Navia Weekly Roundup (Jan 19 – 23 2026)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Indian equity indices remained under pressure throughout the week despite easing trade tensions between the US and Europe. A weaker rupee, sustained FII outflows, delays in the India–US trade deal, and weaker-than-expected Q3 earnings so far continued to weigh on market sentiment.

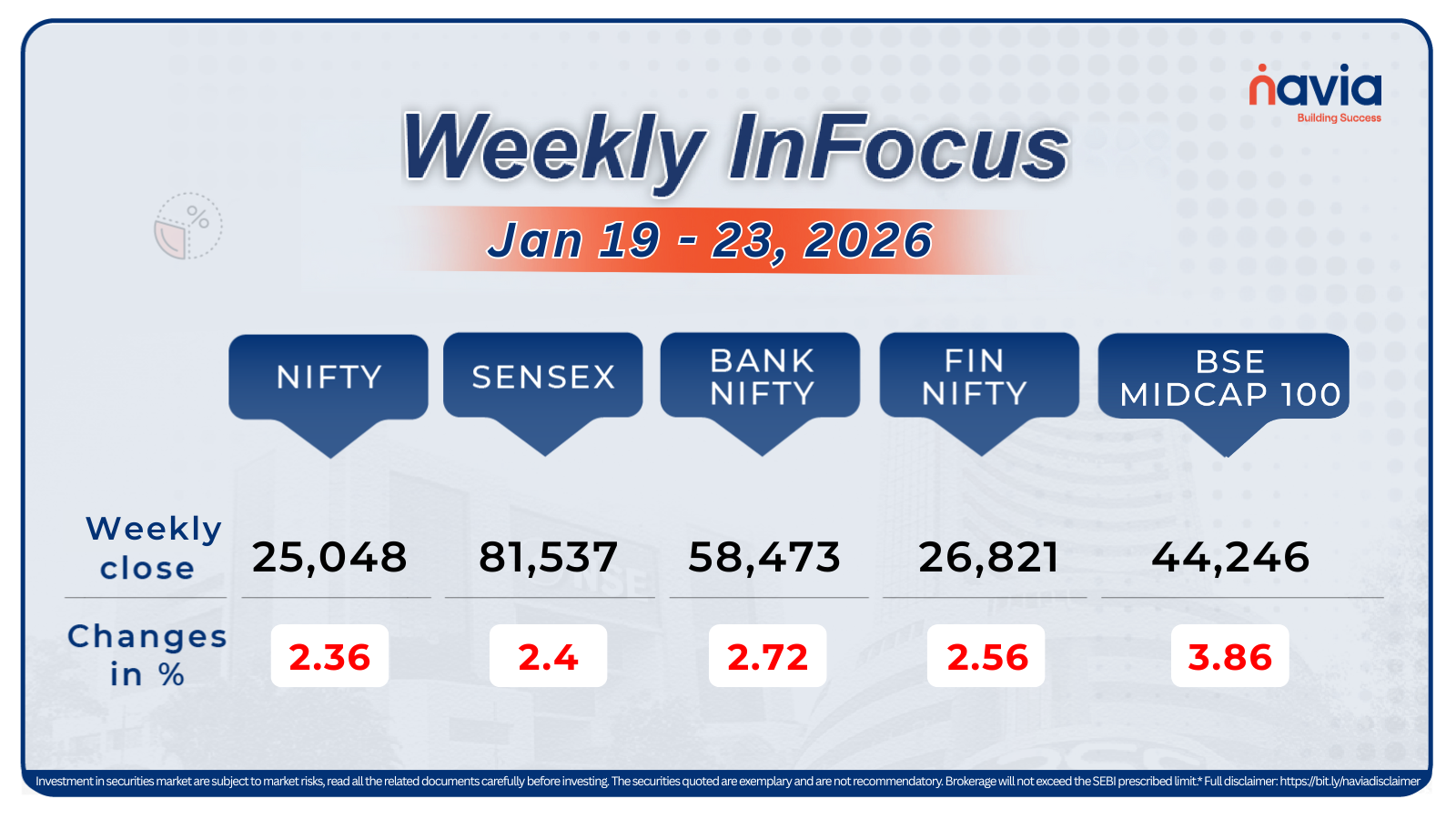

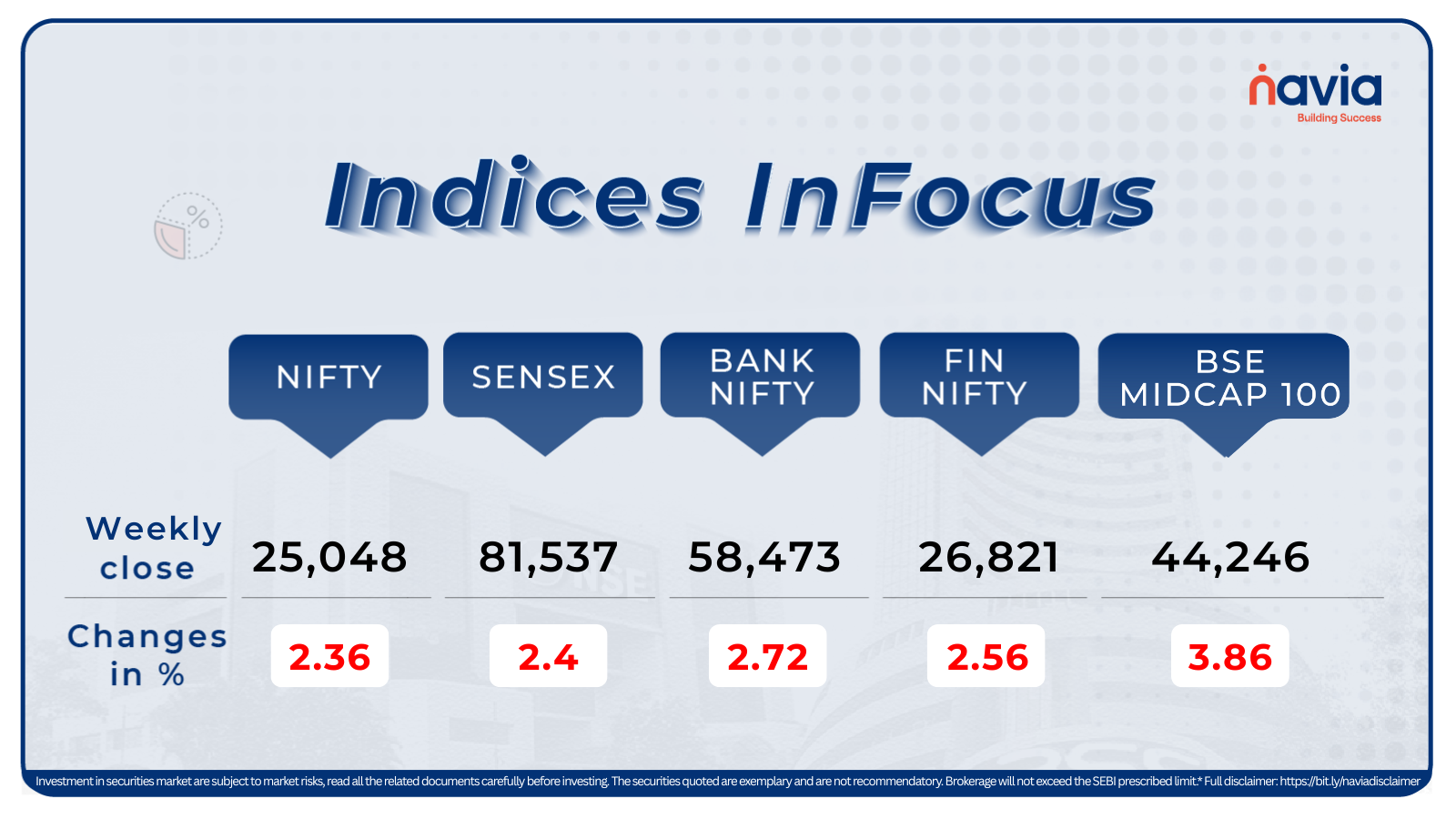

Indices Analysis

The BSE Sensex declined 2.4 percent, to close at 81,537.70, while the Nifty50 shed 2.36 percent, to end at 25,048.65.

