Navia Weekly Roundup (Jan 27 – 30, 2026)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Indian markets erased part of the previous week’s losses to close about 1% higher ahead of the Union Budget. The week remained volatile, driven by sustained FII outflows, DII support, delays in the India–US trade deal, rising geopolitical tensions, mixed corporate earnings, a weakening rupee, and a cautious outlook from the US Federal Reserve after it kept interest rates unchanged.

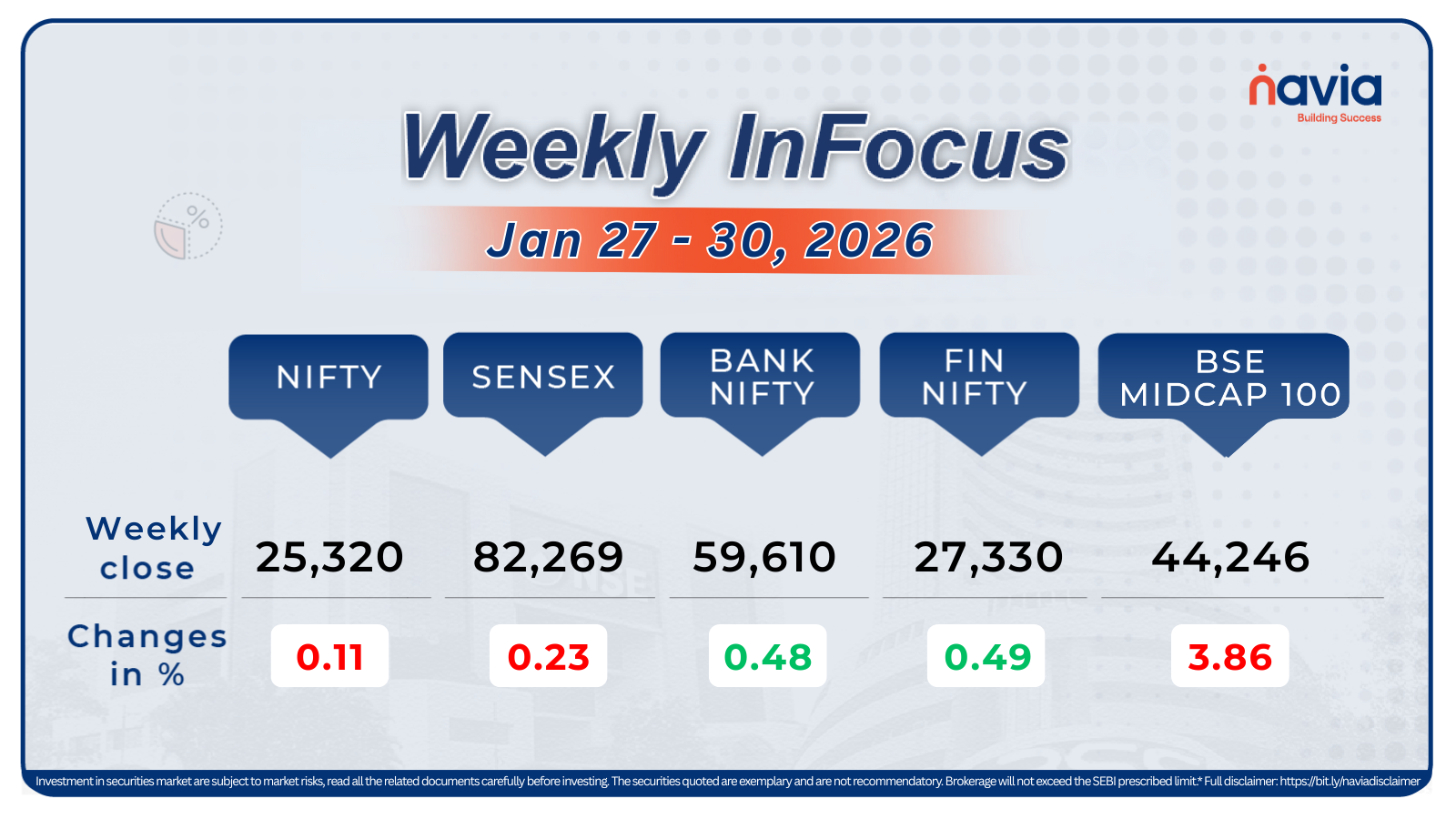

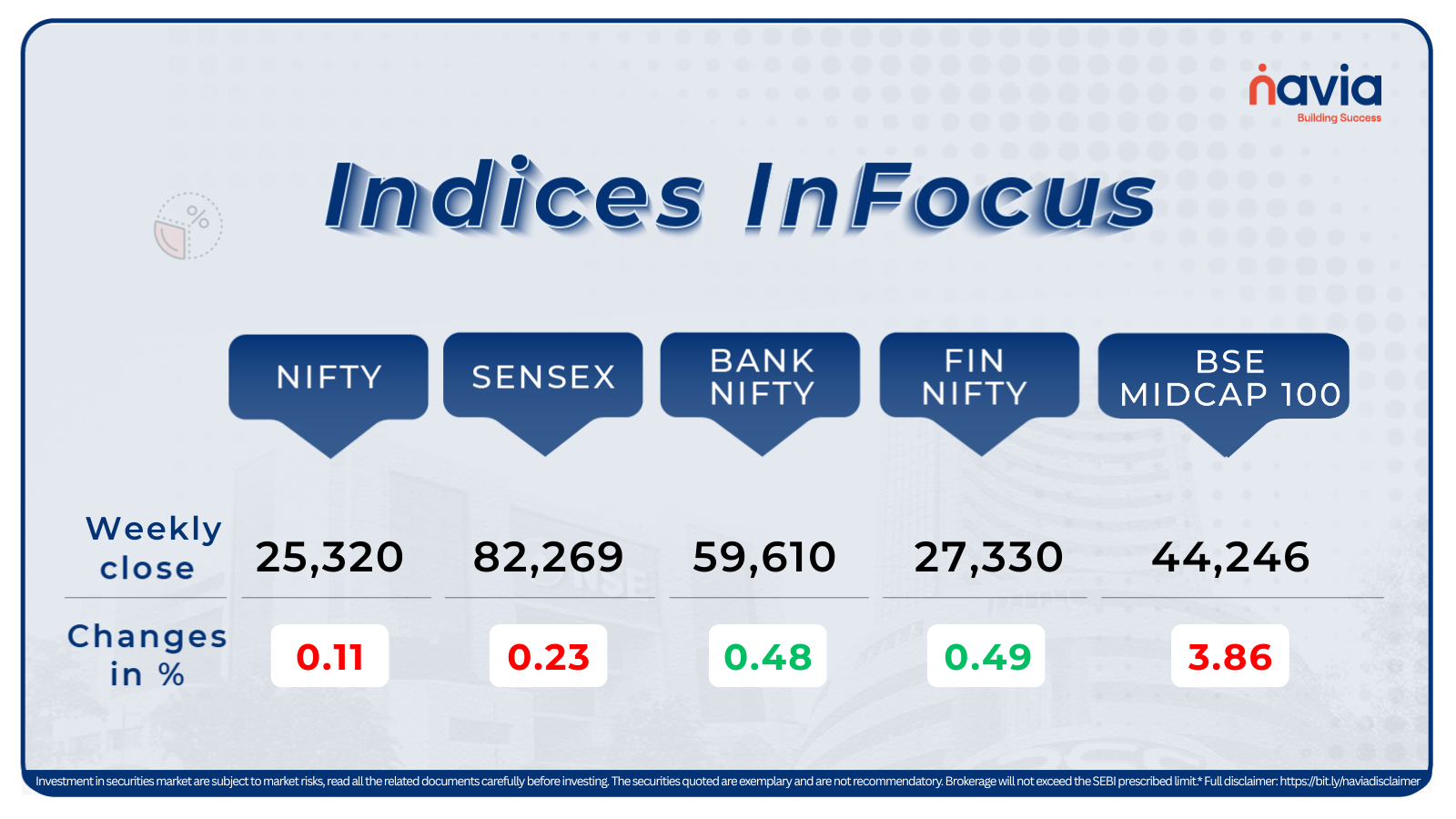

Indices Analysis

The BSE Sensex lose 0.23%, to close at 82,269.78, while the Nifty50 fall 0.11%, to settle at 25,320.65.

