Navia Weekly Roundup (SEP 23 – SEP 27, 2024)

Week in the Review

Market extended the gains in the third consecutive week and continued the record-making run during the week ended September 27 led by positive global markets after stimulus announcements by China.

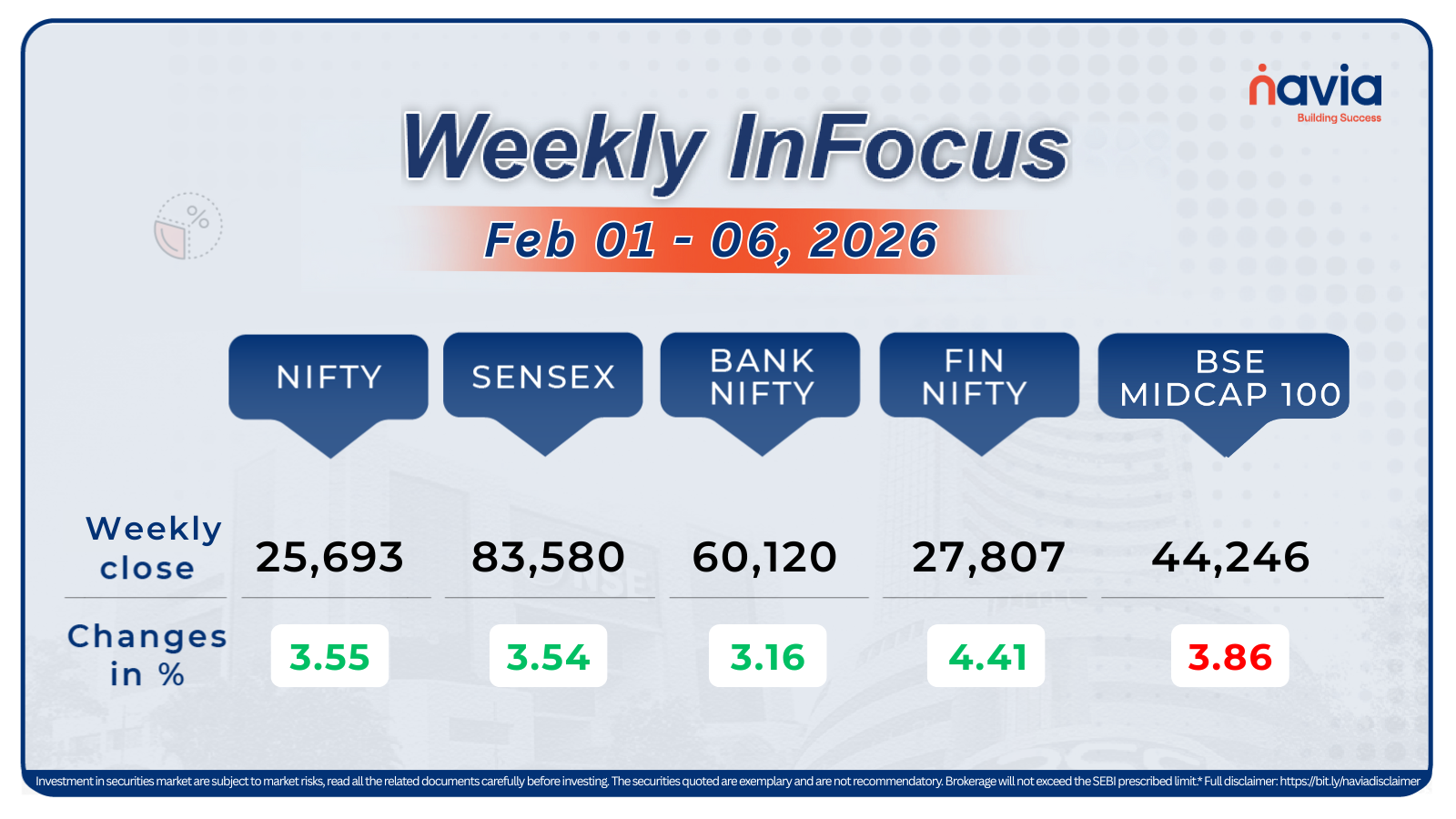

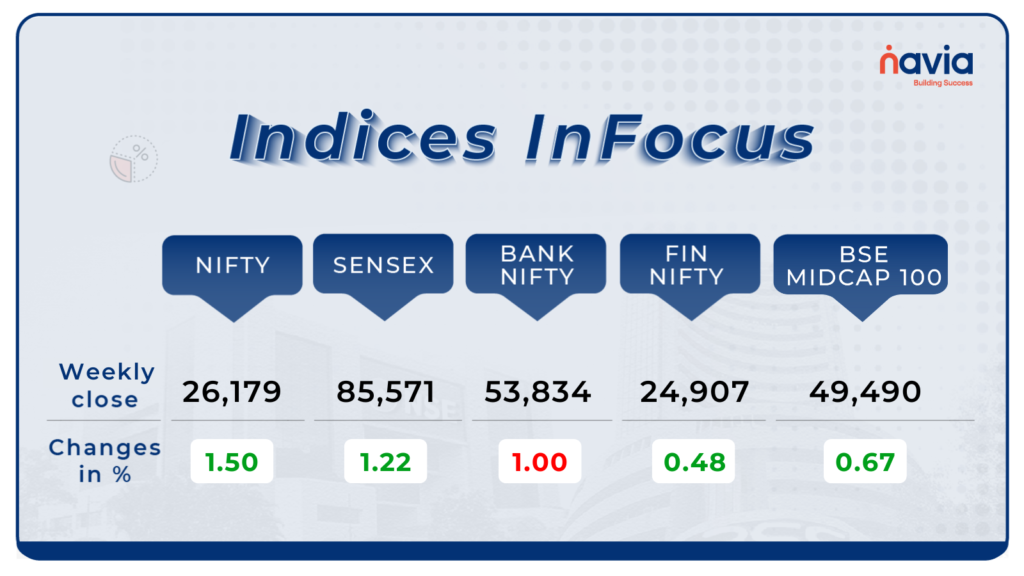

Indices Analysis

This week, BSE Sensex added 1.22 percent to end at 85,571, while the Nifty50 index rose 1.50 percent to end at 26,179. On September 27, BSE Sensex and Nifty touched fresh high of 85,978.25 and 26,277.35, respectively

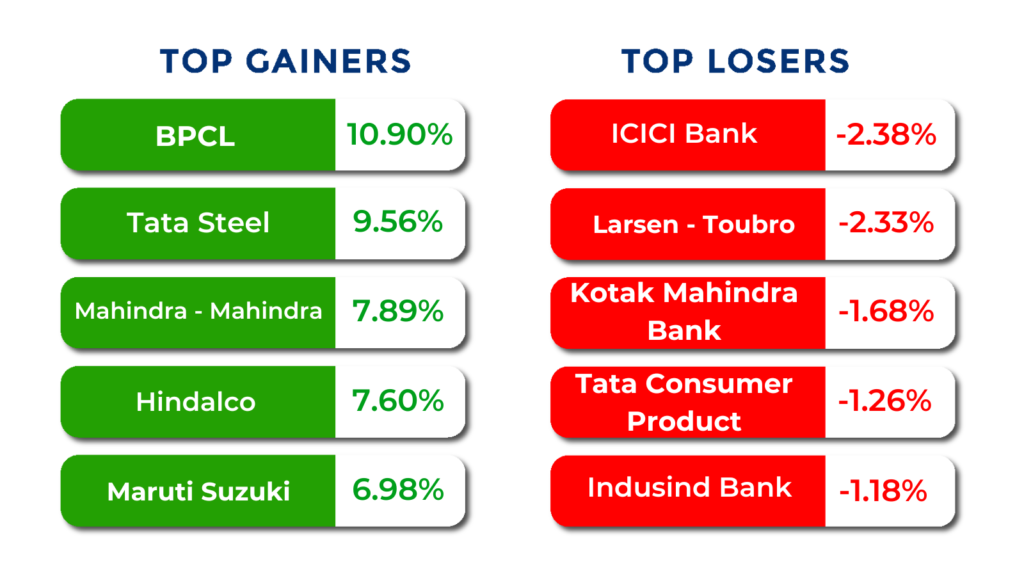

BSE Mid-cap Index jumped 0.7 percent and touched fresh high during the week. Gainers included Steel Authority of India, NMDC, Hindustan Petroleum Corporation, Bharat Heavy Electricals, Canara Bank, Polycab India, Aditya Birla Fashion & Retail, while losers were PB Fintech, Max Healthcare Institute, JSW Energy, Gillette India, Crompton Greaves Consumer Electrical, Supreme Industries.

Interactive Zone!

Last week’s poll:

Q) The worth of a derivative contract ________ throughout the term of the contract.

a) Increases.

b) Decreases.

c) Varies in accordance with the price of the contract’s “underlying” worth.

d) None of the above.

