Navia Weekly Roundup (July 07 – July 11, 2025)

Week in the Review

The Indian equity market extended the fall in the second consecutive week, ending on July 11 amid volatility led by uncertainty over the US tariff plan, a disappointing start to the earnings season, and a delay in finalising the India-US trade pact.

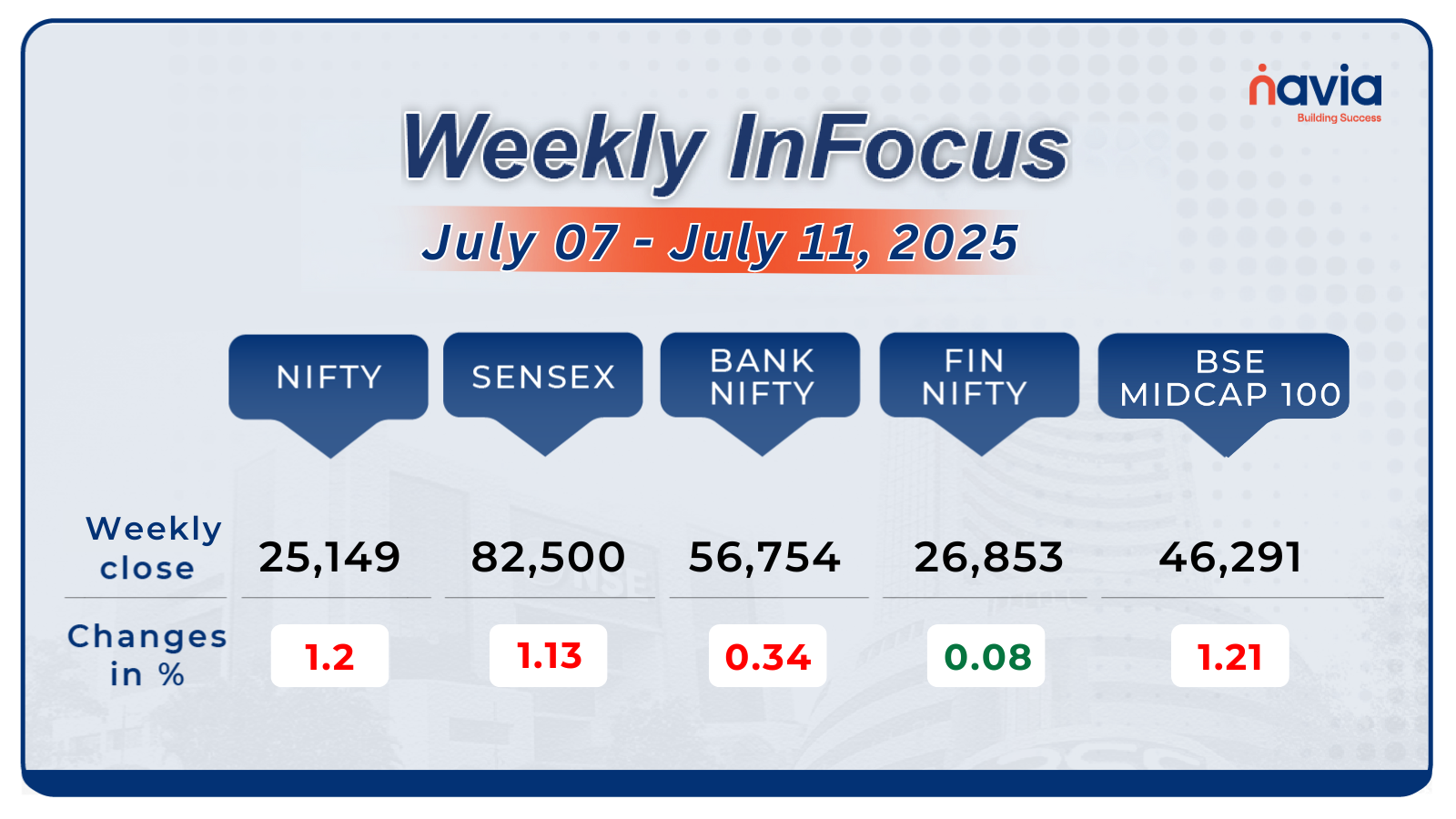

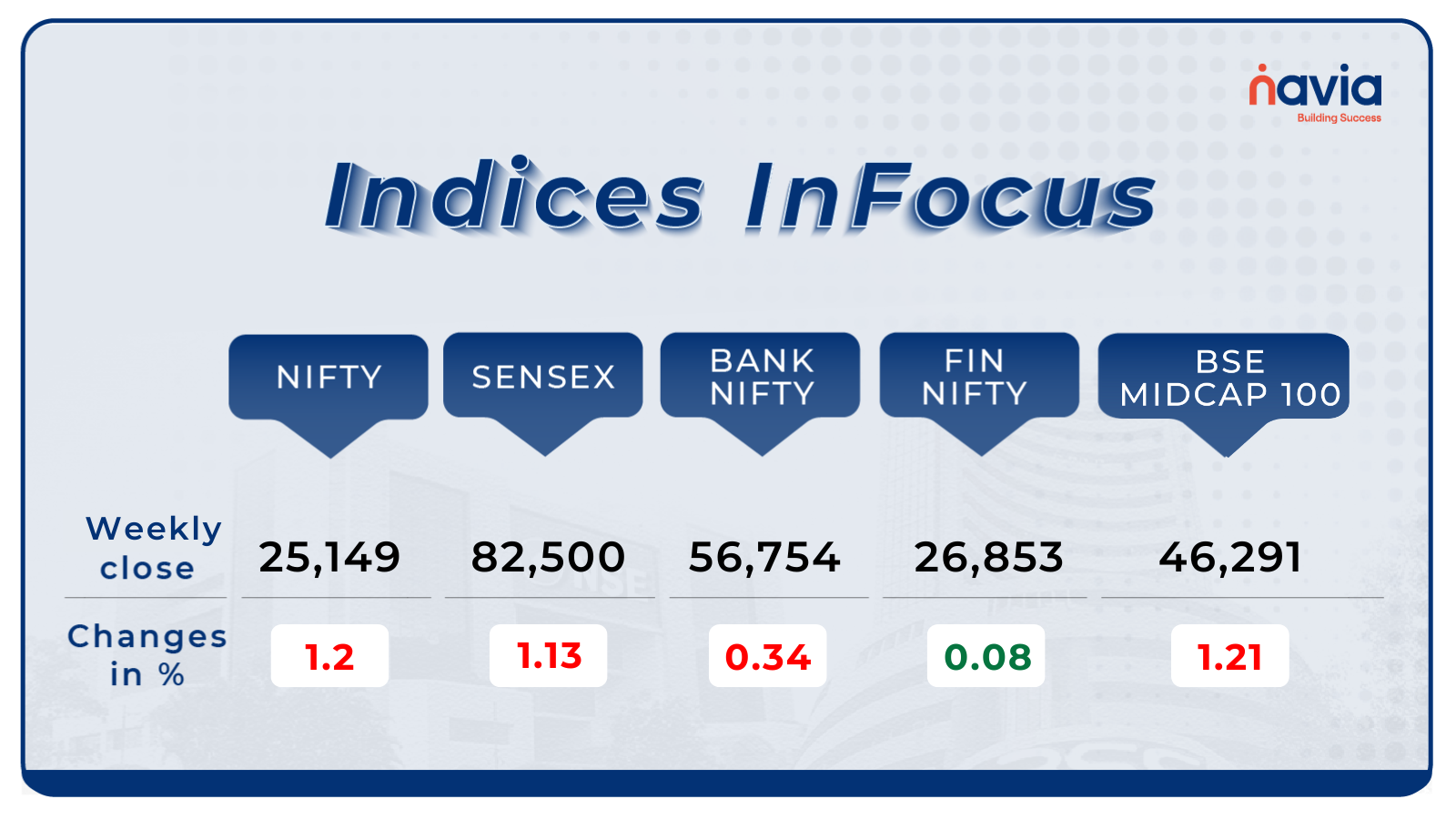

Indices Analysis

For the week, the BSE Sensex index declined 1.13 percent to end at 82,500, and Nifty50 shed 1.2 percent to finish at 25,149.

The BSE Large-cap Index declined 1 percent, dragged by Titan Company, Union Bank of India, Indus Towers, Hindustan Zinc, Info Edge India,and Vedanta. However, gainers were Godrej Consumer Products, Waaree Energies, Dabur India, Mankind Pharma, Kotak Mahindra Bank, and Power Finance Corporation.

BSE Mid-cap Index fell 1 percent, dragged by Bharat Forge, Aarti Industries, Bharti Hexacom, Solar Industries India, Endurance Technologies, Aurobindo Pharma, Sona BLW, and Precision Forgings. On the other hand, Relaxo Footwears, FSN E-Commerce Ventures (Nykaa), Schaeffler India, Delhivery, Emami, Premier Energies, Cummins India, AWL Agri Business, and Prestige Estates Projects rose between 5-11 percent.

