Navia Weekly Roundup (JULY 29 – AUGUST 02, 2024)

Week in the Review

The market ended its eight-week gaining streak after a correction on Friday, August 2, wiped out the weekly gains. This decline followed the trend in global equity markets amid weak economic data. Despite this setback, the benchmarks reached a new all-time high during the week, as the Federal Reserve Chair hinted at a possible rate cut in the September meeting due to easing inflationary pressures.

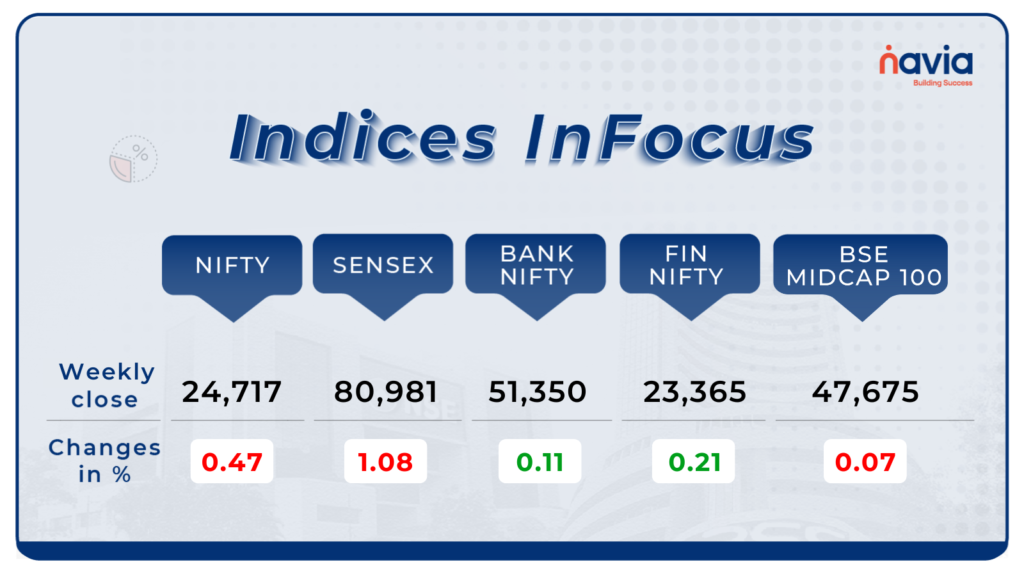

Indices Analysis

This week, BSE Sensex fell 0.43 percent to end at 80,981.95, while the Nifty50 index lost 117.15 points or 0.47 percent to close at 24,717.70. On August 1, the Nifty50 index touched a fresh record high of 25,078.30 while the BSE Sensex hit a new high of 82,129.49.

Interactive Zone!

Last week’s poll:

Q) Which of these factors drives the Sensex to fluctuate?

a) Government monetary policy

b) Fiscal policy

c) Instability in politics

d) All of the above

Last week’s poll Answer: d) All of the above

Poll for the week: Which of the below statements regarding the Securities and Exchange Board of India (SEBI) is not correct?

