Navia Weekly Roundup ( NOV 11- NOV 14, 2024)

Week in the Review

This week saw markets extending their losses for the second straight week amid global uncertainties and domestic challenges. Meanwhile, the rupee continued its downward trajectory, reaching a fresh low against major currencies.

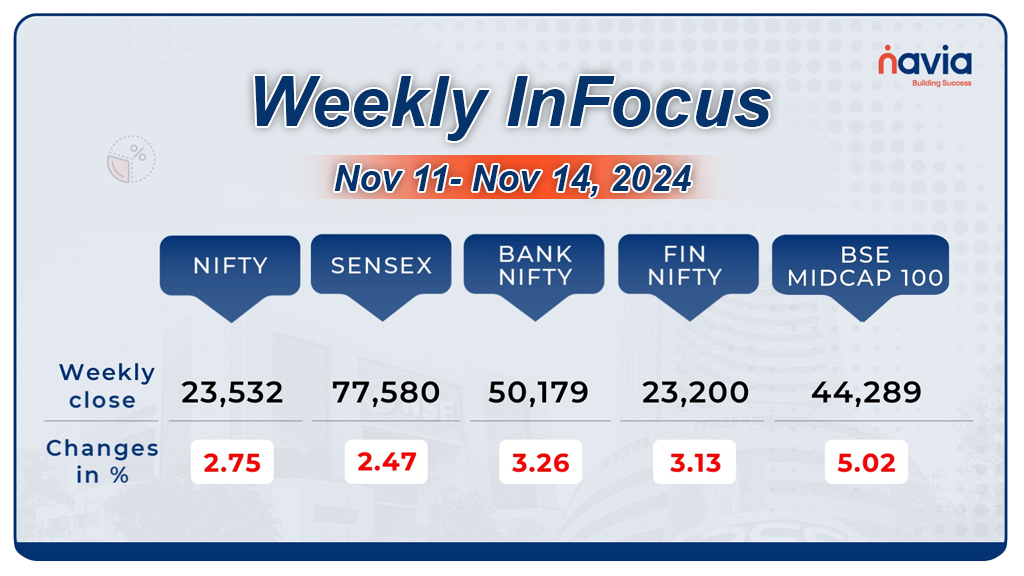

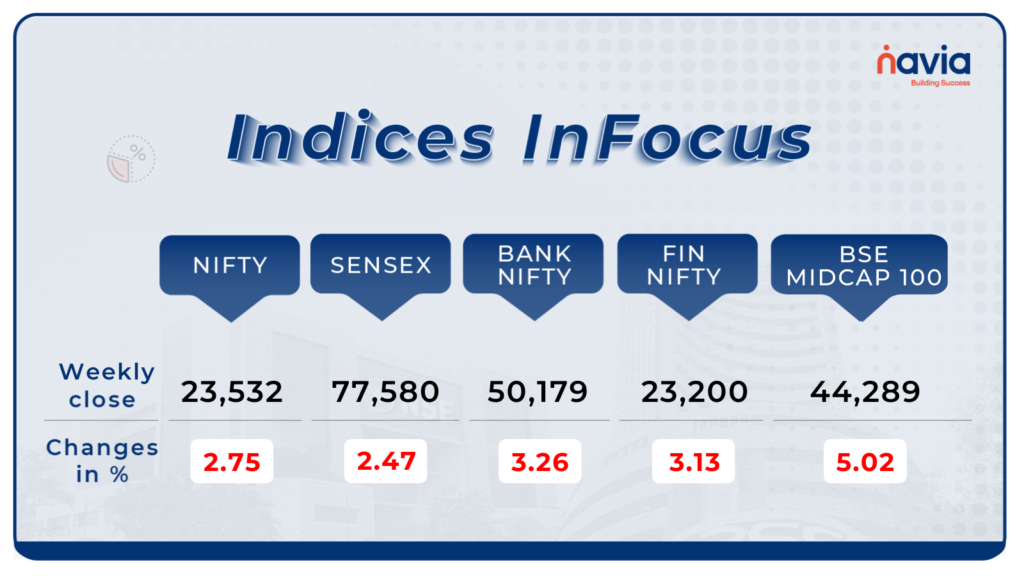

Indices Analysis

This week, BSE Sensex declined 1,906.01 points or 2.47 percent to close at 77,580.31, while the Nifty50 index shed 615.5 points or 2.75 percent to finish at 23,532.70.