The BSE Large-cap index gained 1.3 percent, driven by strong rallies in ABB India, Siemens Energy India, Vodafone Idea, Mazagon Dock Shipbuilders, and Adani Green Energy, which rose between 10 and 18 percent. However, Asian Paints, Hindustan Zinc, Berger Paints India, Godrej Consumer Products, and Maruti Suzuki India were among the laggards.

The Nifty Mid-cap index rose 2 percent, led by gains in GE Vernova TD India, Oil India, Hitachi Energy India, Aegis Vopak Terminals, Cochin Shipyard, Gillette India, Jindal Stainless, Star Health & Allied Insurance Company, and Relaxo Footwears. On the other hand, key losers included KPIT Technologies, Inventurus Knowledge Solutions, Laurus Labs, Bharti Hexacom, Balkrishna Industries, and Emami.

The BSE Small-cap index jumped 3 percent, led by sharp gains in Sharda Cropchem, Hindustan Copper, MIC Electronics, SPEL Semiconductor, Panorama Studios International, JITF Infralogistics, Mahindra Logistics, Moschip Technologies, Walchandnagar Industries, Garden Reach Shipbuilders & Engineers, Manorama Industries, MTAR Technologies, Data Patterns (India), Punjab Chemicals & Crop Protection, Sterlite Technologies, and Taneja Aerospace and Aviation, all of which surged more than 20 percent each. Meanwhile, Vimta Labs, Sri Adhikari Brothers Television, OneSource Specialty Pharma, IFB Industries, South Indian Bank, SBFC Finance, and Best Agrolife declined over 15 percent.

Foreign Institutional Investors (FIIs) turned buyers on Friday, purchasing equities worth Rs 2,251 crore. However, they remained net sellers for the week, having offloaded shares worth Rs 730 crore. Meanwhile, Domestic Institutional Investors (DIIs) continued their support, buying equities worth Rs 14,398.03 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

