Navia Weekly Roundup ( OCT 14- OCT 18, 2024)

Week in the Review

Market extended the losing streak in the third consecutive week ended October 18 amid high volatility led by muted Q2 earnings expectations, continues FII outflows and ongoing Middle East tensions.

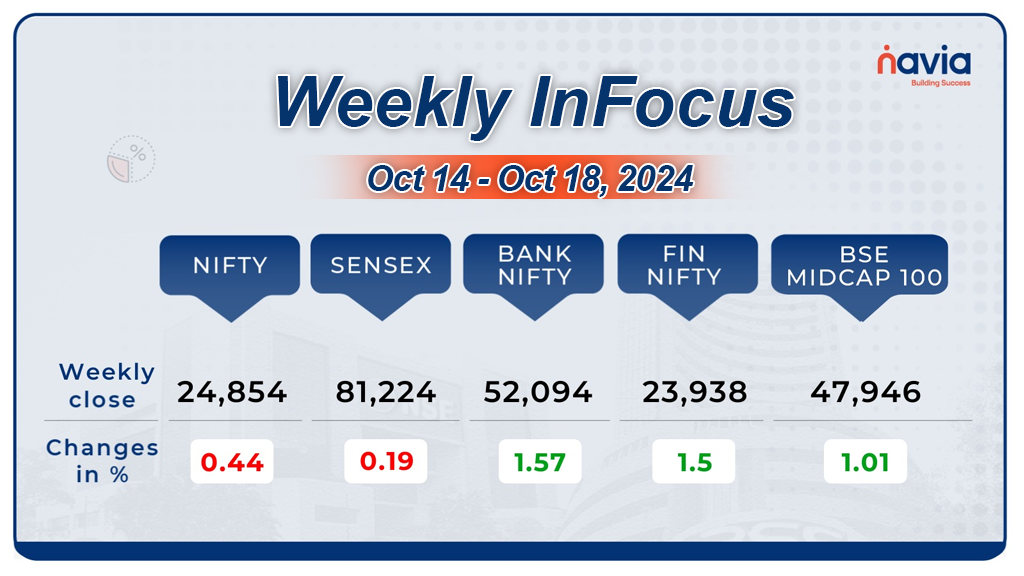

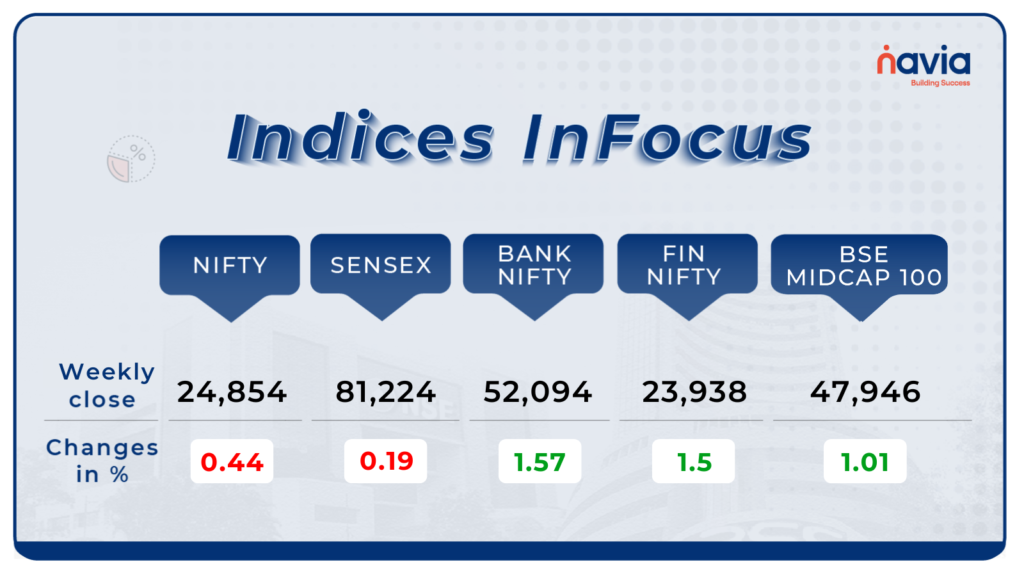

Indices Analysis

This week, BSE Sensex was down 156.61 points or 0.19 percent to end at 81,224.75, while the Nifty50 index shed 110.25 points or 0.44 percent to finish at 24,854.