BSE Mid-cap Index shed nearly 4 percent with Whirlpool of India, Relaxo Footwears, Clean Science & Technology, Tube Investments of India, Bayer CropScience, Linde India, 3M India, Rajesh Exports, UCO Bank, Cummins India, Tata Elxsi, Indraprastha Gas, Glenmark Pharma, Torrent Power falling between 8-12 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

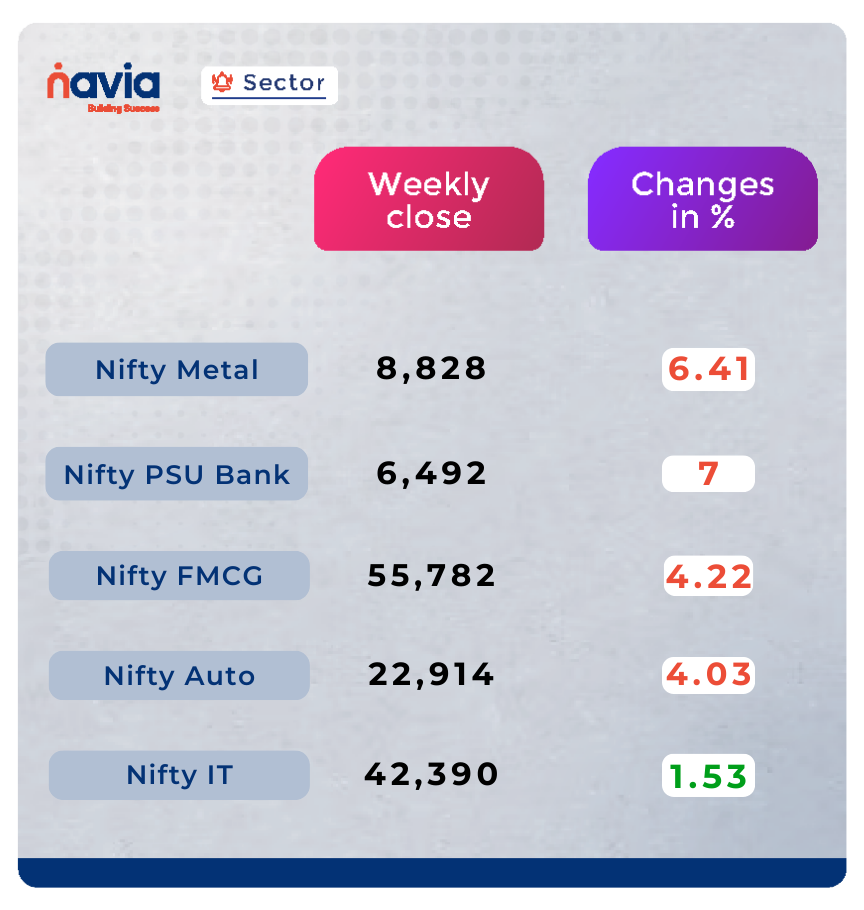

Sector Spotlight

On the sectoral front, Nifty Metal and PSU Bank indices shed more than 5 percent each, Nifty FMCG and Healthcare indices fell more than 4 percent each, Nifty Auto and Oil & Gas indices slipped nearly 4 percent each. However, Nifty Information Technology index added nearly 1 percent.

