Navia Weekly Roundup (SEP 30 – Oct 4, 2024)

Week in the Review

Market snapped three-week gaining momentum to record biggest weekly fall since June 2022 amid ongoing geopolitical tensions. The weak domestic data points, Fed’s Powell hawkish tone, new SEBI F&O rules also dented the investors’ sentiments in this week.

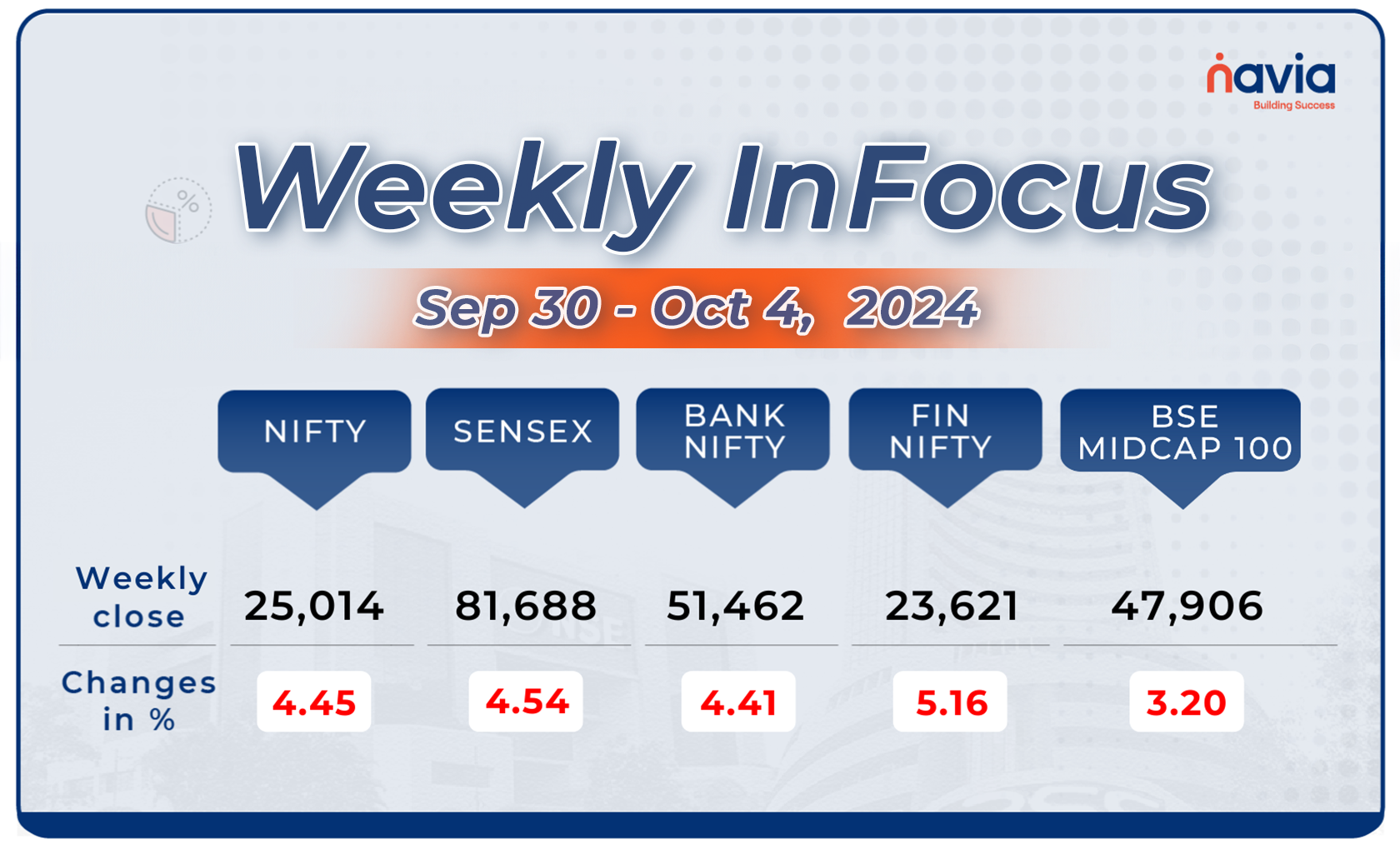

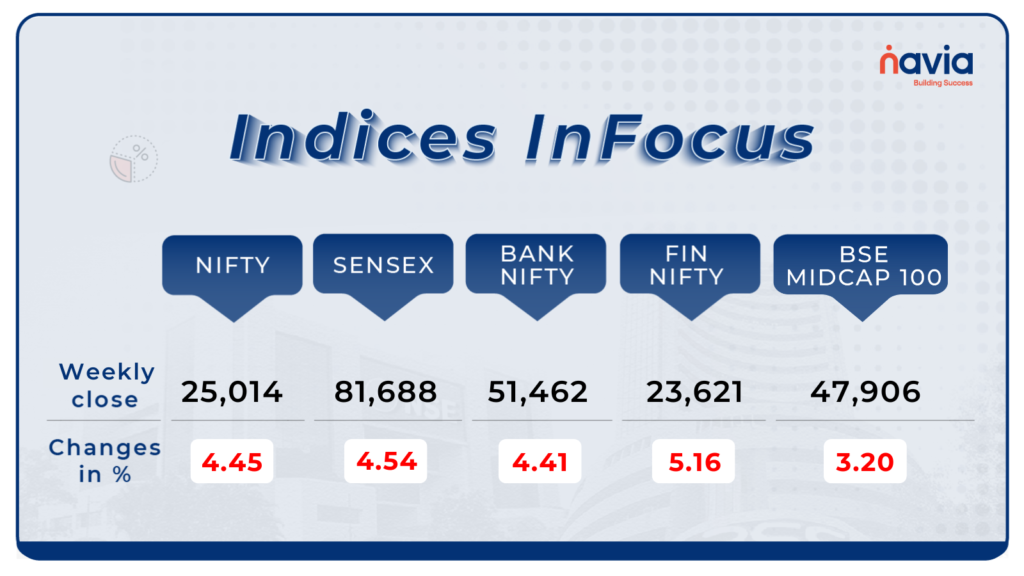

Indices Analysis

This week, BSE Sensex declined 3,883.4 points or 4.54 percent to finish at 81,688.45, while the Nifty50 index fell 1,164.35 points or 4.45 percent to end at 25,014.60. It is the biggest weekly fall since June 2022.

Among broader indices BSE Mid-cap Index shed 3.20 percent dragged by Mahindra & Mahindra Financial Services, Godrej Industries, Godrej Properties, TVS Motor Company, Jubilant Foodworks, Vodafone Idea, while gainers were Whirlpool of India, Petronet LNG, Bayer CropScience, APL Apollo Tubes, PB Fintech.

Interactive Zone!

Last week’s poll:

Q) The feature of shares in primary markets that makes it very easy to sell recently issued securities is known as

a) Large fund

b) Liquidity increase

c) Reduction in liquidity

d) The flow of money

Last week’s poll Answer: b) Liquidity increase

Poll for the week: The London Stock Exchange’s Stock Market Index is known as_______

