Navia Weekly Roundup ( Jan 20 – Jan 24, 2025)

Week in the Review

The Indian equity indices lost further ground in the volatile week ended January 24 as investors remained cautious ahead of Trump policies, persistent FII outflow, mixed Q3 earnings, and global markets. However, market got some support from rupee appreciation and falling crude oil prices.

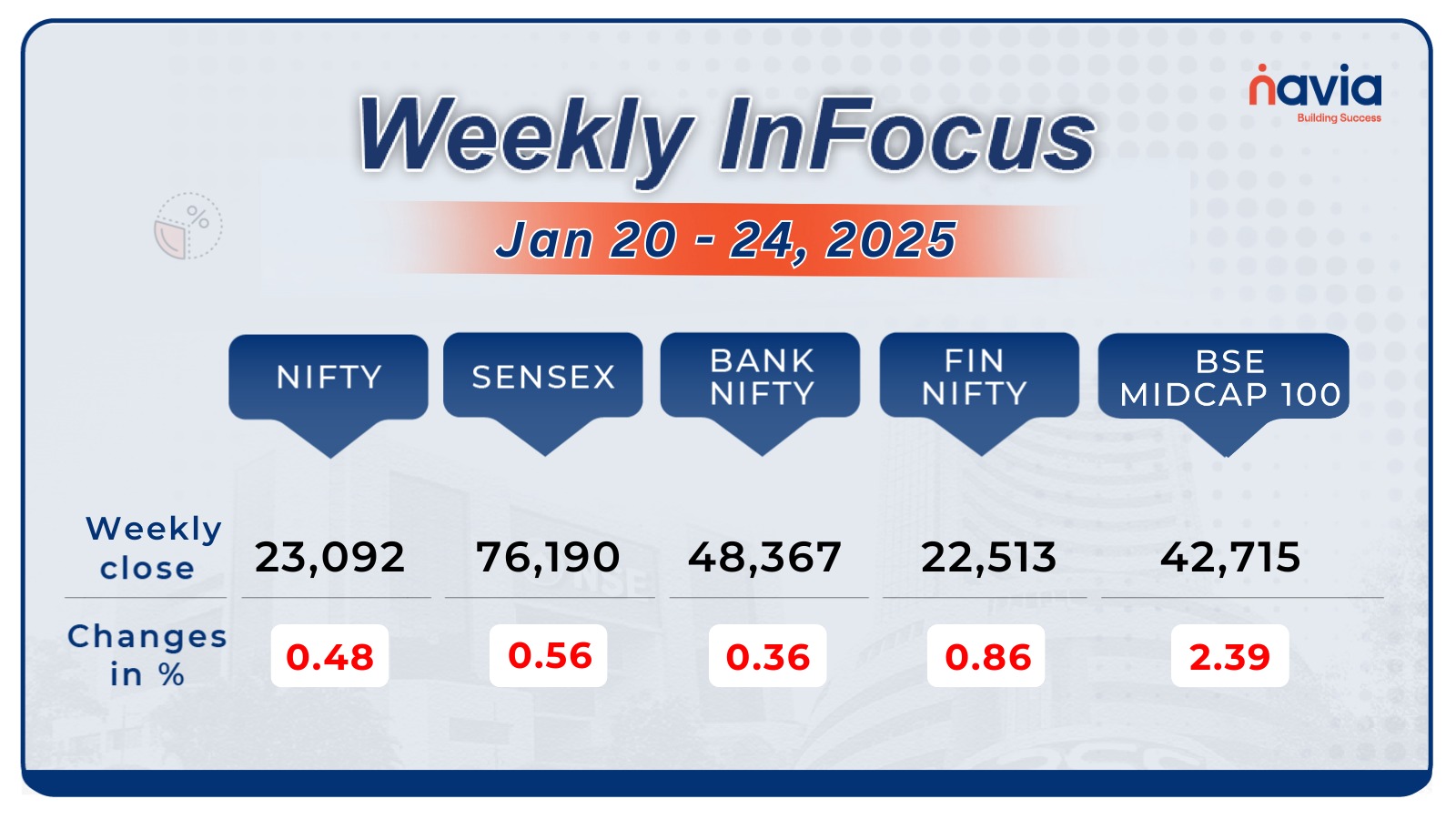

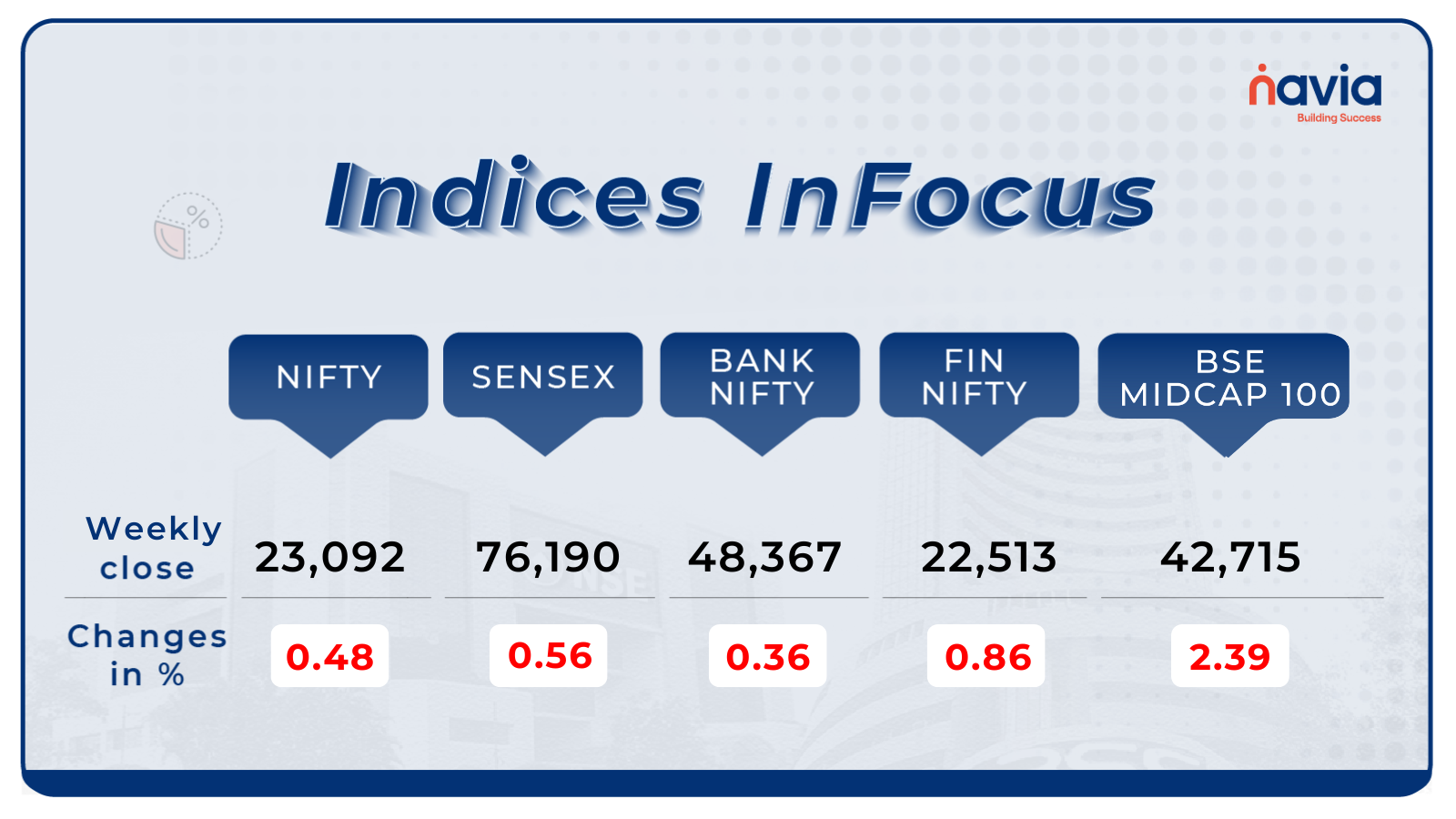

Indices Analysis

This week, BSE Sensex shed 428.87 points or 0.56 percent to end at 76,190.46, while the Nifty50 index fell 111 points or 0.48 percent to close at 23,092.20.