The BSE Small-cap index shed 0.6 percent with Dreamfolks Services, Hampton Sky Realty, Paras Defence and Space Technologies, Sadhana Nitrochem, Garware Hi-Tech Films, KR Rail Engineering, Sindhu Trade Links, Sharda Cropchem, Sigachi Industries, Deepak Fertilisers and Petrochemicals Corporation, HLE Glascoat, Nacl Industries, Indian Metals & Ferro Alloys falling between 7-14 percent. On the other hand, Peninsula Land, Jaiprakash Power Ventures, John Cockerill India, Dish TV India, Shiva Cement, Force Motors, and ACME Solar Holdings gained between 15-39 percent.

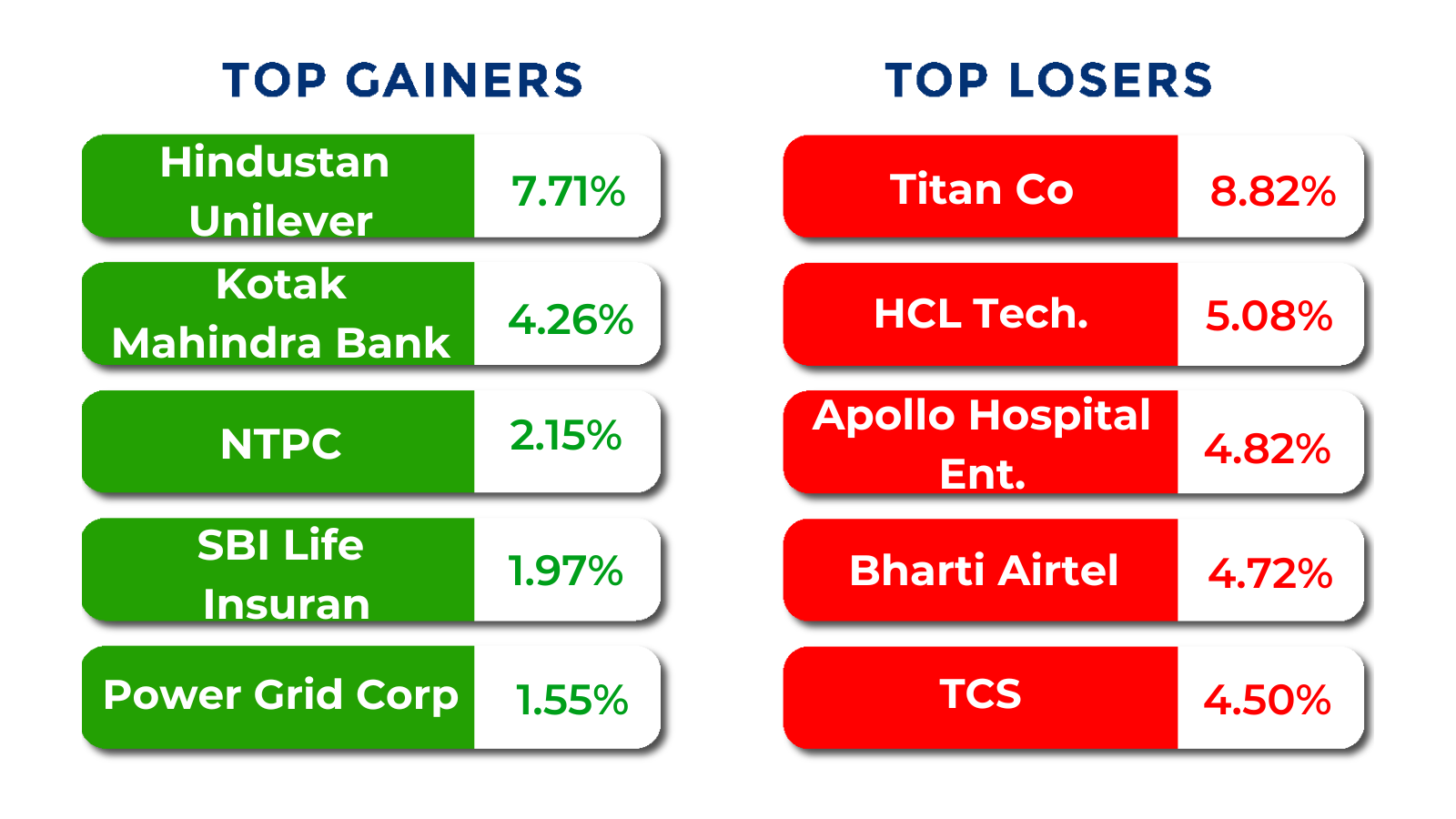

During the week, Bharti Airtel lost the most in terms of market value, followed by Titan Company, HCL Technologies, and Tata Consultancy Services. On the other hand, Kotak Mahindra Bank, Hindustan Unilever, and Bajaj Finance added the most of their market capitalization.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

