Navia Weekly Roundup (June 9 – 13, 2025)

Week in the Review

The Indian equity indices erased all the previous week gains, losing 1 percent in the volatile week ended June 13 amid geopolitical tensions after Israel strikes on Iran, which led to sharp jump in crude oil prices and uncertainty over the US-China trade negotiations. However, 75-month low CPI inflation and progress of monsoon provided some relief to the Indian markets.

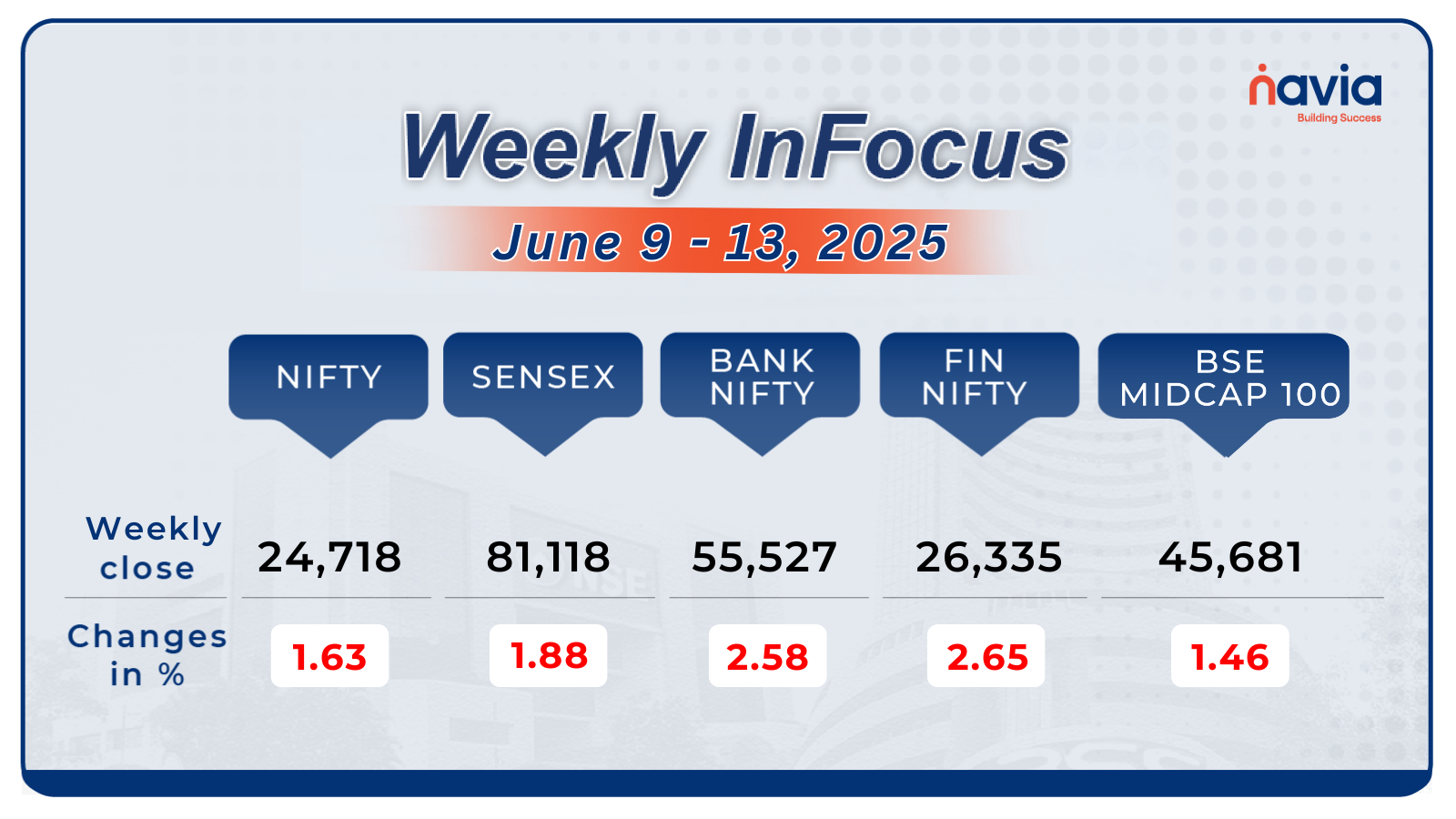

Indices Analysis

For the week, the BSE Sensex index shed 1.88 percent to end at 81,118, and Nifty50 fell 1.63 percent to close at 24,718.

