Navia Weekly Roundup (JULY 15 – JULY 19, 2024)

Week in the Review

During the shortened week, the Indian market reached new record highs, driven by positive global cues, favorable economic data, a strong start to the earnings season, and improved monsoon progress. Despite these gains, the market closed with only minor increases for the week, as profit booking on Friday ahead of the upcoming budget tempered the rally.

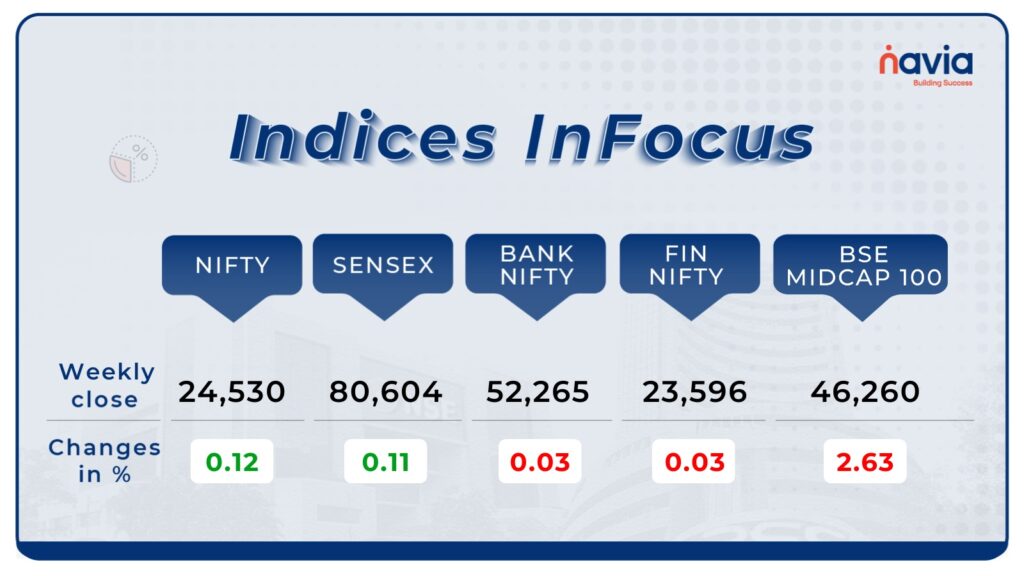

Indices Analysis

This week, BSE Sensex was up 0.11 percent to end at 80604. while Nifty50 index was up 0.12 percent to close at 24,530. On July 19, BSE Sensex and Nifty50 touched record highs of 81587.76 and 24,854.80, respectively.

BSE Mid-cap Index shed 2.63 percent with Zee Entertainment Enterprises, Cummins India, Bharat Heavy Electricals, Solar Industries India, New India Assurance Company, Oil India, CG Power and Industrial Solutions, NMDC fell between 7-11 percent, while gainers included MphasiS, Emami, Gillette India, Ajanta Pharma, IDBI Bank and Colgate Palmolive (India).

Interactive Zone!

Last week’s poll:

Q) What are the indices NIFTY and SENSEX are dependent on?

a) Capitalisation based on free float.

b) The market capitalization of a company.

c) Share capital that has been authorized.

d) Capital that has been paid in full.

Last week’s poll Answer: a) Capitalisation based on free float.

Poll for the week: The UP Stock Exchange is located in which of the below cities?

