Navia Weekly Roundup (Sep 29 – Oct 03, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

In the truncated week, the market regained some of the previous week’s losses led by buying across the sectors amid inline RBI policy outcome with upward revision of GDP growth projection and lowering inflation forecast, good monsoon, persistent DII buying and projection of strong Q2FY26 earnings going ahead.

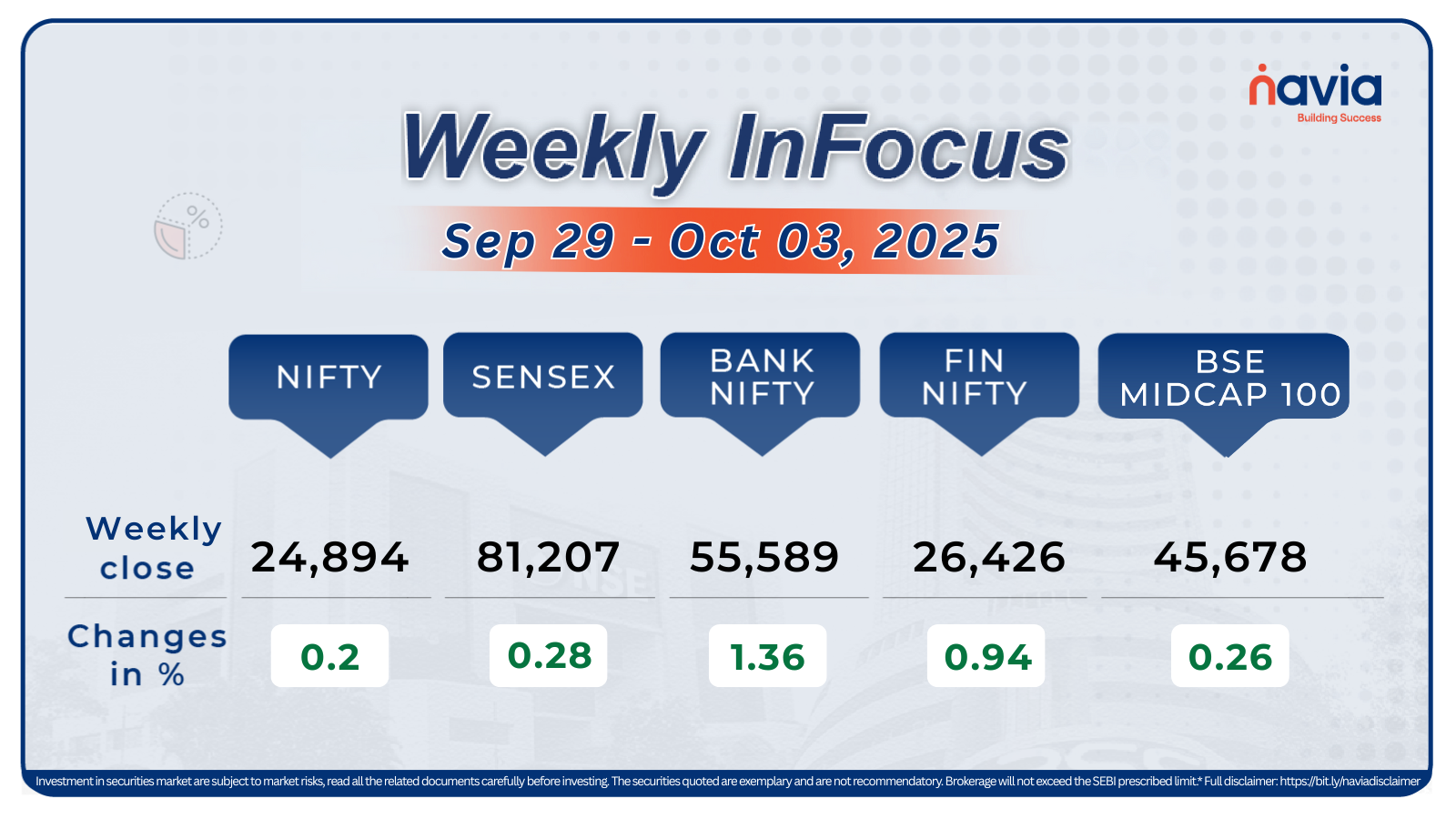

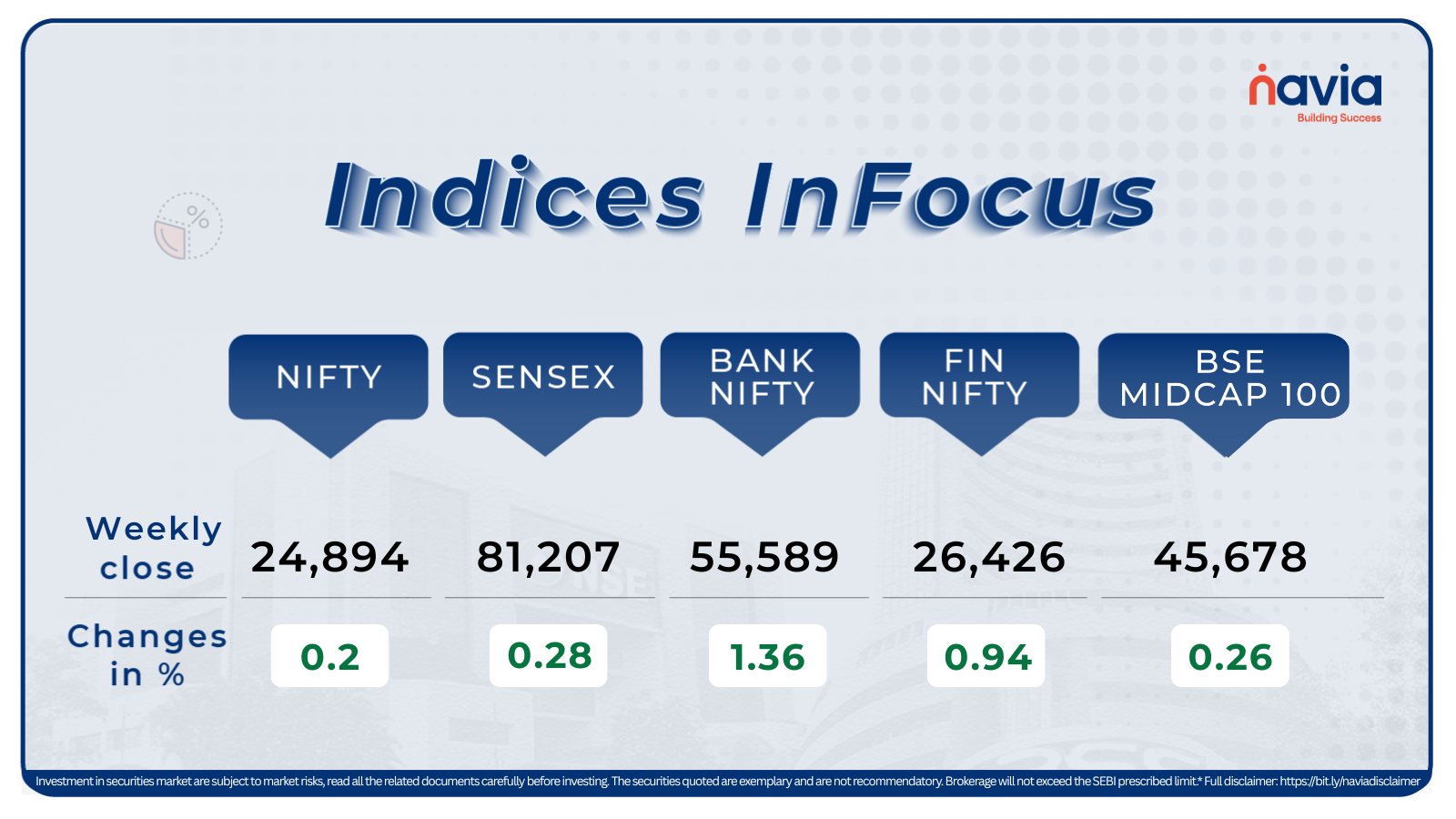

Indices Analysis

For the week, BSE Sensex index rose 0.28 percent to finish at 81,207.17 and Nifty50 added 0.2 percent to close at 24,894.25.

BSE Mid-cap Index added 2 percent supported by Sun TV Network, L&T Finance, Aditya Birla Capital, Bank Of India, Aegis Vopak Terminals, National Aluminium Company, Fortis Healthcare. However, losers included Dixon Technologies, Hitachi Energy India, KPIT Technologies, Whirlpool of India.

The BSE Small-cap index jumped 2 percent with Stallion India Fluorochemicals, Sammaan Capital, Tata Investment Corporation, Dynacons Systems and Solutions, Vascon Engineers, Suryoday Small Finance Bank, V2 Retail, John Cockerill India, Indo Thai Securities, Ugro Capital, Borosil Scientific, Panorama Studios International, Good Luck India, rising 12-33 percent, while Shankara Building Products, JSW Holdings, Wonder Electricals, Integrated Industries, Man Industries (India), Heubach Colorants India, Permanent Magnets fell between 10-14 percent.