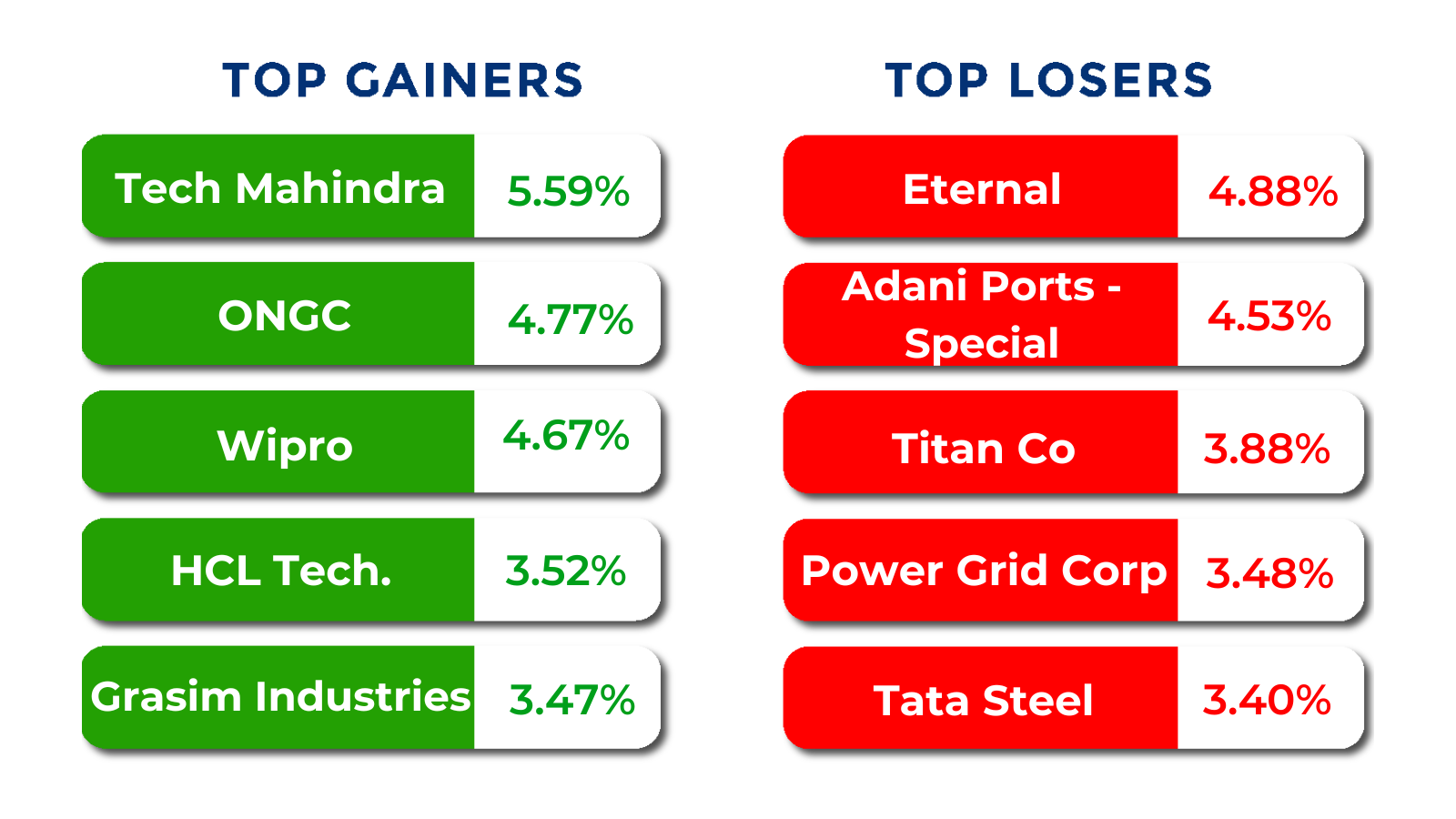

The BSE Large-cap Index lost 1 percent dragged by United Spirits, IDBI Bank, Indian Railway Finance Corporation, Swiggy, Indian Overseas Bank, Eternal, Union Bank of India, Adani Ports and Special Economic Zone, Jindal Steel & Power, Macrotech Developers. However, gainers included Tech Mahindra, Oil and Natural Gas Corporation, Wipro, Hyundai Motor India, LTIMindtree, Grasim Industries, HCL Technologies, Dr Reddy’s Laboratories.

BSE Mid-cap Index shed 1 percent. Losers included Brainbees Solutions, One 97 Communications (Paytm), Kalyan Jewellers India, Nippon Life India Asset Management, GMR Airports, Relaxo Footwears, Mazagon Dock Shipbuilders, Container Corporation of India, Godrej Industries, Indian Hotels Company, Indraprastha Gas, Star Health & Allied Insurance Company, Rail Vikas Nigam, SJVN. However, gainers included Oil India, Zee Entertainment Enterprises, Inventurus Knowledge Solutions, Oracle Financial Services Software, Biocon, Muthoot Finance, The Ramco Cements, Max Healthcare Institute, Glenmark Pharma.