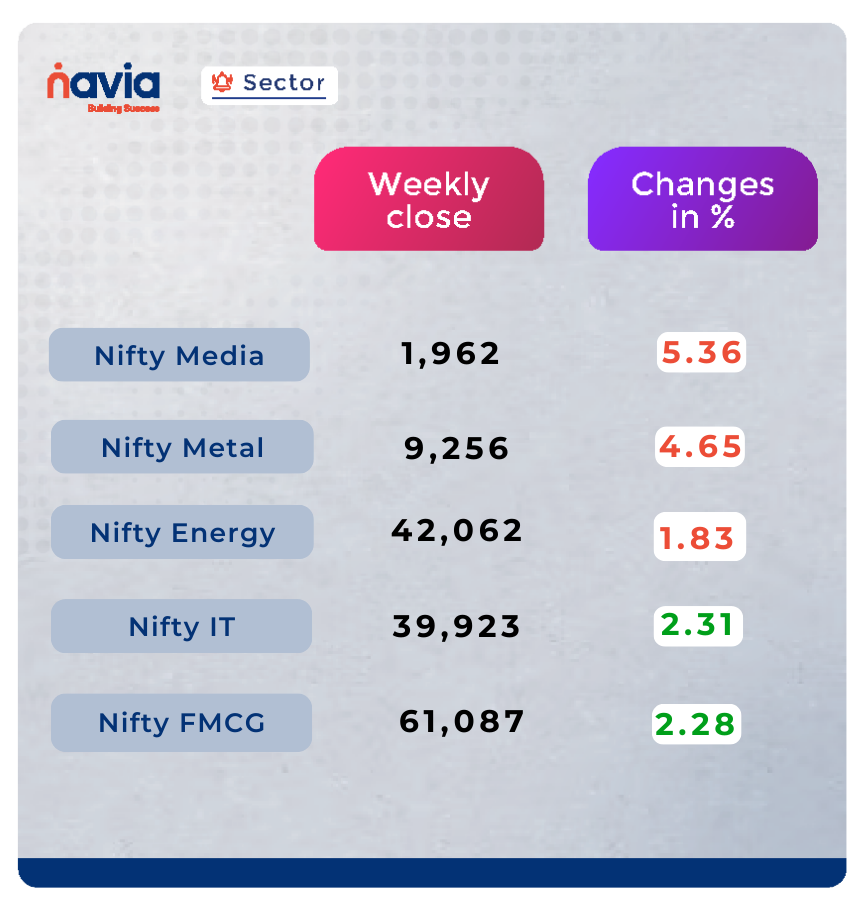

Sector Spotlight

On the sectoral front, the Nifty Media index shed 5.36 percent, the Nifty Metal index was down 4.65 percent, and Nifty Energy index fell 1.83 percent. On the other hand, Nifty Information Technology up 2.31 percent, and FMCG indices added 2.28 percent.

Explore Our Features!

Calculate Stock Returns in 3 Easy Steps!

Learn how to measure your stock investments’ performance with this simple guide to calculating stock returns. Whether you’re a beginner or a seasoned investor, understanding your gains is crucial. Discover more investment tips and tools with the Navia App. Watch our tutorial for a step-by-step walkthrough!

