Navia Weekly Roundup (Sep 08 – 12, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Market witnessed rangebound activity with positive bias helping indices to extend gains in the second consecutive week, posting biggest weekly gain in nearly 3 months on hopes of easing India-US trade tension, expectation of rate cut by the Federal Reserve and reports that the EU may reject US tariff proposals on India’s Russian oil imports.

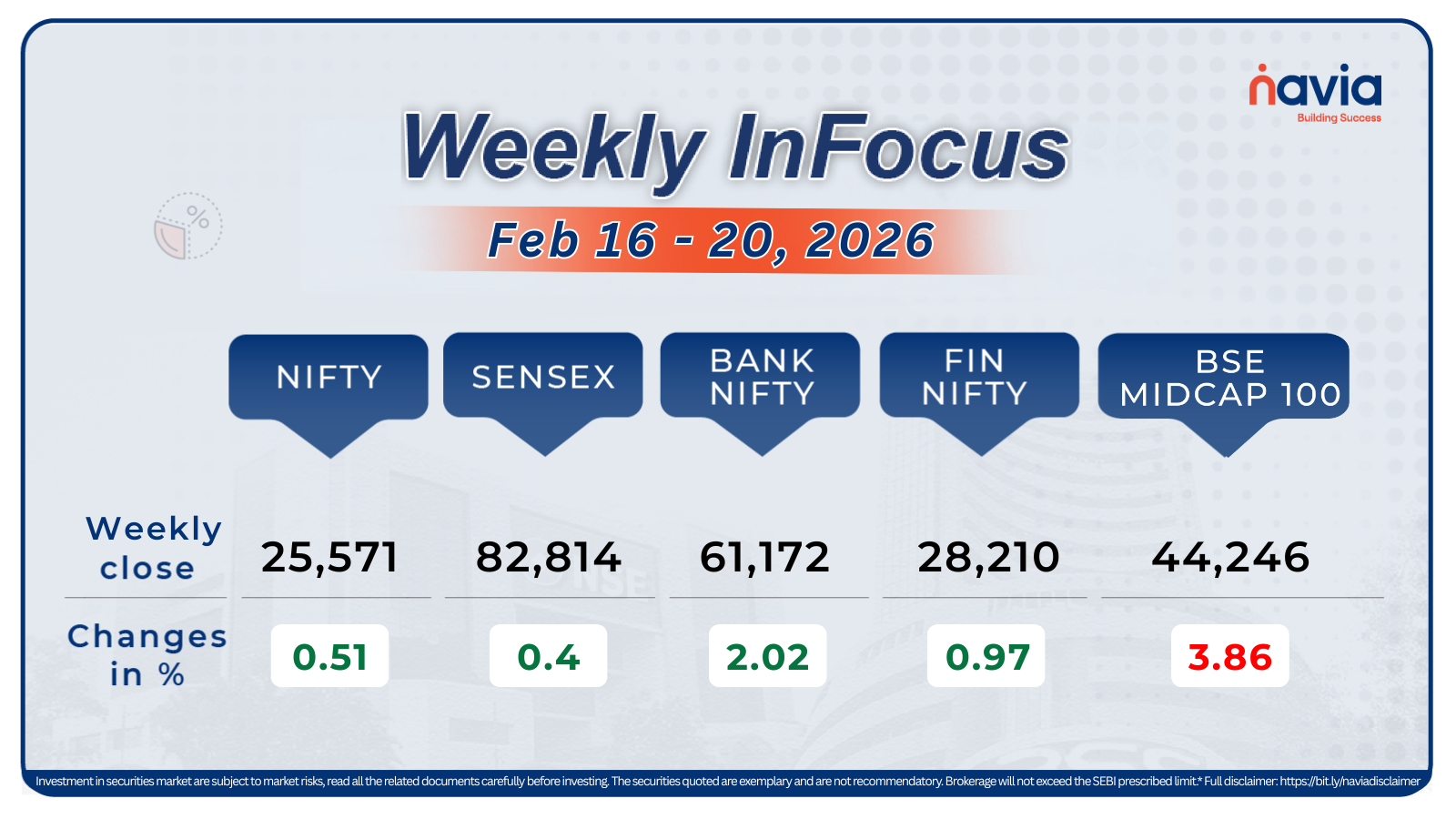

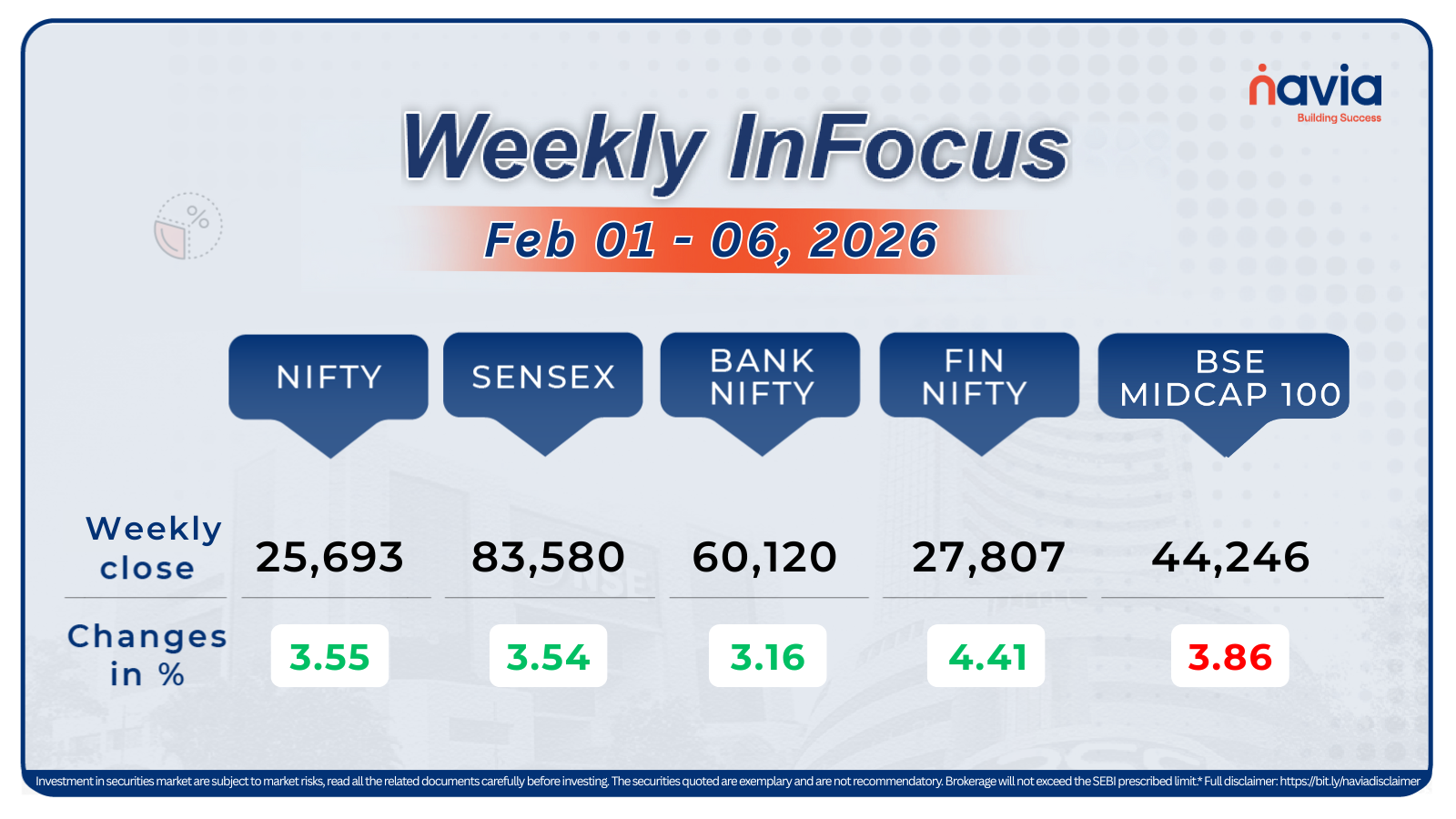

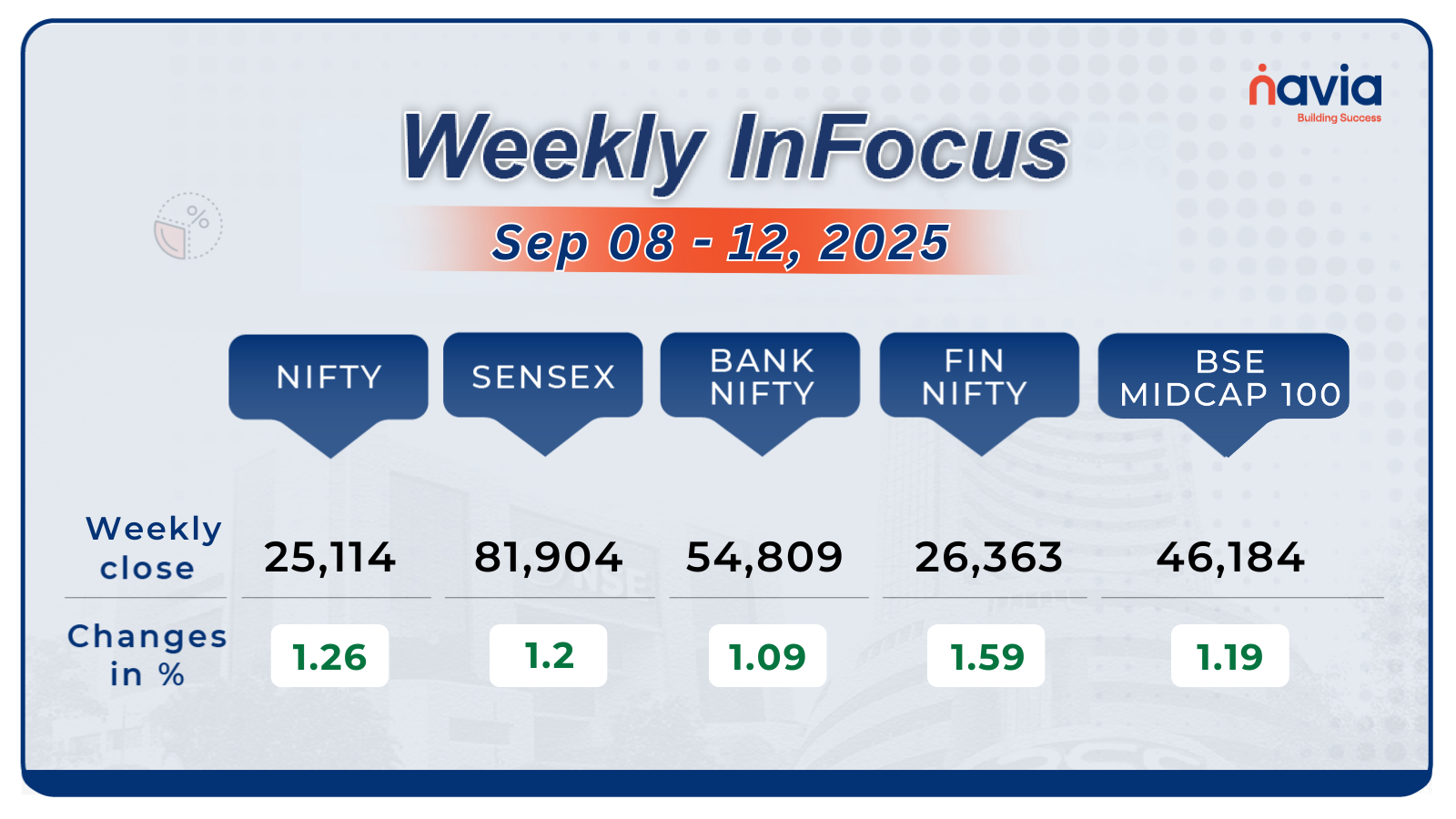

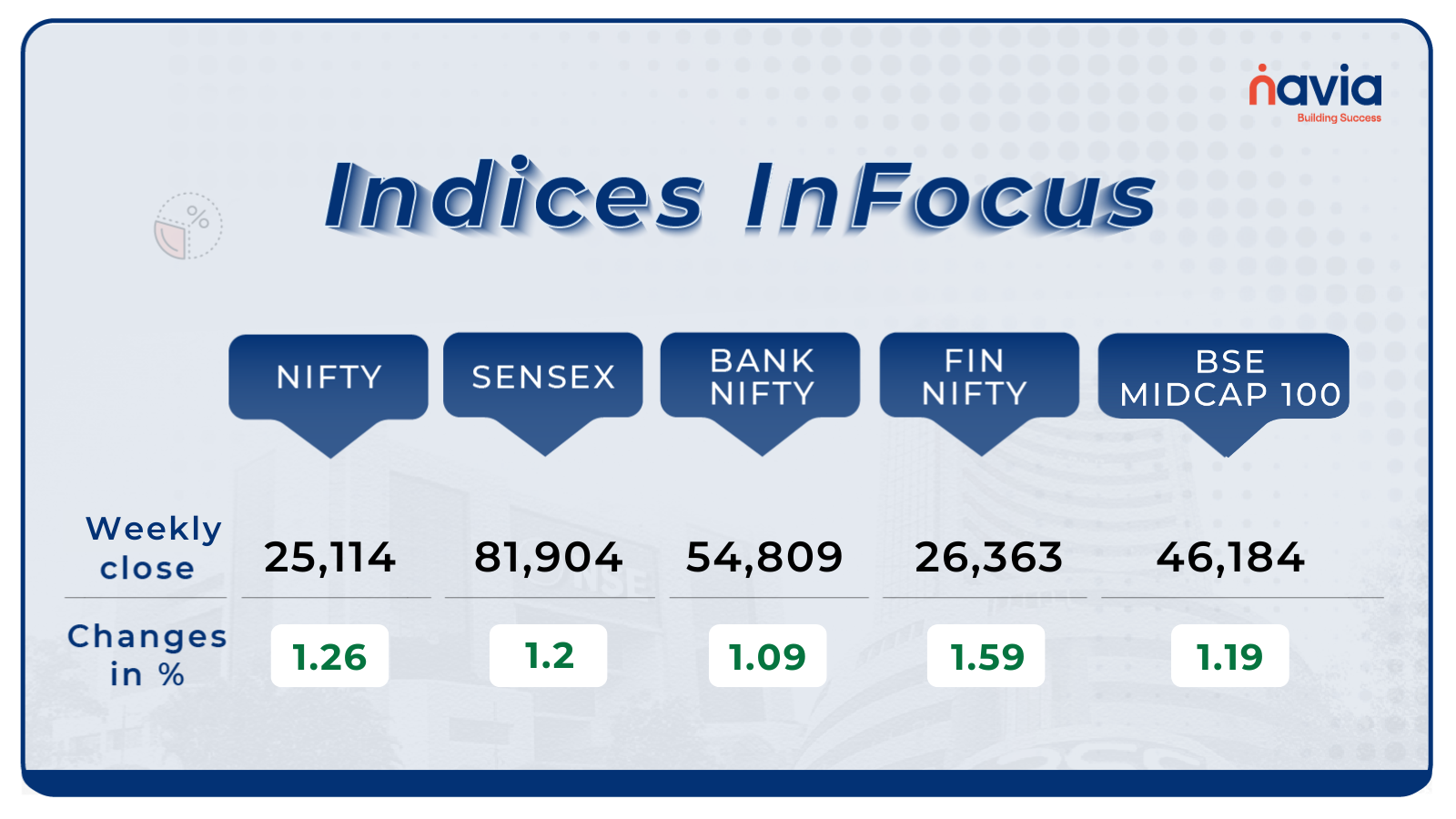

Indices Analysis

For the week, Nifty50 added 1.26 percent to end at 25,114, while the BSE Sensex index added 1.2 percent to end at 81,904.

BSE Mid-cap Index jumped 1.6 percent led by Gujarat Fluorochemicals, Mazagon Dock Shipbuilders, Oracle Financial Services Software, Tube Investments of India, Bharat Heavy Electricals, Bharat Forge, NHPC.

The BSE Large-cap Index added 1.6 percent supported by Waaree Energies, Samvardhana Motherson International, Adani Energy Solutions, SBI Cards & Payment Services, Hindustan Aeronautics, Bharat Electronics, Indus Towers.

The BSE Small-cap index rose 1.5 percent with Sigachi Industries, Faze Three, Precision Camshafts, SMS Pharmaceuticals, Themis Medicare, Indo Count Industries, MTAR Technologies, IOL Chemicals and Pharmaceuticals, Prime Focus, New Delhi Television, India Tourism Development Corporation, Swelect Energy Systems, Greenpanel Industries, Dilip Buildcon, Garware Hi-Tech Films, JBM Auto, Ramco Industries, Salasar Techno Engineering rising 15-36 percent. On the other hand, KR Rail Enginerring, Paradeep Phosphates, Good Luck India, Reliance Infrastructure, Vimta Labs, Rishabh Instruments, CarTrade Tech fell between 10-16 percent.

