Navia Weekly Roundup (Sep 01 – 05, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian market erased some of the previous week’s losses, rising 1 percent in the volatile week amid positive data points, including a 17-year high manufacturing PMI, a services PMI at a 15-year high, GST rate reforms, continued DII buying, and supportive global markets on the expectation of a rate cut by the Fed. However, investors remained worried as exports could be dampened after the US levied a 50% tariff on Indian goods.

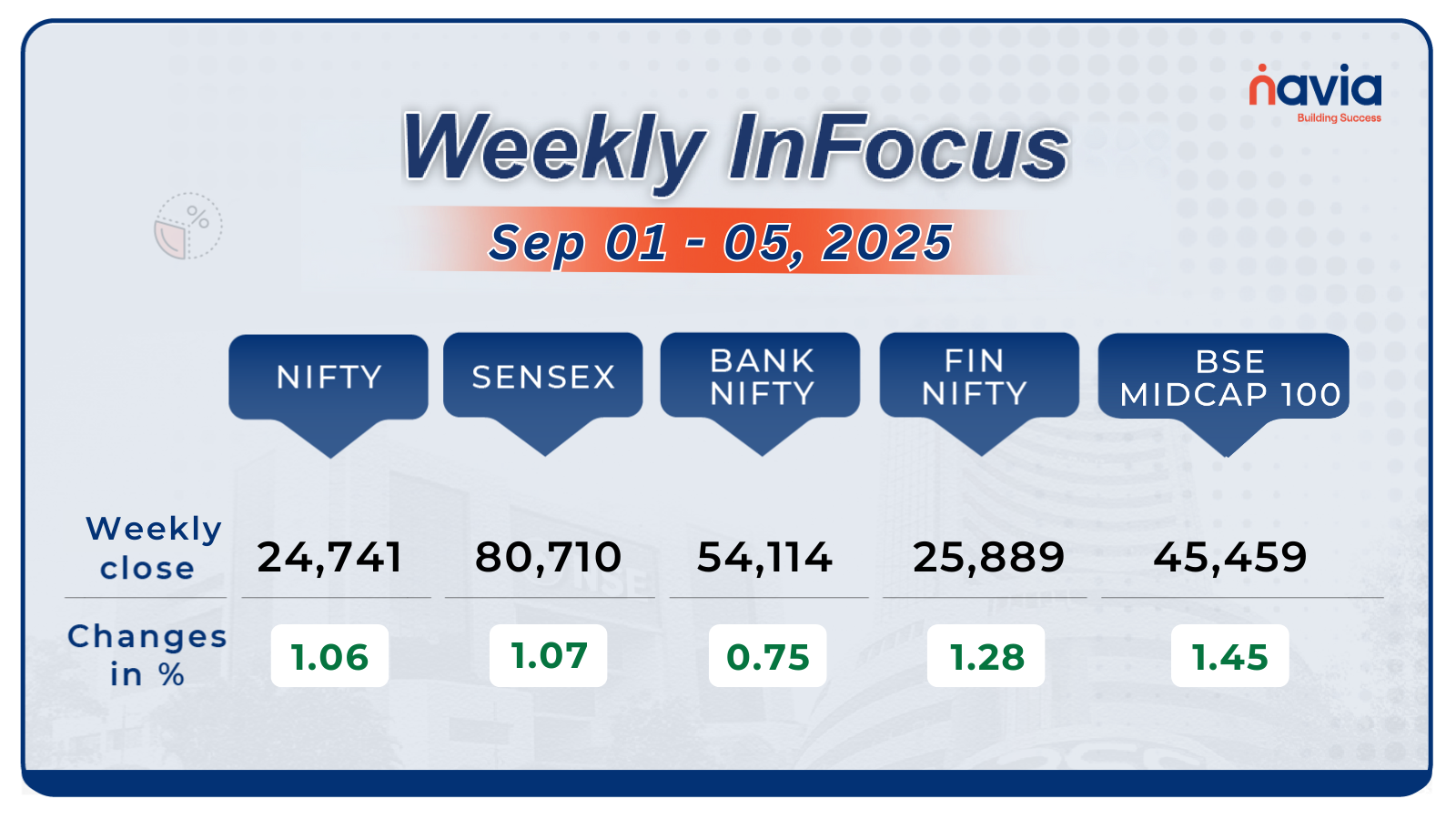

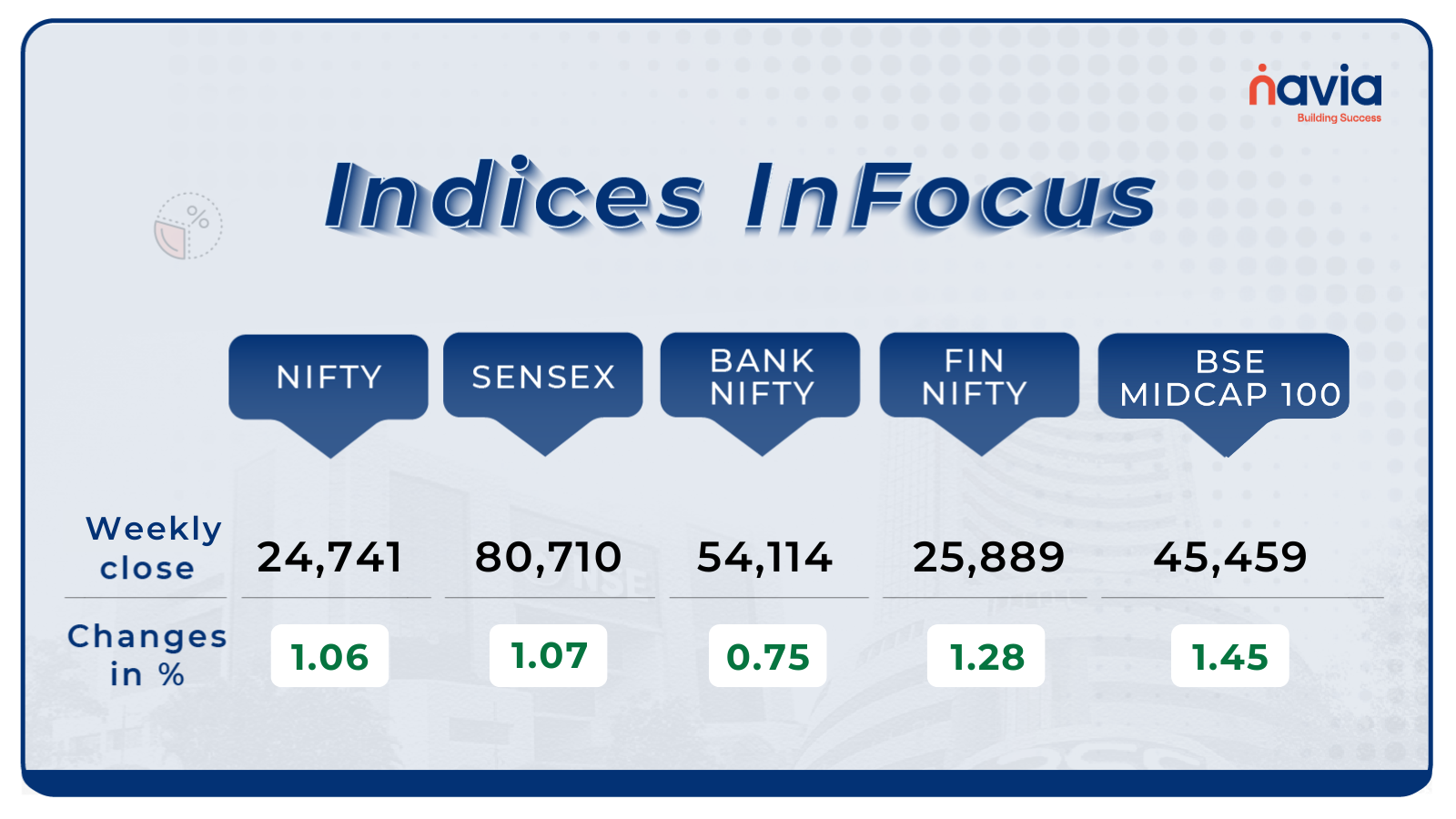

Indices Analysis

For the week, the BSE Sensex index rose 1.07 percent to finish at 80,710.76, while Nifty50 added 1.06 percent to close at 24,741.