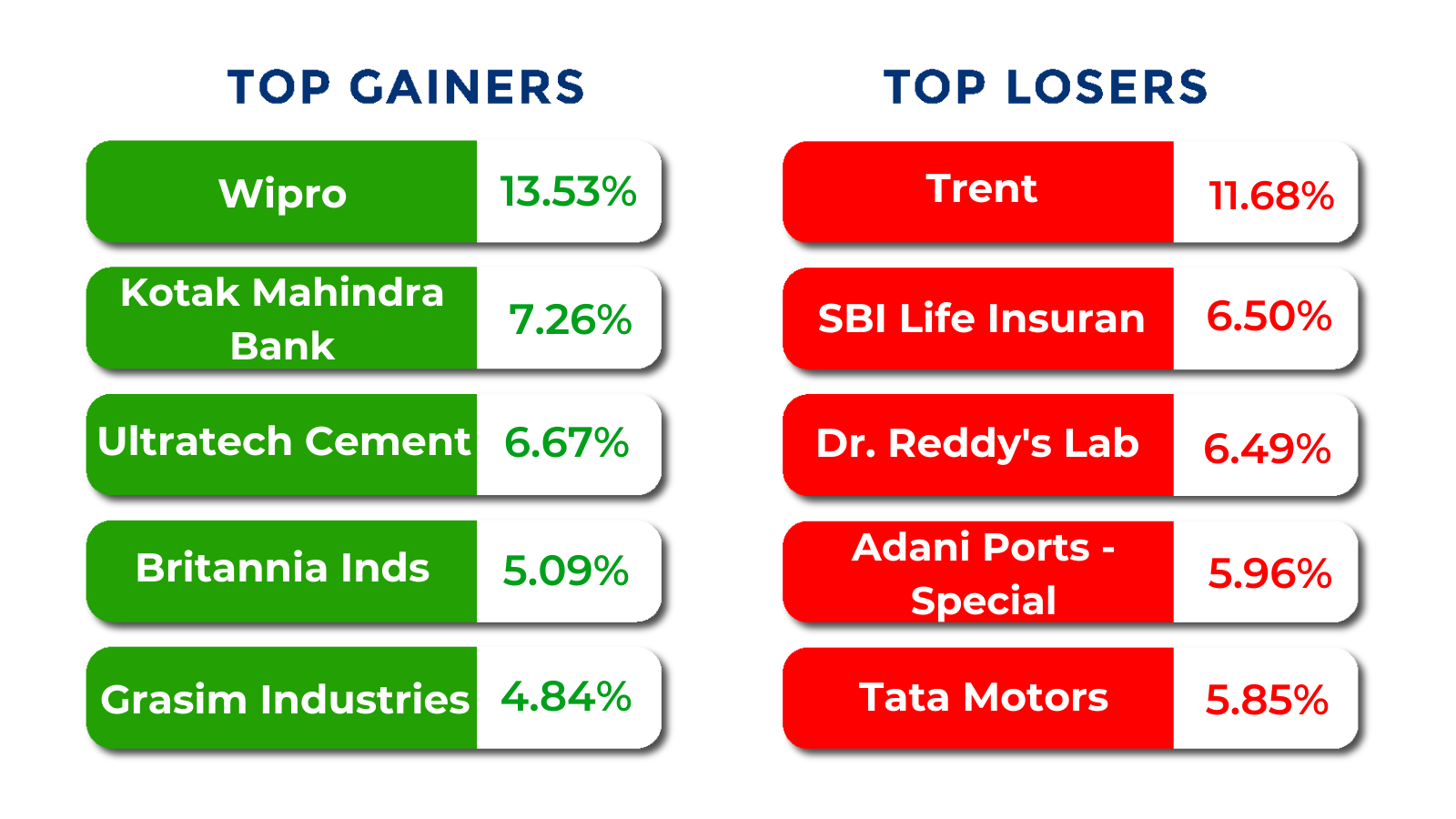

The BSE Large-cap Index declined 1 percent with Zomato, Polycab India, Jio Financial Services, Trent, IDBI Bank, ICICI Prudential Life Insurance Company down 8-13 percent. However, Wipro, Kotak Mahindra Bank, UltraTech Cement, Britannia Industries, Grasim Industries, Bajaj Holdings & Investment gained between 4-13 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

