Navia Weekly Roundup (JUNE 3 – JUNE 7, 2024)

Week in the Review

Market Rises 3% Amid High Volatility; IT Index Leads

The Indian market recovered last week’s losses, gaining over 3% amid extreme volatility after the BJP-led NDA did not receive the clear mandate expected from exit polls. However, the market rebounded strongly, reaching an all-time high after the RBI raised the growth forecast for FY25. Investor sentiment was also boosted by the news that the BJP-led NDA will form a new government under Narendra Modi for the third consecutive term

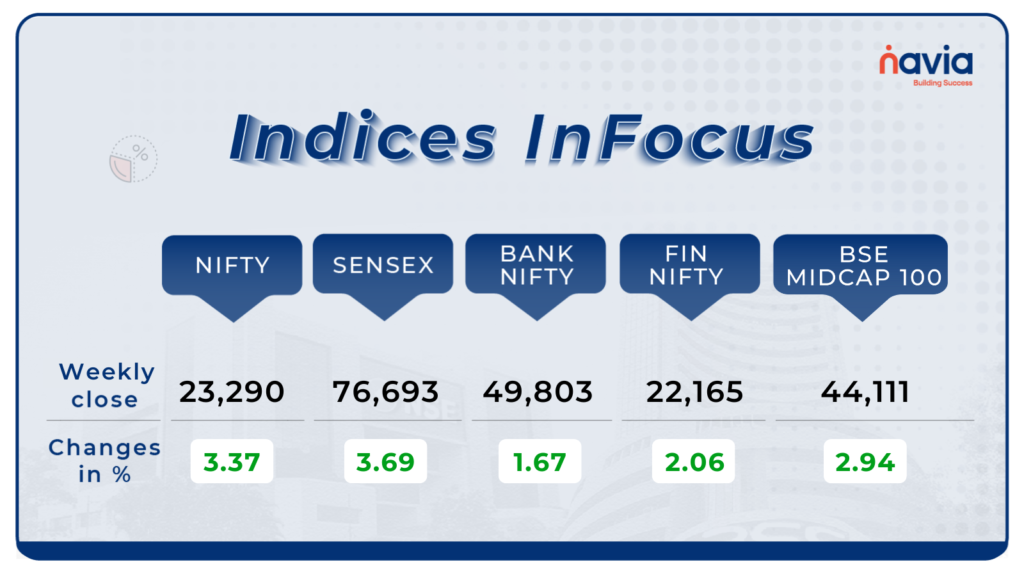

Indices Analysis

In this week, BSE Sensex gained 3.69 percent to close at 76,693. while Nifty50 index rose 3.37 percent to finish at 23,290. During the week, BSE Sensex hit fresh all-time high of 76,795.31, while Nifty also inched near to its record high of 23,338.70.

The BSE Mid-cap Index climbed 3%, driven by notable gains in Emami, Bayer CropScience, UNO Minda, Persistent Systems, Oracle Financial Services Software, Aditya Birla Fashion & Retail, The Ramco Cements, Colgate Palmolive (India), United Breweries, and TVS Motor Company, which saw increases of 10-15%. Conversely, Union Bank of India, REC, Bank Of India, Rajesh Exports, and Indian Bank were among the decliners.

Interactive Zone!

Last week’s poll:

Q) What is a Stoploss order?

a) This order will be placed only by the broker

b) This order will be executed only after triggering the trigger price

c) This order will be executed immediately

Last week’s poll Answer: b)This order will be executed only after triggering the trigger price

Poll for the week: What is the expansion of SENSEX?