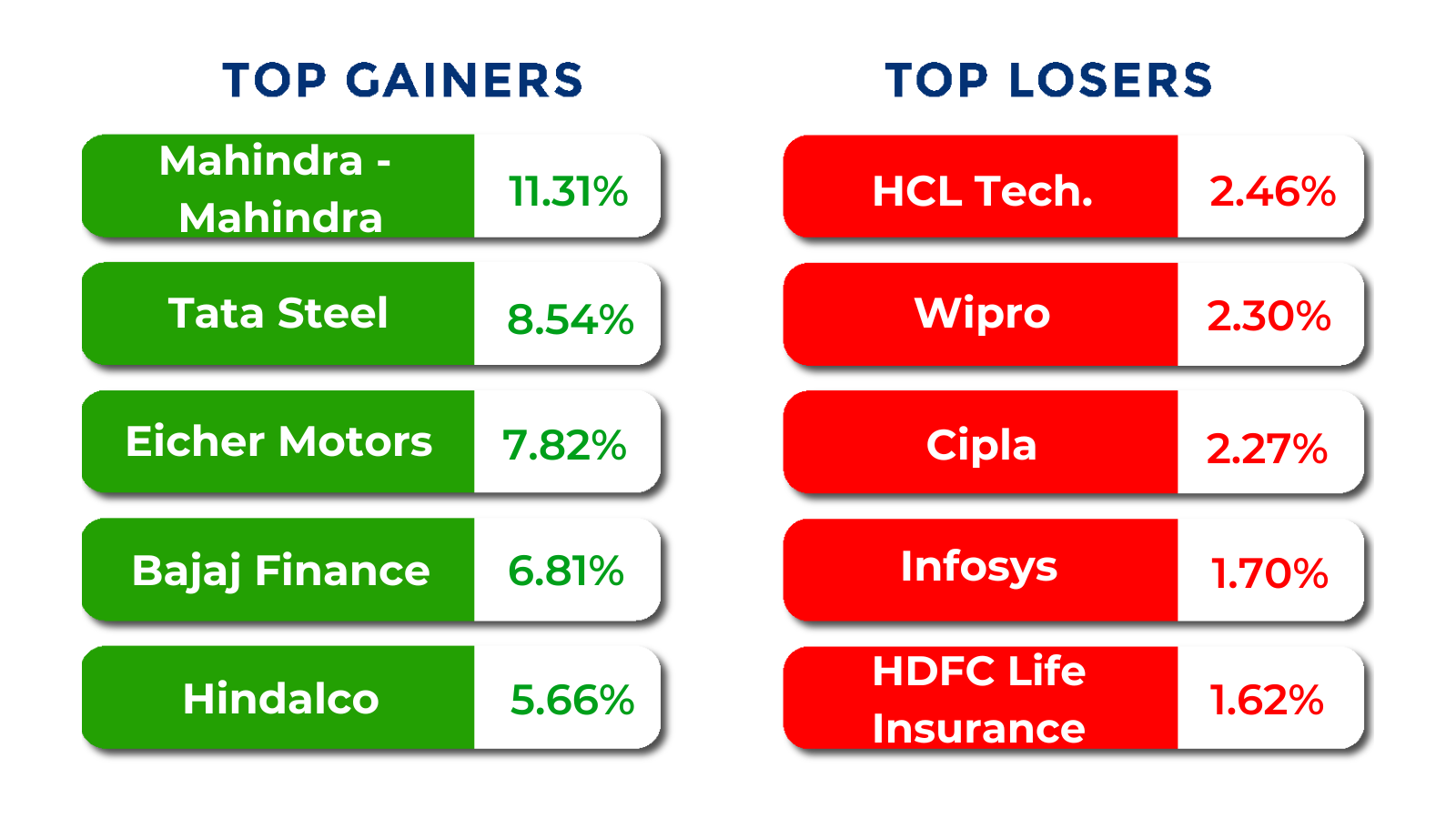

The BSE Large-cap Index rose 1.4 percent, led by Mahindra and Mahindra, Jindal Steel, Tata Steel, Eicher Motors, Swiggy, Bajaj Finance, and TVS Motor Company.

BSE Mid-cap Index gained nearly 2 percent, led by Aditya Birla Fashion & Retail, Ola Electric Mobility, Brainbees Solutions, Steel Authority of India, Rail Vikas Nigam, and NMDC.

The BSE Small-cap index added 2.5 percent with Netweb Technologies India, One Mobikwik Systems, Jai Corp, Hemisphere Properties India, Vimta Labs, Atul Auto, Gujarat Mineral Development Corporation, Rategain Travel Technologies, Zydus Wellness rising between 20-39 percent.