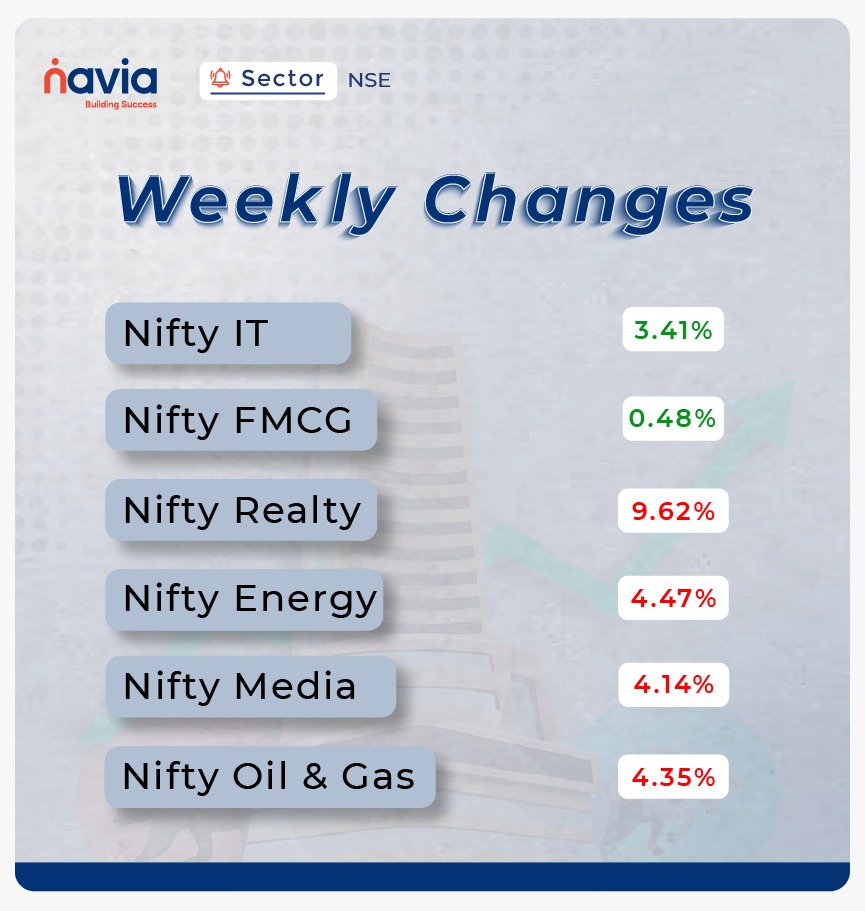

Sector Spotlight

Among sectors, Nifty Information Technology index added 3.5 percent and Nifty FMCG index added 0.5 percent. However, Nifty Realty index declined 9 percent, Nifty Energy index down 4.7 percent, Nifty Media and Oil & Gas down nearly 4.5 percent each.

Top Gainers and Losers

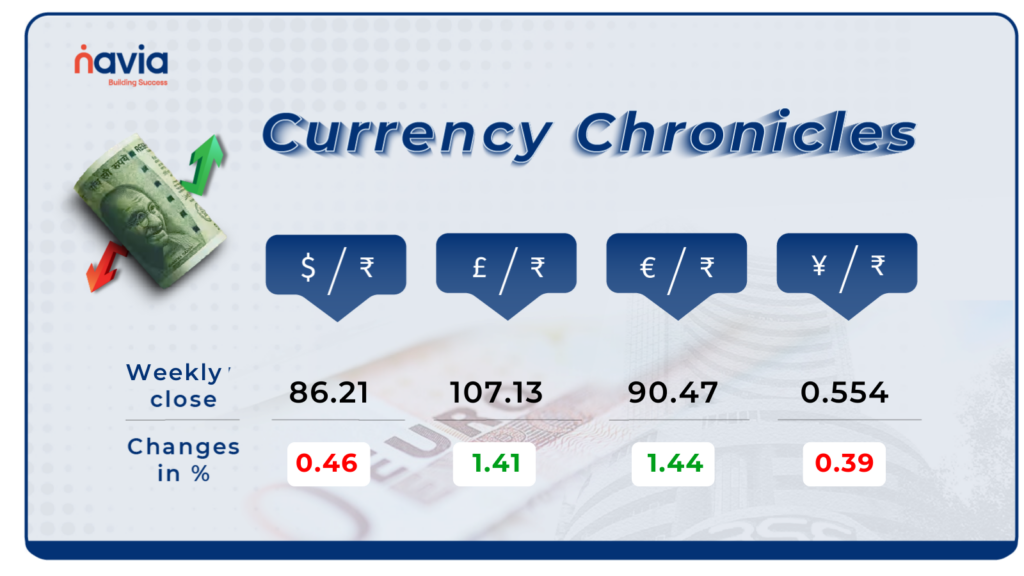

Currency Chronicles

USD/INR:

The Indian rupee ended the week on a stronger note against the US dollar, marking its best weekly performance in the past 17 months. It appreciated by 0.5% (41 paise) to close at 86.20 per dollar on January 24, compared to its January 17 closing of 86.61.

