Navia Weekly Roundup ( Mar 10 – 13, 2025)

Week in the Review

The Indian indices remained under pressure led by weak global markets amid uncertainty over trade policies and recession fears in the US, however, the positive domestic data points, including industrial production and retail inflation, provided some relief.

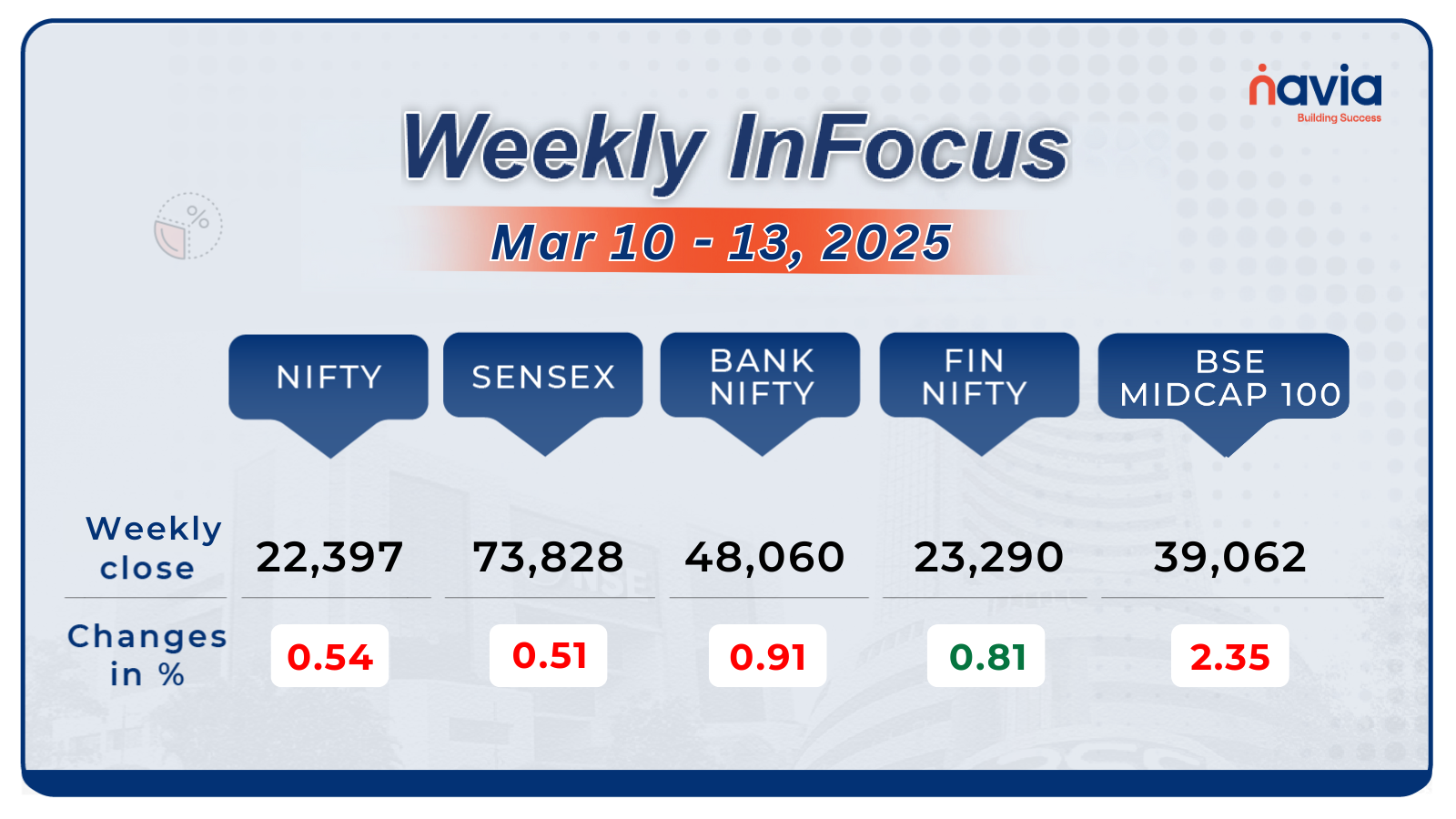

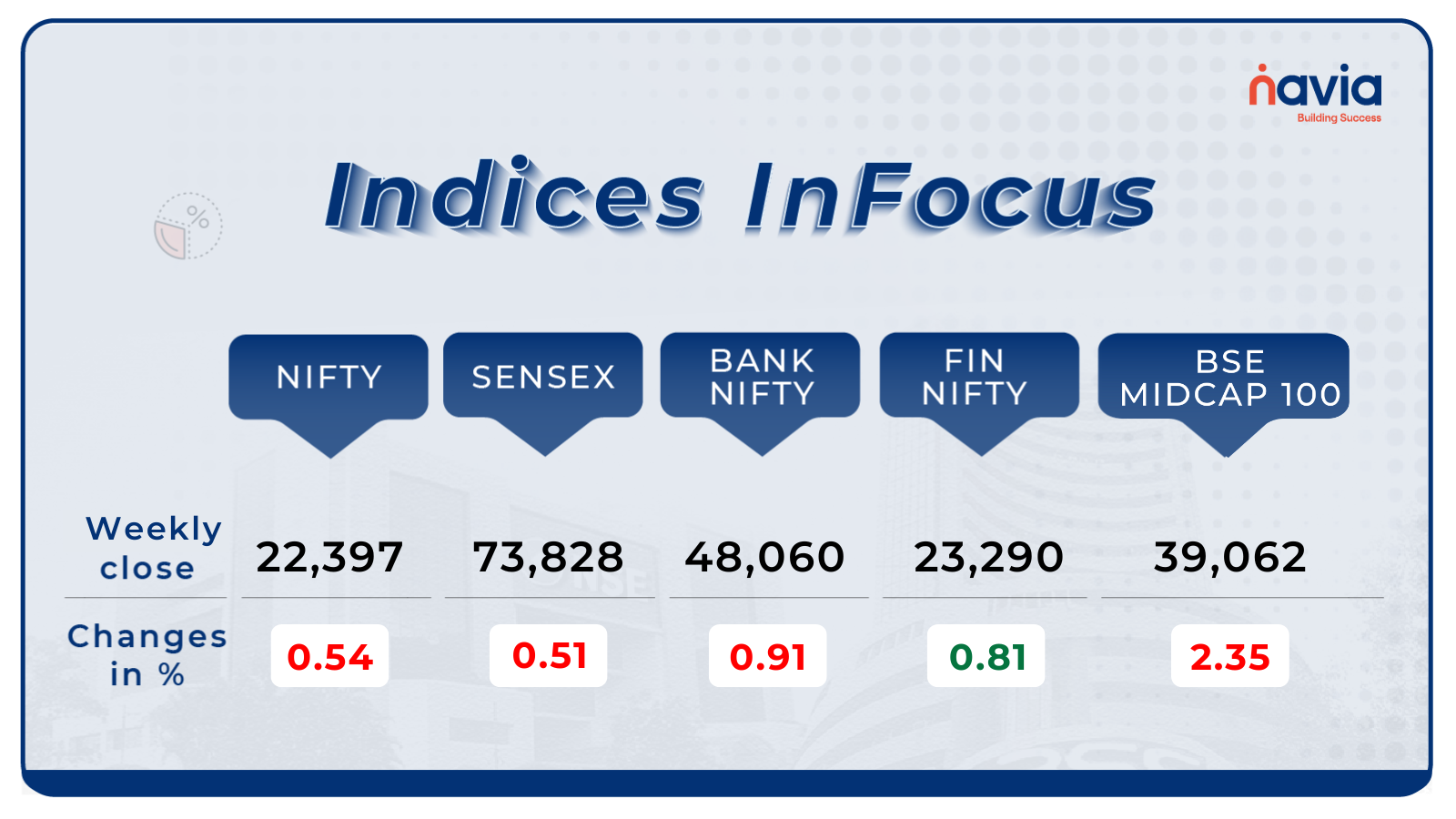

Indices Analysis

For the week, the BSE Sensex index fell 503.67 points or 0.51 percent to close at 73,828.91, and Nifty50 declined 155.3 points or 0.54 percent to close at 22,397.20.

