Navia Weekly Roundup ( OCT 21- OCT 25, 2024)

Week in the Review

The market fall continued in the fourth straight week ended October 25, marking the longest losing streak since August 2023. The losses come amid heavy FII outflows due to China’s stimulus measures, muted Q2 earning season and rising Middle East tensions.

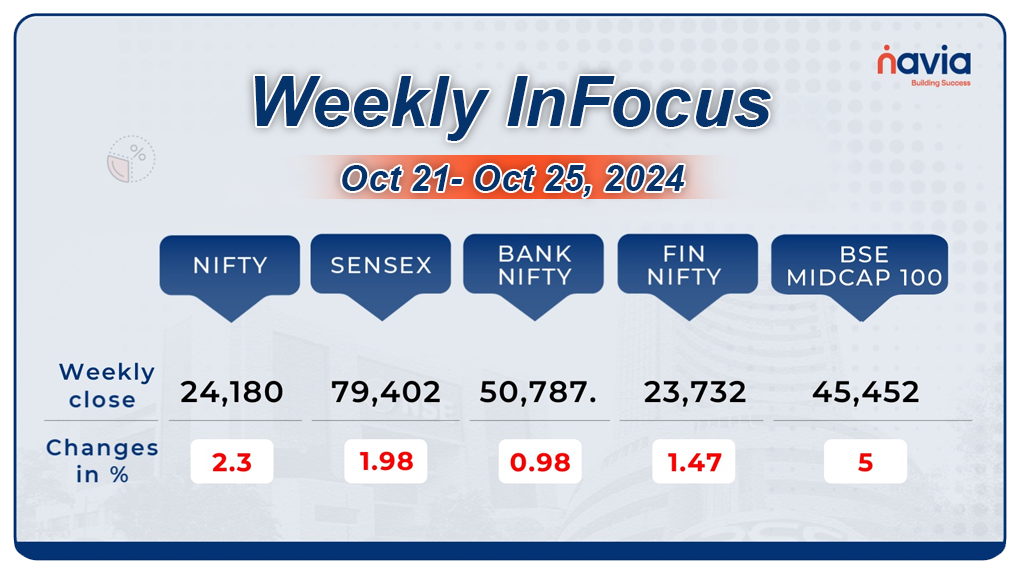

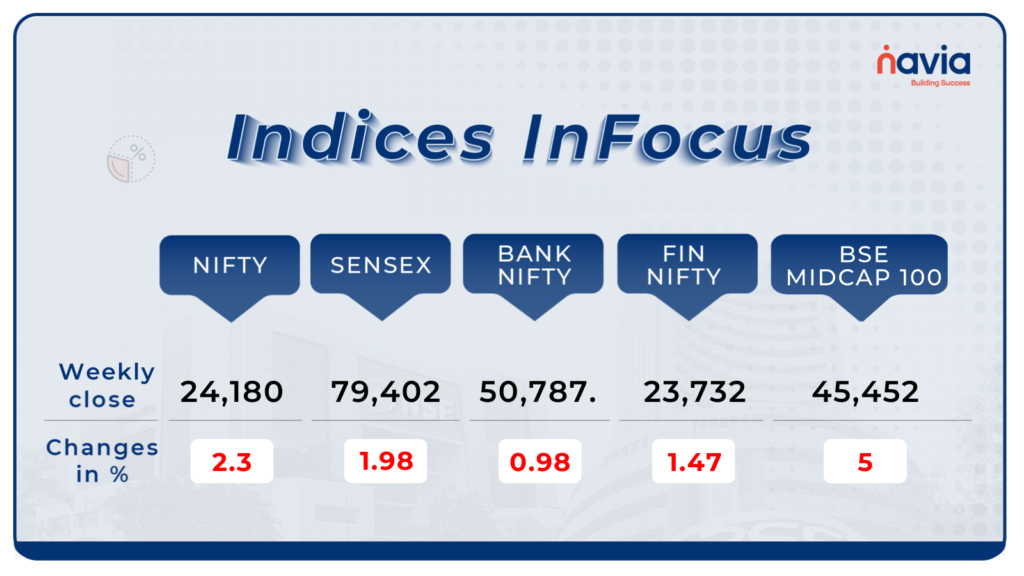

Indices Analysis

This week, BSE Sensex shed 1,822.46 points or 1.98 percent to finish at 79,402.29, while the Nifty50 index fell 673.25 points or 2.3 percent to close at 24,180.80. For October, both benchmarks shed 6 percent each.

