Navia Weekly Roundup (May 26 – 30, 2025)

Week in the Review

During the week, the Indian stock market faced volatility amid global economic uncertainties and renewed concerns over U.S. trade policies. Investor sentiment improved towards the week’s close, despite mixed global cues.

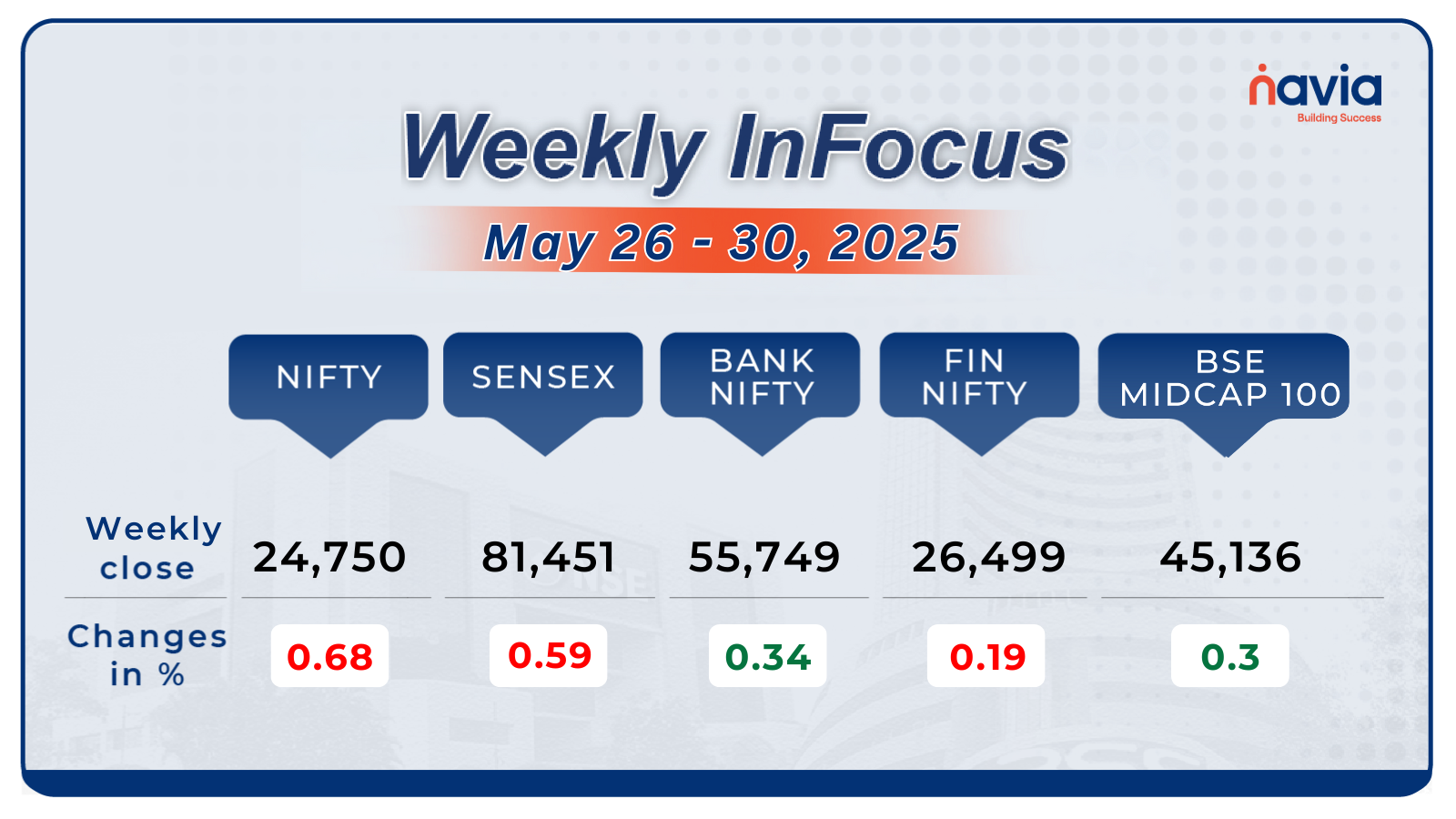

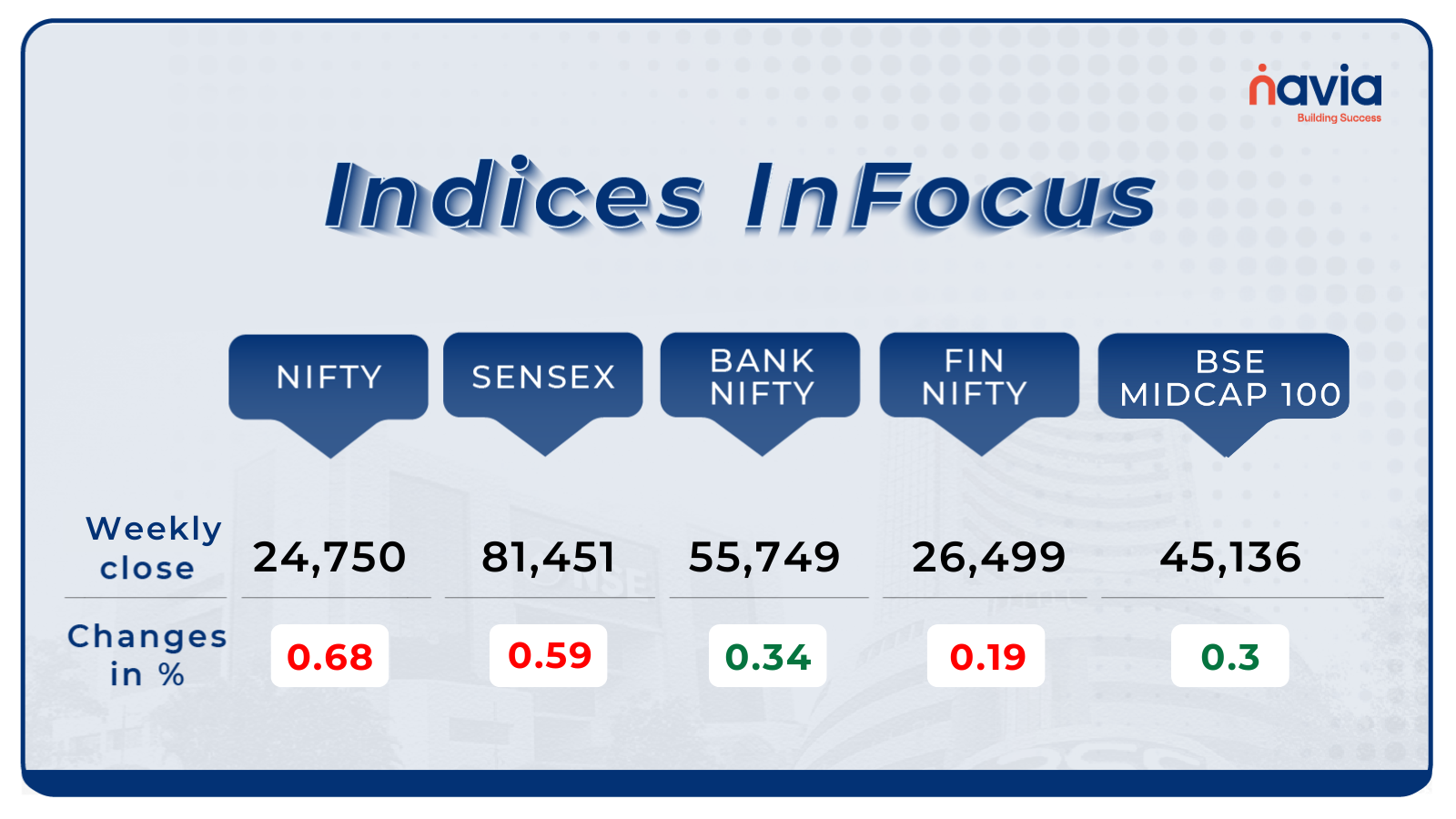

Indices Analysis

The Nifty 50 index ended the week with a modest decline of 0.68%, closing at 24,750.70, while the BSE Sensex fell by about 0.59%, settling at 81,451.01.

The BSE LargeCap Index closed at 9,534.24, marking a slight decline of 0.36% for the week. This downturn was influenced by underperformance in key sectors such as IT, metal, and auto. Notably, stocks like Infosys, Tech Mahindra, and HCL Technologies faced pressure, contributing to the overall decline. Conversely, State Bank of India (SBI) and HDFC Bank showed resilience, with SBI’s shares rising by 1.89% on Friday, outperforming its peers.

