Navia Weekly Roundup (May 12 – 16, 2025)

Week in the Review

The Indian stock market witnessed a robust recovery during the week. This rally was fueled by easing geopolitical tensions, notably a ceasefire agreement with Pakistan, and optimism surrounding trade discussions with the United States.

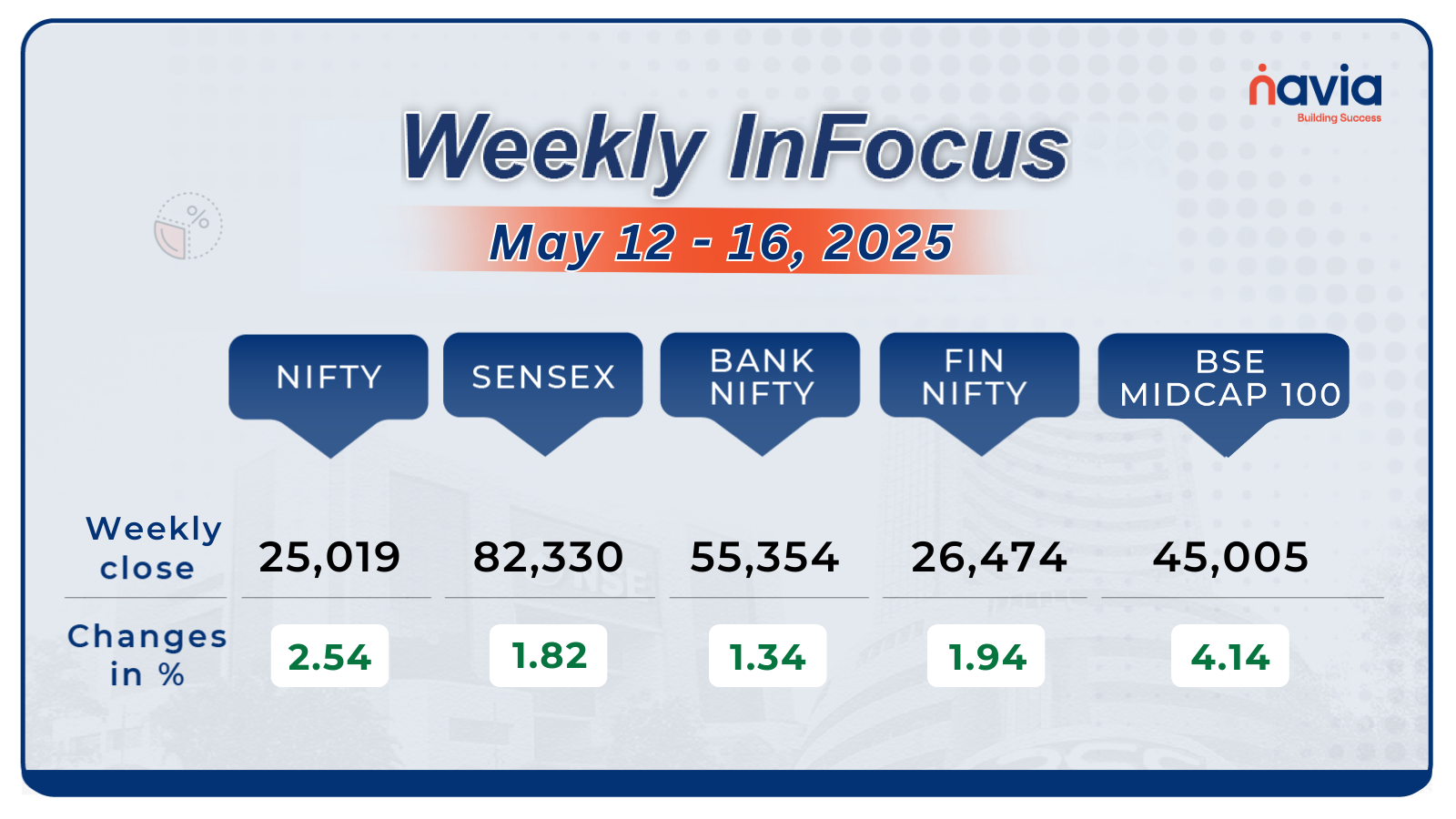

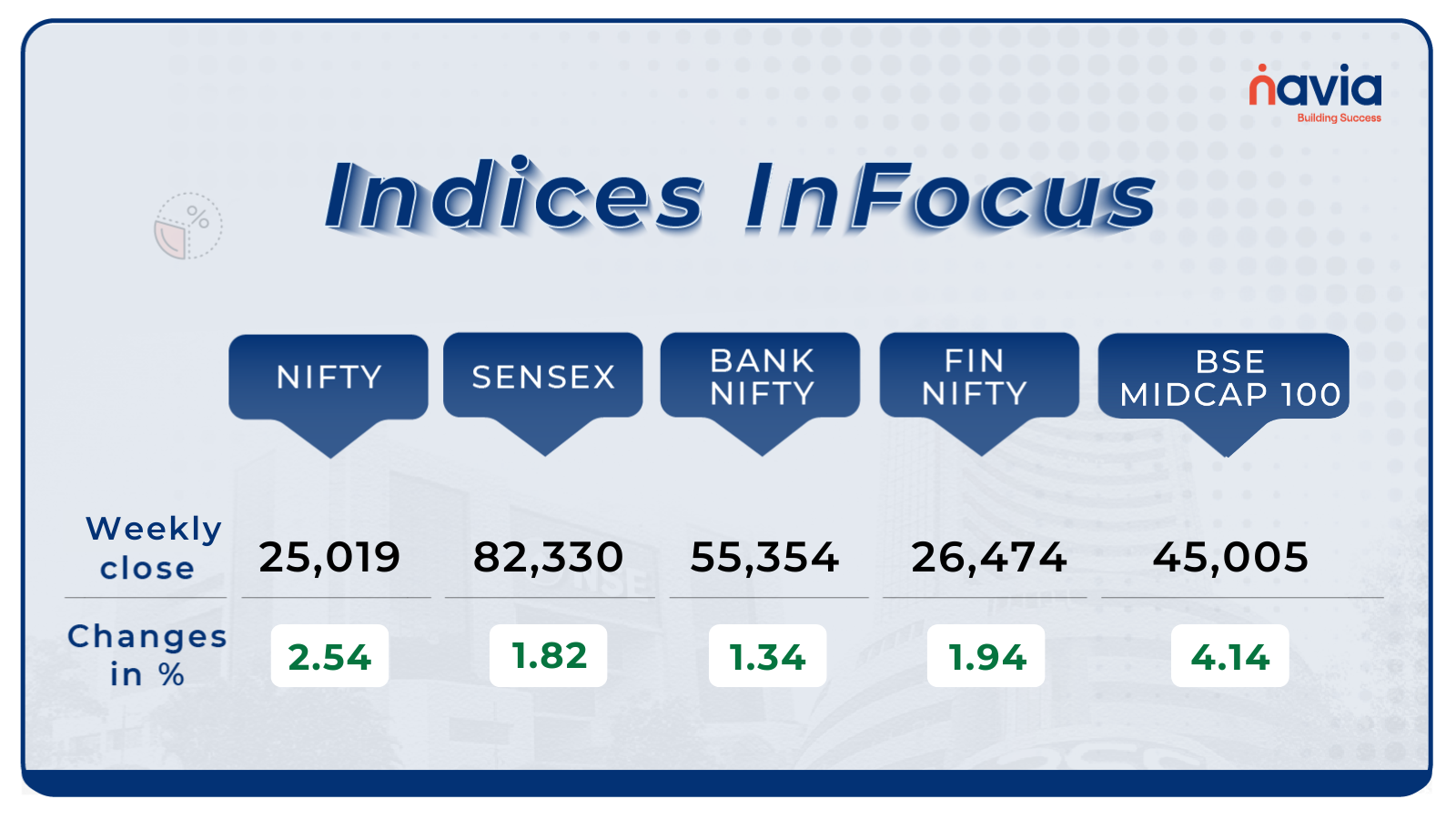

Indices Analysis

The broader market also showed positive movement, with the Nifty 50 index rising by 2.54% to close at 25,019.80 and the BSE Sensex gaining 1.82% to end at 82,330.59 for the week.

The BSE LargeCap index demonstrated a robust performance, registering a 4.7% gain. This upswing was propelled by strong showings in sectors such as defense, energy, and consumer goods. Notable gainers included Hindustan Aeronautics Ltd. (HAL), which surged by 5.01%, Bharat Electronics Ltd. (BEL) with a 4.37% increase, and Adani Gas, rising by 3.16%. These gains reflect heightened investor confidence in large-cap stocks, particularly those linked to infrastructure and defense sectors.