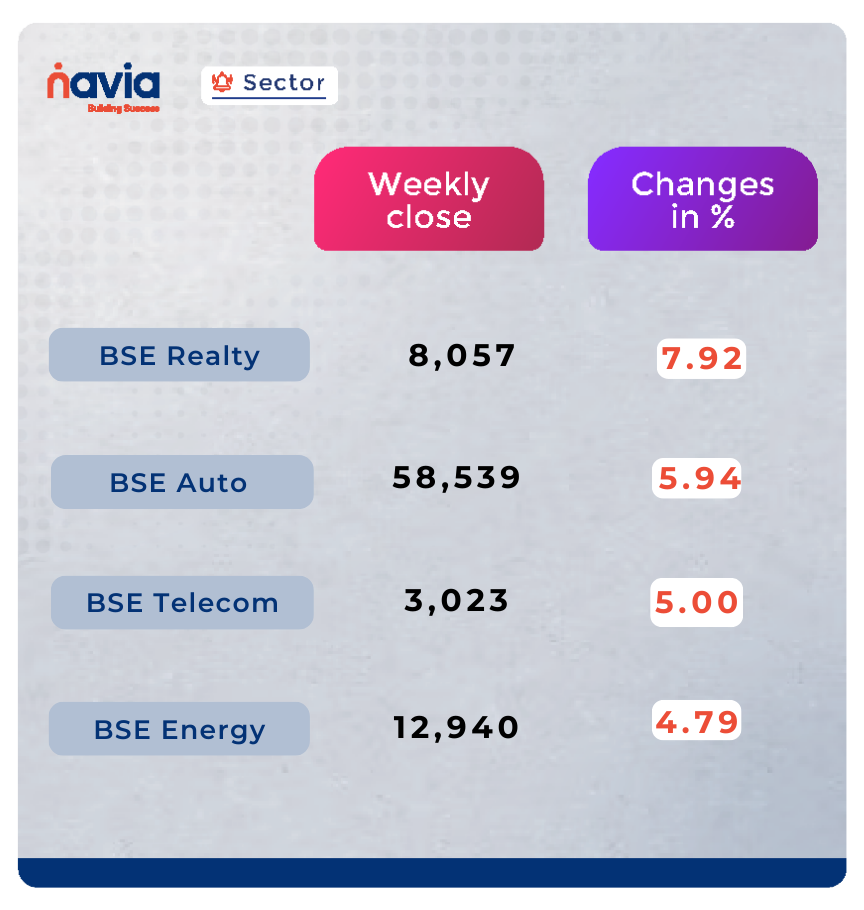

Sector Spotlight

All the sectoral indices ended in the red with BSE Realty shed 7.92 percent, BSE Auto index shed 5.94 percent, BSE Telecom index falling 5 percent, and BSE Energy index declining nearly 4.79 percent.

Explore Our Features!

Check Securities in Ban Easily with Navia App

Stay informed about market restrictions! Learn how to quickly check which securities are under a ban using the Navia app.

