Navia Weekly Roundup (May 19 – 23, 2025)

Week in the Review

The Indian stock market navigated through a week of volatility, influenced by global economic developments and domestic factors. While the indices ended the week lower, the market demonstrated resilience with a few sectors performing well as the investor sentiment improved towards the week’s close.

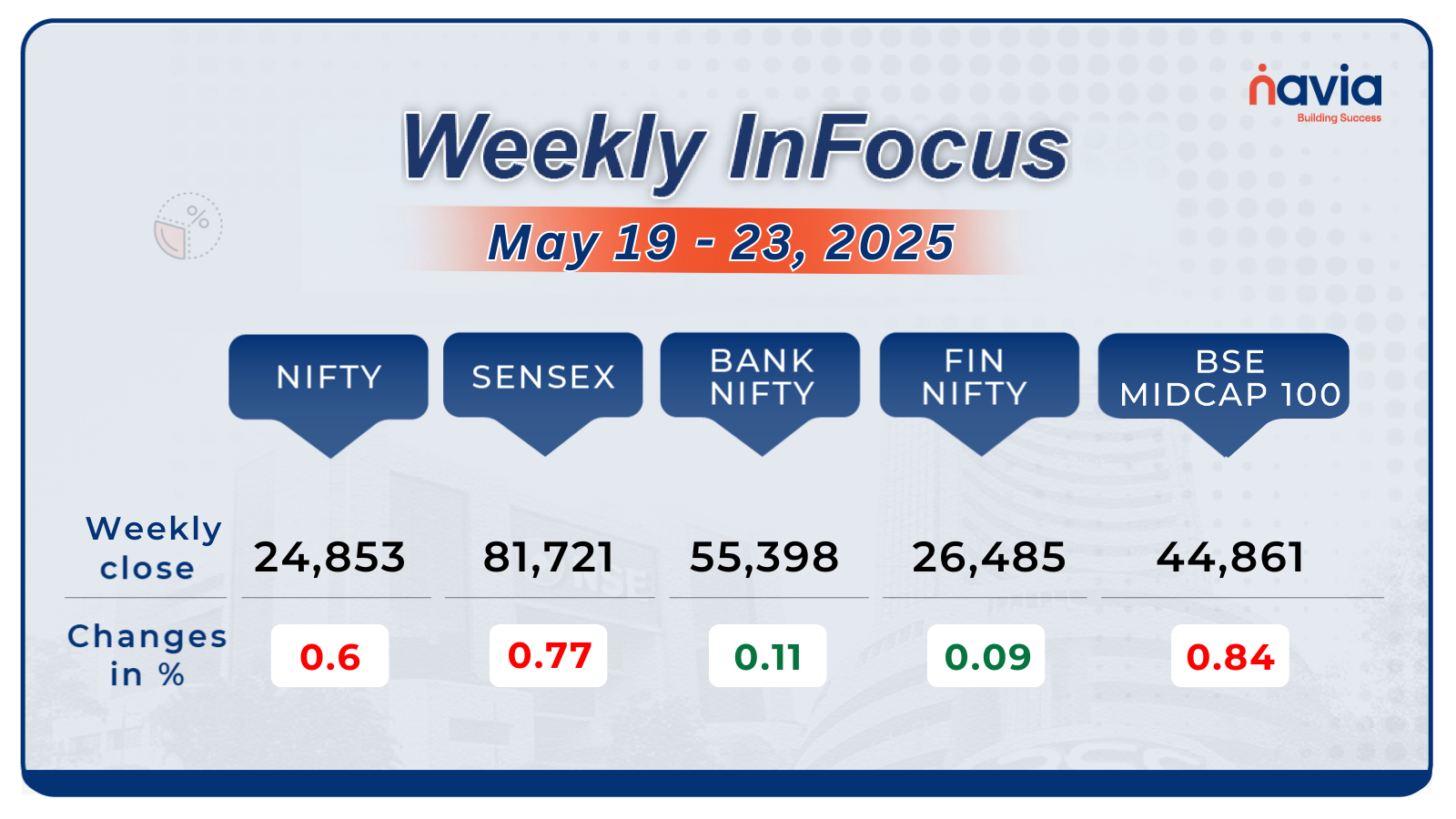

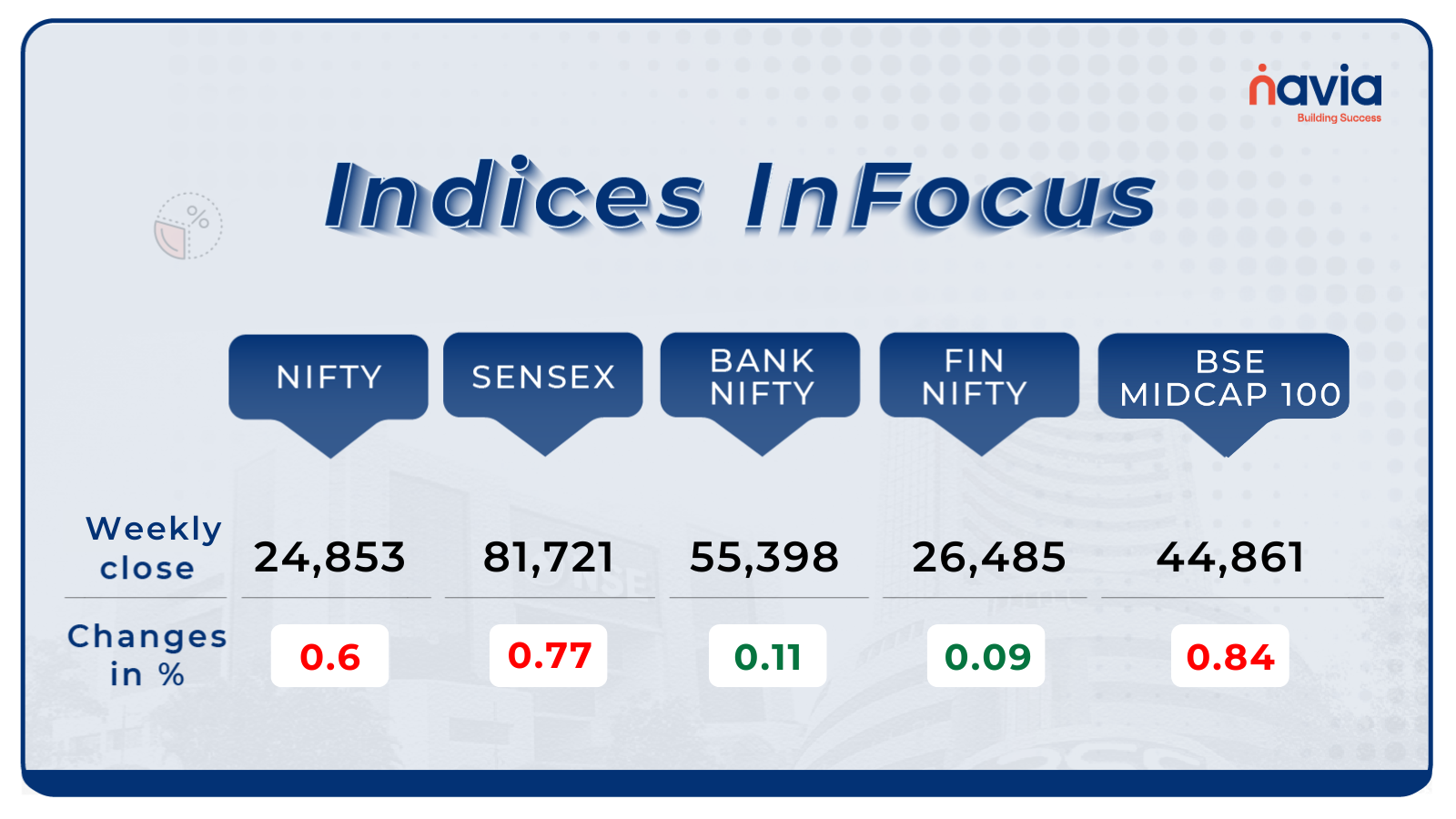

Indices Analysis

The broader market witnessed a downward trend during the week, with the Nifty 50 index declining by 0.6% to close at 24,853, while the BSE Sensex fell by 0.77% to end the week at 81,721.

The BSE LargeCap index showed modest growth, registering a 0.87% gain. This upswing was primarily driven by strong performances in defensive sectors such as utilities, finance, and insurance. Notable gainers included Power Grid Corporation, Bajaj Finance, and HDFC Life, which contributed to the overall positive performance. However, some stocks within the energy and pharma sectors, like Grasim Industries, Sun Pharma, and Adani Energy Solutions, faced declines, somewhat limiting the broader index’s gains. This reflected a mixed sentiment in the market, with investors seeking safer bets amid global economic uncertainties.