The BSE Small-cap index shed 7.3 percent with PNC Infratech, Huhtamaki India, Chennai Petroleum Corporation, KPIT Technologies, Bliss GVS Pharma, RBL Bank, Poonawalla Fincorp, Gravita India, and IIFL Securities falling between 20 percent and 32 percent. On the other hand, Timex Group India, CARE Ratings, Amber Enterprises India, Deepak Fertilisers, and City Union Bank added 10-15 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

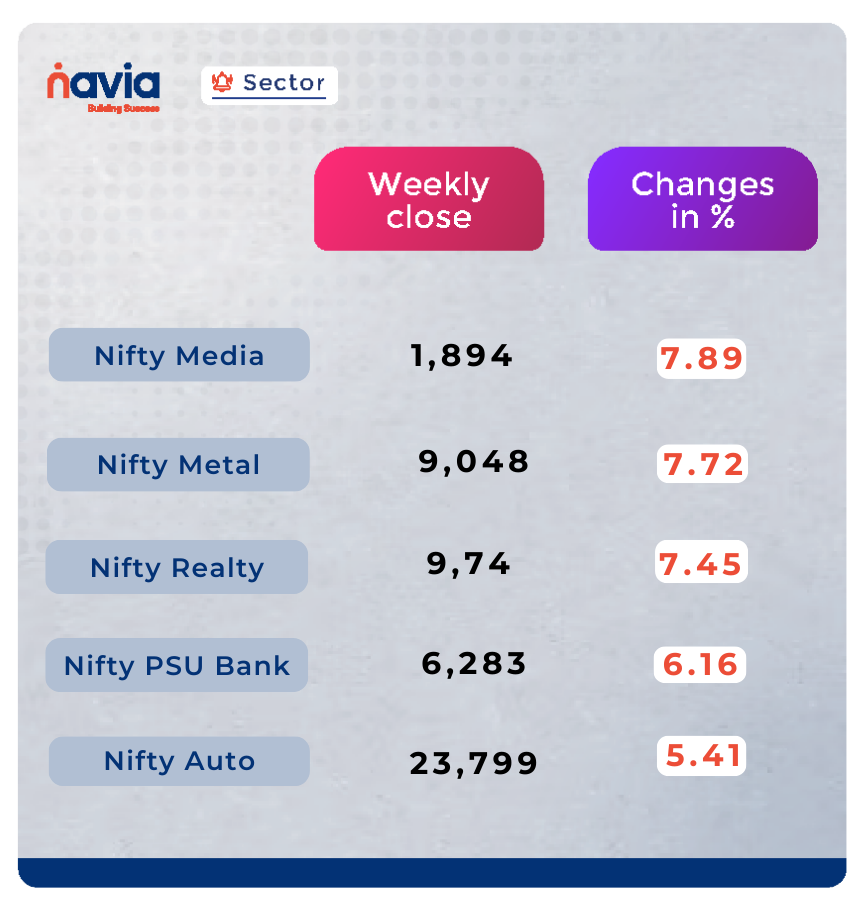

Sector Spotlight

On the sectoral front, Nifty Media, Metal, Realty shed 7 percent each, Nifty Oil & gas index fell more than 6 percent, Nifty PSU Bank index declined nearly 6 percent and Nifty Auto index slipped more than

5 percent.

Explore Our Features!

Feature of the Week: Find the Best Stocks in Minutes with Navia App

Learn how to easily find top-performing stocks using the Navia app! Our tutorial offers a step-by-step guide to leveraging its powerful features for effective stock selection.