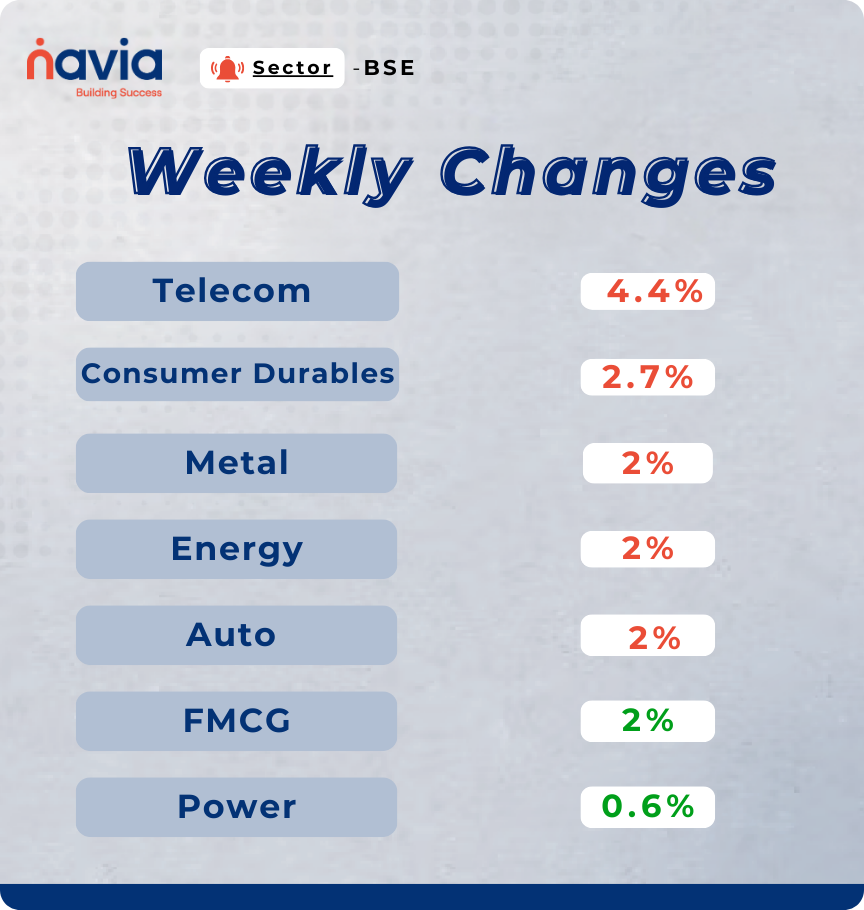

Sector Spotlight

On the sectoral front, the BSE Telecom index shed 4.4 percent, BSE Consumer Durables shed 2.7 percent, BSE Metal, Energy, Auto down 2 percent each. However, BSE FMCG index added 2 percent, while Power index rose 0.6 percent.