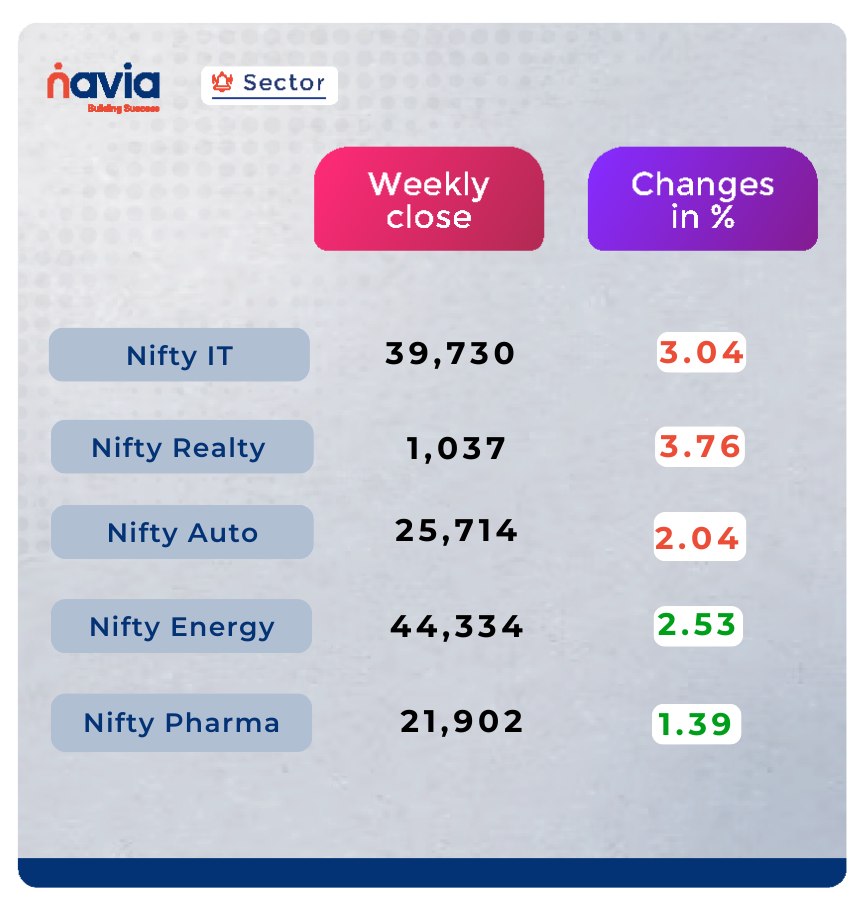

Sector Spotlight

Among sectors, Nifty IT down 3.04 percent, Realty index shed 3.76 percent, Nifty Auto index fell 2.04 percent and However, Nifty Energy index added 2.53 percent, Nifty Pharma added 1.39 percent each.

Explore Our Features!

Learn how to quickly check which securities are under a ban using the Navia app. Stay informed and make better investment decisions effortlessly. Watch our tutorial to see how it’s done!