Meanwhile, the BSE SmallCap index also showed a positive performance, rising by 0.45% over the week. This growth was fueled by strong performances from companies like Goodluck India, Inox India, and Data Patterns (India), all of which saw significant gains. However, some small-cap stocks, such as Chambal Fertilisers & Chemicals and Jindal Saw, faced declines, indicating a degree of volatility within the segment. Despite this, the small-cap sector exhibited resilience, with several stocks continuing to perform well, suggesting that investors remain confident in the growth potential of smaller companies.

Overall, the Indian stock market displayed a mixed yet resilient performance during the week, with large-cap stocks being driven by defensive sector strength and small-cap stocks continuing to see selective growth amidst broader market fluctuations.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

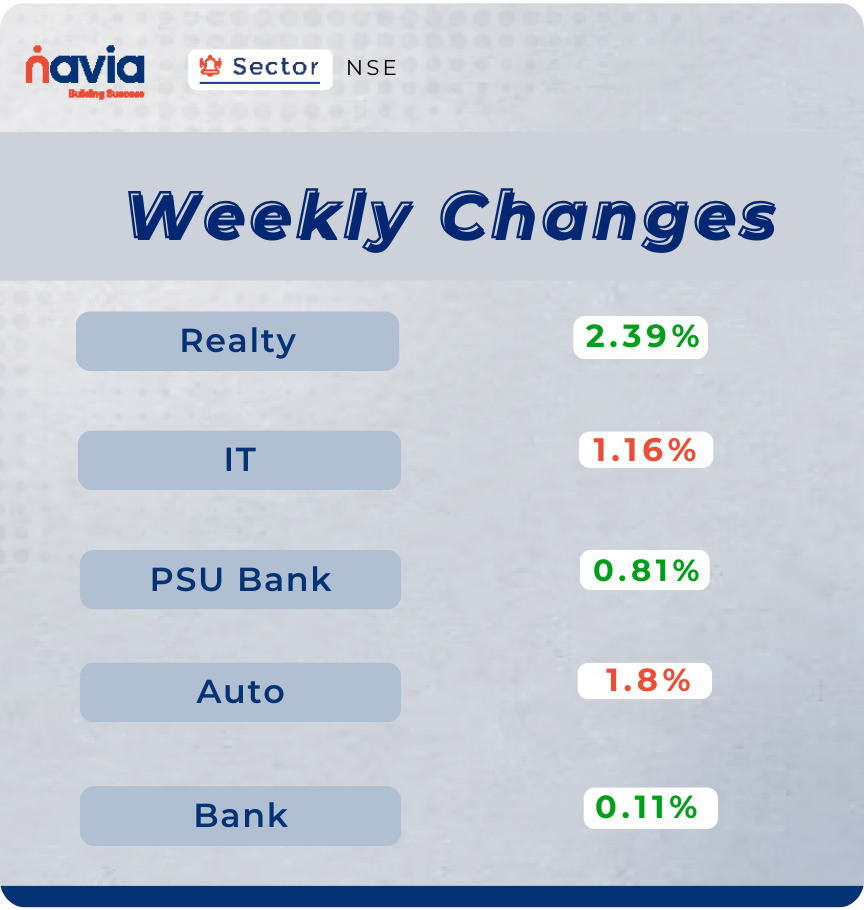

Sector Spotlight

Among sectors, the Nifty Realty index led the gains with a rise of 2.39 percent, followed by the Nifty PSU Bank index, which advanced 0.81 percent. The Nifty Bank index registered a modest uptick of 0.11 percent. On the downside, the Nifty Auto index saw the sharpest decline, falling 1.8 percent, while the Nifty IT index slipped 1.16 percent.

