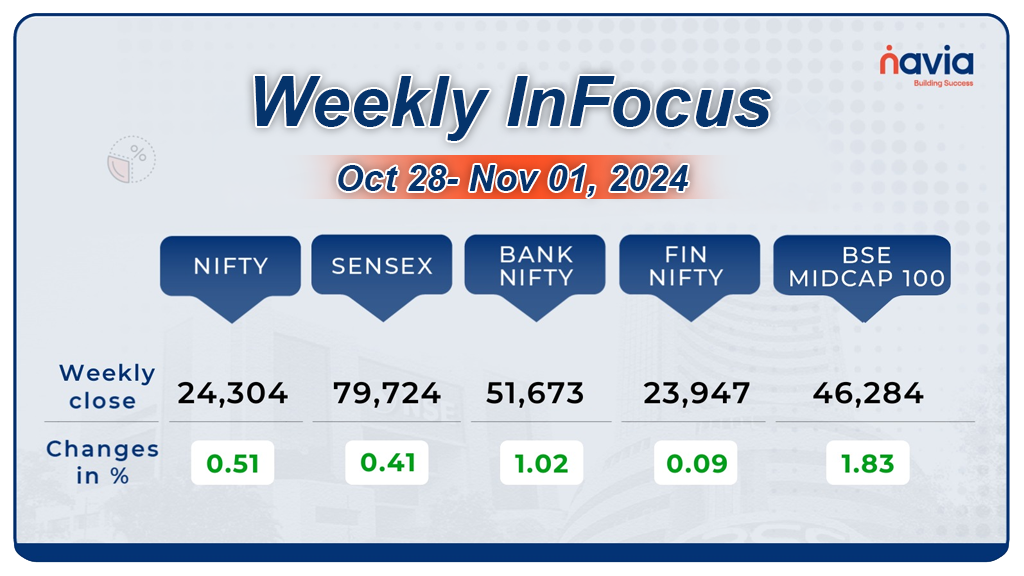

Navia Weekly Roundup ( OCT 28- NOV 01, 2024)

Week in the Review

During the Diwali week, benchmark indices SENSEX and NIFTY closed flat, impacted by profit-taking in blue-chip stocks and record outflows from Foreign Institutional Investors (FIIs).

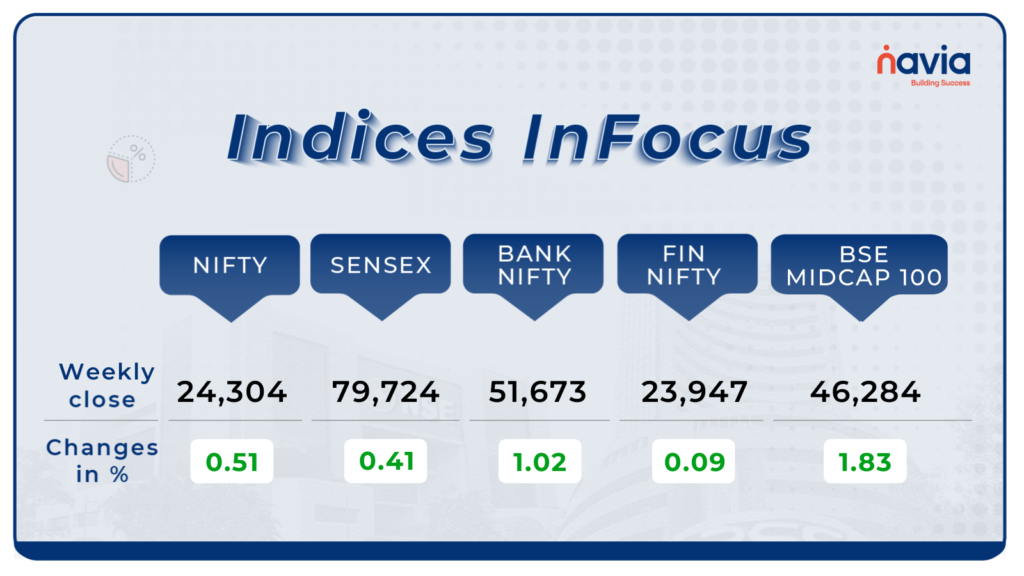

Indices Analysis

In the week, SENSEX slipped by 13 points while NIFTY edged up 24 points to end its four-week slide. Sustained inflows from DIIs and a decline in oil prices restricted losses in key indices.