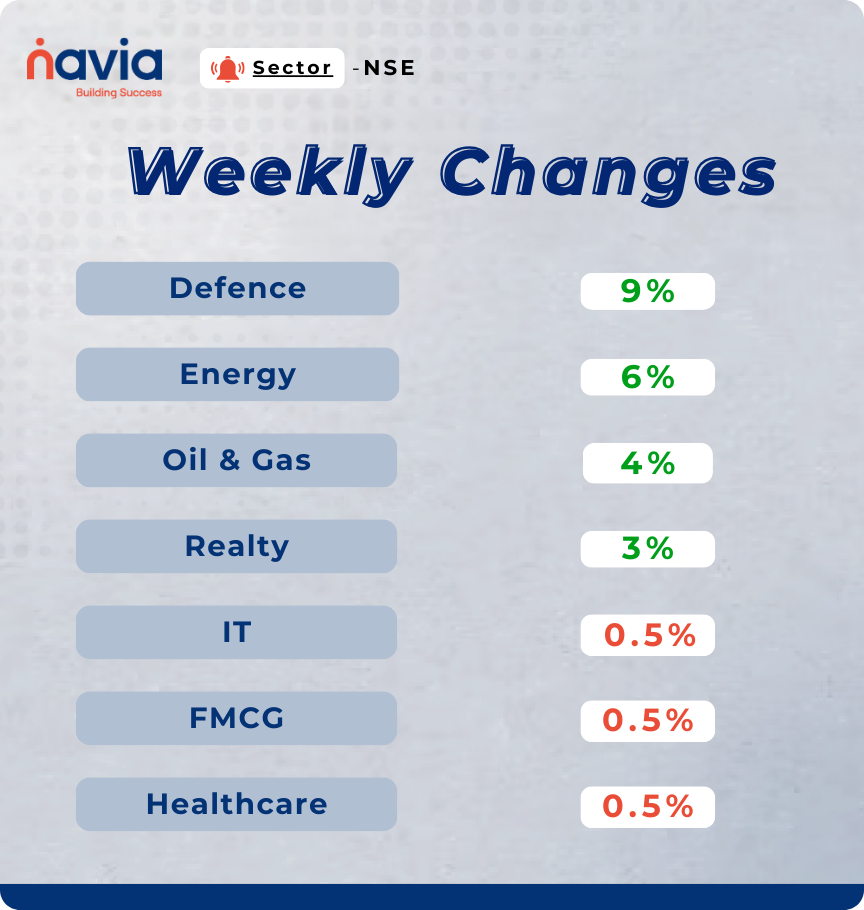

Sector Spotlight

Among sectors, the Nifty Defence index outperformed with a nearly 9 percent gain, followed by Nifty Energy, which rose 6 percent. The Nifty Oil & Gas index added 4 percent, while the Nifty Realty climbed 3 percent each. On the other hand, the Nifty IT, FMCG, and Healthcare indices declined by 0.5 percent each.