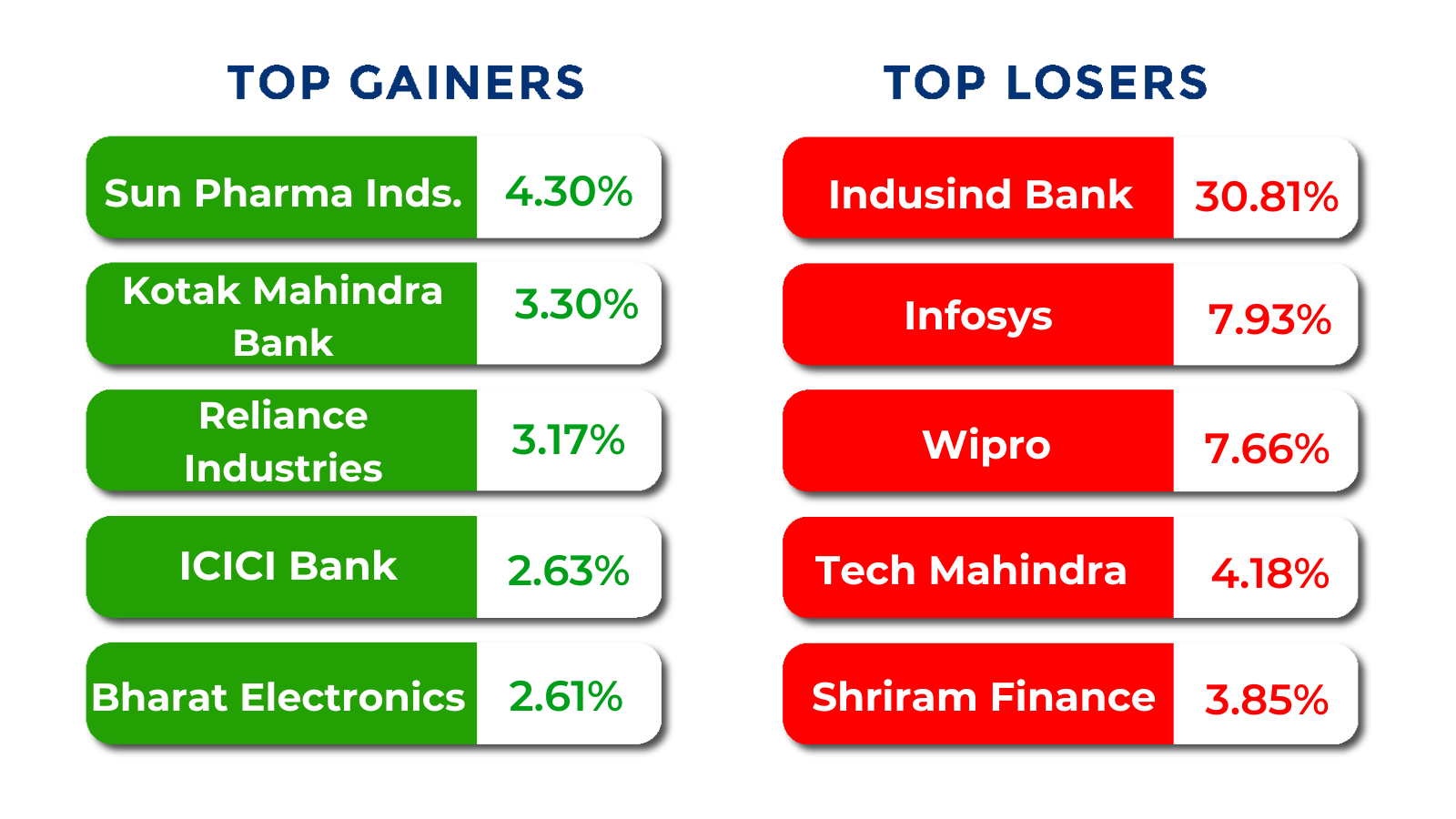

The BSE Large-cap Index fell 0.8 percent with IndusInd Bank falling 28 percent followed by Wipro, Zomato, Indian Overseas Bank, Info Edge India, Infosys, LTIMindtree, Macrotech Developers. On the other hand, gainers included Avenue Supermarts, Adani Energy Solutions, Sun Pharmaceutical Industries, JSW Energy, Adani Green Energy.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