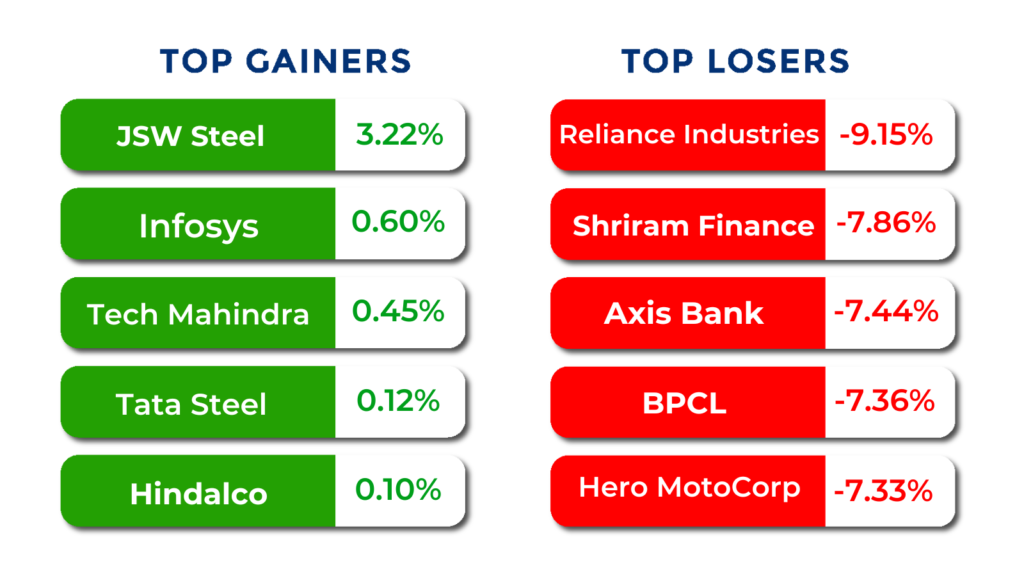

Top Gainers and Losers

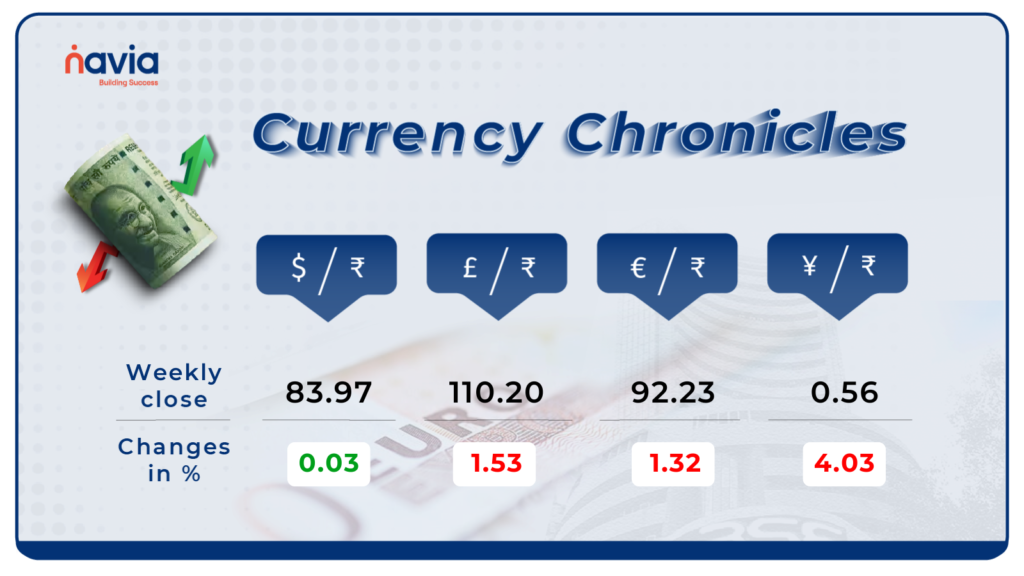

Currency Chronicles

USD/INR:

The Indian rupee extended its losses for the second consecutive week, closing 27 paise lower at ₹83.97 on October 4, compared to ₹83.70 on September 27. This continuous decline reflects ongoing pressure on the domestic currency against the US dollar.

EUR/INR:

The EUR to INR exchange rate declined by 1.32% over the week, ending at ₹92.23. The market sentiment has shifted to bearish, signaling weakened momentum for the euro against the rupee.

JPY/INR:

The JPY to INR exchange rate dropped sharply by 4.03% this week, closing at ₹0.556566. Similar to the euro, the yen has also faced bearish sentiment, indicating a challenging period for the Japanese currency in the Indian market.

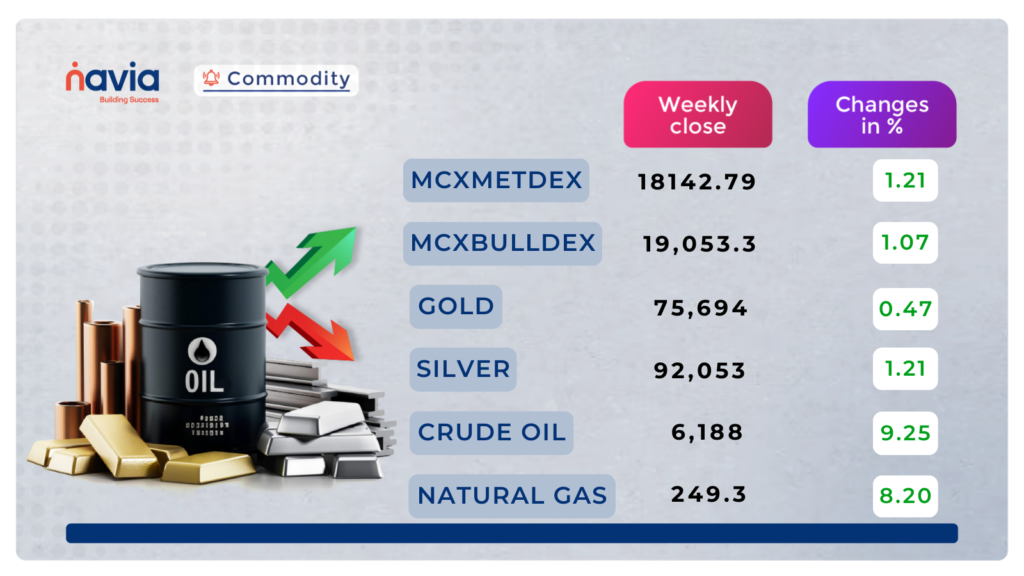

Commodity Corner

Crude oil is showing a strong uptrend rally, with oil prices heading for their sharpest weekly gain in more than a year, as escalating tensions in the Middle East have kept markets on edge ahead of a U.S. jobs report later in the day. The current resistance level (R1) is at 6,311, while the support level (S1) is at 6,044.

Gold trading at record levels, benefiting from its safe-haven status magnified by heightened geopolitical risks.. The current resistance level (R1) is at 77366 and the support level (S1) is at 75157.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

A Comprehensive Guide to Investing in Nifty 50 BeES ETF:

Learn how the Nifty 50 BeES ETF provides diversified exposure, cost-efficiency, and flexibility for your portfolio. Read more to explore its benefits and how to set up a SIP on the Navia App.

Picking the Right Strike Price in Options:

Picking the Right Strike Price in Options

Choosing the right strike price is key to successful options trading. Read more to discover important factors, examples, and how to use the Navia App to simplify your selection.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?