Foreign Institutional Investors (FIIs) extended their selling in the 11th straight week, as they offload equities worth Rs 3,577.37 crore. On the other hand, Domestic Institutional Investors (DII) continued their buying in 22nd week, as they purchased equities worth Rs 13,703.23crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

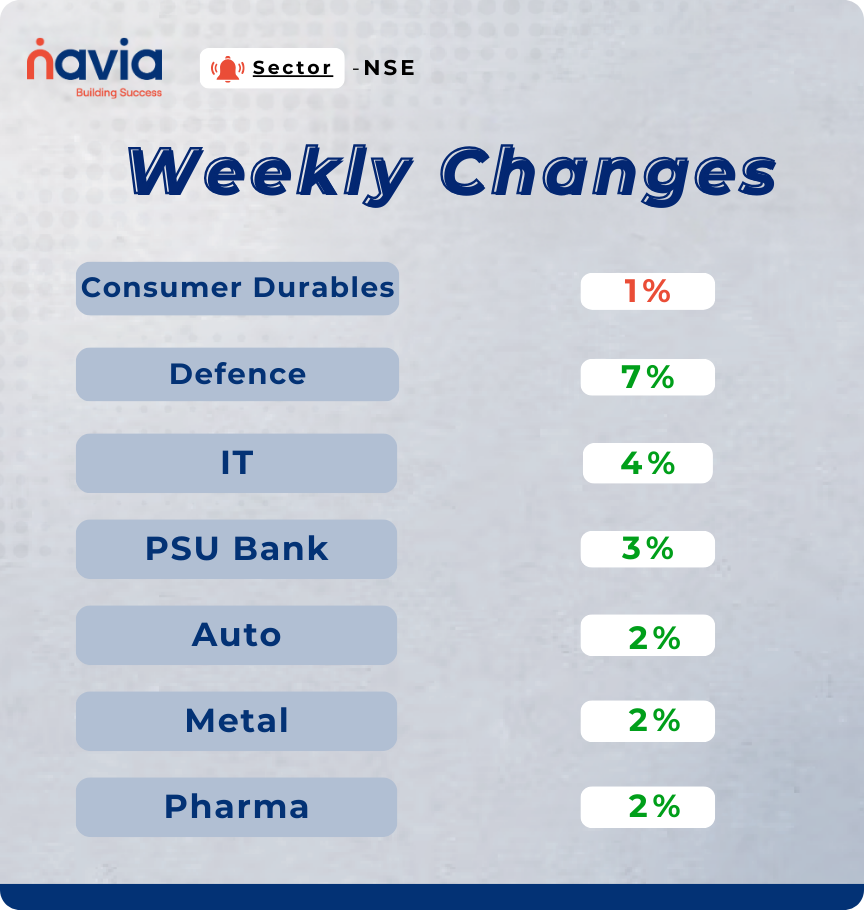

Sector Spotlight

Among sectors, except Nifty Consumer Durables (down 1 percent), all other indices ended in the green with Nifty Defence index rose 7 percent, Nifty IT index jumped over 4 percent, Nifty PSU Bank index added 3 percent, while Nifty Auto, Metal, Pharma jumped 2 percent each.