In the BSE SmallCap Index, which ended the week at 52,413.25, there was a modest gain of 0.17%. This growth was driven by strong performances from companies like Wockhardt, which contributed significantly to the index’s rise. Despite this, the broader market sentiment remained cautious, with mixed performances across individual stocks. The advance-decline ratio within the small-cap segment indicated a balanced market, with 511 stocks advancing and 428 declining, suggesting selective investor interest.

Overall, the week was characterized by sector-specific movements, with defensive sectors like banking showing strength, while cyclical sectors faced challenges. Investors remained vigilant, awaiting further economic cues and corporate earnings reports to guide future market directions.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

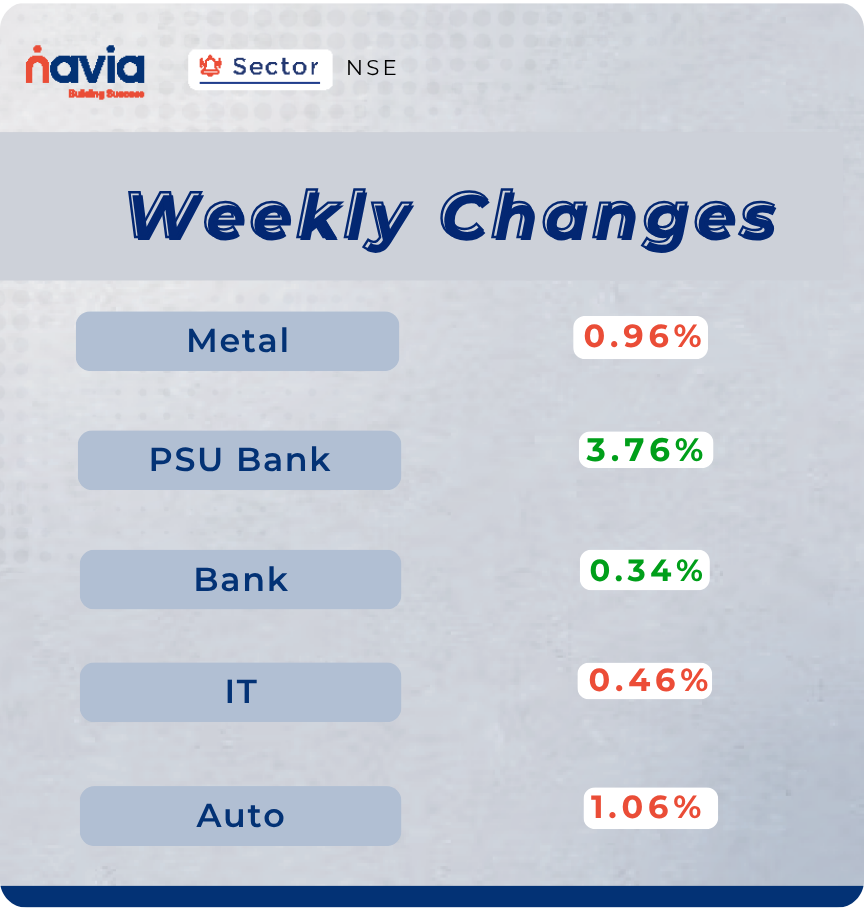

Sector Spotlight

Among sectors, the Nifty PSU Bank index led the gains with a strong rise of 3.76 percent, followed by the Nifty Bank index, which inched up 0.34 percent. On the other hand, the Nifty Auto index declined 1.06 percent, marking the steepest loss of the week. The Nifty Metal index also ended lower, shedding 0.96 percent, while the Nifty IT index slipped 0.46 percent.