Conversely, the BSE SmallCap index also experienced significant growth, climbing 9.21% over the same period. This surge was driven by impressive performances from companies like Titagarh Wagons, which advanced by ₹104 to ₹912.85, and Cochin Shipyard, which increased by ₹224 to ₹2,036. Other notable gainers included Dhanuka Agritech, GRSE, and Data Patterns (India), each posting substantial gains. The strong performance in the small-cap segment indicates a broad-based market rally, with investors showing renewed interest in smaller companies poised for growth.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

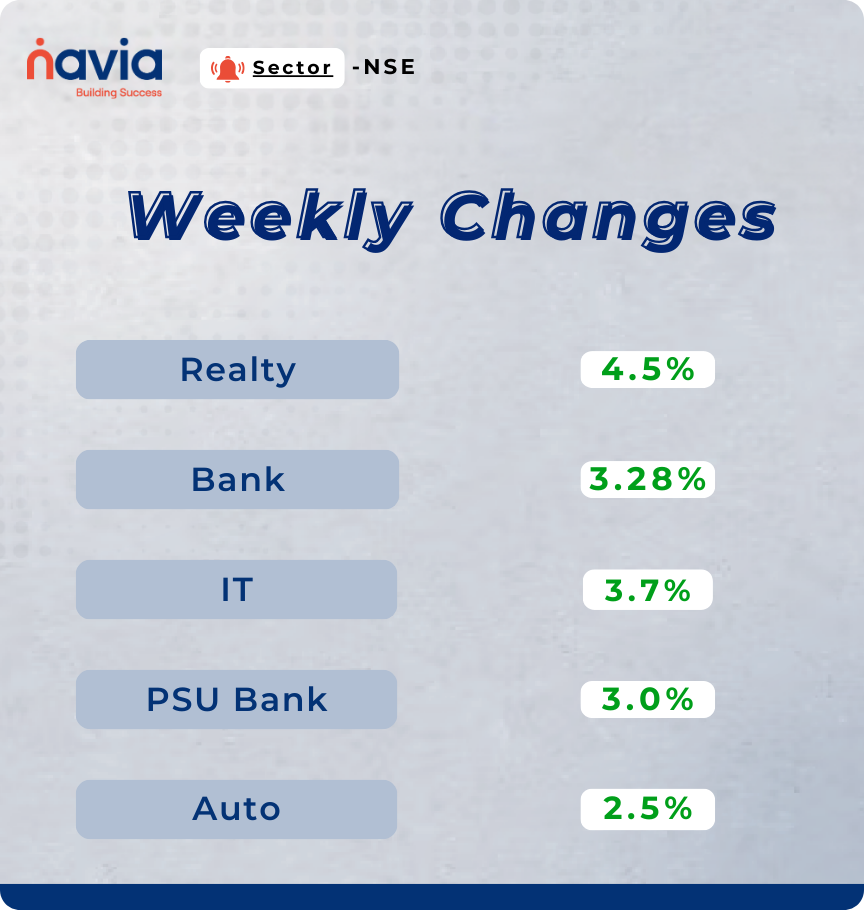

Sector Spotlight

Among sectors, the Nifty Realty index led the rally with an impressive gain of 4.5 percent, the IT sector followed closely, rising 3.7 percent, the Nifty PSU Bank index climbed 3 percent, the Nifty Auto index gained 2.5 percent, and the banking sector as a whole performed well, with the Nifty Bank index advancing 3.28 percent.

