Navia Weekly Roundup ( OCT 7- OCT 11, 2024)

Week in the Review

Market ended lower for the second consecutive week in the volatile session amid rising geopolitical tensions, weak quarterly earnings projections and continued selling by FIIs.

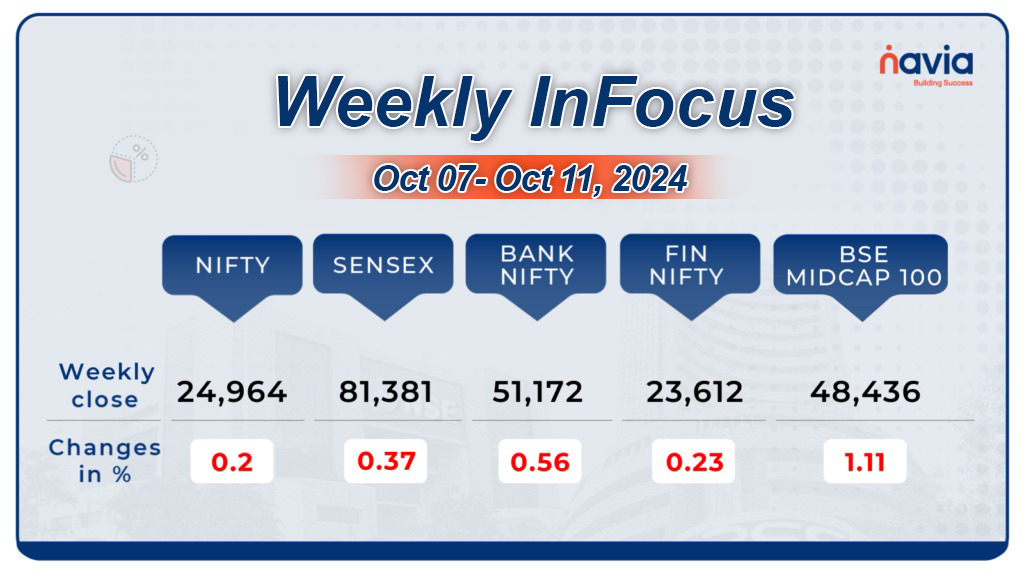

Indices Analysis

This week, BSE Sensex fell 307.09 points or 0.37 percent to close at 81,381.36, while the Nifty50 index declined 50.3 points or 0.20 percent to close at 24,964.30.

BSE Mid-cap Index added 1 percent led by CG Power and Industrial Solutions, Gujarat Fluorochemicals, Page Industries, Glenmark Pharma, Indian Hotels Company, CRISIL, Laurus Labs, Persistent Systems, Nippon Life India Asset Management, Oberoi Realty. However, losers included L&T Finance, Vodafone Idea, Star Health & Allied Insurance Company, Mahindra & Mahindra Financial Services, UNO Minda, SJVN.

Interactive Zone!

Last week’s poll:

Q) The London Stock Exchange’s Stock Market Index is known as___

a) Brent

b) The Sensex

c) Footsie (FTSE)

d) NIFTY

Last week’s poll Answer: c) Footsie (FTSE)