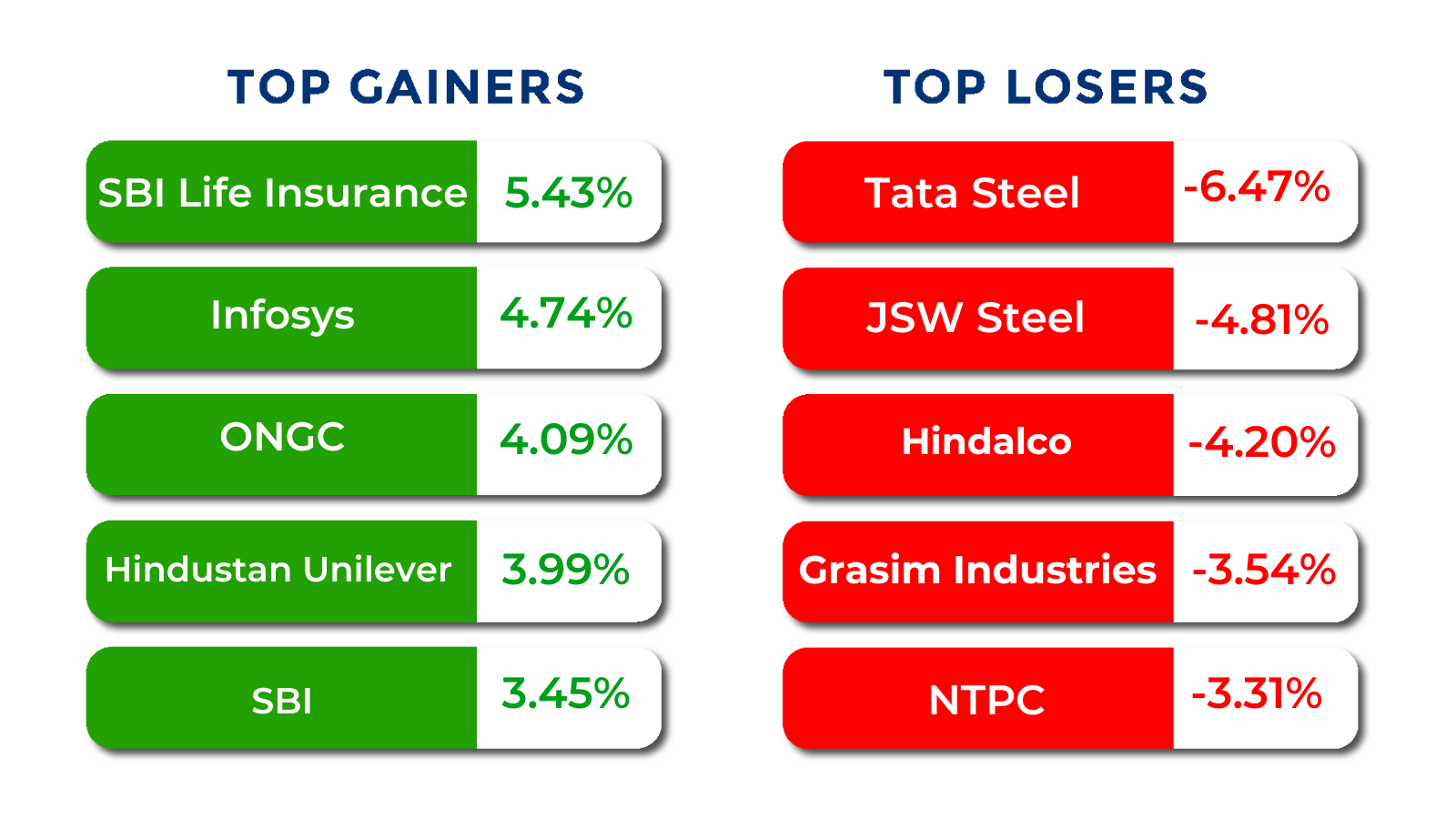

Top Gainers and Losers

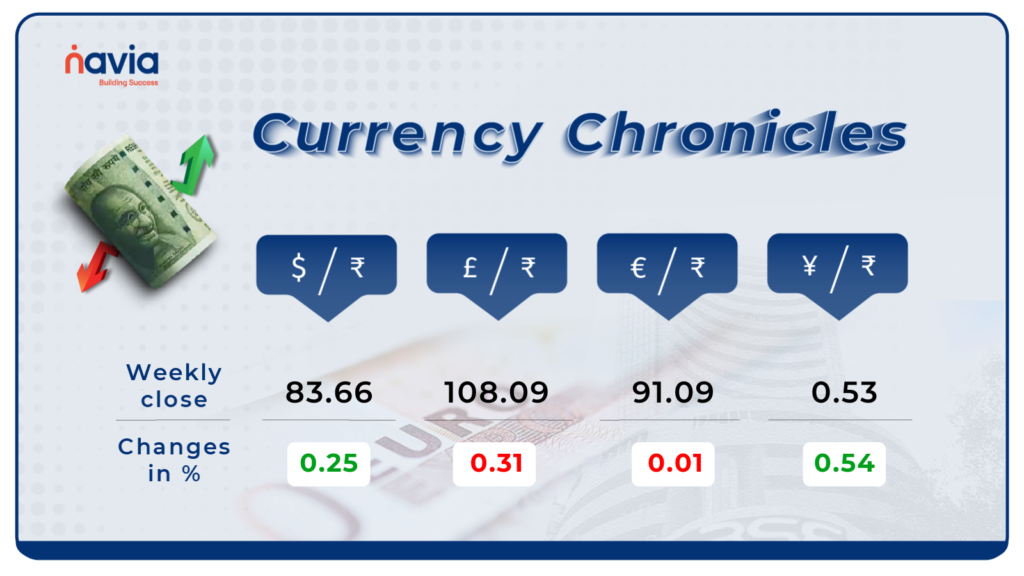

Currency Chronicles

USD/INR:

This week, the Indian rupee continued to lose ground against the US dollar, ending 13 paise lower. The rupee closed at 83.66 on July 19, down from its July 12 closing of 83.53. Persistent pressure on the domestic currency highlights the ongoing challenges faced in maintaining its value against the dollar.

EUR/INR:

The EUR to INR exchange rate saw a modest increase of 0.01% for the week, closing at ₹91.09. The euro’s performance against the Indian rupee has been supported by positive market sentiment and investor confidence, maintaining a bullish outlook despite minimal growth.

JPY/INR:

The JPY to INR exchange rate improved by 0.54% for the week, reaching ₹0.532067. The bullish sentiment in the JPY/INR market indicates strong performance and growing confidence in the Japanese yen’s stability against the Indian rupee.

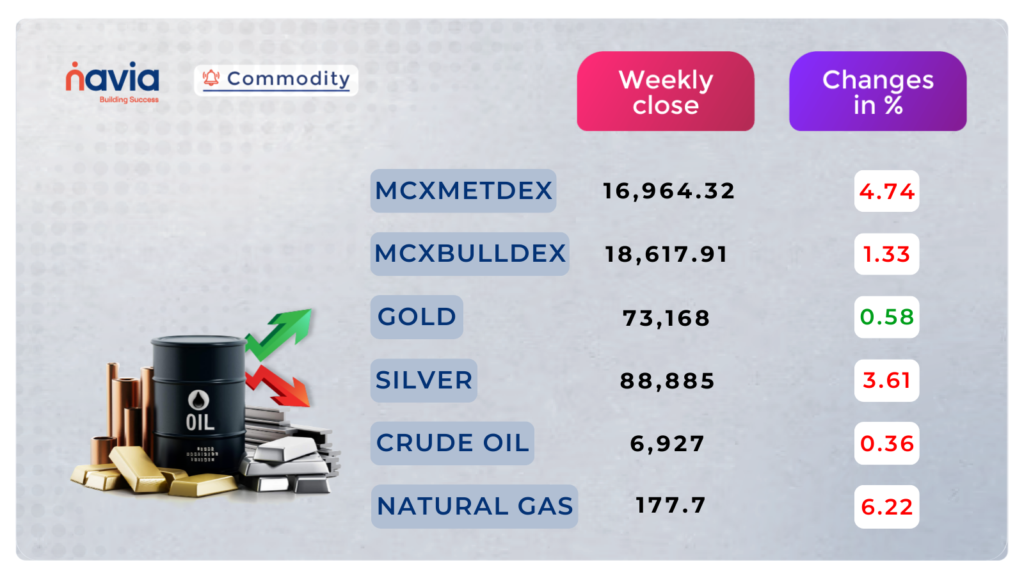

Commodity Corner

Gold faces pressure from a rising dollar as investors assess the market, indicating consolidation or a minor correction at current levels. The current resistance level (R1) is placed at 74862, and the support level (S1) is placed at 73458

Crude oil faced a larger-than-expected decline in crude stockpiles last week. The current resistance level (R1) is at 7042, while the support level (S1) is at 6,888

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

An Investor’s Ultimate Therapy Session: Taming the Emotional Rollercoaster

Dive into the journey of Sandeep, a new investor grappling with market volatility, and learn from Anshul, a seasoned investor who offers valuable insights and calming wisdom. This blog is a must-read for anyone navigating the ups and downs of investing, providing both practical advice and emotional support.

The Psychology of Options Trading: Mastering Your Emotions

Explore the psychological challenges of options trading and learn strategies to maintain emotional composure for better trading outcomes. This blog delves into the emotional landscape, common cognitive biases, and the impact of stress on decision-making, offering practical techniques to manage stress and improve your trading performance.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.