Last week’s poll Answer: c) Varies in accordance with the price of the contract’s “underlying” worth.

Poll for the week: The feature of shares in primary markets that makes it very easy to sell recently issued securities is known as_______

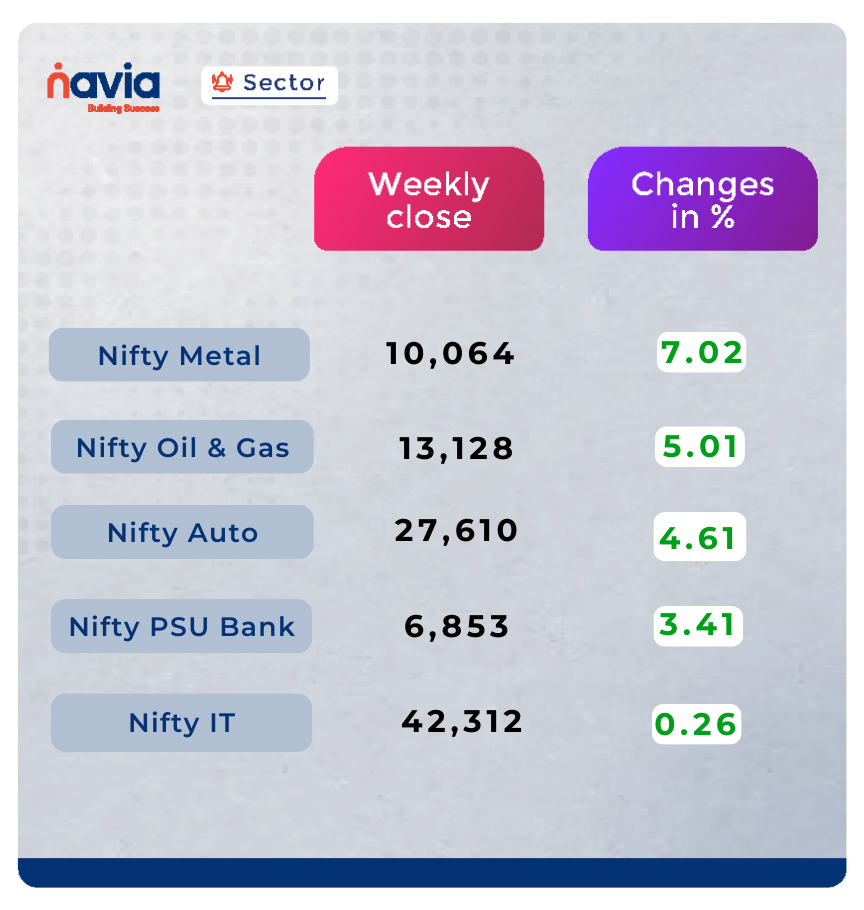

Sector Spotlight

All the sectoral indices ended in the green with Nifty Metal index rising 7.02 percent, Nifty Oil & Gas index jumped 5.01 percent, Nifty Auto index added 4.61 percent, Nifty PSU Bank index added 3.41 percent.

Explore Our Features!

How to Apply for Buyback on Navia App

Get step-by-step instructions and tips to navigate the Navia app smoothly, ensuring you don’t miss out on important buyback opportunities. Watch now and take control of your investment journey today!