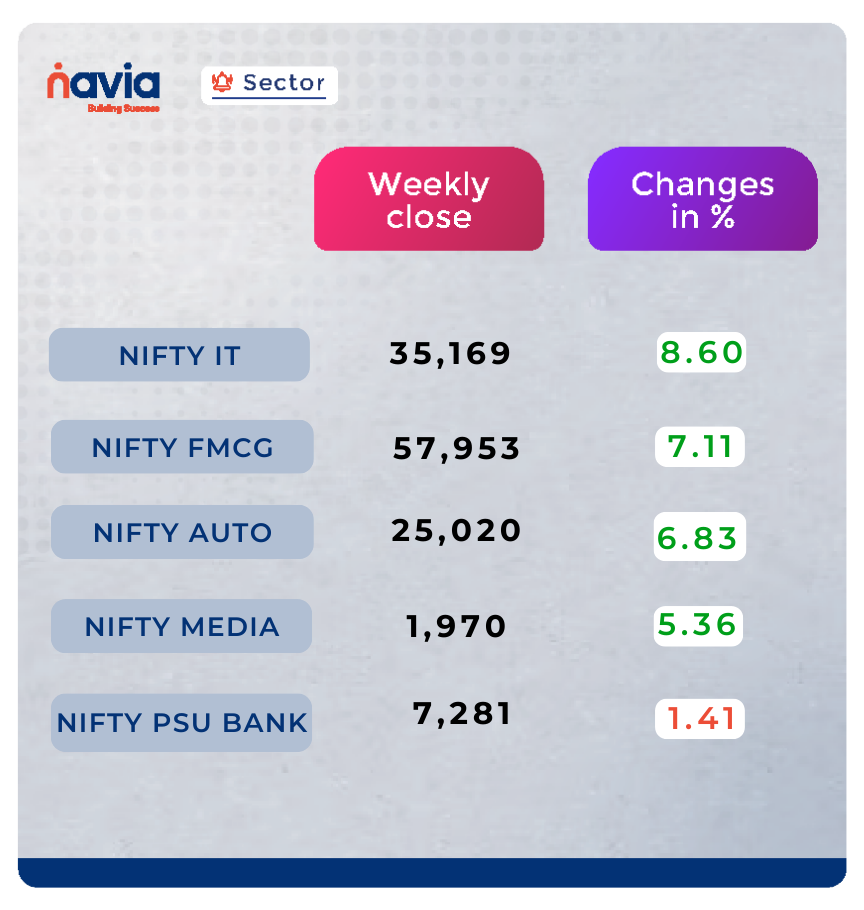

Sector Spotlight

Among sectors, Nifty Information Technology index rose 8.60 percent, Nifty FMCG index rose 7.11 percent, Nifty Auto index gained 6.83 percent, and Nifty Media added 5.36 percent. However, Nifty PSU Bank index declined 1.41 percent.

Explore Our Features!

Invest in stocks effortlessly every month with Navia’s SIP setup. Follow our Navia App tutorial to create baskets, add your favorite stocks, and set up SIP orders seamlessly.