BSE Mid-cap Index shed 1 percent with Indraprastha Gas, Oil India, Colgate Palmolive (India), NHPC, Exide Industries, Bharat Heavy Electricals, Godrej Industries, Indian Renewable Energy Development Agency, United Breweries, Crompton Greaves Consumer Electrical falling 5-16 percent. However, gainers included Hindustan Petroleum Corporation, MphasiS, Tube Investments of India, Torrent Power, Federal Bank, Godrej Properties, Voltas, ICICI SecuritieZone!

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

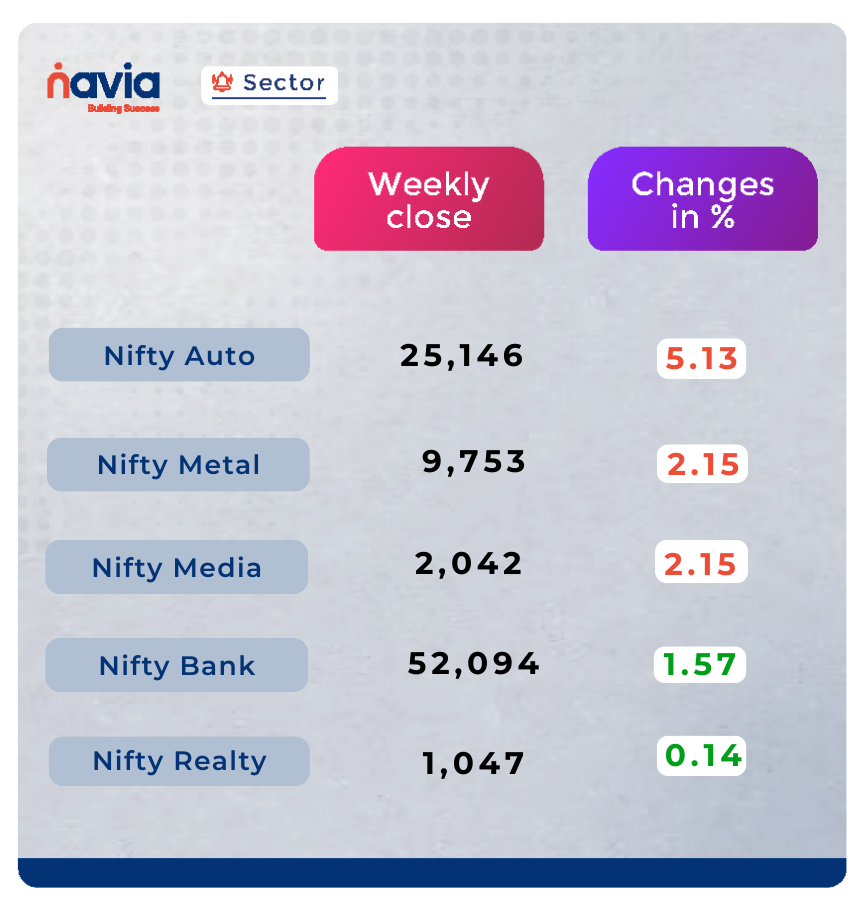

Sector Spotlight

On the sectoral front, Nifty Auto index slipped nearly 5 percent, Nifty Metal index fell nearly 2 percent, Nifty Media, FMCG and Oil & Gas index shed 1.5 percent each. On the other hand, Nifty Bank index up nearly 2 percent, Nifty PSU Bank index added 1 percent, and Nifty Realty index gained 0.6 percent.

Explore Our Features!

Calculate Stock Returns in 3 Easy Steps with Navia App!

Learn how to measure your stock investments’ performance with our simple guide to calculating stock returns. Whether you’re a beginner or a seasoned investor, understanding your gains is essential. Discover more investment tips and tools with the Navia App!