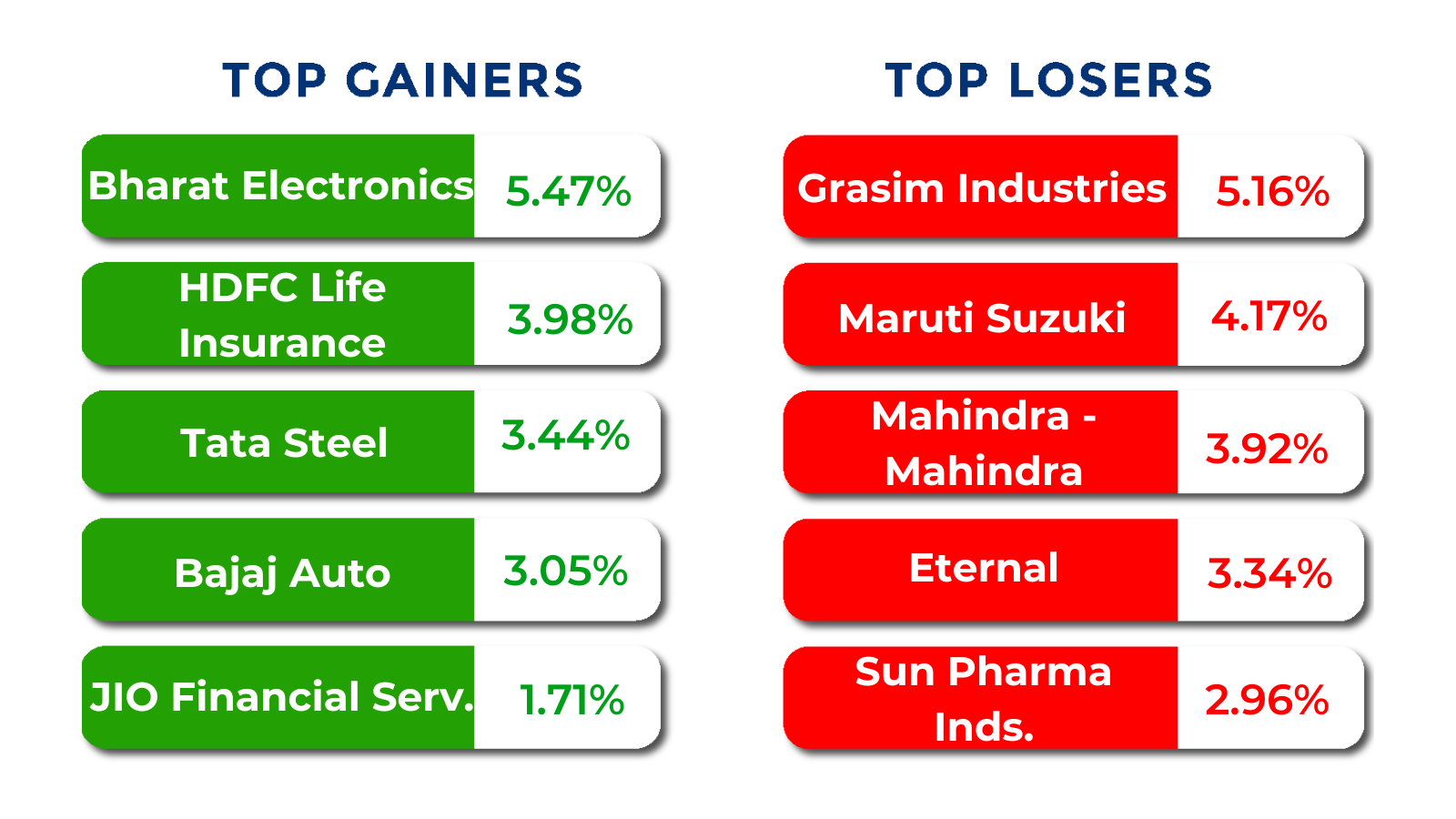

Top Gainers and Losers

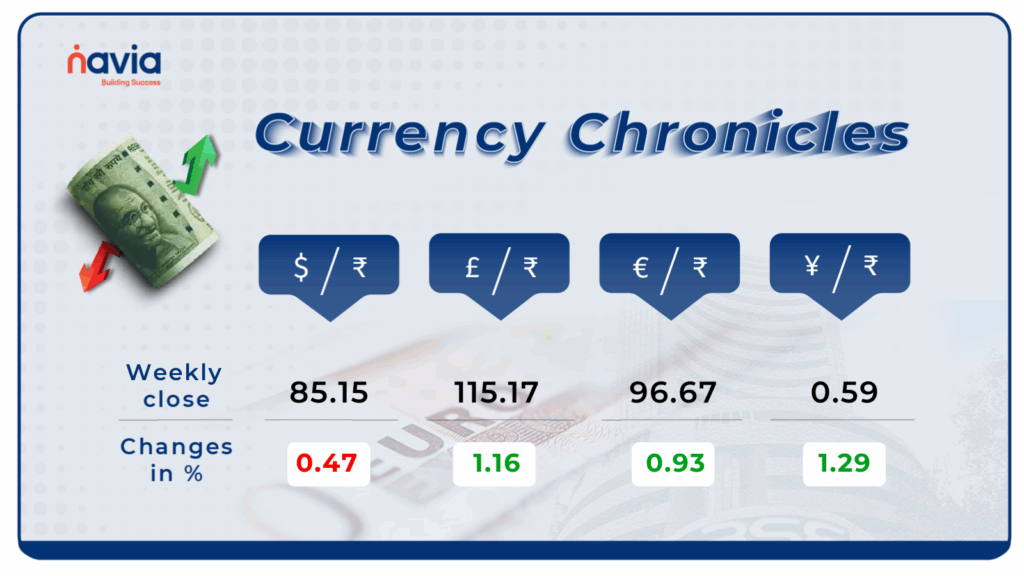

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹85.15 per dollar, losing 0.47% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹96.67 per euro, gaining 0.93% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining 1.29% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

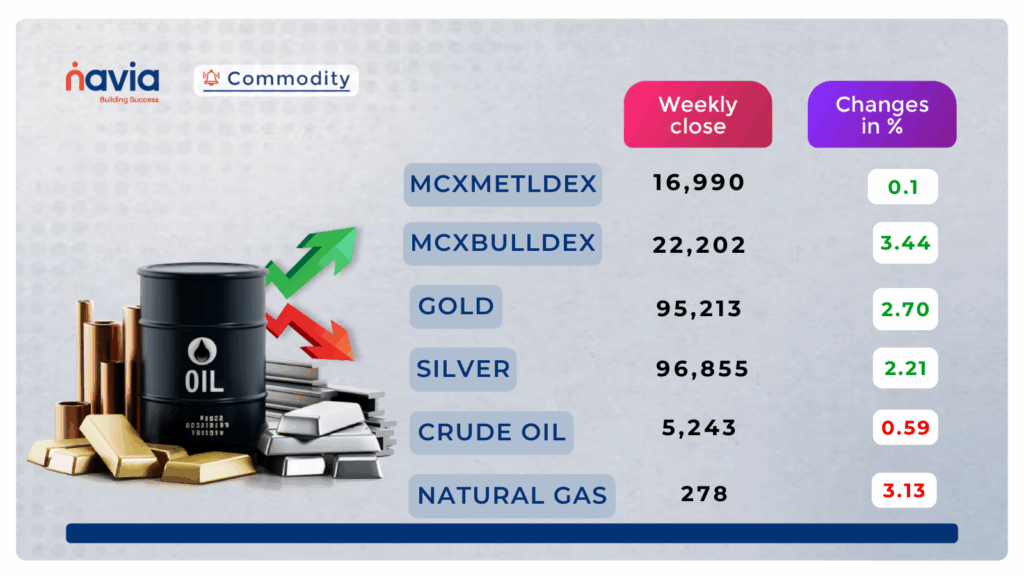

Commodity Corner

Crude Oil is currently trading in a broken ascending channel on the 30-minute chart. In the last session, it closed at 5,243. Holding above the resistance near the 5,440 range could lead to further upside, while immediate support is placed at 5,200. Further intraday upside momentum is likely above 5,285, while a breakdown below 5,200 could trigger additional selling pressure.

In the last session, Gold closed at 95,213, in a slight negative. Gold is trading in an ascending channel in the wider time frame and in a descending channel in the shorter time frame, as shown in the chart. The descending channel resistance is placed in the 95,700–95,800 range, and the immediate support is placed at the 91,000 range. Gold needs to hold above the 96,500 range for a confirmed uptrend. For intraday traders, a move above 95,800 may indicate upside potential, while a dip below 95,200 could trigger further downside pressure.

Natural Gas is currently trading in a broken descending channel, as seen in the chart. It is facing resistance in the 294–295 range. The last session closed at 278 down. Another intraday move is likely above 283. However, a close below 278 could signal further downside in prices. Sustaining above 330 on a broader timeframe could lead to short-term bullishness in Natural Gas.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of Navia!

What ChatGPT Says About Navia!

ChatGPT highlights Navia’s zero brokerage model, free account opening, and powerful trading platforms as major wins for options traders. While minor charges apply, it concludes Navia is a cost-effective choice for active traders looking to maximize savings.

What Gemini Says About Navia!

Gemini presents Navia as a 30+ year veteran in stock broking, offering zero brokerage for life, free account setup, and advanced trading tools like strategy builders and TradingView charts. While the platform stands out for savings and features, Gemini also flags statutory and service-related charges to be aware of.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?