The BSE Small-cap index ended on flat note. Advait Energy Transitions, Rattanindia Enterprises, SMC Global Securities, GOCL Corporation, Suratwwala Business Group, Motisons Jewellers, Electrosteel Castings, Expleo Solutions, Dhani Services, Somany Ceramics added between 20-28 percent, while Sadhana Nitrochem, Orient Cement, Deccan Gold Mines, Harsha Engineers International, Cupid lost between 10-22 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

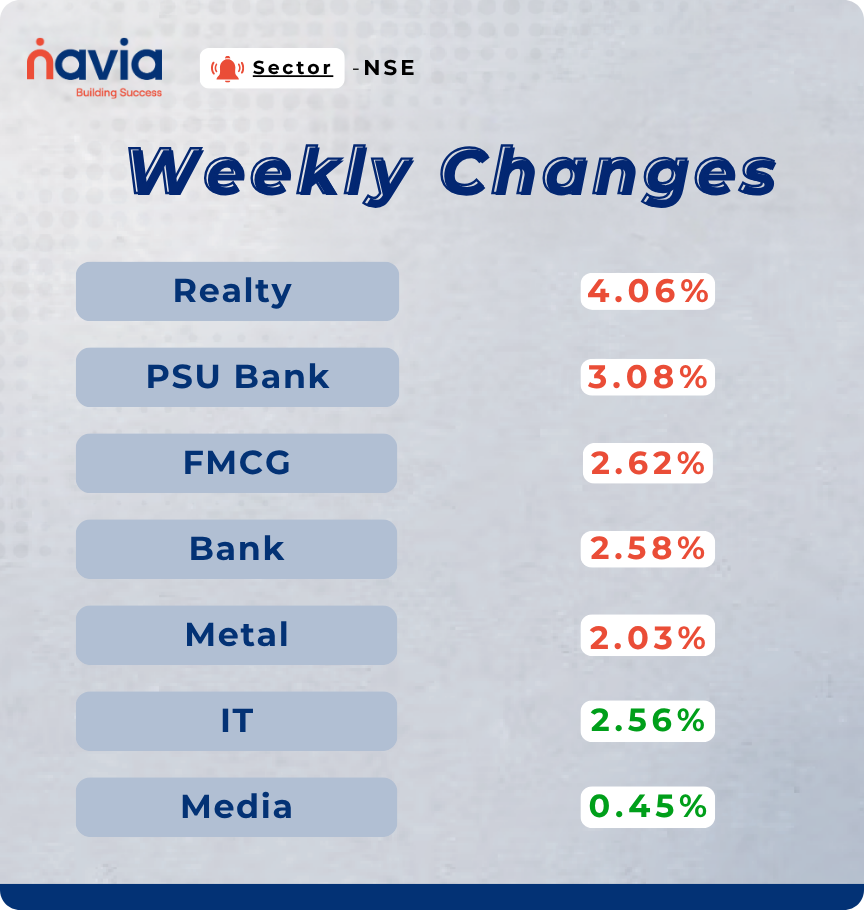

Sector Spotlight

On the sectoral, Nifty Realty index fell 4.06 percent, Nifty PSU Bank index down 3.08 percent, Nifty FMCG shed 2.62 percent, Nifty Bank fell 2.58 percent and Nifty Metal index declined 2.03 percent. However, Nifty Information Technology index added 2.56 percent and Nifty Media rose 0.45 percent.