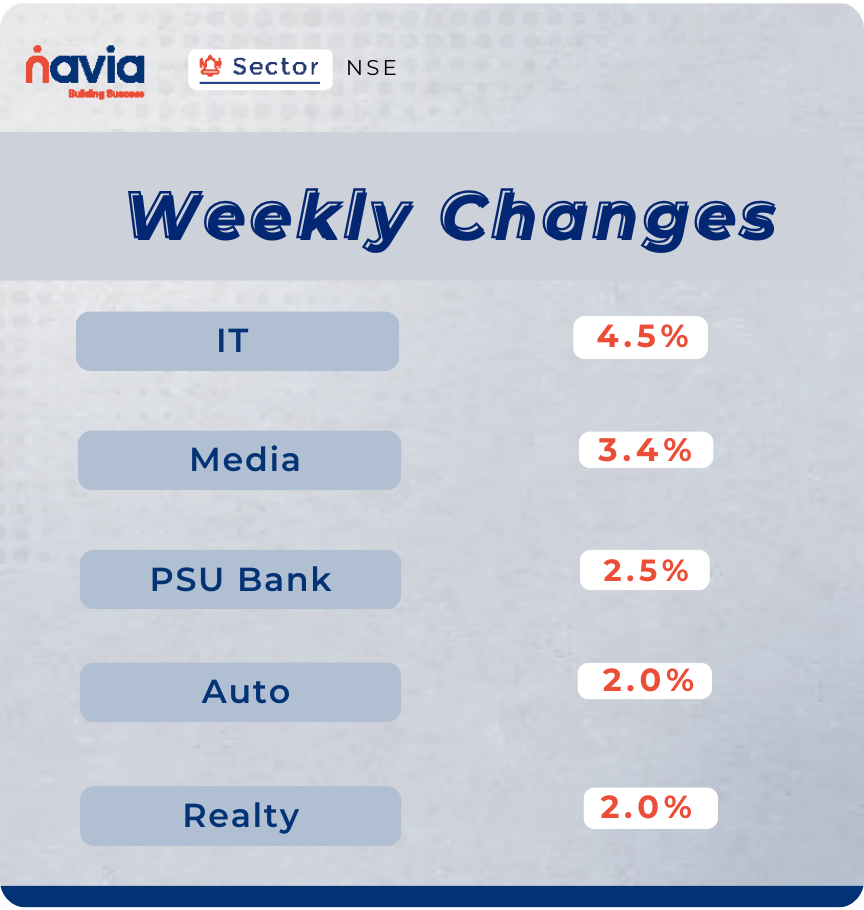

Sector Spotlight

All the sectoral indices ended in the red with Nifty IT index shed 4.5 percent, Nifty Media index declined 3.4 percent, Nifty PSU Bank index fell 2.5 percent, Nifty Auto and Realty indices fell 2 percent each.

Top Gainers and Losers

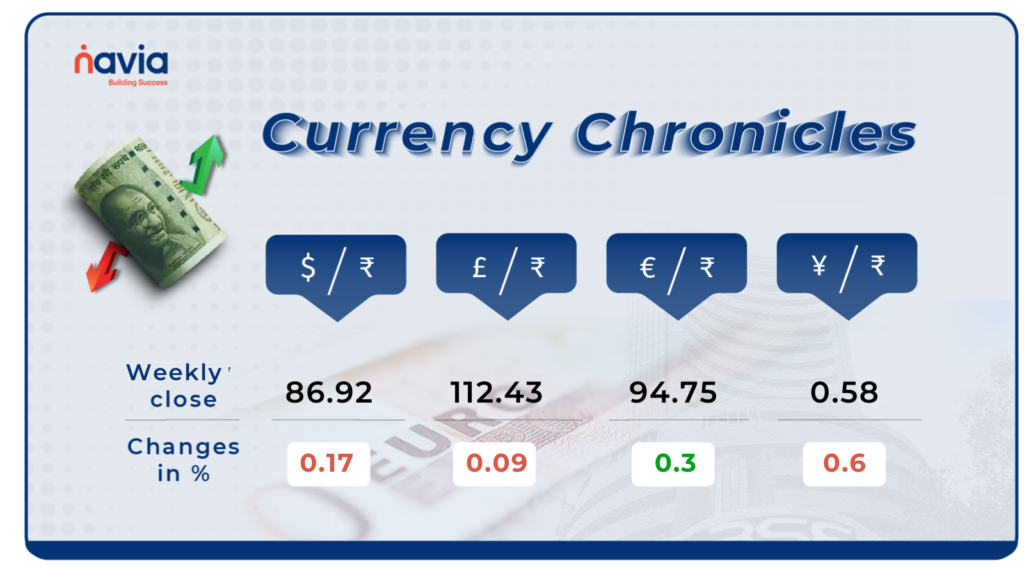

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹86.92 per dollar on March 13, compared to ₹87.06 on March 7. The rate rose by 0.17% during the week, reflecting a neutral market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹94.75 per euro, gaining 0.3% during the week, reflecting a neutral market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, declining by 0.6% during the week, reflecting a neutral market sentiment.