Selling from Foreign Institutional Investors (FIIs) continued 10th consecutive week, as they sold equities worth Rs 5,666.90 crore. On the other hand, Domestic Institutional Investors (DII) continued their buying in the 21st consecutive week, as they bought equities worth Rs 13,444.09 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

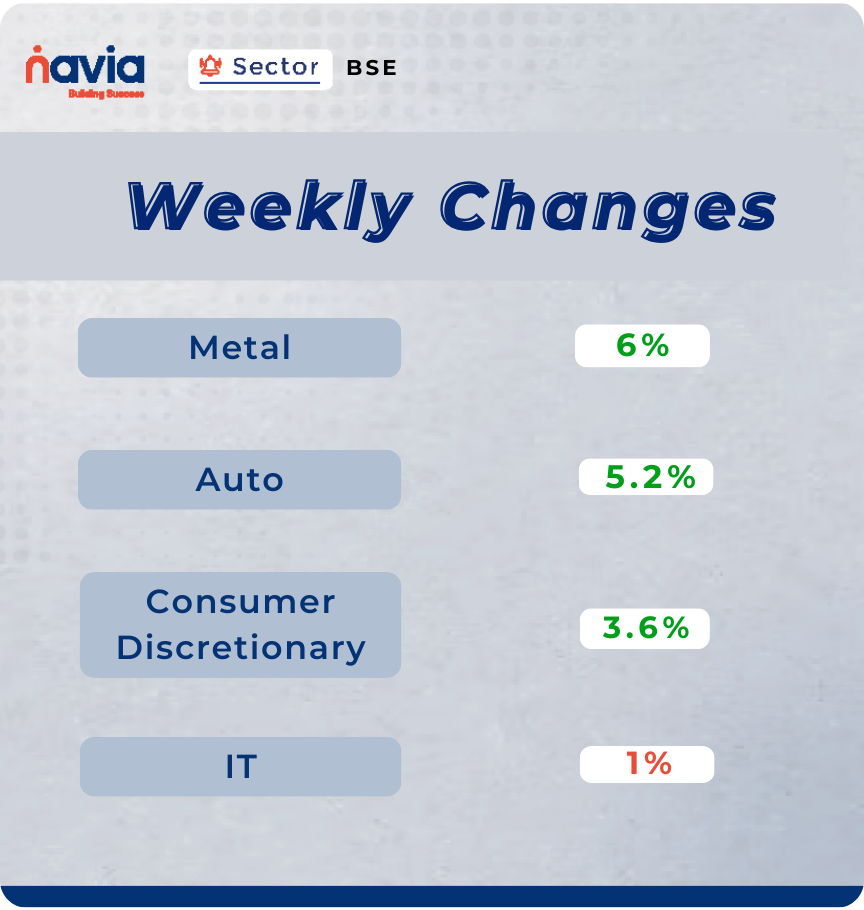

Sector Spotlight

Among sectors, the BSE Metal index added nearly 6 percent, the BSE Auto index rose 5.2 percent, the BSE Consumer Discretionary index gained 3.6 percent, while the BSE Information Technology index shed 1 percent.