The BSE Large-cap index fell 2.8 percent dragged by Adani Green Energy, Lodha Developers, Adani Enterprises, Wipro, Adani Energy Solutions, SRF, Eternal.

The BSE Mid-cap index plunged 4.2 percent with Kalyan Jewellers India, Godrej Properties, One 97 Communications (Paytm), Ola Electric Mobility, KEI Industries, Oberoi Realty, Motilal Oswal Financial Services, UPL, Tata Communications, Yes Bank, Crompton Greaves Consumer Electrical falling between 10-21 percent. However, gainers included Ashok Leyland, PB Fintech, GE Vernova TD India, Bandhan Bank, APL Apollo Tubes, Sun TV Network, Federal Bank.

The BSE Small-cap index declined shed nearly 6 percent with Best Agrolife, Sudarshan Colorants India, Wardwizard Innovations and Mobility, Systematix Corporate Services, Ajmera Realty and Infra India, Sigachi Industries, Wanbury, OneSource Specialty Pharma, IIFL Finance, Jayaswal Neco Industries, Ramco System, Authum Investment & Infrastucture, Arisinfra Solutions, Bigbloc Construction falling between 17-25 percent, while gainers included Dhampur Bio Organics, Lotus Chocolate Company, Baazar Style Retail, Jindal Saw, Shanthi Gears, Mercury Ev-Tech.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 14,651.99 crore during the period, while Domestic Institutional Investors (DIIs) offset the selling with purchases worth Rs 20,746 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