Stay tuned for more currency insights next week!

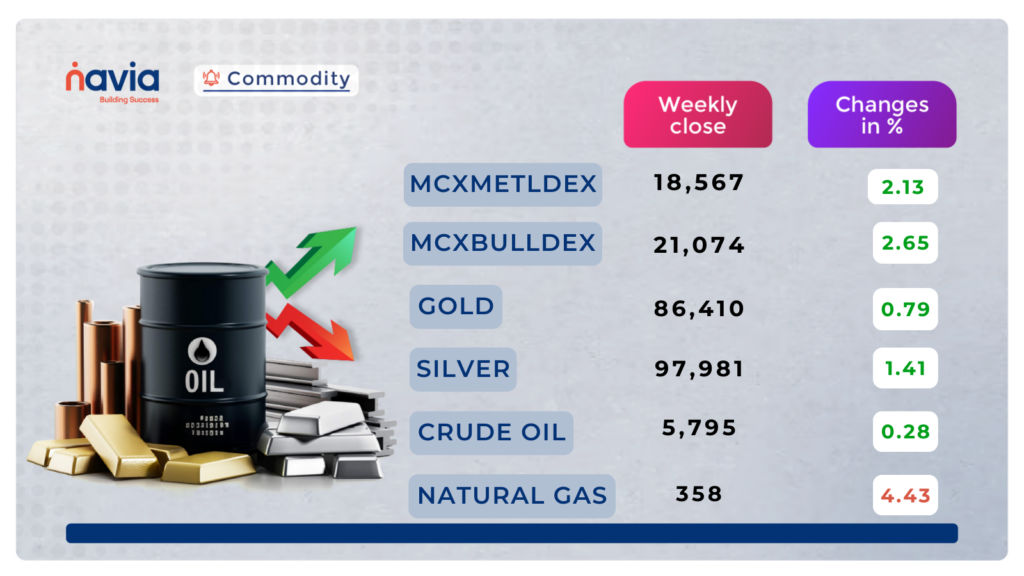

Commodity Corner

Crude oil broke a symmetrical triangle on the 1-hour chart, closing slightly positive at 5,795, down 113 points. Further momentum is expected above 5,820 for an upside move or below 5,765 for a downside move. A retest of the breakout area at 5,814 is possible. India’s crude imports from Russia rebounded, easing supply concerns, while OPEC+ increased output, adding pressure on prices. Meanwhile, a sharp drop in U.S. gasoline inventories has provided support to oil prices, reflecting strong demand. These factors are influencing market sentiment, creating a mixed outlook for crude oil in the near term.

Gold has been trading in an ascending channel on the 4-hour chart, closing at 86,410, up 1,089 points, marking a new all-time high. If gold sustains above 87,300, further positive momentum is expected. The support zone lies between 85,100-85,200, and a breakdown below this range could lead to weakness. Intraday movement is expected above 87,890 for an upside or below 87,300 for a downside move. Gold remains strong as U.S. inflation data fuels expectations of rate cuts, enhancing its appeal as a hedge against economic uncertainty. Analysts anticipate further upside, with price forecasts pointing to $3,100 per ounce in the coming months amid global economic concerns.

Natural gas is trading in a widening ascending wedge pattern, closing the last session flat at 358. Further momentum can be expected above 366 for an upside move or below 354 for a downside move. A retest of the breakout area of the ascending channel is possible.

Recent developments in the natural gas market indicate strong LNG demand and infrastructure challenges in the U.S., while regulatory shifts and geopolitical decisions, such as the U.S. backing TotalEnergies’ Mozambique project, are shaping the market. Additionally, efforts to expand natural gas pipelines and deregulate energy policies could impact long-term price stability.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blog of the Week!

Smart Investment & Strong Women: Asha’s Women’s Day Win

At a lively Women’s Day event, Asha realized that saving alone wasn’t enough—smart investing was the key to real financial growth. But where should she begin? With expert guidance, she unlocked the power of equity, diversification, and digital investing. Discover Asha’s journey to financial freedom in this inspiring story!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?