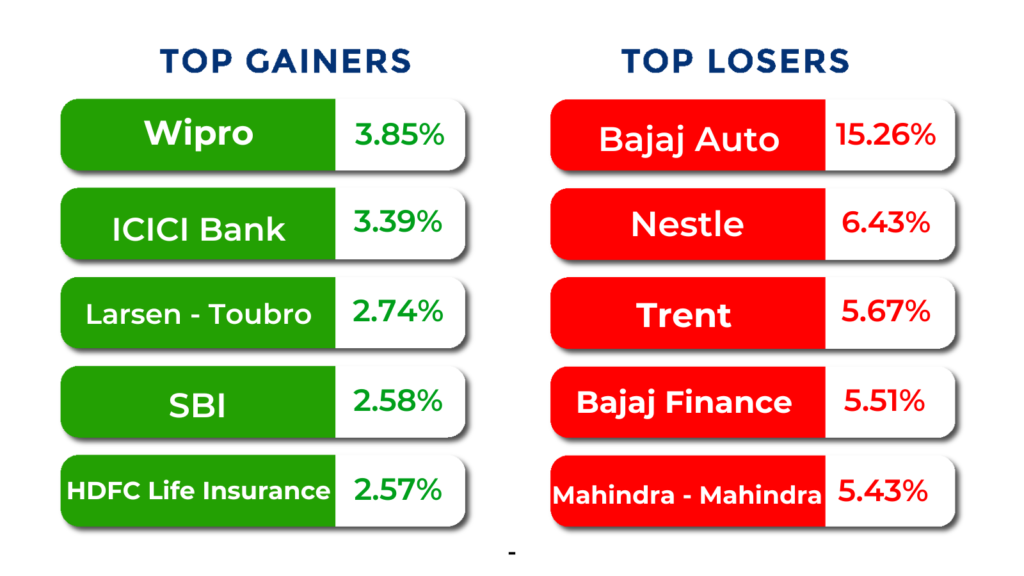

Top Gainers and Losers

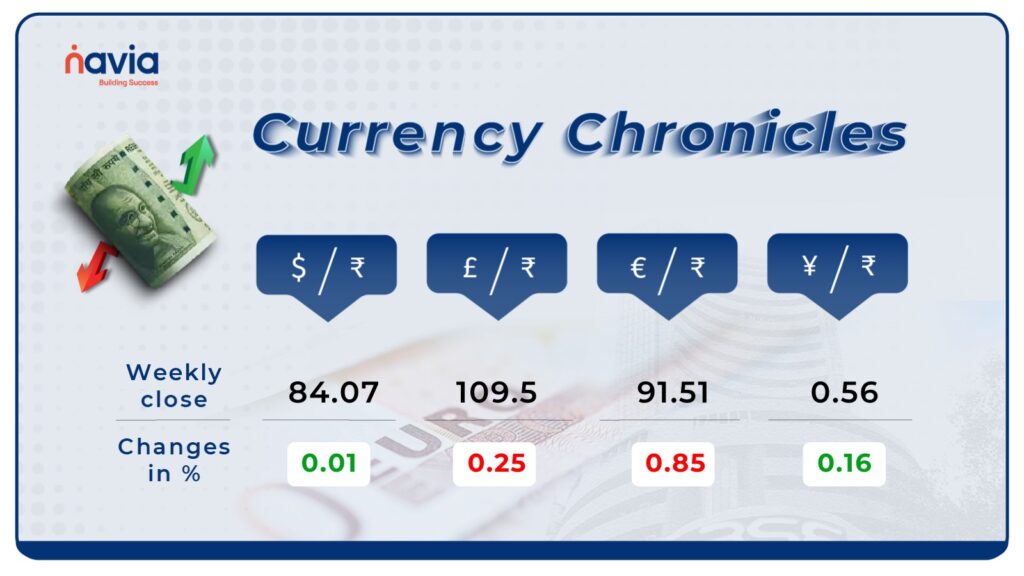

Currency Chronicles

USD/INR:

The Indian rupee concluded the week flat, ending at ₹84.07 per dollar on October 18, indicating stability amid fluctuating market conditions.

EUR/INR:

The EUR to INR exchange rate fell by 0.58% for the week, closing at ₹91.51. The market sentiment remains bearish, suggesting ongoing challenges for the euro against the rupee.

JPY/INR:

The JPY to INR exchange rate slipped by 0.16% this week, closing at ₹0.564074. The prevailing market sentiment remains bearish for the yen, indicating potential challenges ahead as it faces pressure against the rupee.