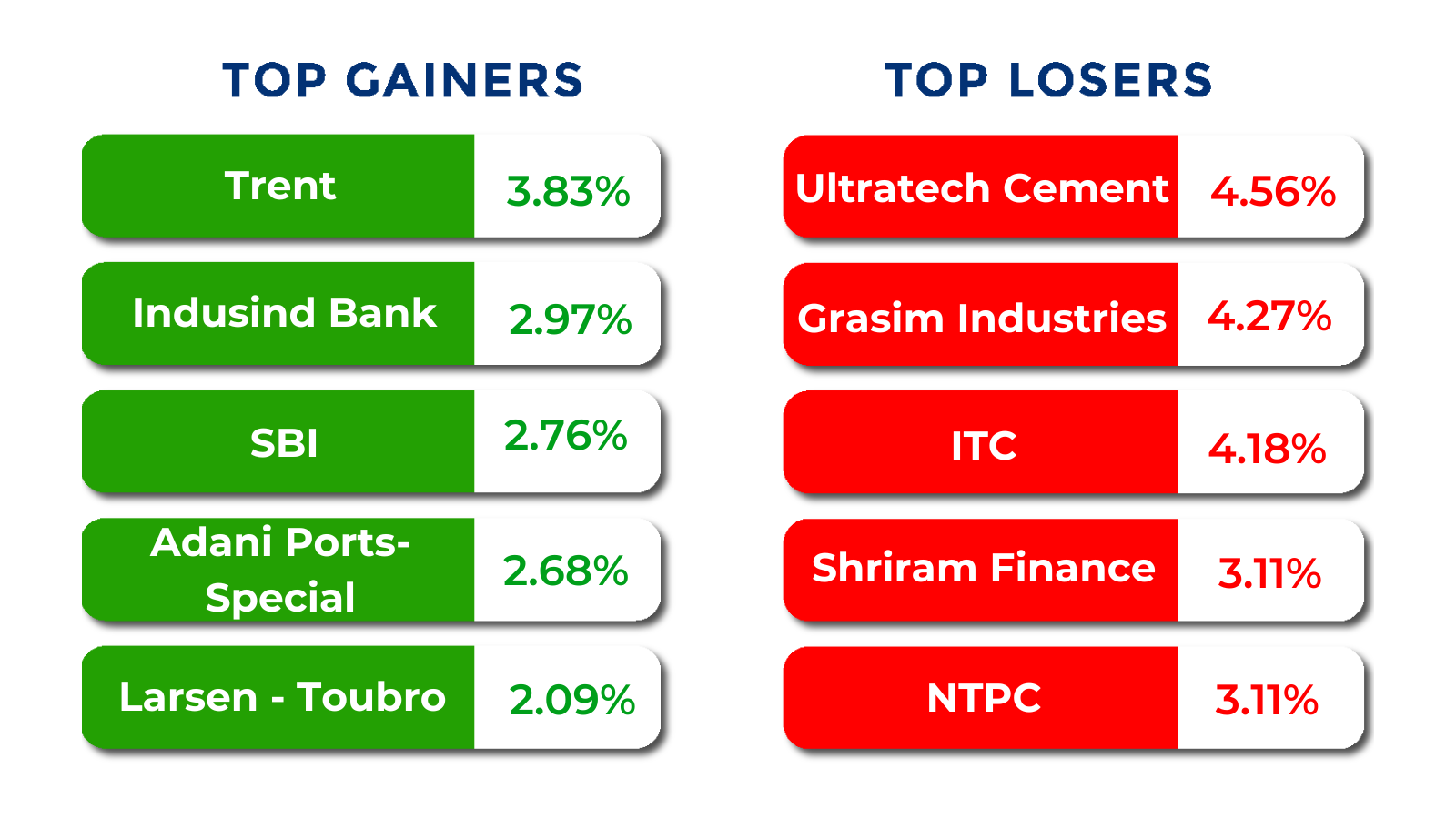

Top Gainers and Losers

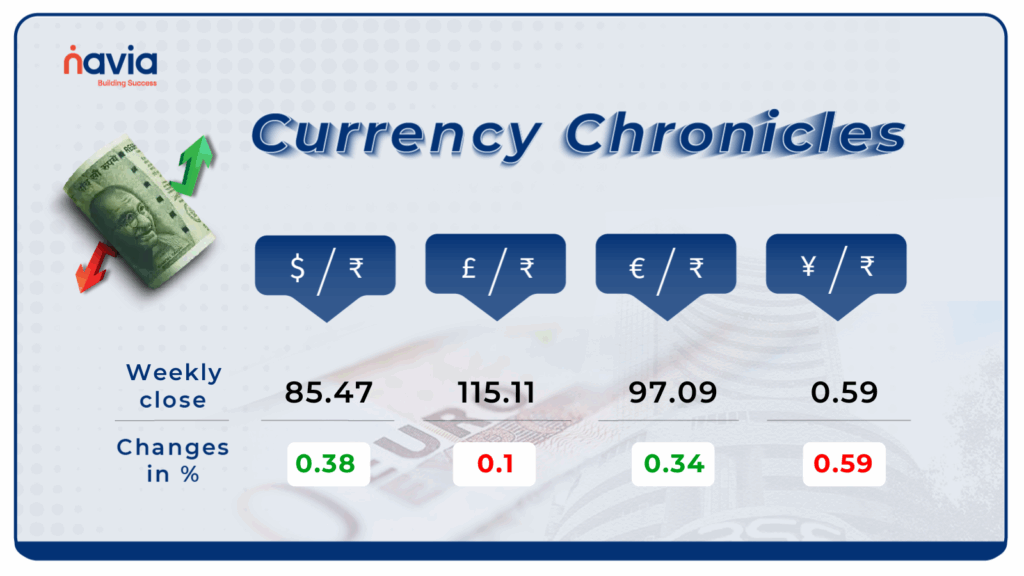

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹85.47 per dollar, gaining 0.38% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹97.09 per euro, gaining 0.34% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, losing 0.59% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

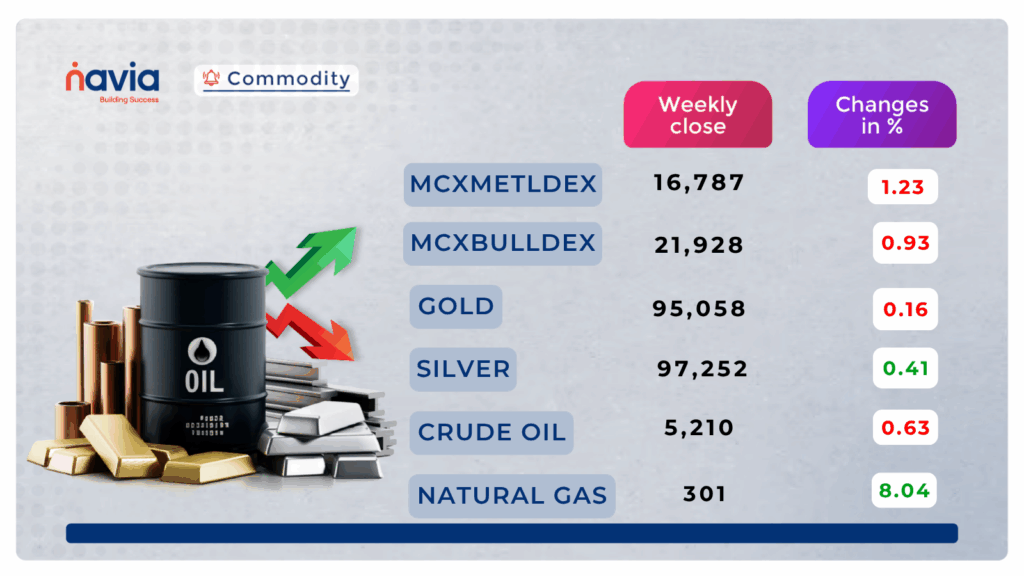

Commodity Corner

Crude Oil is currently trading in a consolidation pattern on the 45-minute chart. In the last session, it closed at 5,210 down. Holding above the resistance near the 5,440 range could lead to further upside, while immediate support is placed at 5,160. Further intraday upside momentum is likely above 5,250 while a breakdown below 5190 could trigger additional selling pressure.

In the last session, Gold closed at 95,058. Gold is trading in an ascending channel on the wider timeframe and in a descending channel on the shorter timeframe, as shown in the chart. Currently, it is trying to break the resistance range of 96,850. A sustained move above this range could lead to further upside in Gold. For intraday traders, a move above 95,400 may indicate upside potential, while a dip below 94,800 could trigger further downside pressure.

Natural Gas traded with mild strength during the week, showing signs of stabilizing after a previous decline. Prices rose steadily, supported by global supply constraints and steady demand. However, a close above 301. A sustained move above ₹380 on a broader timeframe could indicate a shift toward short-term bullishness in Natural Gas.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Introducing the All-New Navia All-in-One App – Your Ultimate Trading & Investment Companion!

Discover a revolutionary upgrade to your trading experience with the Navia All-in-One App—now smarter, faster, and packed with powerful tools for Stocks, Options, MTF, Mutual Funds, and more! With advanced features like Insta Options, FREE APIs, and real-time margin insights, your financial journey just found its perfect companion.

Unlock Market Opportunities with Pay Later (MTF) – Amplify Your Returns in Momentum Markets!

Don’t let limited capital hold you back—boost your buying power by up to 65% and tap into high-return market days with ease! With low interest rates, unlimited holding periods, and smart profit potential, Navia’s Pay Later (MTF) is your gateway to amplified gains.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?