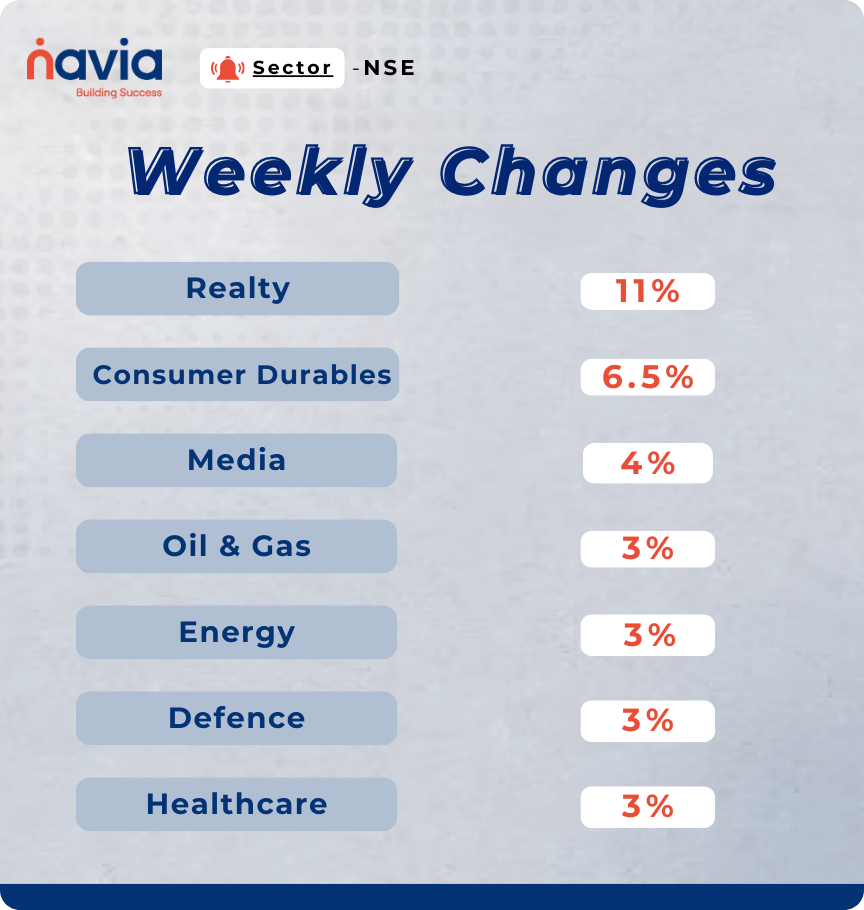

Sector Spotlight

All the sectoral indices gave negative return with Nifty Realty shed more than 11 percent, Nifty Consumer Durables index slipped 6.5 percent, Nifty Media plunged 4 percent, Nifty Oil & Gas, Energy, Defence, Healthcare fell 3 percent each.