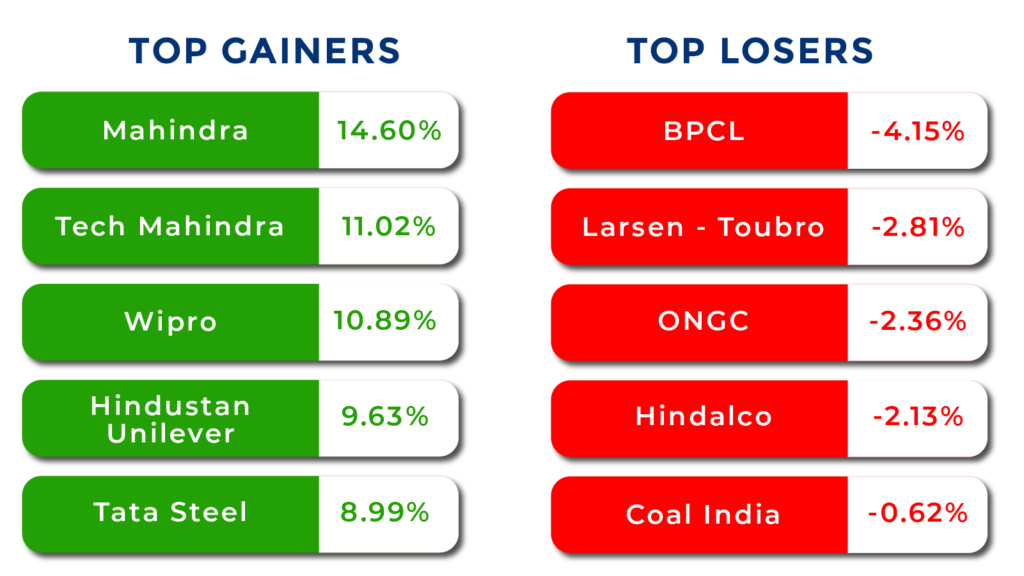

Top Gainers and Losers

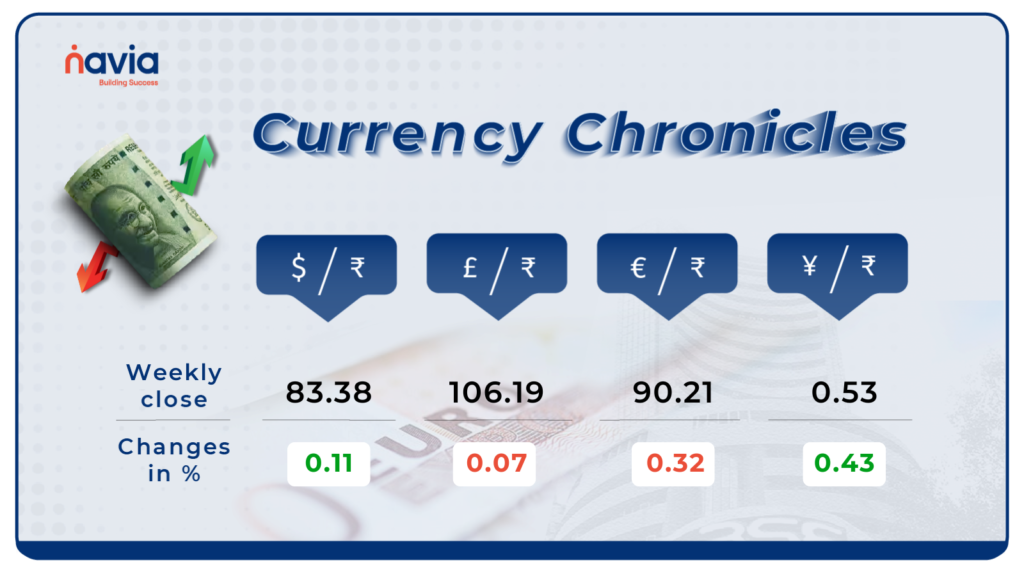

Currency Chronicles

USD/INR:

The Indian rupee erased some of the previous week losses and closed 8 paise higher at 83.38 on June 7 against its May 31 closing 83.46.

EUR/INR:

The EUR to INR exchange rate decreased by 0.32% over the week. The Euro edged up as traders braced for an ECB rate cut. In June, the ECB lowered its key interest rates by 25 basis points, bringing the main refinancing operations rate to 4.25%.

JPY/INR:

Similarly, the JPY to INR exchange rate saw an increase of 0.43% for the week. JPY steadied as BOJ Toyoaki Nakamura warned that the country may fall short of the 2% inflation target next year if consumption stagnates.

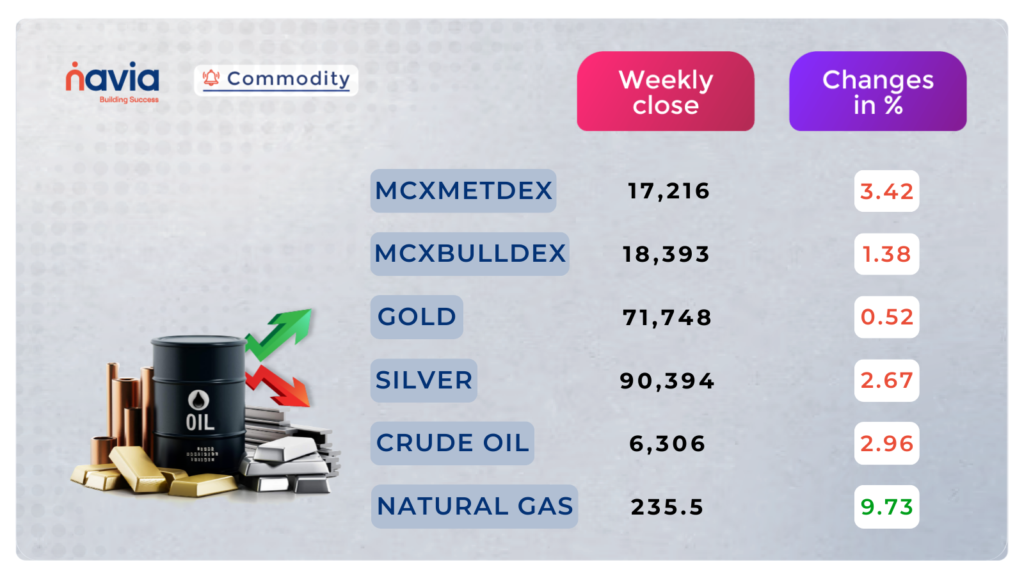

Commodity Corner

Crude oil is extending its downtrend momentum amid concerns about the prospects for a supply surplus due to OPEC+’s plans to gradually phase out voluntary output cuts. The current R1 is placed at 6,448, and S1 is placed at 6191.

Currently, natural gas is taking strong support from 217 levels and closed the previous week at 9.73% positive. Forecasts for hotter US temperatures are expected to boost natural gas demand. The current R1 is placed at 245, and S1 is placed at 224.

In the previous session, gold closed 0.52% lower as investors awaited U.S. jobs data due later this week for clues on the Federal Reserve’s interest rate trajectory. The current R1 is placed at 73502, and S1 is placed at 72420

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

How are ETFs Taxed in India?

Understanding how ETFs are taxed in India can help investors make informed decisions and optimise their returns. This blog will explore the tax implications of investing in ETFs in India.

From Sparkles to Stocks: Ananya’s Journey to Financial Brilliance!

Discover how Ananya navigates her financial journey from jewelry savings to stock investments.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?