Top Gainers and Losers

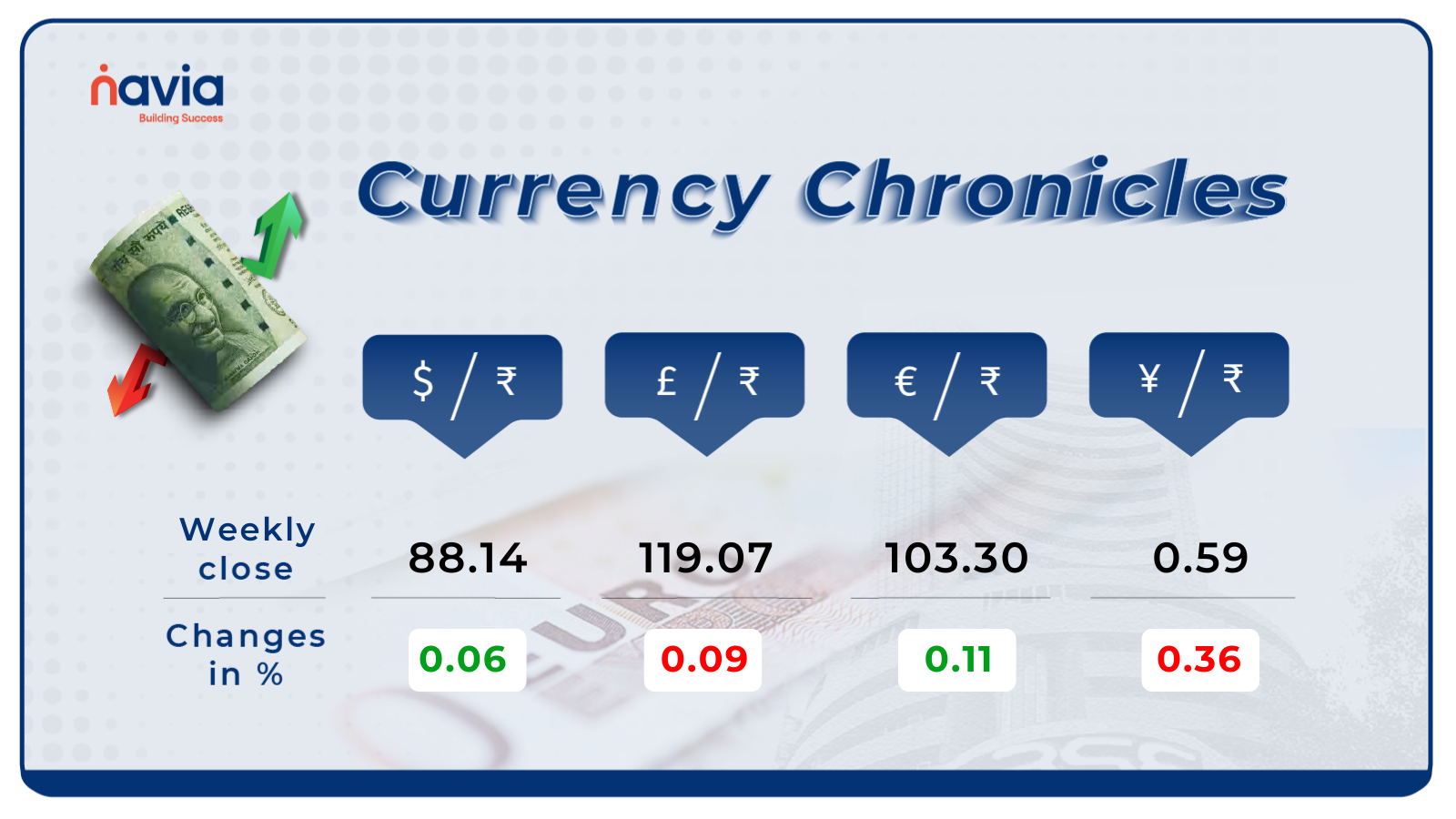

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.14 per dollar, gaining 0.06% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹103.30 per euro, gaining 0.11% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, losing by 0.36% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