The BSE Large-cap Index gained 1 percent led by Hindustan Zinc, Shriram Finance, Tata Motors, Vodafone Idea, Bharat Petroleum Corporation, Canara Bank, Bank Of Baroda, Punjab National Bank, IndusInd Bank, Adani Power.

The selling from Foreign Institutional Investors’ (FIIs) continued on 12th consecutive week, as they sold equities worth Rs 8,347.25 crore, while buying from Domestic Institutional Investors (DII) continued in 24th week, as they bought equities worth Rs 13,013.40 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

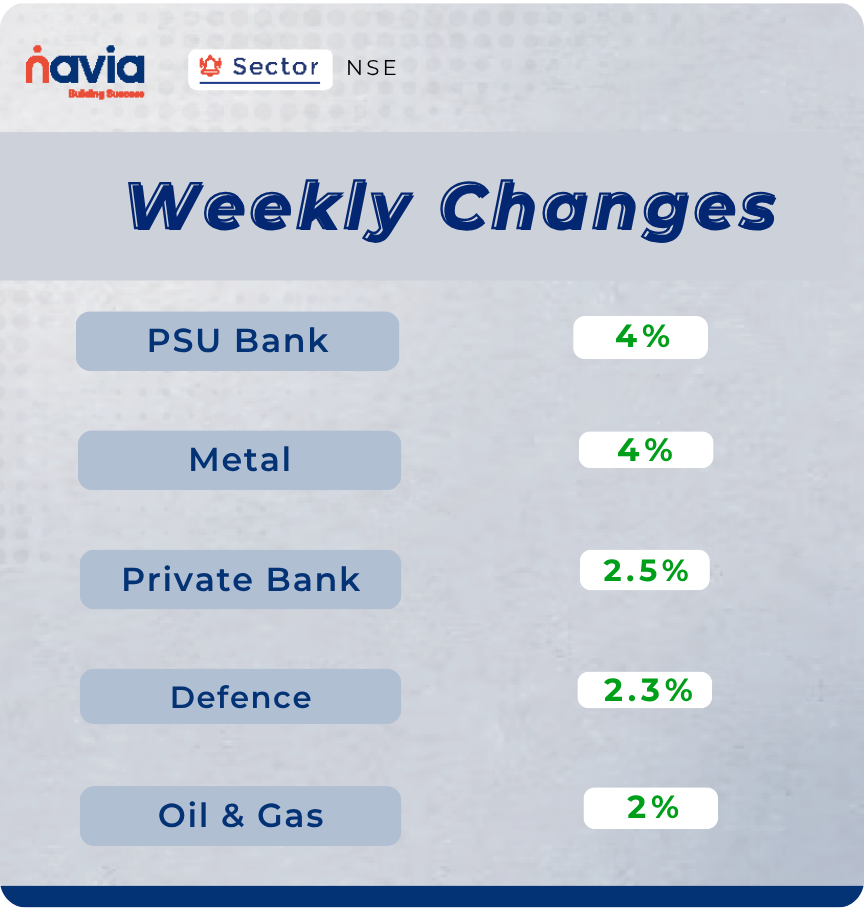

Sector Spotlight

All the sectoral indices ended in the green with Nifty PSU Bank index rose more than 4 percent, Nifty Metal index gained 4 percent, Nifty Private Bank index jumped 2.5 percent, Nifty Defence Index rose 2.3 percent, Nifty Oil & Gas index added 2 percent.