Top Gainers and Losers

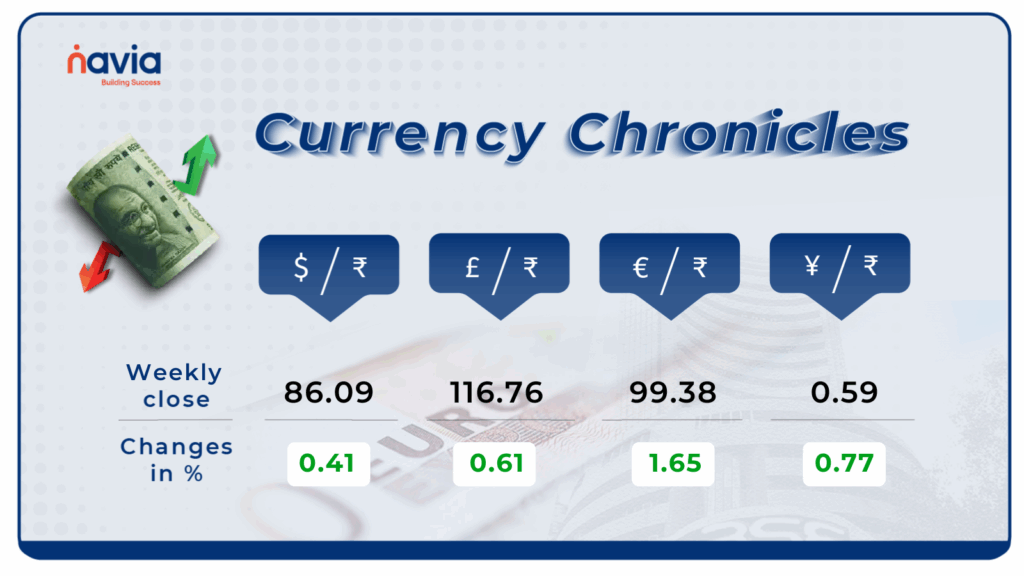

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹86.09 per dollar, gaining 0.41% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹99.38 per euro, gaining 1.65% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining 0.77% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

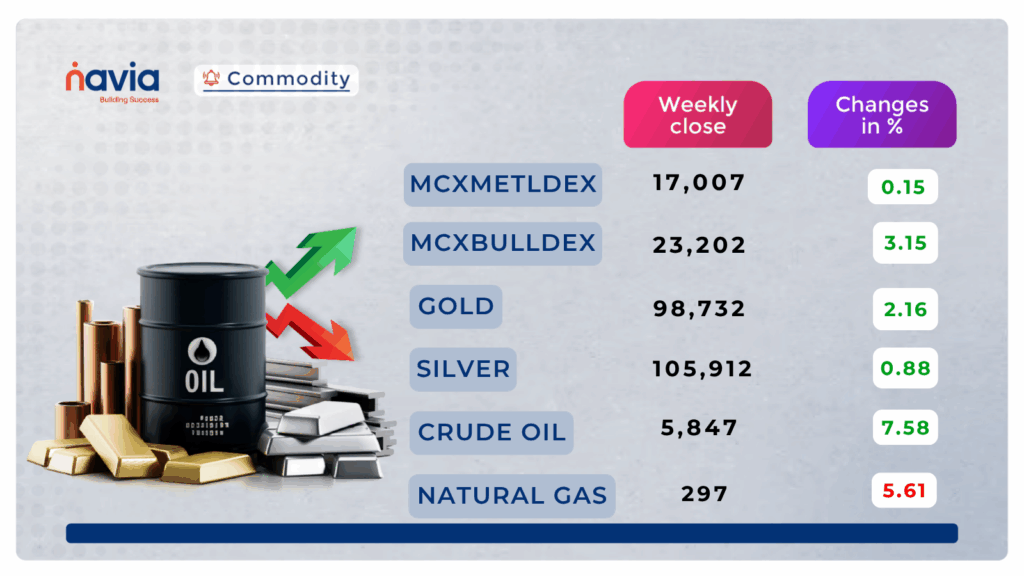

Commodity Corner

Crude Oil is currently trading in a broken brodening descending wedge pattern on the 4 hour chart. In the last session, it closed at 5,847. Sustaining above 5780 could be good for crude oil, while immediate support is placed at 5,700. Further intraday upside momentum is likely above 5,870 while a breakdown below 5800 could trigger additional selling pressure.

In the last session, Gold closed at 98,732. Gold is trading in an ascending channel on the wider timeframe and in a descending channel on the shorter timeframe, as shown in the chart. Sustaining above 98000 could be good for Gold. A sustained move above this range could lead to further upside in Gold. For intraday traders, a move above 98800 may indicate upside potential, while a dip below 98000 could trigger further downside pressure.

Natural Gas is currently trading in a Ascending channel shwoing a uptrend. Holding above 320 level could lead to higher levels. The last session closed at 297. Another intraday move is likely above 308. However, a close below 293 could signal further downside in prices. Sustaining above 330 on a broader timeframe could lead to short-term bullishness in Natural Gas.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Difference Between Stock Split and Bonus Issue

Stock splits and bonus issues both increase the number of shares, making them more accessible and liquid, but differ in their origin and impact. A stock split divides existing shares, lowering the per-share price without using company reserves. A bonus issue, however, distributes additional free shares from accumulated company profits to reward existing shareholders.

What are Sinking Funds?

Sinking funds are strategic savings accounts designed to accumulate money gradually for specific future expenses or debt repayments, preventing financial strain. Unlike general savings, they’re dedicated to a clear goal, such as a vacation, home renovation, or bond repayment.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?