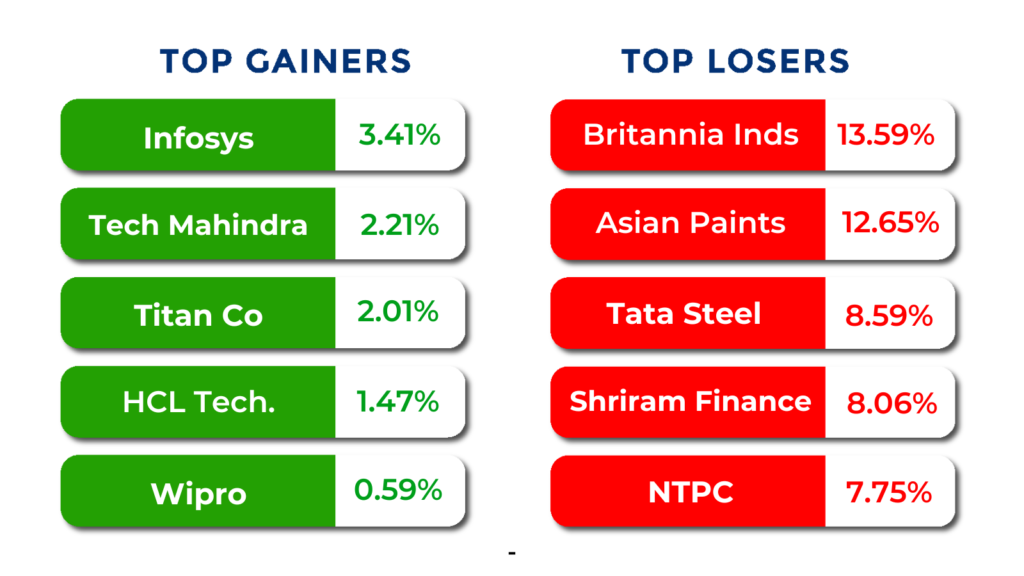

Top Gainers and Losers

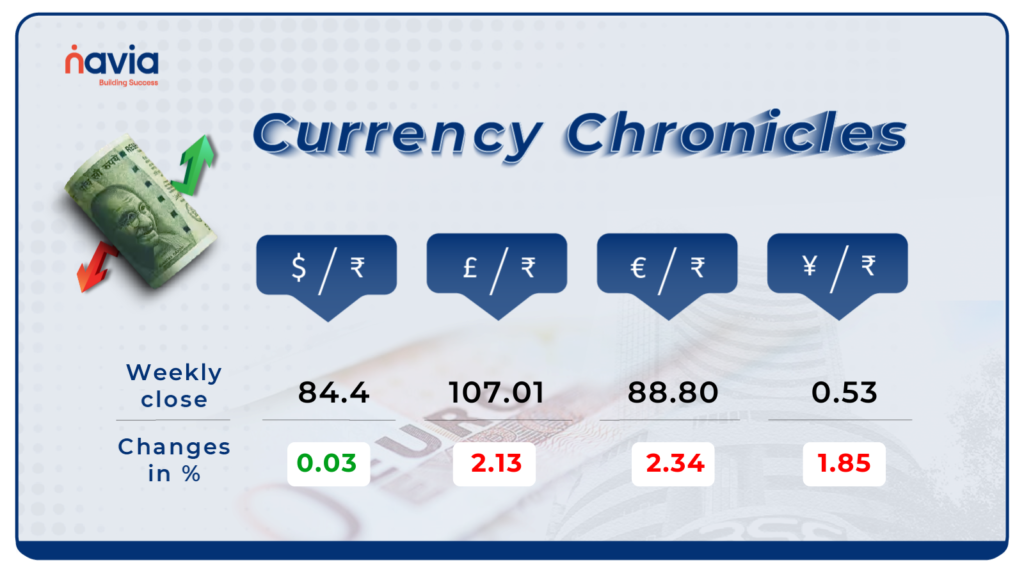

Currency Chronicles

USD/INR:

The Rupee hit a fresh low of ₹84.41 against the Dollar before closing at ₹84.40, losing 3 paise over the week.

EUR/INR:

The Euro stumbled, dropping -2.34% to ₹88.80 this week, with a bearish vibe dominating the market.

JPY/INR:

The Yen slid -1.85%, wrapping up the week at ₹0.53, as sentiment stayed firmly bearish.