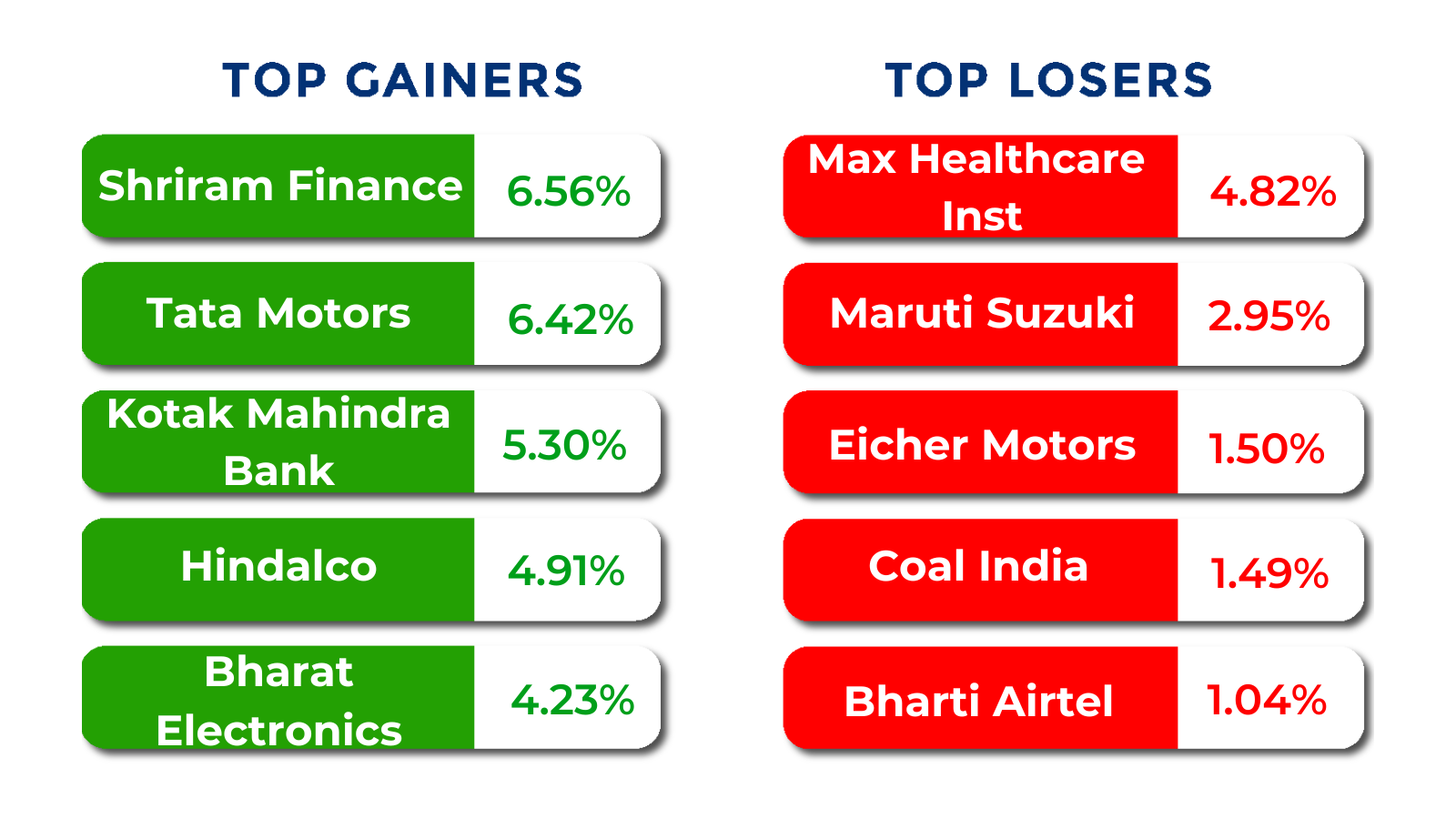

Top Gainers and Losers

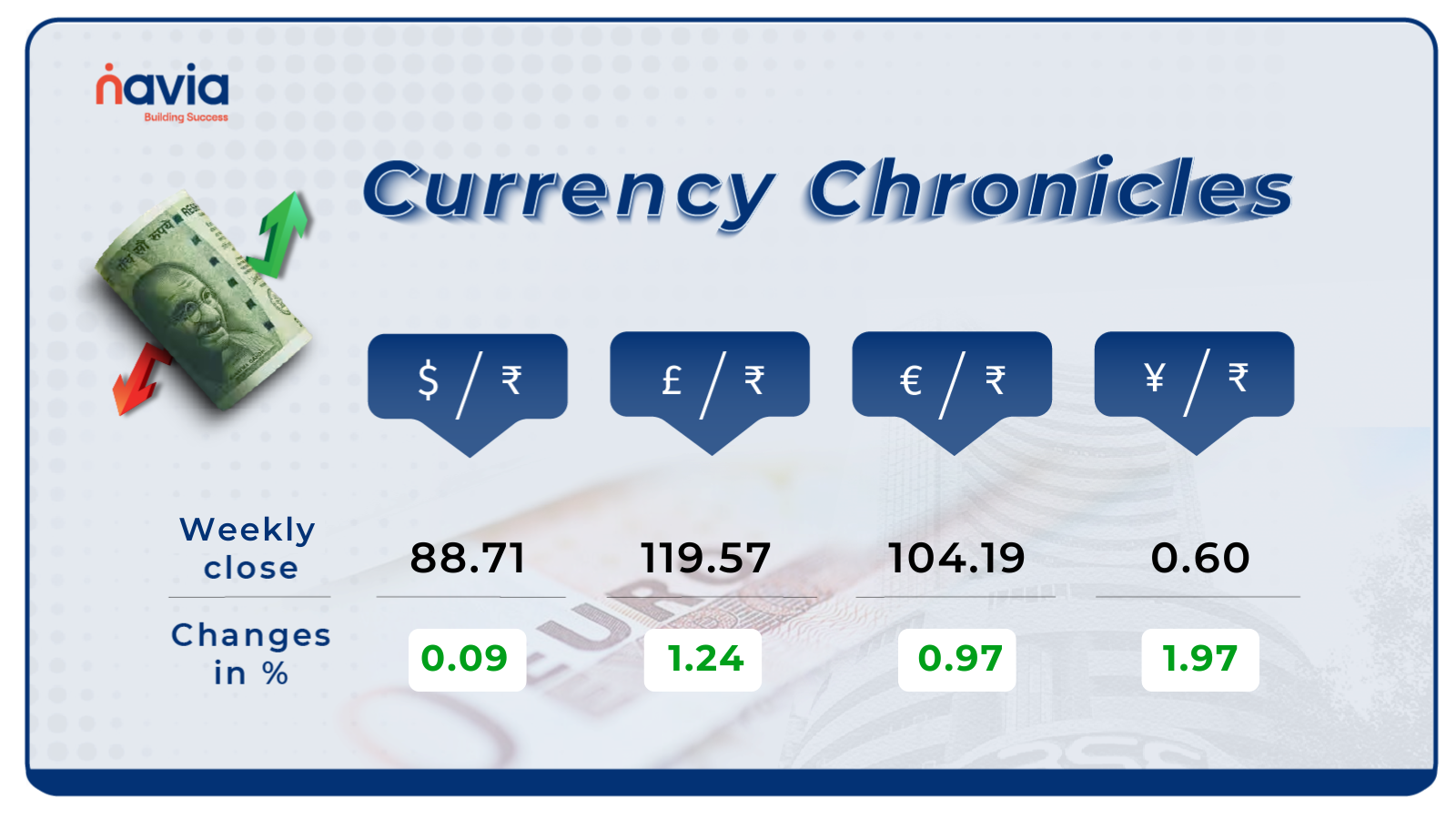

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.71 per dollar, gaining 0.09% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹104.19 per euro, gaining 0.97% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.60 per yen, gaining by 1.97% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