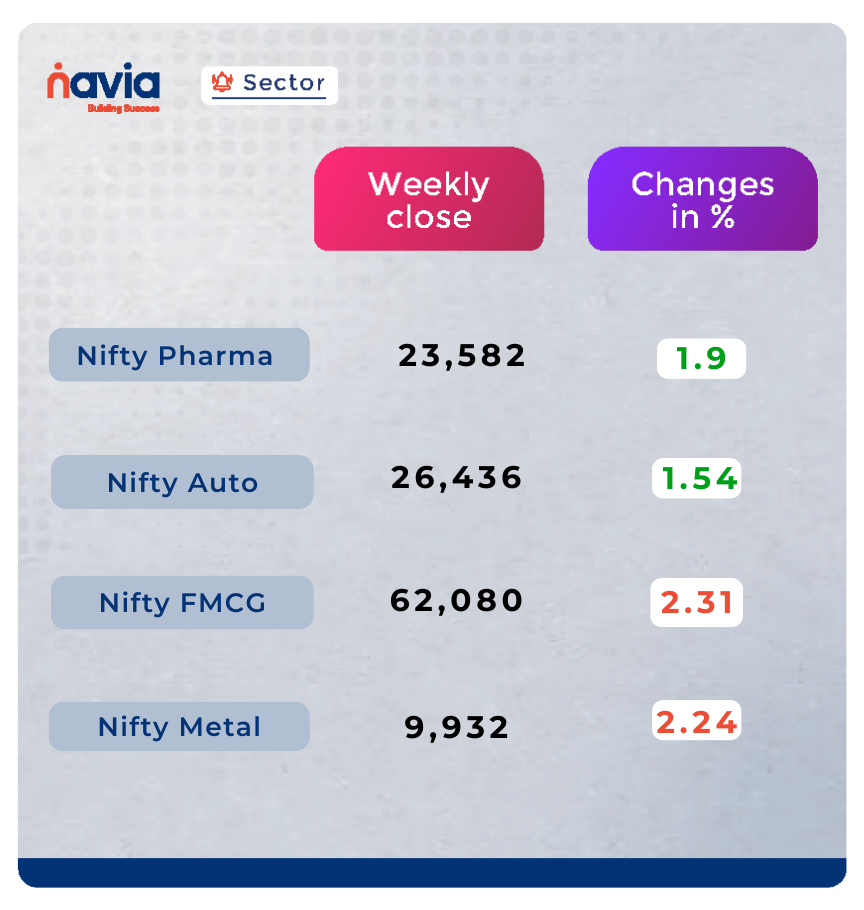

Sector Spotlight

Mixed trend saw on the sectoral front, with Nifty Pharma and Auto indices rose 2 percent each, Nifty IT index was up 1 percent and Nifty Realty index gained nearly 1 percent. On the other hand, Nifty FMCG index shed 2 percent, Nifty Metal and PSU Bank fell 1.5 percent each.

Explore Our Features!

Learn how to quickly shortlist the best stocks using the Navia app!

Our step-by-step tutorial shows you how to leverage powerful features for efficient and effective stock selection.