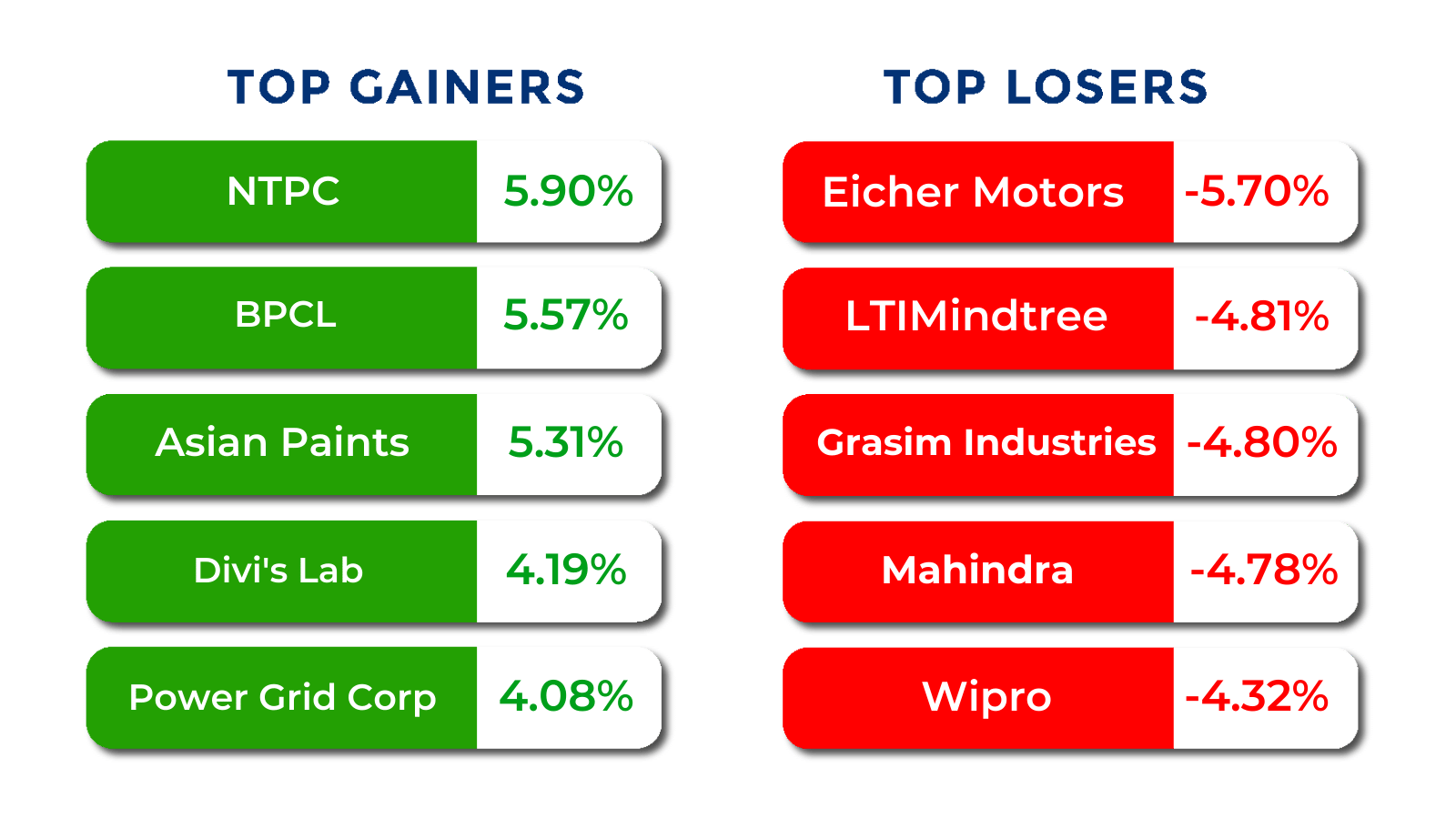

Top Gainers and Losers

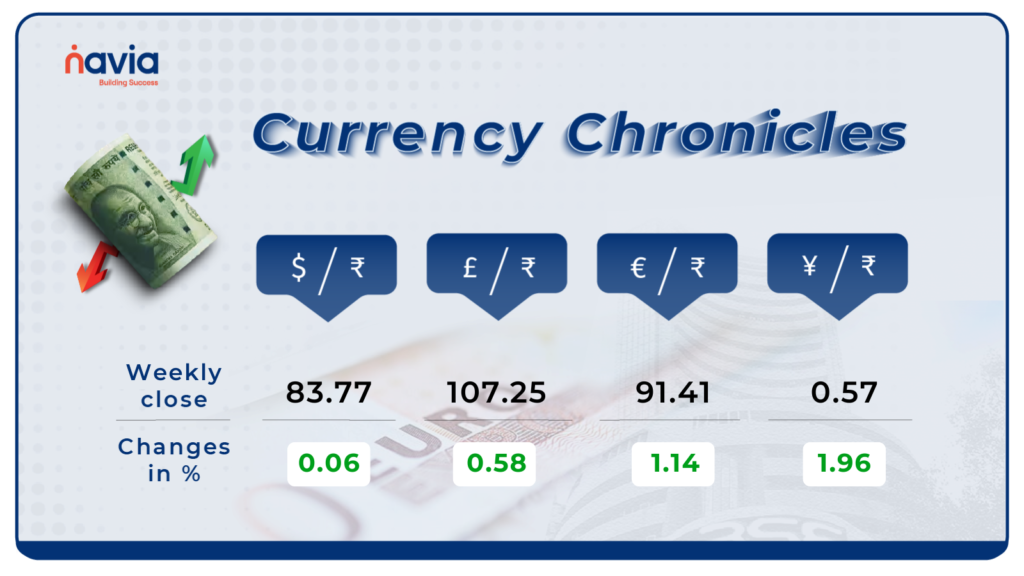

Currency Chronicles

USD/INR:

This week, the Indian rupee fell to a record low but ended flat against the US dollar, closing at 83.77 on August 2 compared to 83.72 on July 26. The stability at the week’s end reflects a period of uncertainty and adjustment for the domestic currency.