Top Gainers and Losers

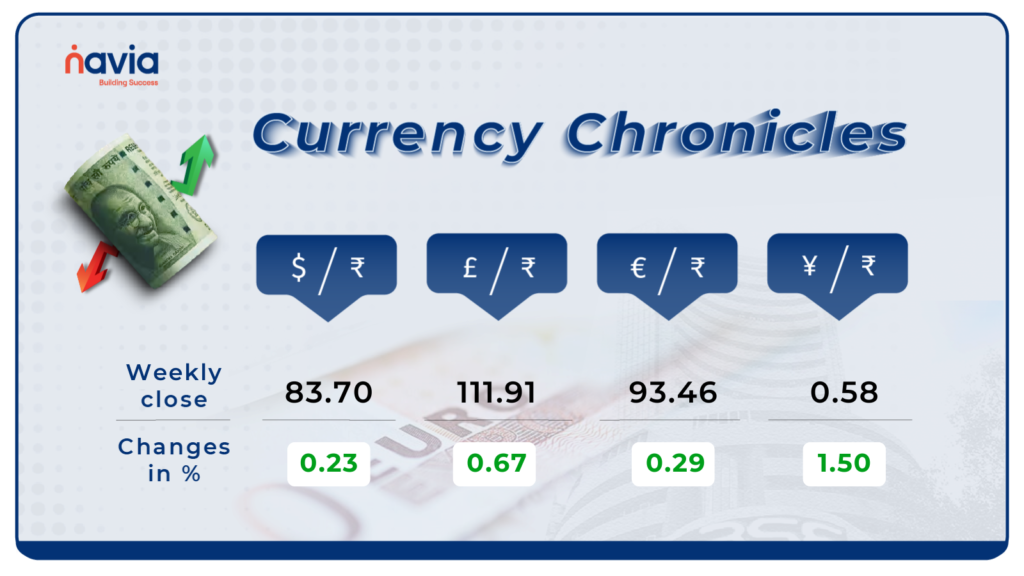

Currency Chronicles

USD/INR:

The Indian rupee reversed its previous week’s gains, ending lower against the US dollar. It declined by 13 paise, closing at ₹83.70 on September 27, compared to ₹83.57 on September 20. This slight drop highlights ongoing volatility in the currency markets.

EUR/INR:

The EUR to INR exchange rate increased by 0.29% over the week, closing at ₹93.46. The current sentiment in the EUR/INR market remains bullish, indicating continued investor confidence in the euro’s strength against the Indian rupee.

JPY/INR:

The JPY to INR exchange rate saw a notable rise of 1.50% this week, closing at ₹0.58. Market sentiment remains bullish, reflecting positive expectations for the yen’s performance in the near term.

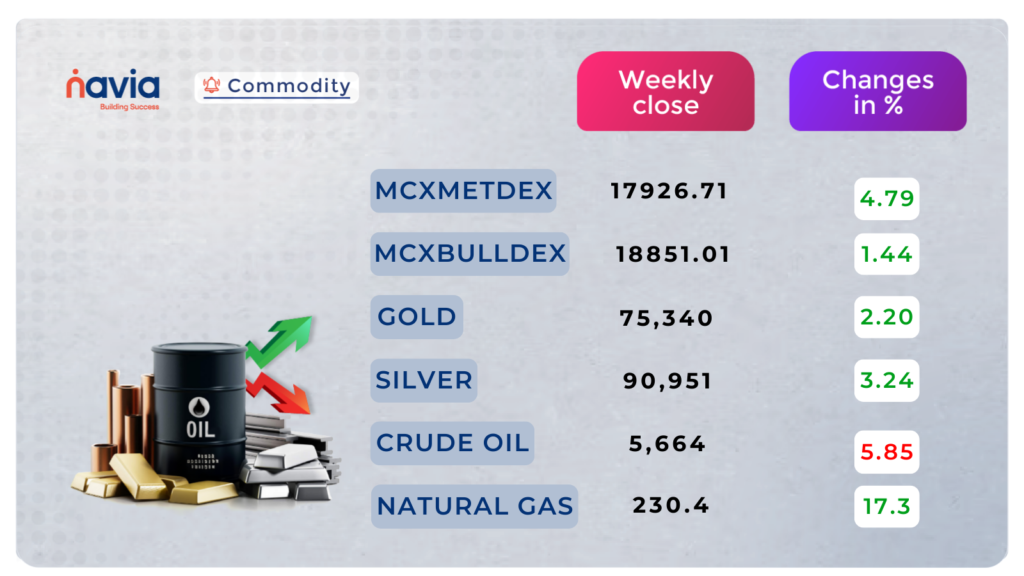

Commodity Corner

Crude oil is showing selling pressure, declining for the third straight session as prospects of oversupply weigh on the market The current resistance level (R1) is placed at5905, and the support level (S1) is placed at 5495

Gold is currently trading at higher levels, reaching record highs as markets brace for the highly anticipated US PCE report, seeking further guidance on the Federal Reserve’s monetary policy outlook. The current resistance level (R1) is at 76591and the support level (S1) is at 73994

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

The Four Pillars of Wealth: Redefining Success

Discover how true wealth goes beyond money! This blog explores the four essential types of wealth—Financial, Social, Time, and Health—and how balancing them can lead to a fulfilling life. Curious about your own pillars of wealth?

Understanding Option Greeks for Profitable Options Trading: A Beginner’s Guide

Master the key Option Greeks—Delta, Gamma, Theta, Vega, and Rho—and learn how they impact your trading decisions. This beginner-friendly guide breaks down each Greek and shows how Navia’s app can simplify your options strategy. Ready to level up your trading? Read more in the blog!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?