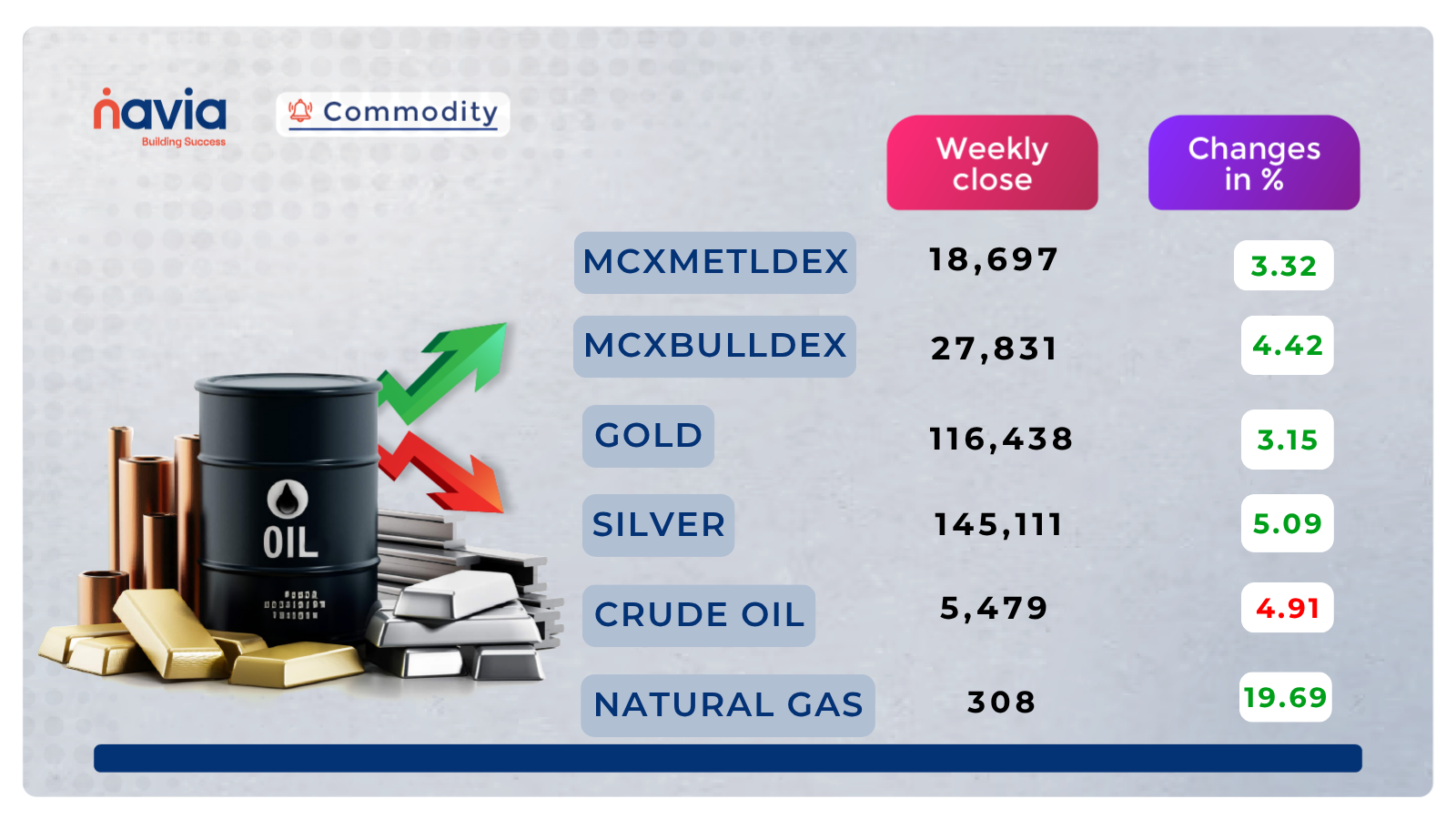

Commodity Corner

MCX Crude Oil Price is hovering near a crucial horizontal support around 5,450–5,480. Multiple tests of this level indicate it’s a strong support; a decisive breakdown could trigger further downside. Immediate resistance is near 5,580. A sustained move above this, could open the way toward 5,700–5,900. Price has been making lower highs and lower lows since the recent peak near 5,900. Momentum is weak, and the recent candles show selling pressure near resistance levels. If 5,450 holds and crude rebounds, a move toward 5,650–5,780 is possible, but resistance there is strong.

In the last session, Gold closed at 116,438. MCX Gold price is moving within a well-defined rising channel. The uptrend is intact with higher highs and higher lows. The nearest support lies around 116,000. A deeper support is visible near 108,940, but that is far below current levels and acts as a long-term base. Gold is currently consolidating near the channel top (117,800–118,000). This zone may act as resistance in the short term. As long as Gold sustains above 116,000, the uptrend is intact. Upside targets could be around 118,500–119,000 in the near term. A breakdown below 116,000 may trigger profit booking, dragging price back toward 114,000–113,000 levels (mid-channel support).

Natural Gas had been consolidating in a falling wedge pattern. It has broken out strongly above the resistance trendline with high momentum. Sharp bullish candles indicate aggressive buying. Volume and momentum suggest a trend reversal from bearish to bullish. Sustaining above 282 keeps the bullish outlook intact. Natural Gas likely to test 315–320 zone. If it sustains above 320, rally can extend toward 340–345. A fall below 282 could invite profit booking toward 265–270; major trend support remains 248.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Have You Chosen Financial Freedom as Your Goal?

Financial freedom is when your passive income (from investments, etc.) covers all your living expenses, allowing you to work by choice, not necessity, securing peace of mind and time for yourself. Stop delaying this goal; define your required annual expense (“Know Your Number”), start investing consistently (even small SIPs, like the price of a daily coffee), and let compounding build multiple income streams over time.

Why Do We Cling to Things That Don’t Work?

The Sunk Cost Fallacy is a costly cognitive bias where you stick with an unproductive decision (like holding a losing stock) because you’ve already invested time or money, letting unrecoverable past costs dictate future choices. Avoid this trap—driven by pride and fear of regret—by focusing solely on future value, setting clear exit rules, and basing decisions on objective data, not emotion.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.