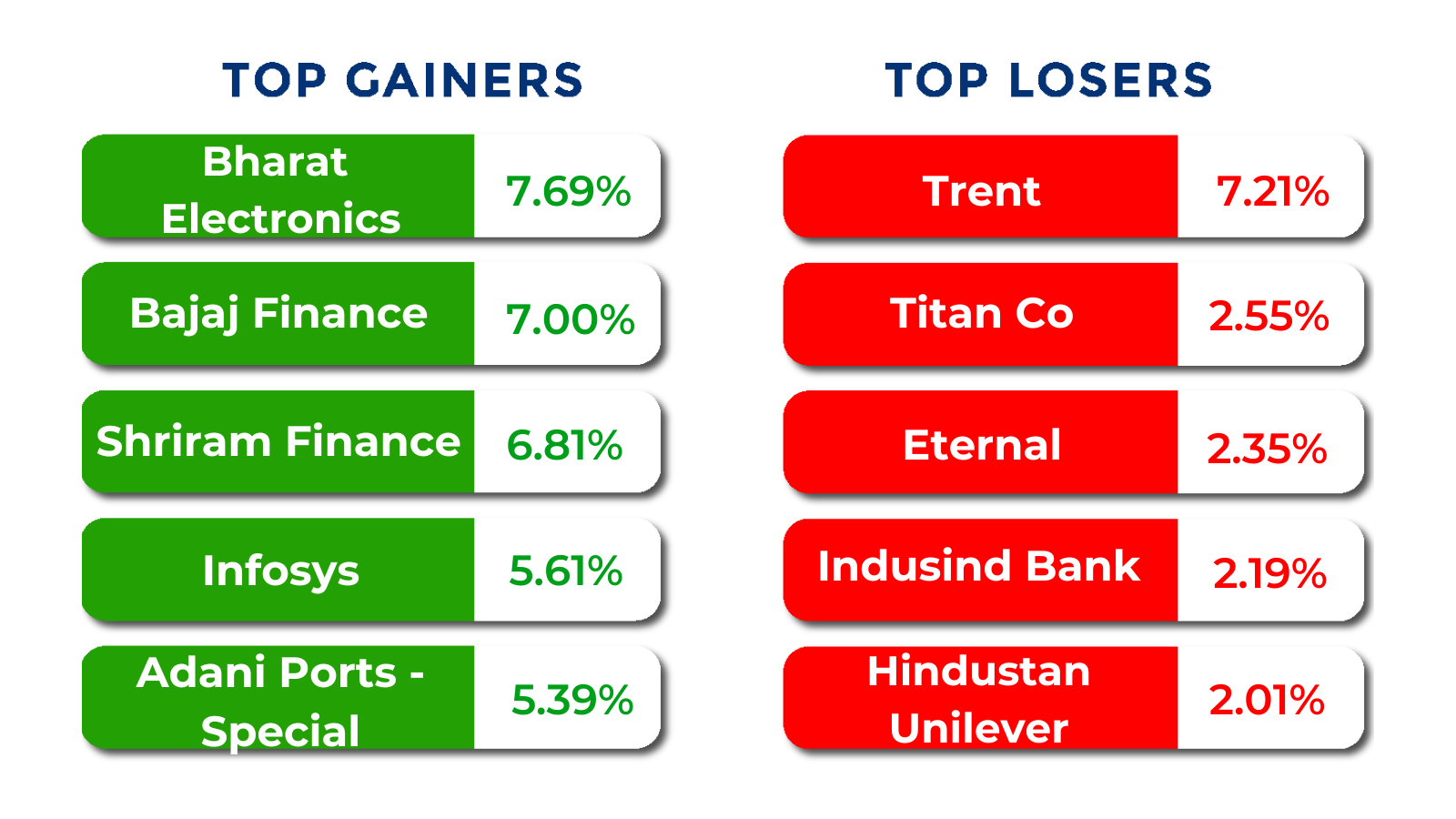

Top Gainers and Losers

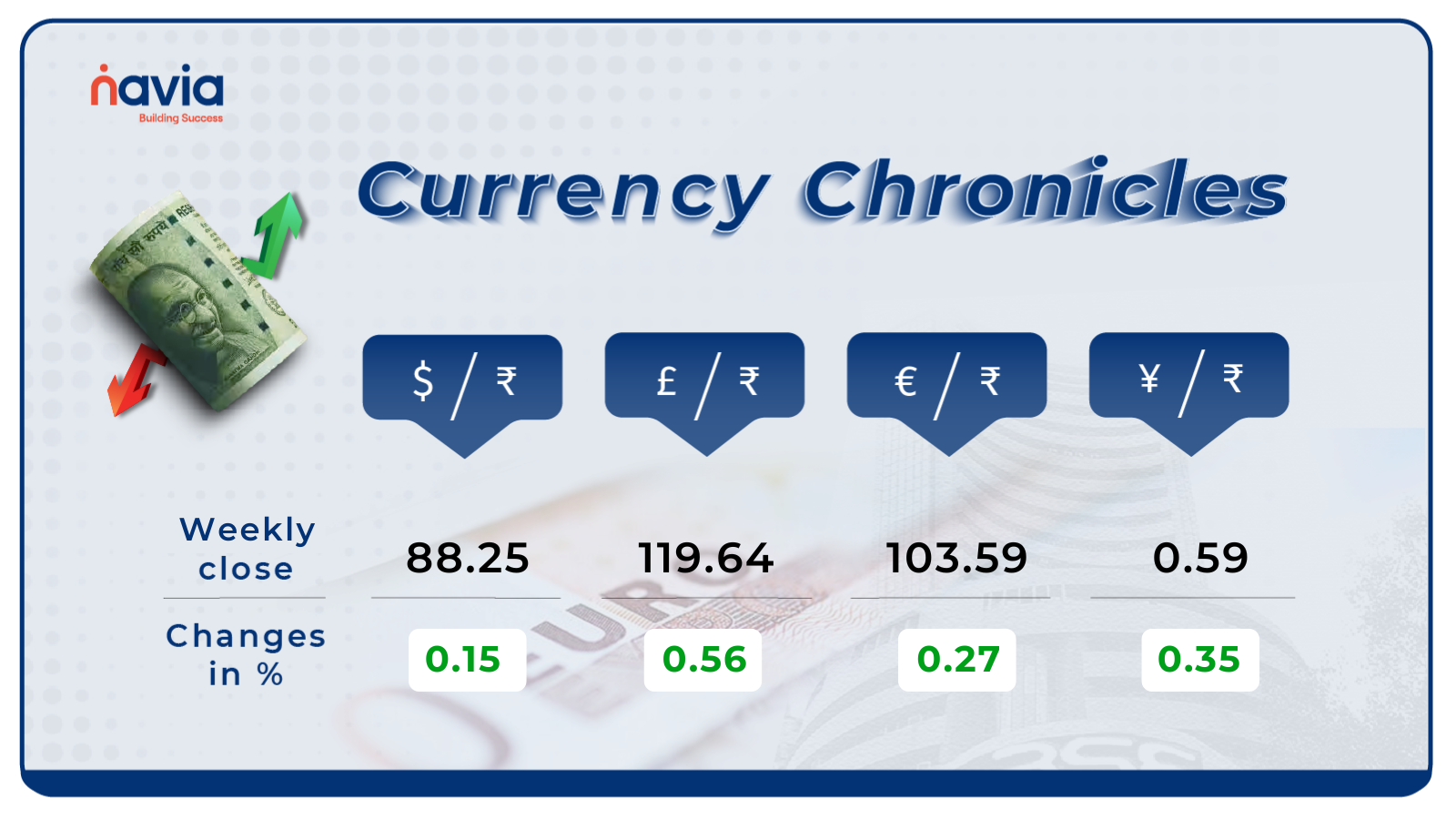

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.25 per dollar, gaining 0.15% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹103.59 per euro, gaining 0.27% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining by 0.35% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