Broader markets bucked the trend with NIFTY midcap indices gaining up to 2% and NIFTY smallcap rising up to 5%. Larsen & Toubro shares rallied around 6% on Thursday after the company reported a 5% growth in consolidated profit after tax for the September quarter. Indian IT major Infosys, Tech Mahindra, HCL Tech declined this week after US counterparts lagged analysts estimates for the September quarter.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

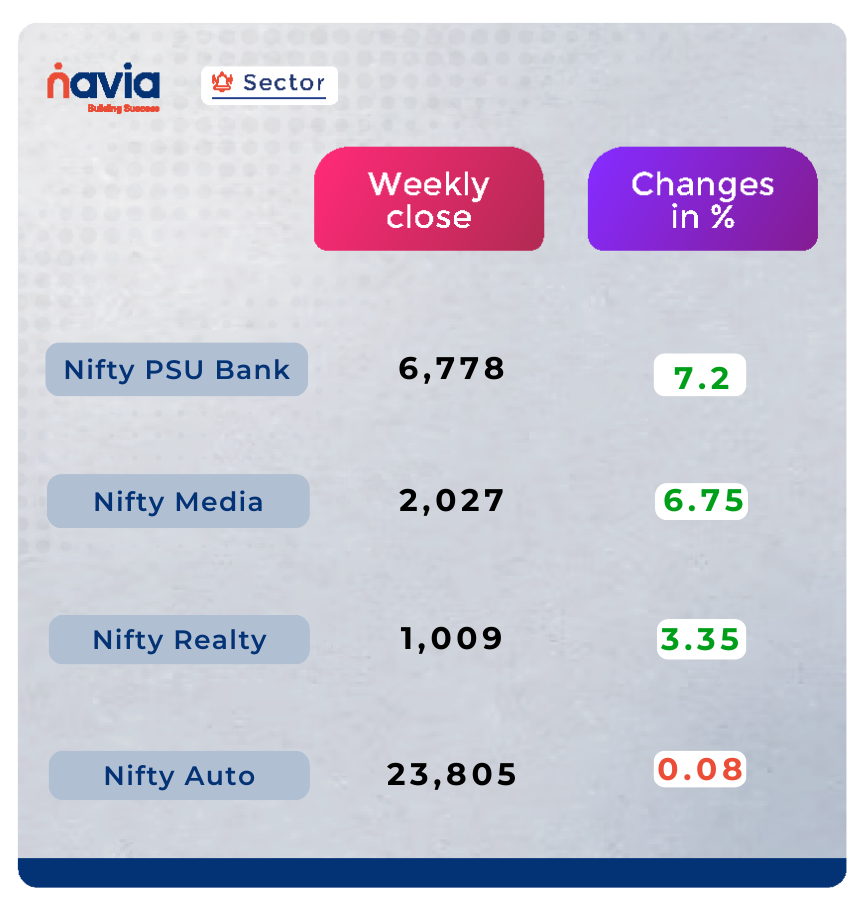

Sector Spotlight

Sectoral indices, PSU Bank and Media rallied around 7% this week. The Realty index gained 3%. On the other hand, auto, consumer durables and IT shares declined.

Top Gainers and Losers

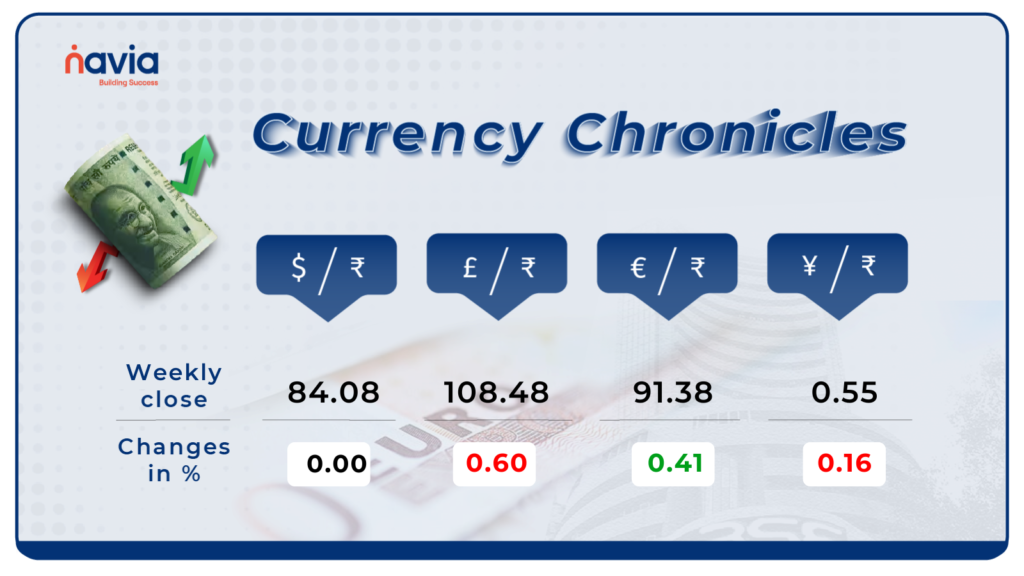

Currency Chronicles

USD/INR:

The USD to INR exchange rate rose during the week, closing at ₹84.08. The sentiment in the market remains neutral, suggesting stability in dollar-rupee exchanges.