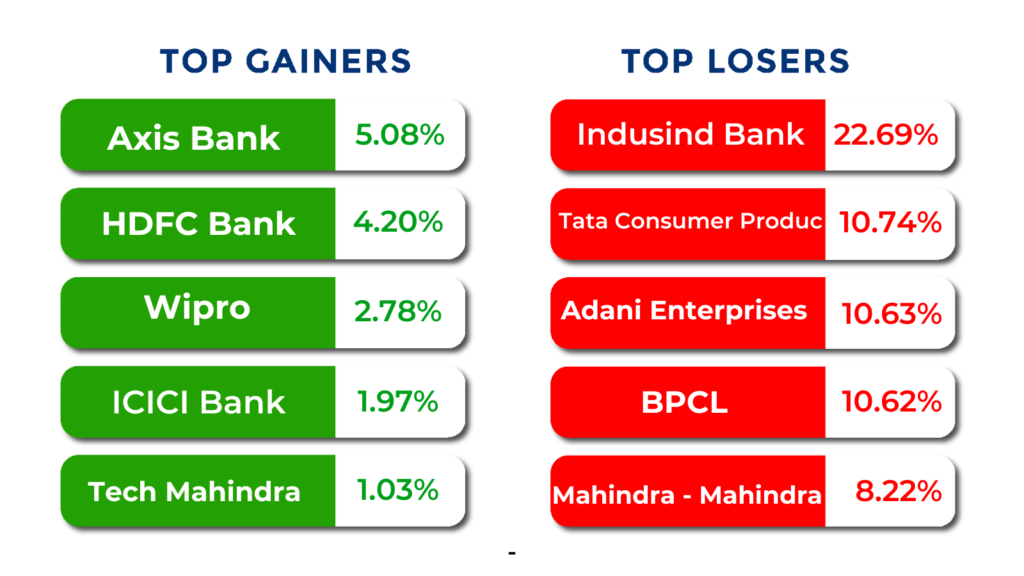

Top Gainers and Losers

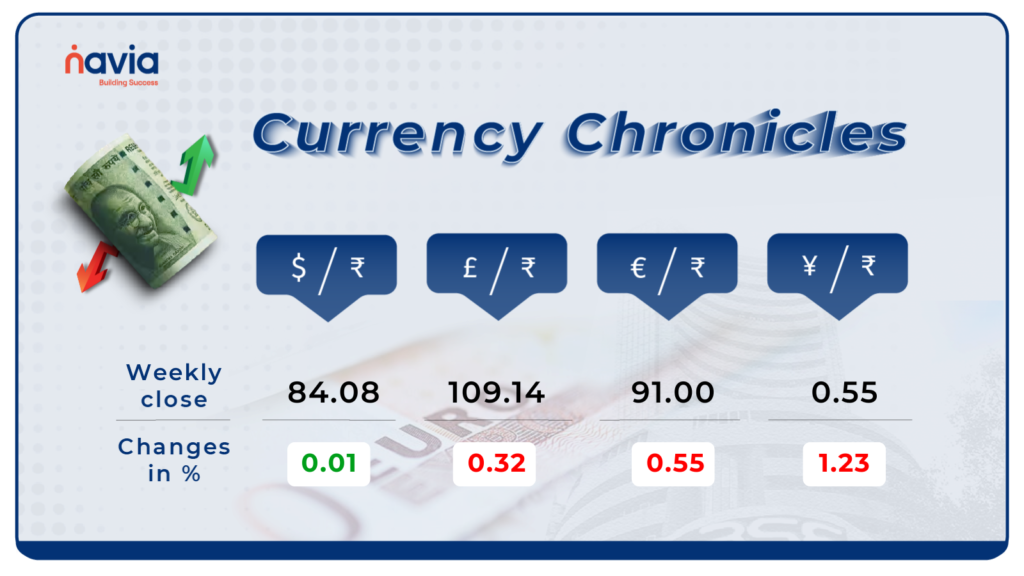

Currency Chronicles

USD/INR:

The Indian rupee remained steady at ₹84.08 per dollar for the week ending October 25, reflecting stability.