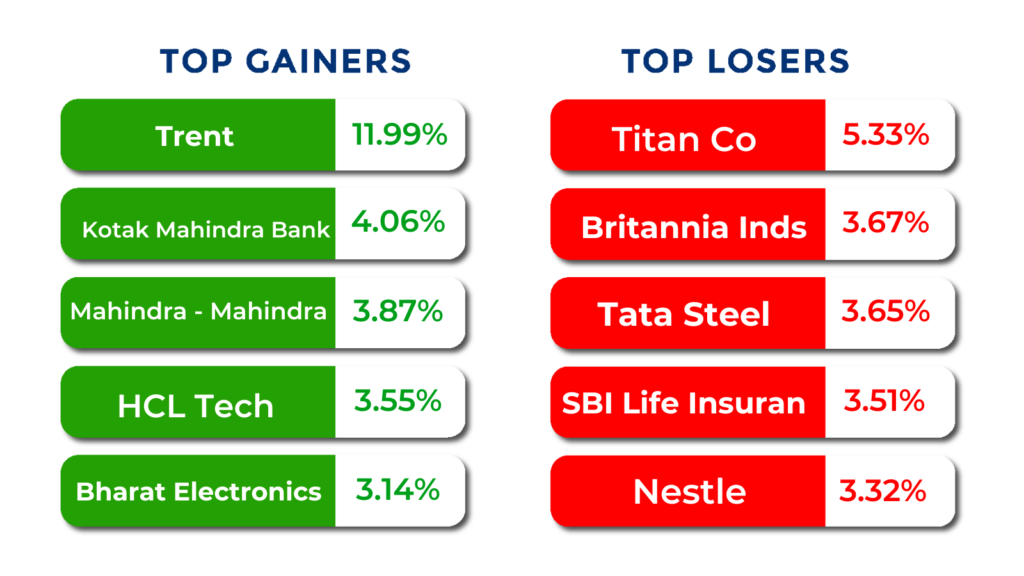

Top Gainers and Losers

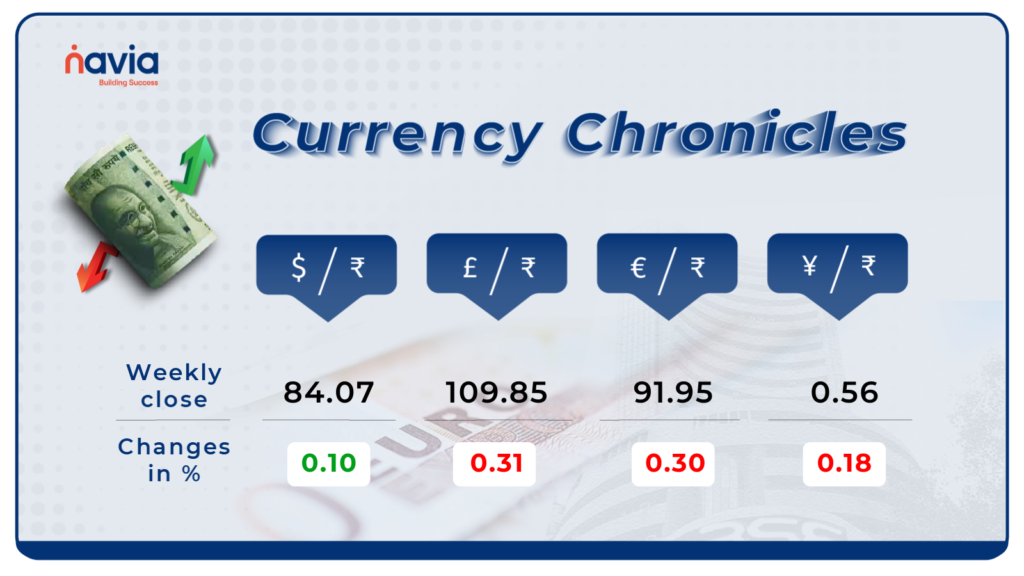

Currency Chronicles

USD/INR:

USD/INR: The rupee crossed a major milestone, weakening beyond 84 for the first time. It closed at 84.07 on October 11, down 10 paise from 83.97 on October 4.

EUR/INR:

EUR/INR: Despite a 0.30% uptick, the EUR/INR market remains bearish, with the euro closing the week at ₹91.95.

JPY/INR:

JPY/INR: The yen slipped by 0.18% against the rupee, ending the week at ₹0.563282, with market sentiment still bearish.

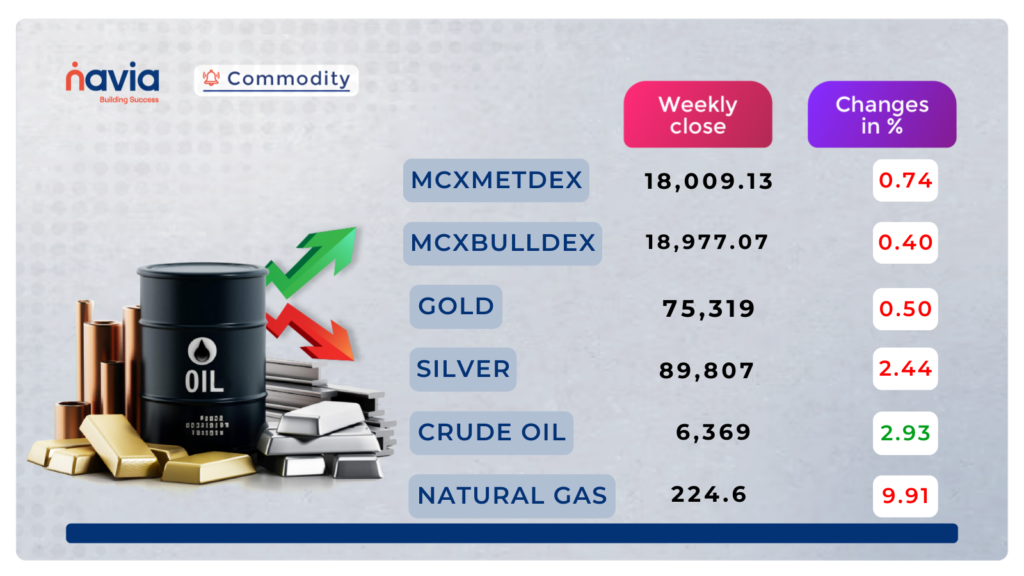

Commodity Corner

Crudeoil after falling for two consecutive sessions, supported by concerns over potential supply risks. The current resistance level (R1) is placed at 6,324, and the support level (S1) is placed at 5910.

Gold prices had eased to its lowest level in nearly three weeks, weighed down by diminishing expectations that the Fed will implement more aggressive policy actions.The current resistance level (R1) is at 75744, and the support level (S1) is at 74146. Naturalgas forecasts for above-normal fall temperatures that curb nat-gas demand for heating are weighing on prices. The current resistance level (R1) is at 175, while the support level (S1) is at 156.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Investing in Hang Seng ETF: A Smart Way to Gain Exposure to the Asian Market

Discover why the Nippon India Hang Seng BeES ETF is a smart choice for Asian market exposure. Get insights on its features, holdings, and how to invest. Read more in the blog!

A Comprehensive Guide to Investing in CPSE ETF

Unlock the potential of CPSE ETF! Explore top holdings, performance, and easy SIP setup in this week’s must-read blog

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?