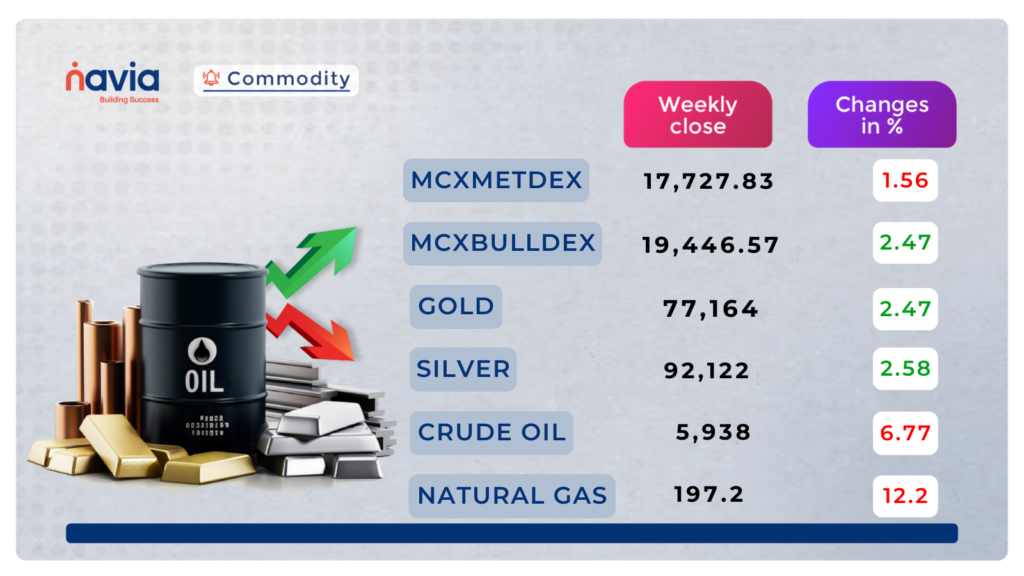

Commodity Corner

Crudeoil showing muted trade poised for its sharpest weekly decline in over a month due to concerns over demand outlook and a looming surplus. The current resistance level (R1) is placed at 6,122 and the support level (S1) is placed at 5678.

Gold showing uptrend rally amid rising geopolitical tensions in the Middle East, which typically lead to demand for the precious metal as a safe-haven asset. The current resistance level (R1) is at 77731, and the support level (S1) is at 76519. Currently showing positive momentum, with higher levels reflecting increased buying interest. The current resistance level (R1) is at 92858, and the support level (S1) is at 90237. Naturalgas shwoing downtrend rally the outlook for above-normal US temperatures that will reduce heating demand for nat-gas is weighing on nat-gas prices. . The current resistance level (R1) is at 215, while the support level (S1) is at 186.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Dive into our detailed comparison of Navia and Angel One!

Discover how Navia’s zero brokerage model and lower MTF interest rates give it the edge for savvy investors.

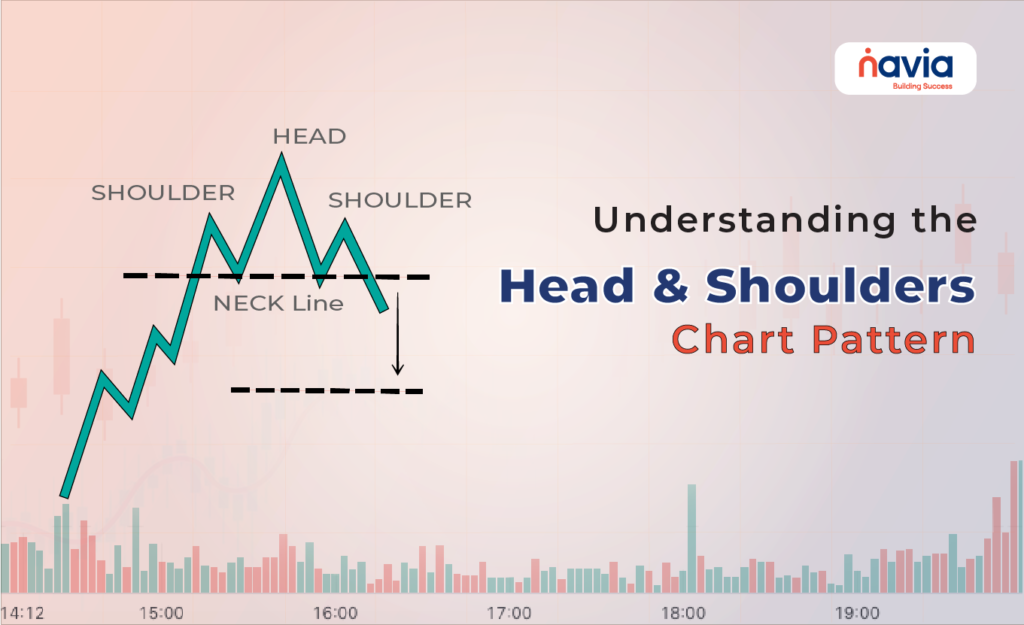

Understanding the Head and Shoulders Chart Pattern: A Guide for Traders

Unlock the secrets behind this powerful chart formation and elevate your trading game. Ready to spot trends and make smarter moves?

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?