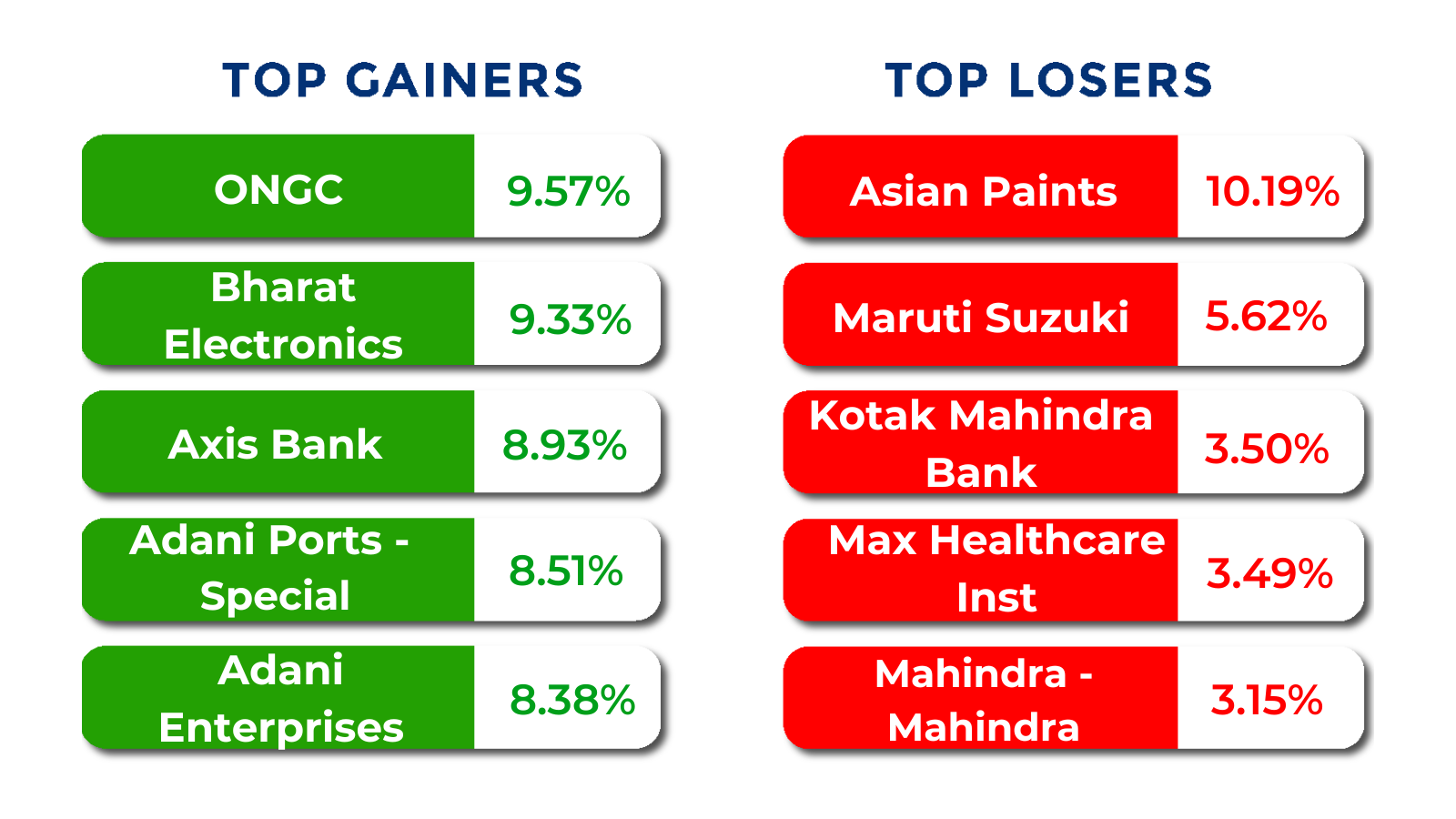

Top Gainers and Losers

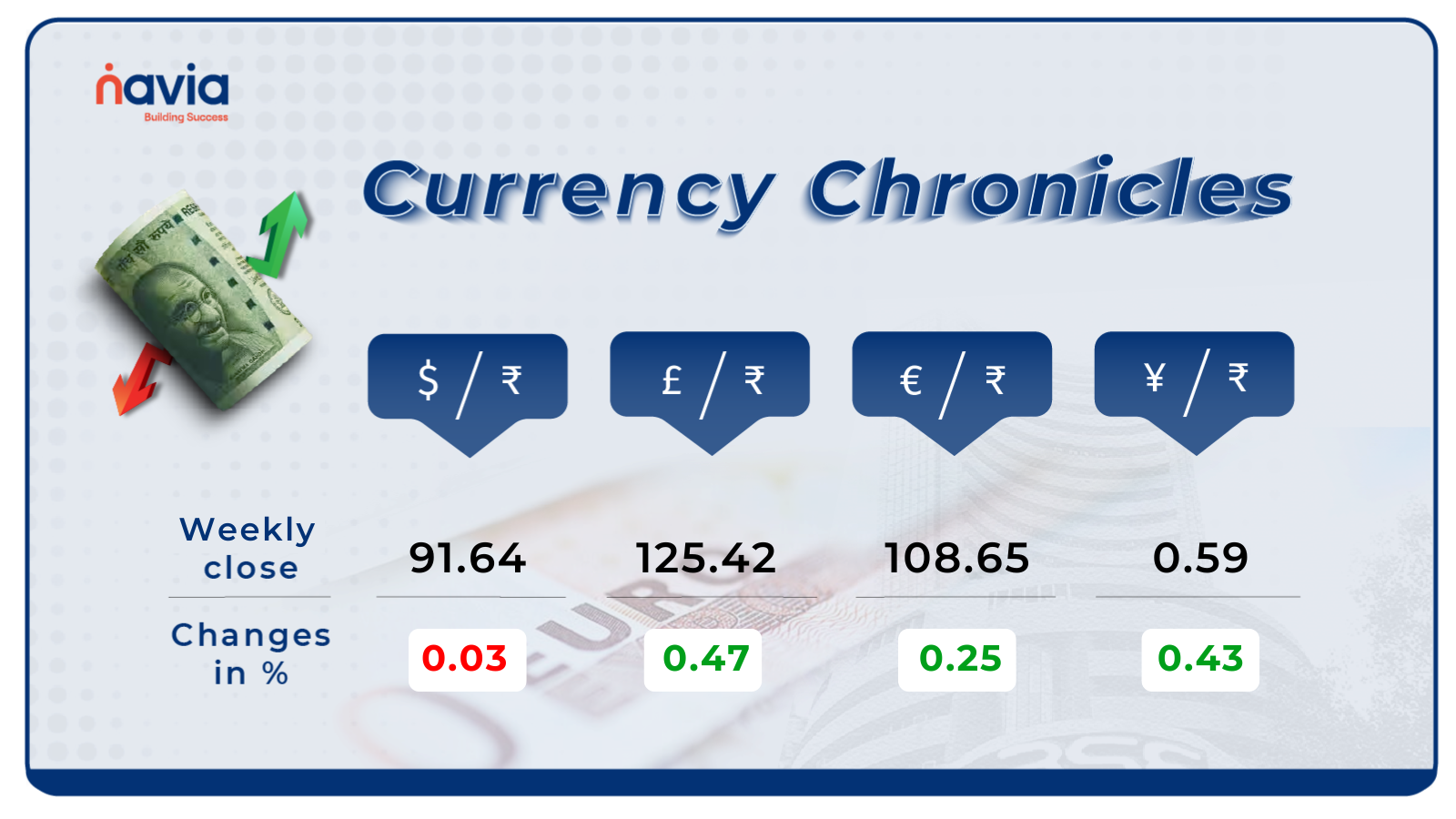

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹91.64 per dollar, losing 0.03% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹108.65 per euro, gaining 0.25% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining 0.43% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