EUR/INR:

The euro ended the week on a stronger note, marking a significant gain of 1.44%. It appreciated to close at ₹90.4727 on January 24, compared to its January 17 closing.

JPY/INR:

The Japanese yen ended the week lower, declining by 0.39% to close at ₹0.554. Sentiment in the JPY/INR market remains cautious, reflecting slight pressure on the yen.

Stay tuned for more currency insights next week!

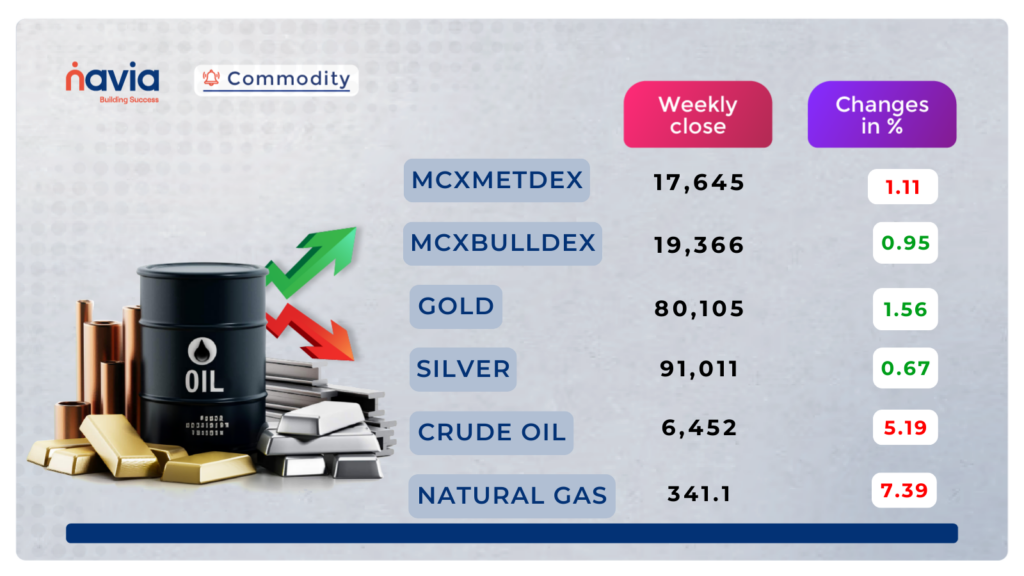

Commodity Corner

Crude oil prices closed at 6,452, down by 77 points, and are currently trading within an ascending broadening wedge pattern. Upside momentum can be expected above 6,588, while downside momentum may occur below 6,410. Crude oil might also find support in the 6,410–6,420 range, as shown in the chart, aligning with the support level of a descending channel.

Recent comments from the U.S. President urging OPEC to lower oil prices and increased crude supply expectations have pressured prices. Additionally, a decline in U.S. crude inventories has provided some support, balancing the downward pressure. These developments add to the market’s volatility, influencing crude oil’s short-term movement.

Gold is currently trading within an ascending channel on the 4-hour chart, closing the last session at 80,105 up by 62 points. The metal could encounter trendline resistance in the 79,650–79,800 zone. A decisive breakout above this range may lead to higher levels, while a drop below 79,000 would signal bearish momentum.

Trading at an 11-week high, gold’s movement is influenced by a weaker US dollar and declining Treasury yields, which could impact investor sentiment.

Natural gas is trading within an ascending broadening wedge pattern on the 4-hour chart. In the last session, it closed 2.5 points higher at 341.1. A momentum move is expected either above 344.5 or below 336. The trendline resistance is positioned between 385 and 388, while the trendline support lies between 319 and 321. Natural gas may encounter significant resistance and support within these levels.

Silver has formed a descending channel on the 4-hour chart, as indicated. The last session closed at 91,011, down by 795 points. Silver is currently finding support in the 90,900–91,300 range within the rising channel. A breakdown below this level could trigger an intraday decline, while a breakout above 91550 may present a buying opportunity. The resistance of the descending channel lies in the 93,150–93,550 range.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

2024 IPO Performance: A Year of Growth and Gains

Explore how 2024 became a standout year for Mainboard IPOs in India, with an impressive 80% win rate and 93 listings showcasing robust investor enthusiasm. Dive into detailed stats, top performers, and monthly trends!

SIP Growth in India: A Journey of Wealth Creation

Discover how SIPs have transformed investing in India with record-breaking inflows, robust returns, and unmatched wealth creation over the years. Dive in to explore trends, strategies, and insights for maximizing your SIP investments!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?