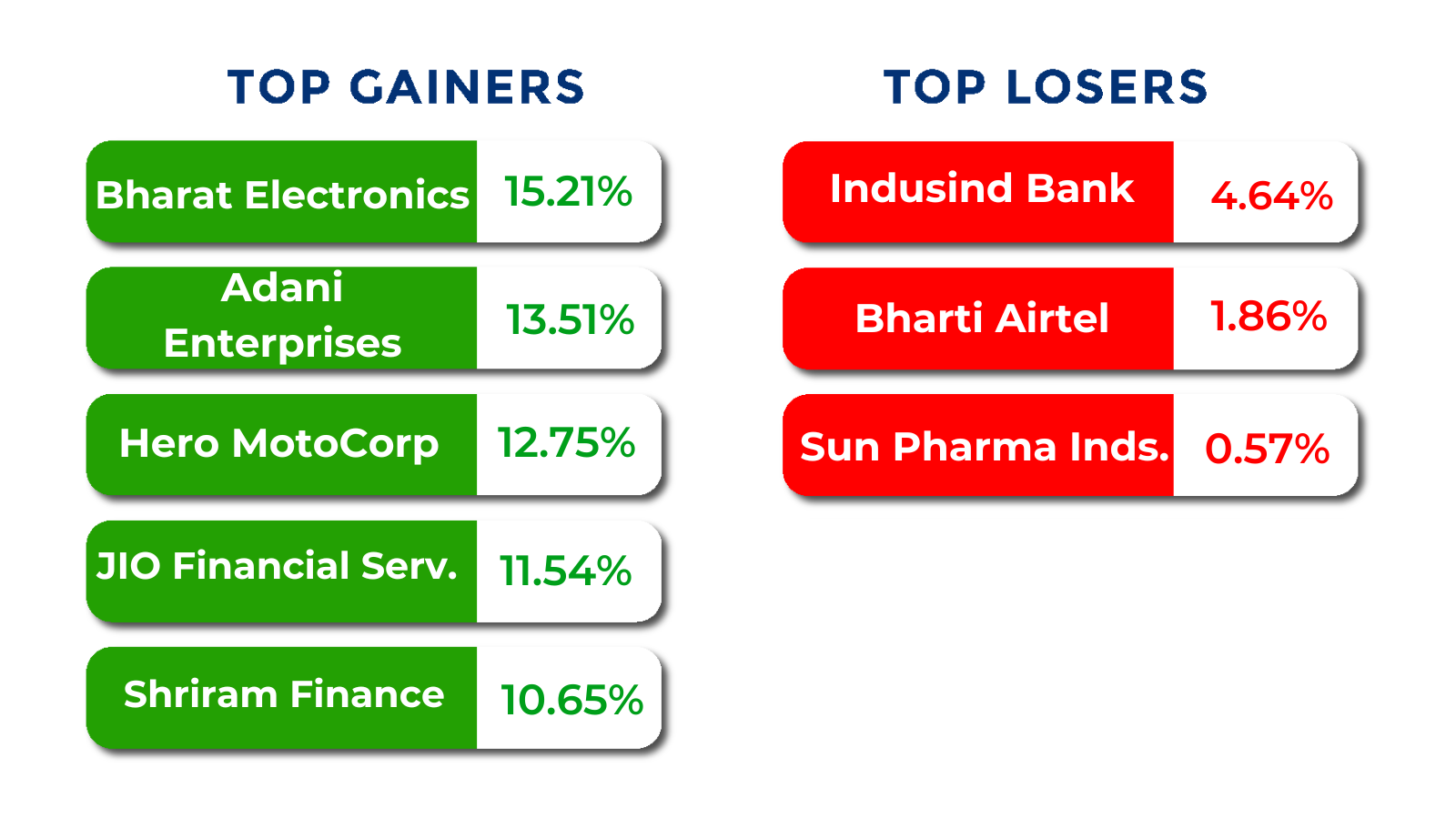

Top Gainers and Losers

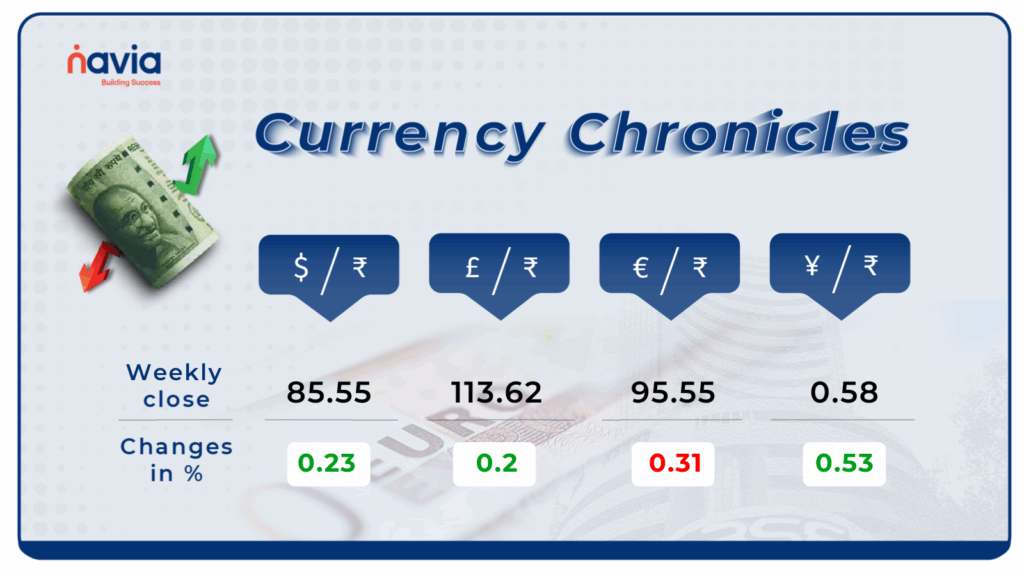

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹85.55 per dollar, gaining 0.23% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹95.55 per euro, lose 0.31% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, gaining 0.53% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

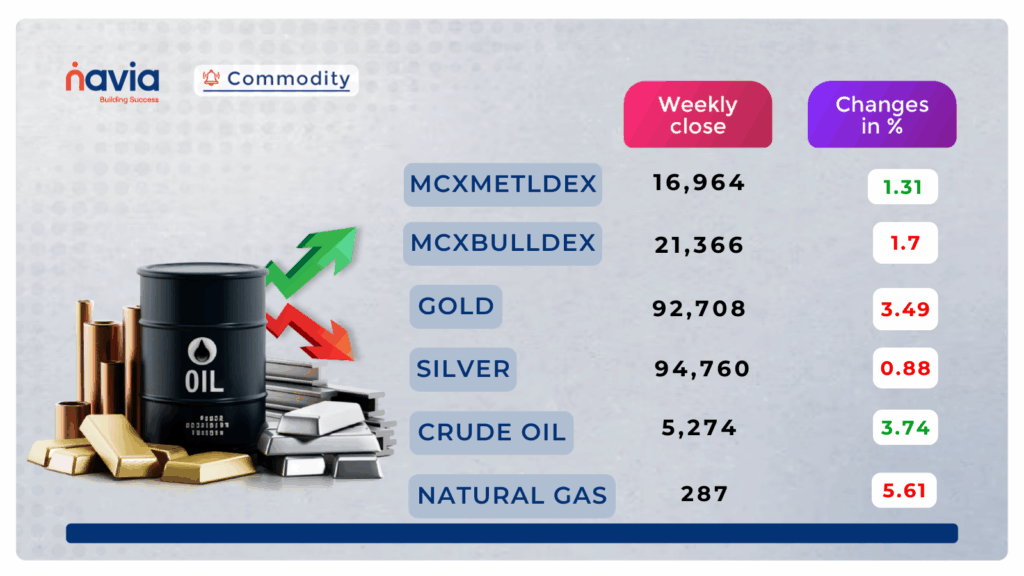

Commodity Corner

Crude Oil is currently forming an ascending channel on the 30-minute chart. In the last session, it closed at 5,274, down by 147 points. Holding above resistance in the 5,400 range could lead to further upside. Also, the immediate support is placed at 5,100. Further intraday upside momentum is likely above 5,300, while a breakdown below 5,259 could trigger additional selling pressure.

In the last session, Gold closed at 92,708 up by 904 points. Technically, Gold has entered a bearish territory. Trading below 94,000 could add further negativity to Gold. It is currently trading in an ascending channel on the wider frame and may face resistance near the 95,700–95,900 range and may take support from the 90,400–90,600 range. For intraday traders, a move above 92,600 may indicate upside potential, while a dip below 92,000 could trigger further downside pressure.

Natural Gas experienced significant volatility in the last session. Currently, it is trading in a broken ascending channel, as shown in the chart. The last session closed at 287, down by 7.20 points. Another intraday move is likely above 294. However, a close below 289 could signal a further fall in prices. Sustaining above 330 could lead to short-term bullishness in Natural Gas.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of Navia!

Gold Price Decoded: From Global Rates to Your Local Jeweller

Learn how international rates, currency conversion, and Indian taxes shape what you actually pay. Decode the real price of gold before your next buy!

The Lipstick Index: A Quirky Yet Powerful Economic Indicator

The Lipstick Index suggests that during tough times, consumers skip big luxuries but still indulge in affordable treats like lipstick. Discover how this quirky trend signals deeper economic and psychological shifts.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?