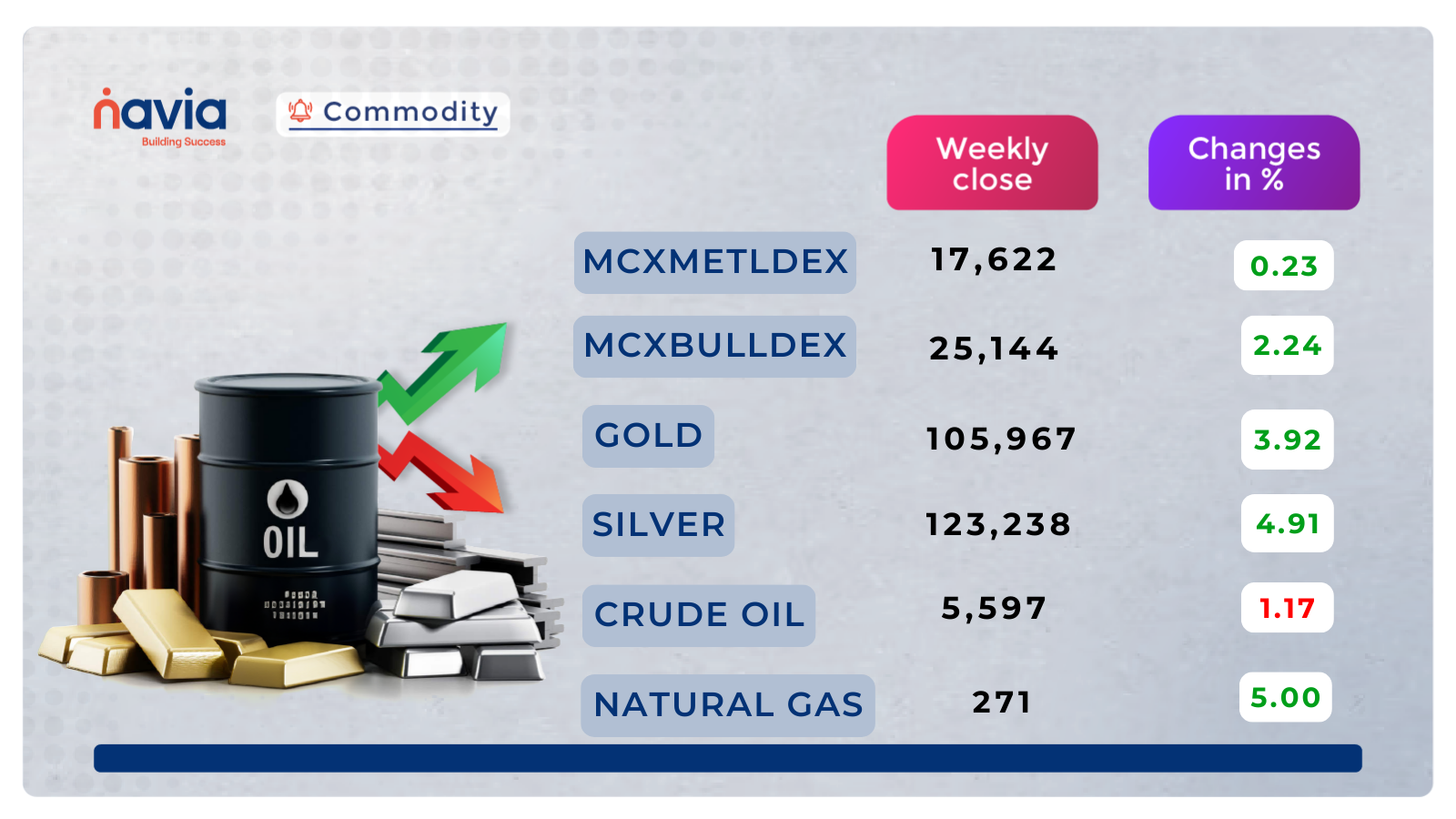

Commodity Corner

Crude Oil Futures session end at 5,597. The chart shows a sharp rally till early August, followed by a steep correction downtrend. Recently, prices staged a recovery, moving in a rising channel, but faced rejection near 5,815 resistance and broke the channel on the downside. The recent breakdown from the rising channel suggests bullish momentum is weakening. Price is currently consolidating just above support levels. Failure to reclaim 5,642–5,695 may indicate weakness in price momentum.

In the last session, Gold closed at 105,967. It has been in a very strong uptrend since mid-August. Price moved inside a steep rising channel, making higher highs and higher lows. Price moved inside a steep rising channel, making higher highs and higher lows. After the sharp rally, price is consolidating in a narrow range → suggests pause in momentum. Still above trendline support, so the uptrend remains intact. A breakdown below 106,000 could trigger deeper pullback.

MCX Natural gas was in a falling channel through July–August. It recently broke out above the channel with strong momentum, confirming a trend reversal to bullish. Strong bullish candles after breakout → suggests buying pressure. However, near-term overbought conditions may cause a pullback to 268.8 support before another move higher. As long as Natural Gas holds above 271, the trend remains bullish.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Mental Accounting in Personal Finance – Why All Money Should Be Treated Equally

Many of us treat bonuses, tax refunds, or windfalls as “extra money,” while guarding our salary carefully — that’s mental accounting in action. The truth is, every rupee has equal value, and treating all money the same way helps avoid impulsive spending, improve discipline, and build long-term wealth.

Framing Effect in Investing – A Tale of Two Investors

In investing, the way information is framed can change everything. A “90% success rate” feels safer than a “10% failure rate” — even though both mean the same! Recognizing the framing effect helps investors focus on facts, not words, and make smarter financial choices.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.