EUR/INR:

The EUR to INR rate is expected to close at ₹91.00 by week’s end, reflecting a modest dip of 0.55%. Stay tuned as we track short- and long-term currency trends for the weeks ahead!

JPY/INR:

This week, the JPY to INR rate is forecasted to close at ₹0.5510, reflecting a 1.23% decline. Follow along for insights on short-term shifts and what to expect in the currency market ahead!

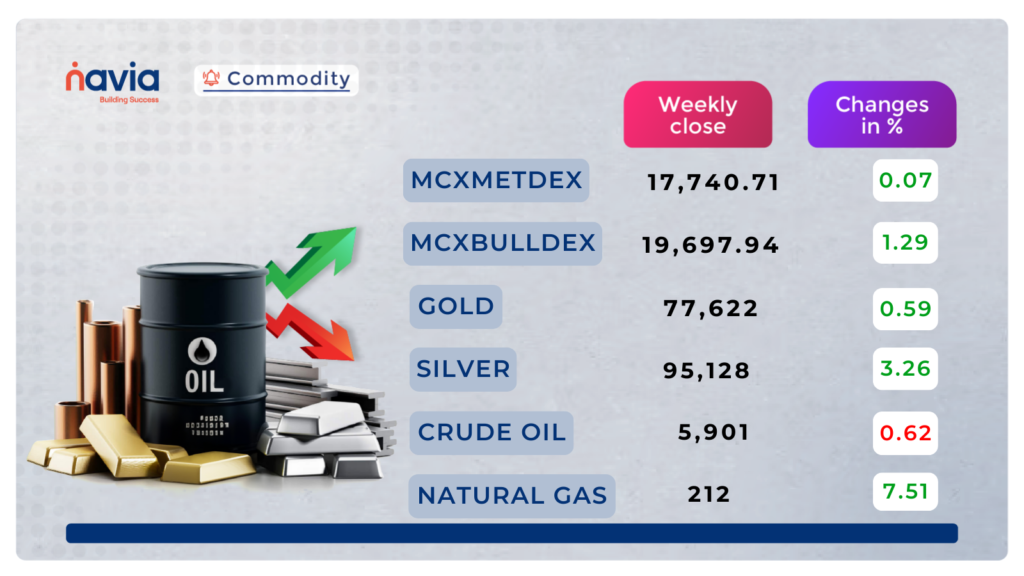

Commodity Corner

Crude oil is currently in a period of uncertainty, forming a symmetrical triangle pattern. While the trend of the last few sessions has been downward,

If the price can break below the support level of 5890, it may fall to 5820 and 5740. However, if the price rises above the resistance level of 5990, it could signal an upward trend, potentially leading to a rise to 6120 or 6240.

Gold has been rising recently, forming a pattern on the 4-Hour chart that suggests a continuation of this upward trend. However, yesterday, the market ended neutrally, indicating a potential continuation of the upward trend in the upcoming sessions.

If the market can break above the current resistance level of 78,500, it may rise to 78,920 and potentially reach new higher levels. However, if the price manages to break below the support level of 77,890, it could signal a downward trend, potentially leading to a fall to 77,290 and 76,660 levels. Natural gas has been trending upward recently, forming a Cup and Handle chart pattern in the Daily interval chart. This suggests that the upward trend may continue. If the market breaks above the resistance level of 210, it could further rise to 215 and 220 levels. However, if the price breaks below the support level of 203.50, it could revive the downward trend, potentially leading to a decline to 197.50 and 189.50.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Using an Option Calculator for Profitable Options Trading

Dive into our latest blog to discover how an option calculator can simplify your trading journey! Learn step-by-step how to assess risks, calculate potential profits, and enhance your options trading strategy with the Navia Mobile App.

Unlock the potential of Margin Trade Funding (MTF) to maximize your returns as a momentum or swing trader.

Discover its advantages, real-world examples, and how Navia can elevate your trading strategy. Read more to learn how to boost your profits!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?