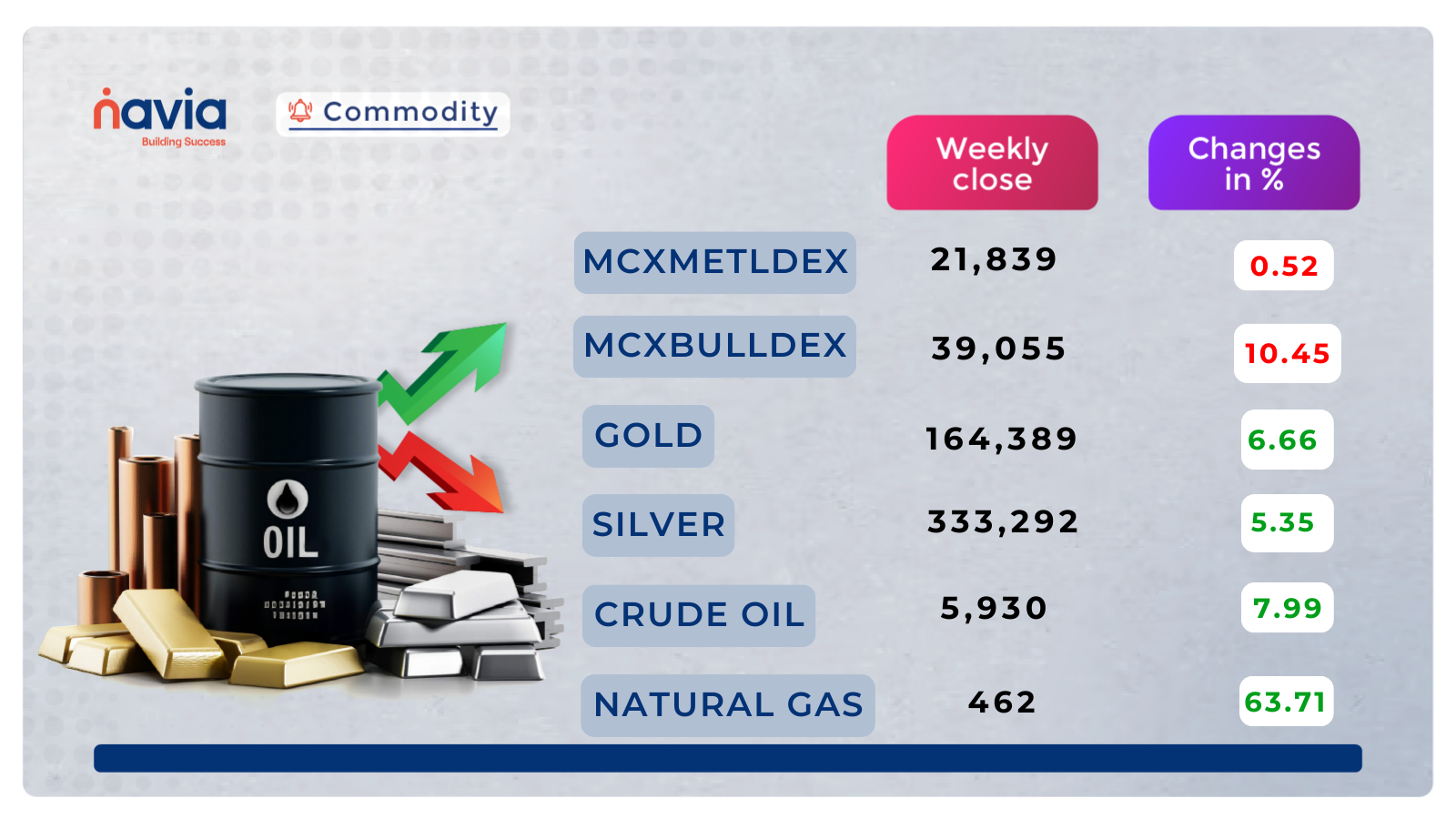

Commodity Corner

Crude Oil Futures are trading in a strong bullish continuation structure, having decisively broken out from the prior falling channel and established a steep rising channel on the upside. Price has cleared multiple overhead resistances, with 5602 and 5890 now acting as key demand zones after successful retests. The impulsive move toward the 6000–6060 region confirms strong buyer dominance and momentum-driven price action rather than short covering. The current consolidation near 6000–6020 suggests healthy absorption of supply at higher levels. As long as Crude Oil holds above 5890, the broader trend remains firmly bullish. A sustained acceptance above 6060 would open the door for an extension toward 6200–6300. Only a breakdown below 5602 would weaken the bullish structure and shift the bias back to range-to-bearish.

Gold Futures witnessed a strong impulsive breakout followed by high-volatility rejection from the 175,800–176,000 supply zone, indicating aggressive profit booking at higher levels. Despite the sharp pullback candle, price has recovered and is holding above the key breakout base at 159,400–160,000, which confirms structural strength. The broader trend remains bullish, supported by higher highs and higher lows, but the recent long upper wicks near 175,800 signal supply pressure and exhaustion at the top. As long as price sustains above 159,400, dips are likely to be bought. A decisive acceptance above 166,400 would reopen upside momentum, whereas a failure below 151,960 would indicate deeper corrective retracement toward the lower demand zones.

Natural Gas Futures are currently in a post-impulsive consolidation phase after a sharp vertical rally from the 280–300 demand zone toward the 600–620 supply region. The price faced strong rejection near 618.7, followed by a corrective pullback toward 352–360, indicating profit booking after an exhaustion move. Structurally, the prior downtrend has been decisively broken, but the market is now transitioning into a range-bound digestion phase between 313.3 and 420. The zone around 352–360 is acting as an immediate pivot, where buyers and sellers are evenly matched. As long as price holds above 313.3, the broader structure remains bullish on a higher timeframe. A sustained hold above 420 would signal trend continuation, while failure below 313.3 would expose deeper retracement toward 280.4. Volatility remains elevated, so directional confirmation is essential before fresh positional trades.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

SilverBees ETF: A Sparkling Investment Prospect

The Nippon India Silver ETF (SILVERBEES) has emerged as a powerhouse in the commodities market of 2026. As silver transitions from a mere “precious metal” to a critical “industrial tech metal,” this ETF provides investors with a high-liquidity, low-cost gateway to benefit from the soaring global demand.

Navigating the Shift: A Comprehensive Guide to SEBI PMS Regulatory Changes in 2026

The investment landscape in India has witnessed a massive transformation. As Portfolio Management Services (PMS) become the preferred choice for High Net-worth Individuals (HNIs), SEBI has introduced stringent updates to ensure transparency and wealth protection.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.