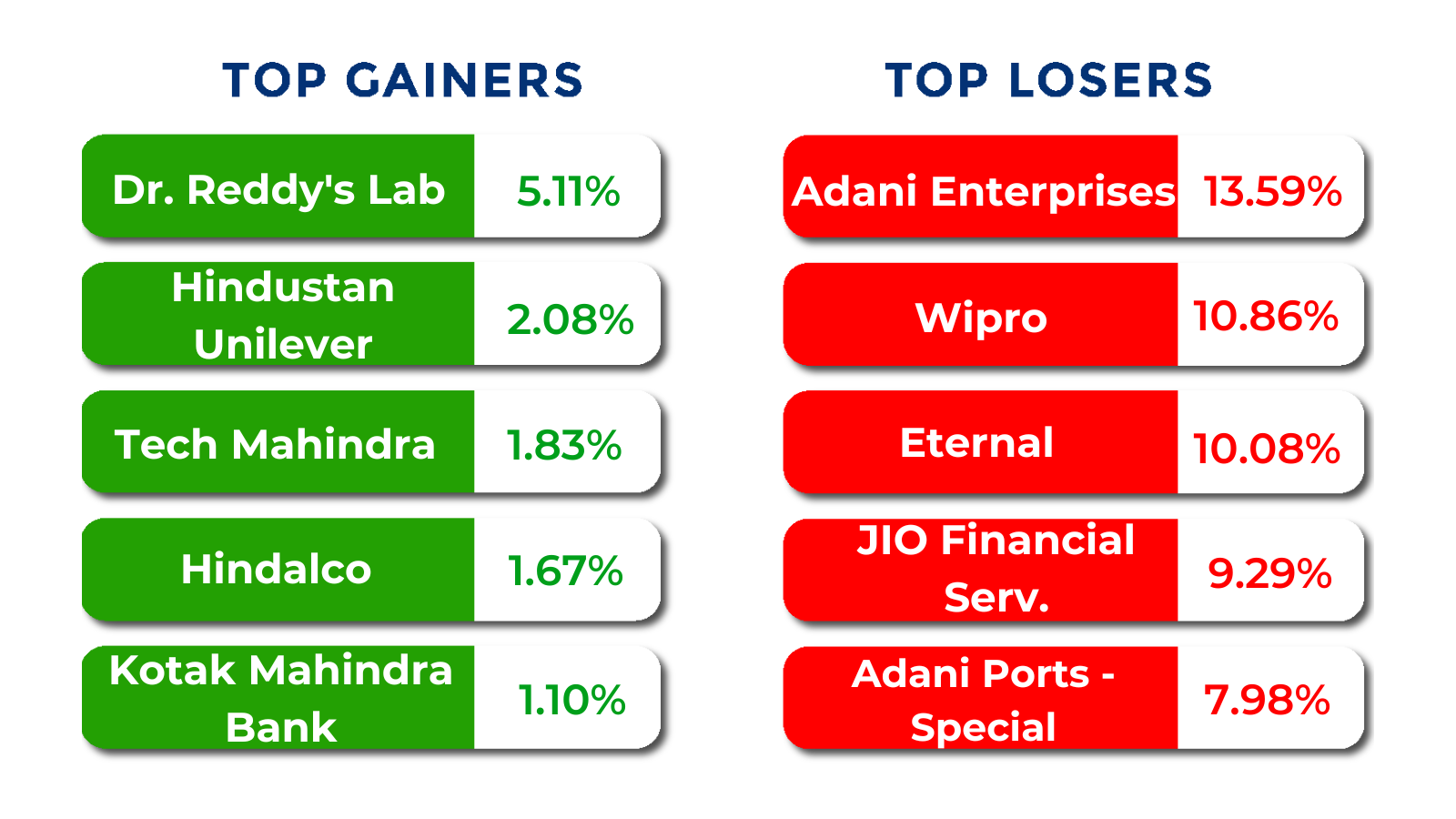

Top Gainers and Losers

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹91.63 per dollar, gaining 1.07% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹108.40 per euro, gaining 3.03% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, gaining 2.3% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