EUR/INR:

The EUR to INR exchange rate slipped by 0.41% this week, closing at ₹91.38. Market sentiment is currently neutral, reflecting a cautious outlook.

JPY/INR:

The JPY to INR exchange rate fell by 0.16%, ending the week at ₹0.55. Sentiment in the market is bearish, indicating potential challenges ahead for the yen.

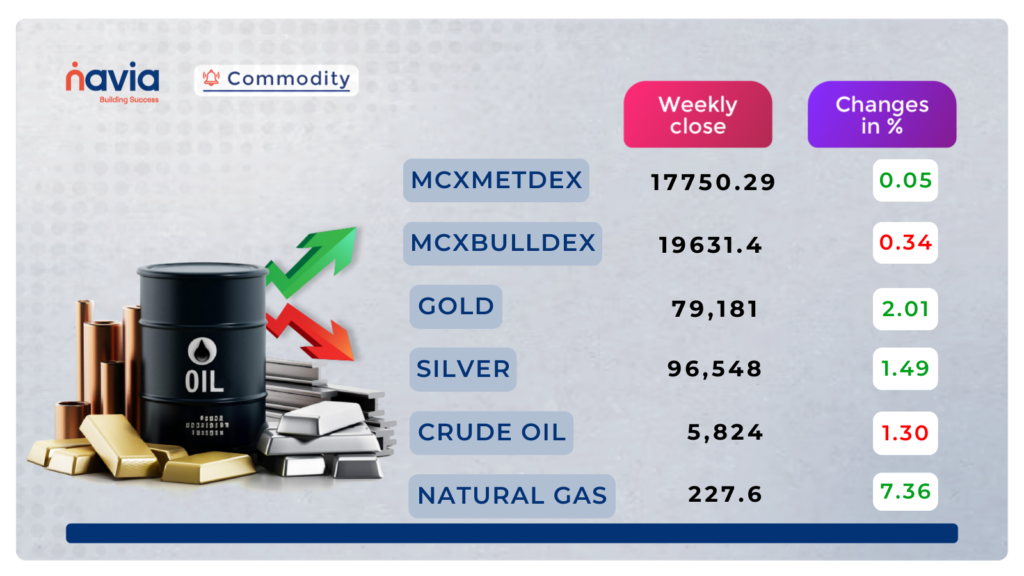

Commodity Corner

Crude oil is currently in a period of uncertainty, forming a Falling channel pattern. While the last session ended up sideways once again.

If the price can break above the resistance level of 5890, it may rise to 5960 and 6060. However, if the price falls below the support level of 5800, it could signal a downward trend, potentially leading to a fall to 5730 or even 5630.

Gold has been rising recently, forming an Ascending Broadening Wedge pattern on the daily chart. Yesterday, the market ended bearish, breaking strong supports. We can expect some more downward movements in the upcoming sessions.

If the market can break below the current support level of 78,250, it may fall to 77,790 and 77,280 levels. However, if the price manages to break above the resistance level of 78,920, it could signal a upward trend, potentially leading to a rise to 79,500 and 79,780 levels.

Natural gas has been trending uncertainly, where the last few sessions after opening on a gap down have been bearish in the symmetrical triangle pattern on the daily interval chart. The future direction of the market is uncertain at this point and will depend on how it reacts to these key support and resistance levels. If the market breaks below the support level of 227.50, it could further fall to 221 and 215.50 levels. However, if the price breaks above the resistance level of 235, it could revive the upward trend, potentially leading to a rise to 241.50 and 246.50.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Unlocking the Potential of REITs: A Gateway to Income-Generating Real Estate in India and Beyond

Explore the world of Real Estate Investment Trusts (REITs) and discover how they can offer you income-generating real estate without the hassle of ownership. This blog covers the basics of REITs, their growth in India, and why they might be the perfect investment for you.

Using Options as a Stop Loss Strategy for Your Investments: A Comprehensive Guide

Learn how to safeguard your investments using options as a stop loss strategy! This blog covers techniques like protective puts and collar strategies to manage risk while maximizing gains. Discover how the Navia Mobile App can enhance your options trading experience.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?