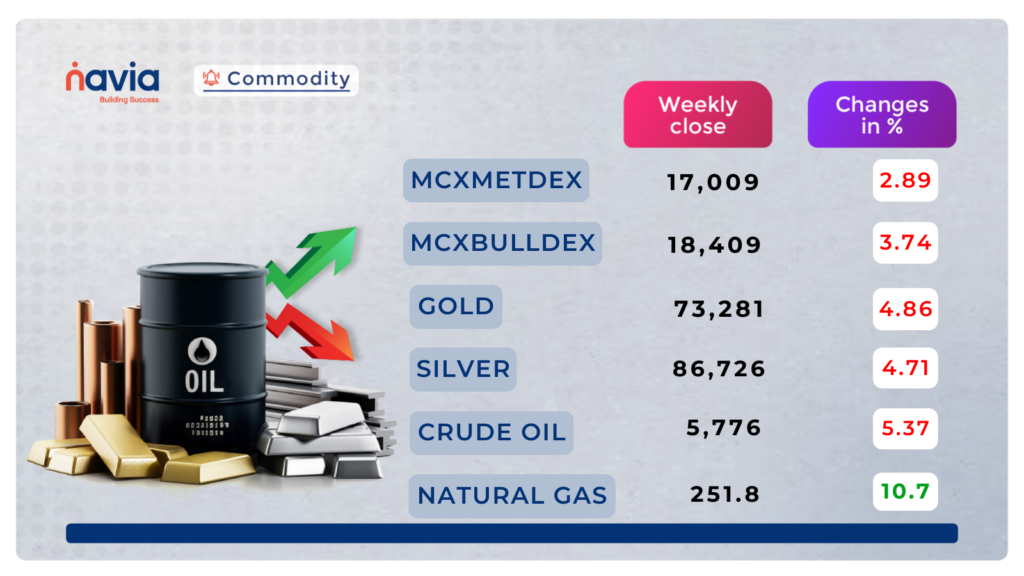

Commodity Corner

Crude oil is currently in a period of uncertainty, forming a Symmetrical Triangle pattern. While the last session ended up slightly bullish after retesting the channel. The market’s future movement will depend on whether it breaks above the resistance or below the support.

If the price can break above the resistance level of 5850, it may rise to 5940 and 6030. However, if the price breaks and trades below the support level of 5740, it could signal a downward trend once again, potentially leading to a decline to 5660 or even 5560.

Gold has been falling recently, forming a Descending broadening wedge pattern on the daily chart. Yesterday, the market ended strongly bearish. We can expect some more decline in the upcoming sessions.

If the market can break below the current support level of 74,350, it may decline to 74,050 and 73,780 levels. However, if the price manages to break above the resistance level of 74,750, it could signal an upward trend, potentially leading to a rise to 75,100 and 75,400 levels.

Natural gas has been trending uncertainly, where the last sessions ended bullish testing the channel resistance, forming an Ascending triangle pattern on the daily interval chart. The future direction of the market is uncertain at this point and will depend on how it reacts to these key support and resistance levels.

If the market breaks above the resistance level of 253, it could further rise to 258 and further levels. However, if the price breaks below the support level of 246, it could revive the downward trend, potentially leading to a decline to 240 and 235. Natural gas has been trending uncertainly, where the last sessions ended slightly bearish in the symmetrical triangle pattern on the daily interval chart. The future direction of the market is uncertain at this point and will depend on how it reacts to these key support and resistance levels.

Silver has been falling, as shown in the Descending Triangle Pattern. The last session ended up bearish testing the channel, indicating some uncertainties moving forward. The market’s future movement will depend on whether it breaks above the resistance or below the support. If the market breaks below the current support level of 88,800, it may continue to fall to 87,900 and 86,700 levels.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

When to Stop SIP and Sell Your Investments: A Practical Guide

SIPs are a disciplined and popular way to build wealth over time, but there are moments when reassessing your strategy is crucial. Whether it’s due to changing financial goals, market shifts, or a need for funds, knowing when to pause or redeem your SIP investments can make all the difference. This week’s blog by Navia explores key scenarios and practical tips to help you make informed decisions.

Investing in ICICI Prudential Nifty FMCG ETF: A Gateway to India’s Leading Consumer Sector

Looking to diversify your portfolio with stable, consumer-focused companies? The ICICI Prudential Nifty FMCG ETF offers exposure to India’s leading FMCG firms, combining low costs with strong market potential. This week’s blog by Navia highlights its key features, top holdings, and how you can set up a SIP using the Navia Zero Brokerage Stock Investing App.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?