EUR/INR:

The EUR to INR exchange rate rose by 1.14% for the week, reaching ₹91.41. Despite the increase, the market sentiment remains bullish, indicating strong confidence in the euro’s performance against the Indian rupee.

JPY/INR:

The JPY to INR exchange rate increased by 1.96% over the week, closing at ₹0.57. The bullish sentiment in the JPY/INR market highlights continued strength and optimism for the Japanese yen against the Indian rupee.

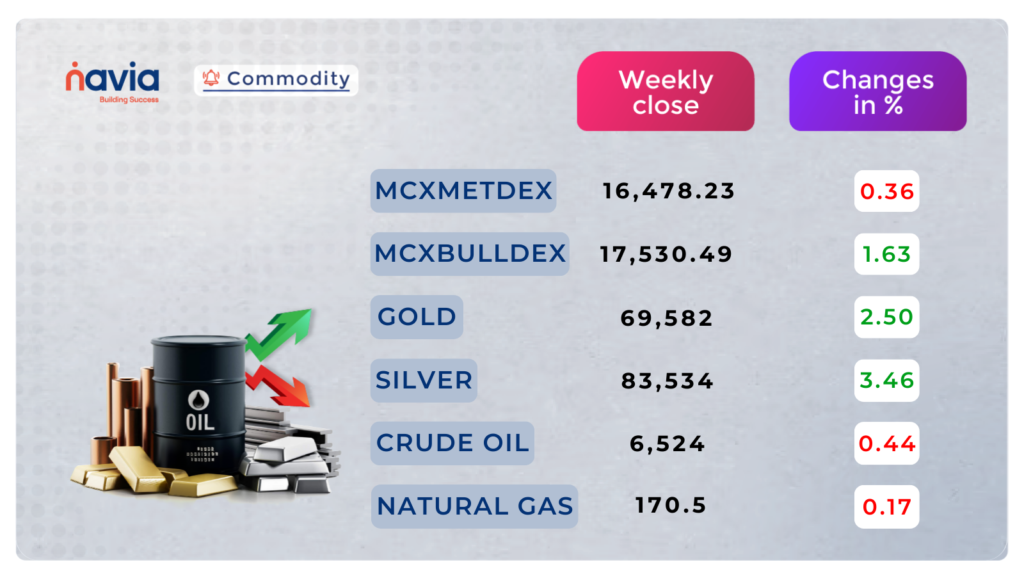

Commodity Corner

Amid ongoing concerns about potential supply disruptions due to the increasing threat of a broader conflict in the Middle East. The current resistance level (R1) is placed at 6,712 and the support level (S1) is placed at 6,265

gold prices are expected to be supported by potential Fed rate cuts in the coming months. The current resistance level (R1) is at 71110, and the support level (S1) is at 69001

Natural gas prices continued to experience selling pressure, Forecasts for cooler temperatures in the Midwest that will curb nat-gas demand The current resistance level (R1) is at 173, while the support level (S1) is at 162.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

12 Powerful Ways AI is Revolutionizing Stock Market Trading Strategies in 2024

Discover how AI is transforming stock market trading in 2024! Uncover powerful AI-driven strategies and tools that can give you a competitive edge. Read more on our latest blog!

Dividend Dilemma: A Desi Cafe Chat

Explore the “Dividend Dilemma” with Shreya and Rohan at a cozy Kolkata café! Learn how dividend stocks can be a steady income source and why they attract investors. Read more on our latest blog!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.