Top Gainers and Losers

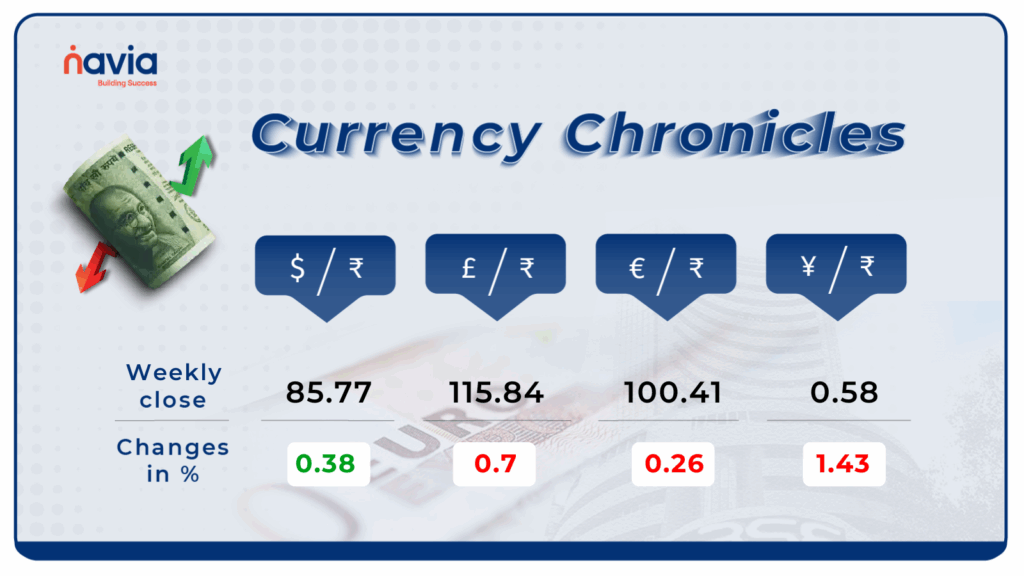

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹85.77 per dollar, gaining 0.38% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹100.41 per euro, losing 0.26% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, losing 1.43% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

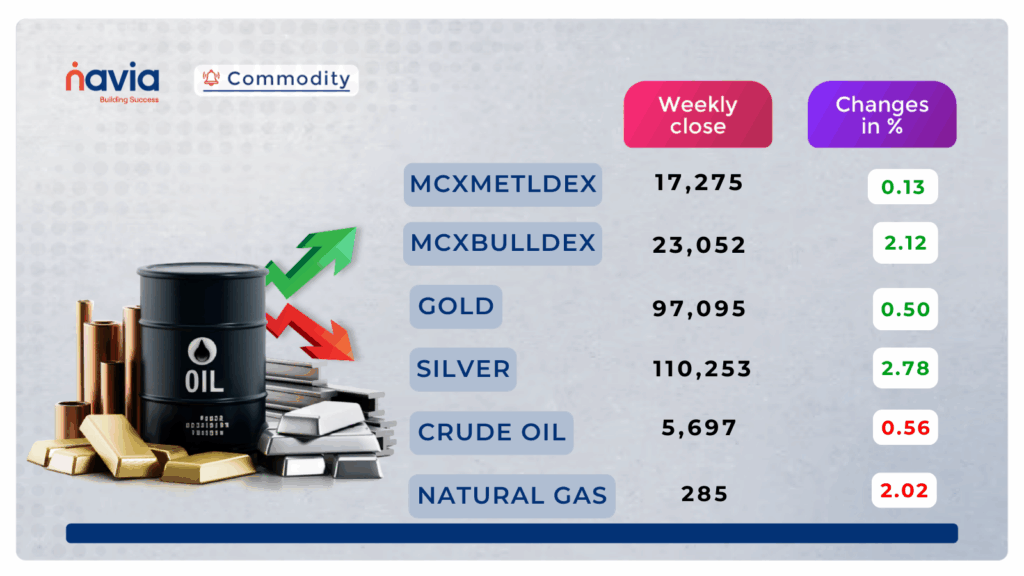

Commodity Corner

Crude Oil is currently trading in an Ascending Channel in 45 minute chart. In the last session, it closed at 5697. Crude oil sustaining above ₹5,800 could indicate strength, while a breakdown below ₹5,690 may trigger further selling pressure. Further intraday upside momentum is likely above 5740 while a breakdown below 5690 could trigger additional selling pressure.

In the last session, Gold closed at 97095. Gold broke out of a descending channel on the 45-minute chart. Sustaining above ₹98,000 could support further upside, while a dip below ₹96,000 may trigger fresh downside pressure. For intraday traders, a move above 96600 may indicate upside potential, while a dip below 96000 could trigger further downside pressure.

Natural Gas is currently trading in an Descending channel showing a downtrend. The last session closed at 285. Another intraday move is likely above 287.5. However, a close below 283 could signal further downside in prices. Sustaining above 330 on a broader timeframe could lead to short-term bullishness in Natural Gas

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

How Pro Traders Use Put-Call Ratio (PCR) Charts to Time Their Option Trades

This content explains how professional traders utilize Put-Call Ratio (PCR) charts to time their option trades. It defines PCR, details how to chart its values, and provides insights into interpreting extreme zones, divergences, and trend shifts for market reversals. The article emphasizes using PCR as a sentiment gauge in conjunction with other technical analysis for informed trading decisions.

SEBI’s Latest Guidelines on F&O Trading – What Retail Traders Should Know!

SEBI’s latest regulations for Futures & Options (F&O) trading, designed to enhance market stability and protect retail investors. It covers key changes like the shift to Future Equivalent Open Interest, updated MWPL calculations, new position limits for individuals and indices, and real-time monitoring. The article explains how these reforms aim to curb excessive speculation and foster a more transparent derivatives market.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER:Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.