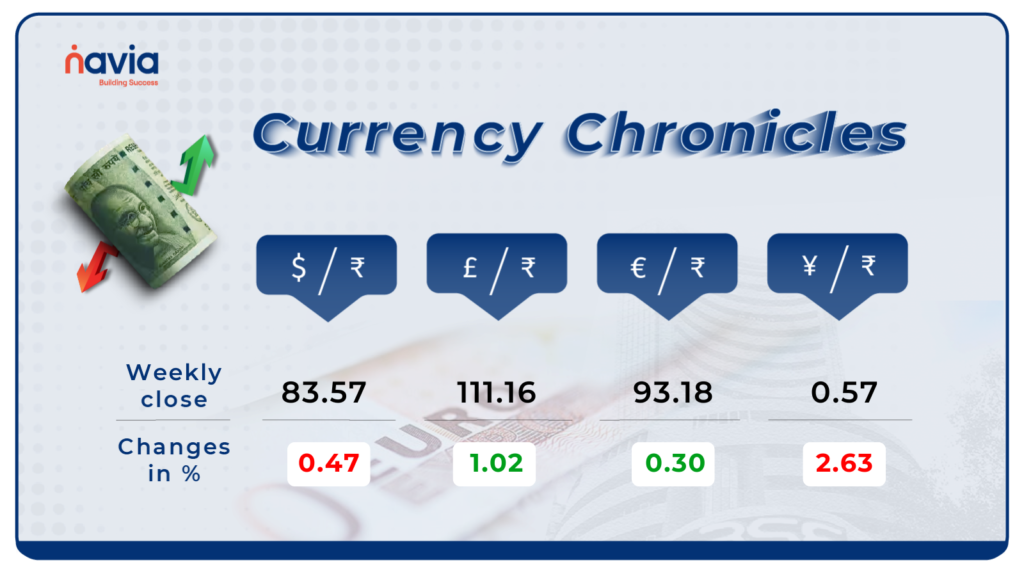

Currency Chronicles

USD/INR:

The Indian rupee continued its upward trajectory, closing strong against the US dollar. It gained 32 paise, finishing at 83.57 on September 20, up from 83.89 on September 13. This positive momentum reflects growing confidence in the rupee’s stability.

EUR/INR:

The EUR to INR exchange rate increased by 0.30% for the week, closing at 93.18. Market sentiment in the EUR/INR sector remains bullish, indicating positive expectations for the euro against the rupee in the near term.

JPY/INR:

In contrast, the JPY to INR exchange rate experienced a decline of -2.63% for the week, ending at 0.578714. The sentiment in the JPY/INR market is currently neutral, suggesting a wait-and-see approach among investors regarding future movements.

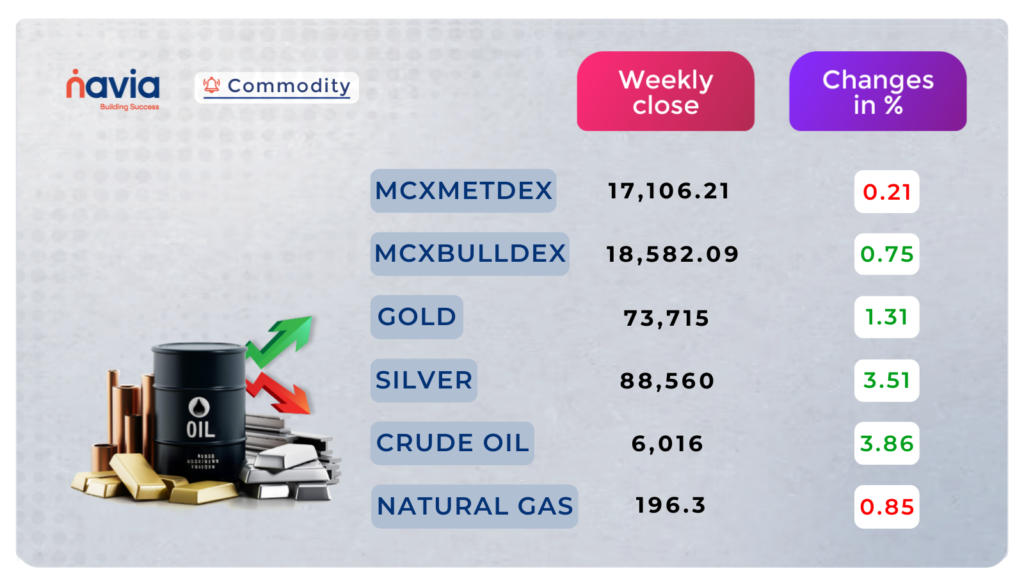

Commodity Corner

Crude oil is showing an uptrend, driven by demand optimism and potential supply risks amid rising Middle East tensions.

Gold is showing an uptrend, supported by Middle East tensions, which are sustaining safe-haven demand for the precious metal. The current resistance level (R1) is at 74,088, while the support level (S1) is at 72,833.

Natural gas is showing minor consolidation at higher levels, with forecasts of warmer U.S. temperatures expected to boost demand from electricity providers for air conditioning. The current resistance level (R1) is at 204, while the support level (S1) is at 186.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Anatomy of a Straddle or Strangle: A Comprehensive Guide for Options Traders

Unlock the secrets of options trading with our comprehensive guide on straddles and strangles. Learn how these strategies can help you profit from market volatility, complete with practical examples and tips for using the Navia Mobile App. Dive in to enhance your trading skills!

Unlocking Market Potential: Navigating Profits with Navia’s MTF Mastery

Discover how Margin Trade Funding can amplify your buying power and enhance your profits. This blog breaks down the benefits of Navia’s MTF, from competitive rates to zero brokerage on funded trades. Read more to unlock smarter trading strategies!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?