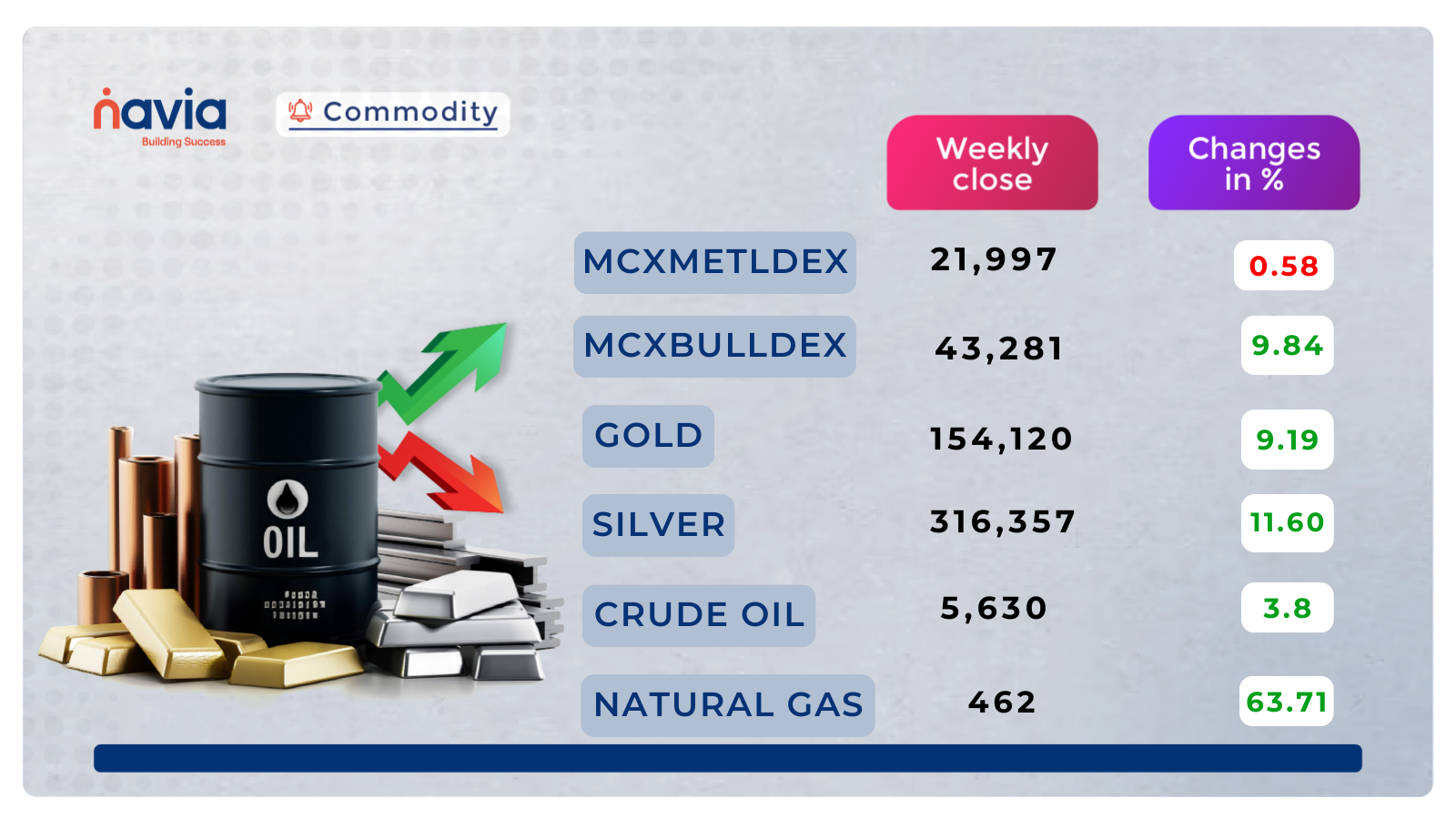

Commodity Corner

Crude Oil Futures remain in a broader bullish structure, but the near-term momentum has shifted to corrective-to-range-bound after facing strong rejection near the 5,600–5,620 supply zone. Price failed to sustain above 5,600, leading to profit booking and a pullback toward the 5,430–5,450 demand-conversion zone, which earlier acted as a breakout level. The overall structure still shows higher highs and higher lows, supported by the sharp rally from the 5,010–5,050 base, indicating that the broader trend has not reversed. However, the steep rising channel has been violated, suggesting short-term exhaustion. As long as Crude Oil holds above 5,300, the bullish structure remains intact and the current decline should be viewed as a healthy retracement. A sustained move below 5,300 would weaken the structure and open downside risk toward 5,120–5,050. On the upside, acceptance above 5,600 is required to resume the primary uptrend toward higher resistance levels.

Gold Futures remain in a strong bullish trend, respecting an ascending channel structure on the 4H timeframe. Price has delivered an impulsive breakout above the 1,52,000–1,53,000 supply zone, confirming continuation strength. The rally extended sharply toward 1,58,052, where profit booking emerged, indicating a major overhead resistance zone. Despite the rejection, price is holding firmly above the key breakout base at 1,51,960, which now acts as an immediate demand and trend validation level. The broader structure remains bullish as long as Gold sustains above 1,50,000–1,51,000, supported by the rising channel and higher-high–higher-low formation. Any consolidation between 1,52,000 and 1,56,000 should be treated as healthy, while a decisive breakout above 1,58,052 would open fresh upside momentum. Only a breakdown below 1,51,960 would indicate short-term exhaustion and a deeper corrective phase toward 1,48,000–1,46,500.

Natural Gas Futures have shifted into extreme volatility with a sharp bullish reversal, following a prolonged bearish phase from the 500–480 supply zone down to the 280–255 major demand base. Price formed a strong base near 280–285, from where an impulsive short-covering rally triggered a vertical move, breaking multiple resistance levels at 313, 340, 360, and 380 in quick succession. The recent candle shows a high-volume spike toward 510–520, followed by immediate rejection and profit booking, indicating supply pressure near the 500 psychological and historical resistance zone. Despite the rejection, the structure has shifted from bearish to short-term bullish, as price is now trading well above the prior breakdown range of 340–360, which should act as a key demand zone on pullbacks. As long as Natural Gas sustains above 380–360, the bullish bias remains intact, though volatility is expected to stay elevated. A sustained acceptance above 500 would open further upside, while a breakdown below 360 would signal exhaustion and a deeper corrective move.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Understanding NRI Investments: What is the Difference Between a PIS and a NON-PIS Account?

For Non-Resident Indians (NRIs) eyeing the Indian bull market of 2026, choosing the right account is the most critical step in ensuring regulatory compliance and capital mobility.

The Digital Revolution: How Technology is Redefining Modern Trading

The transition from chaotic trading pits to high-speed digital interfaces has turned the stock market into a high-tech frontier.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.