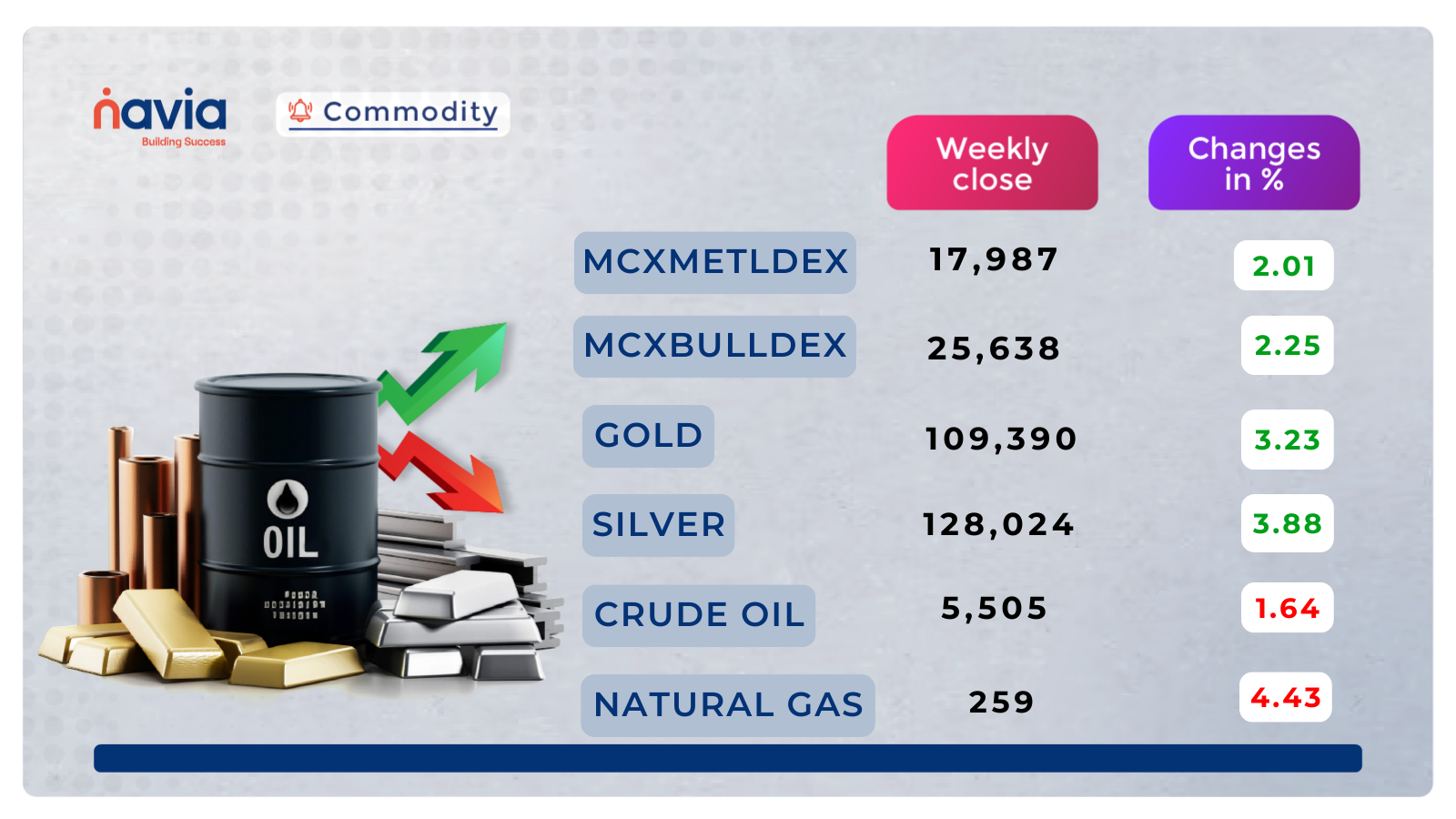

Commodity Corner

Crude Oil session end at 5,505. The price broke out of a falling wedge pattern around mid-August allowed by a steady upward channel until early September. Recently, prices corrected sharply from 5,815 and tested support near 5,460 before rebounding. Latest candles show rejection near resistance (5,621) and a pullback toward support. The ascending channel has now broken on the downside. Momentum looks neutral to slightly bearish in the short term.

In the last session, Gold closed at 109,390. It has been in a strong uptrend since late August, moving within an ascending channel. The rally broke through major resistance at 106,688, which is now acting as strong support. Price is consolidating around 108,900-109,000 after the sharp rally. The channel is intact, but candles near the upper boundary suggest some profit-taking / consolidation. Momentum is strongly bullish, but short-term sideways consolidation is visible. As long as price holds above 106,688, the broader trend remains up.

Natural gas price was in a clear falling channel until late August, consistently making lower highs and lower lows. Towards the end of August, Natural Gas broke out of the falling channel, sparking a sharp rally toward 278 resistance. The rally has stalled near 278, which is acting as a strong resistance. Price is consolidating between 278 resistance and 270–265 support zone. Rising trendline support is still intact, keeping the structure short-term bullish. If Natural Gas sustains above 270–265 and breaks 278, fresh buying momentum could push it higher towards 290–300 levels.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Navia Market Price Protection (MPP) – Trade Fast, Stay Protected

Market volatility shouldn’t cost you more than expected. Navia’s Market Price Protection (MPP) shields your market orders from sudden spikes or dips, ensuring fast execution within safe price limits. Trade confidently knowing you’re protected from bad fills, rejections, and costly surprises.

Limit Price Protection (LPP) – How Navia Keeps Your Trades Safe

One wrong keystroke can cost you lakhs — but not with Navia’s Limit Price Protection (LPP). By blocking abnormal buy or sell orders outside exchange-defined ranges, LPP safeguards your money and keeps markets fair. Whether it’s NSE, BSE, or MCX, Navia ensures your trades stay safe and error-free.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.