Navia Weekly Roundup ( Jan 13 – 17, 2025)

Week in the Review

The Indian equity market extended the profit booking in the second consecutive week led by continues FII selling, mixed global markets, further rupee depreciation and rising dollar and crude oil prices.

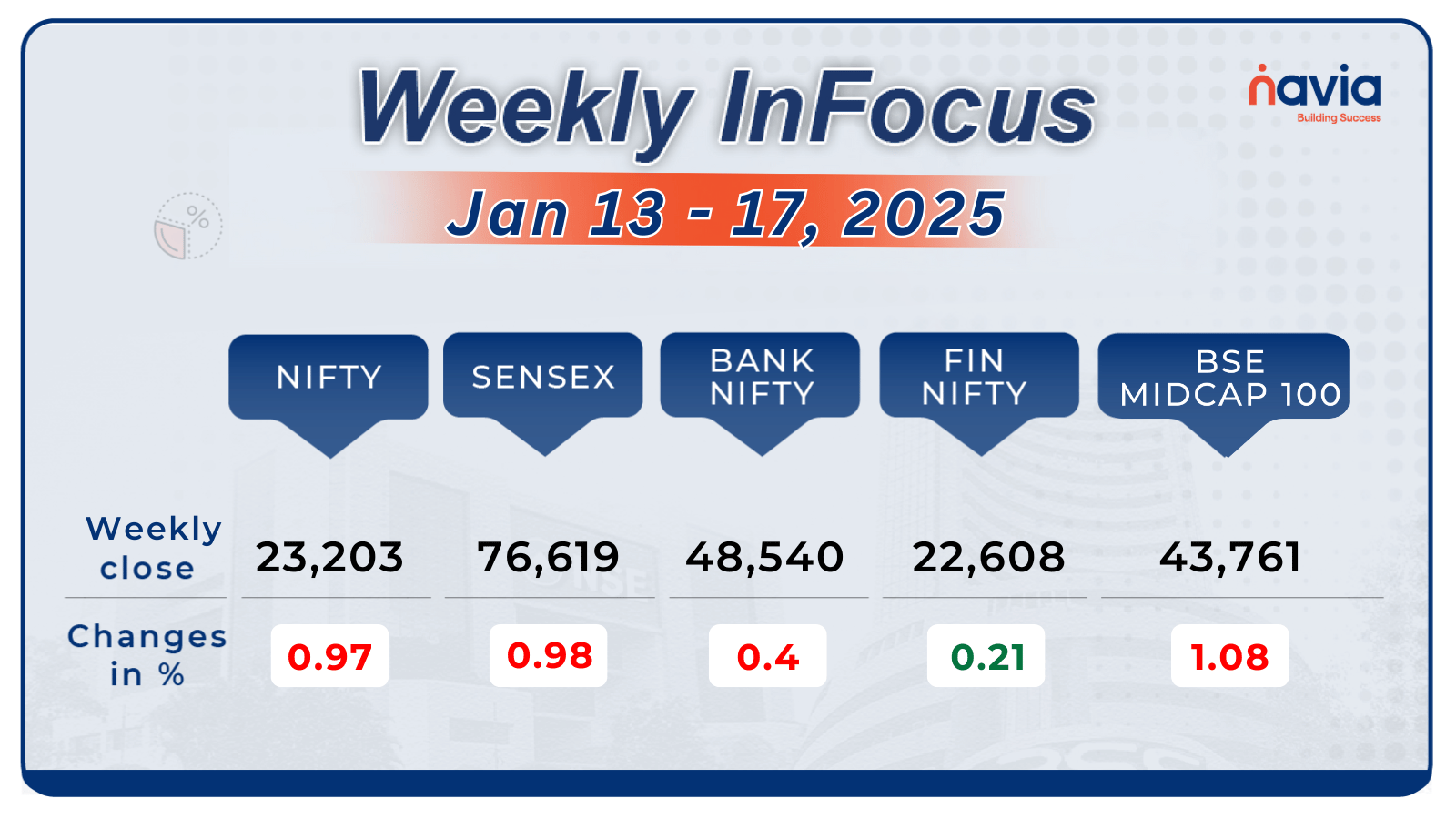

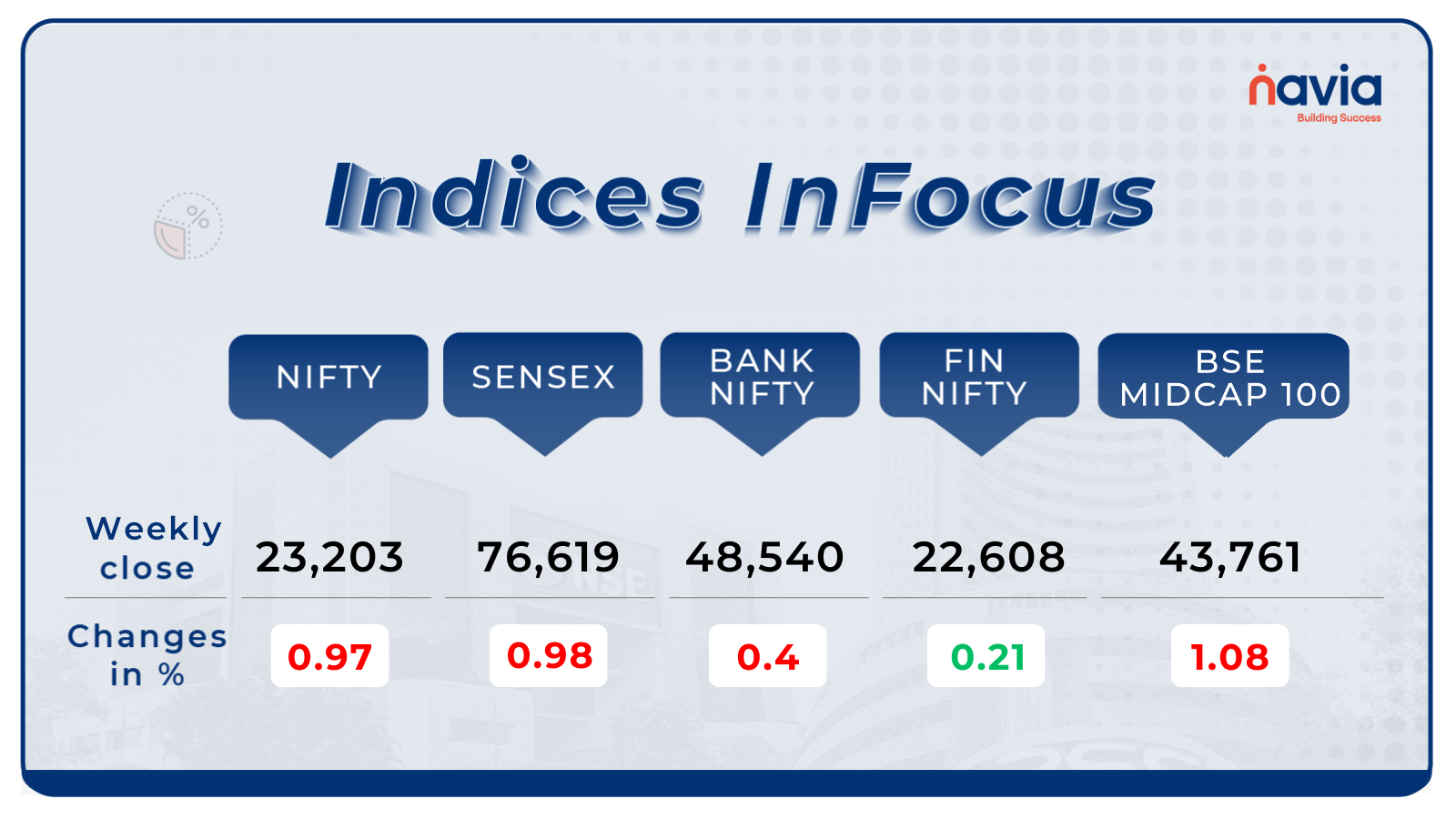

Indices Analysis

This week, BSE Sensex declined 759.58 points or 0.98 percent to finish at 76,619.33, while the Nifty50 index shed 228.3 points or 0.97 percent to end at 23,203.20.

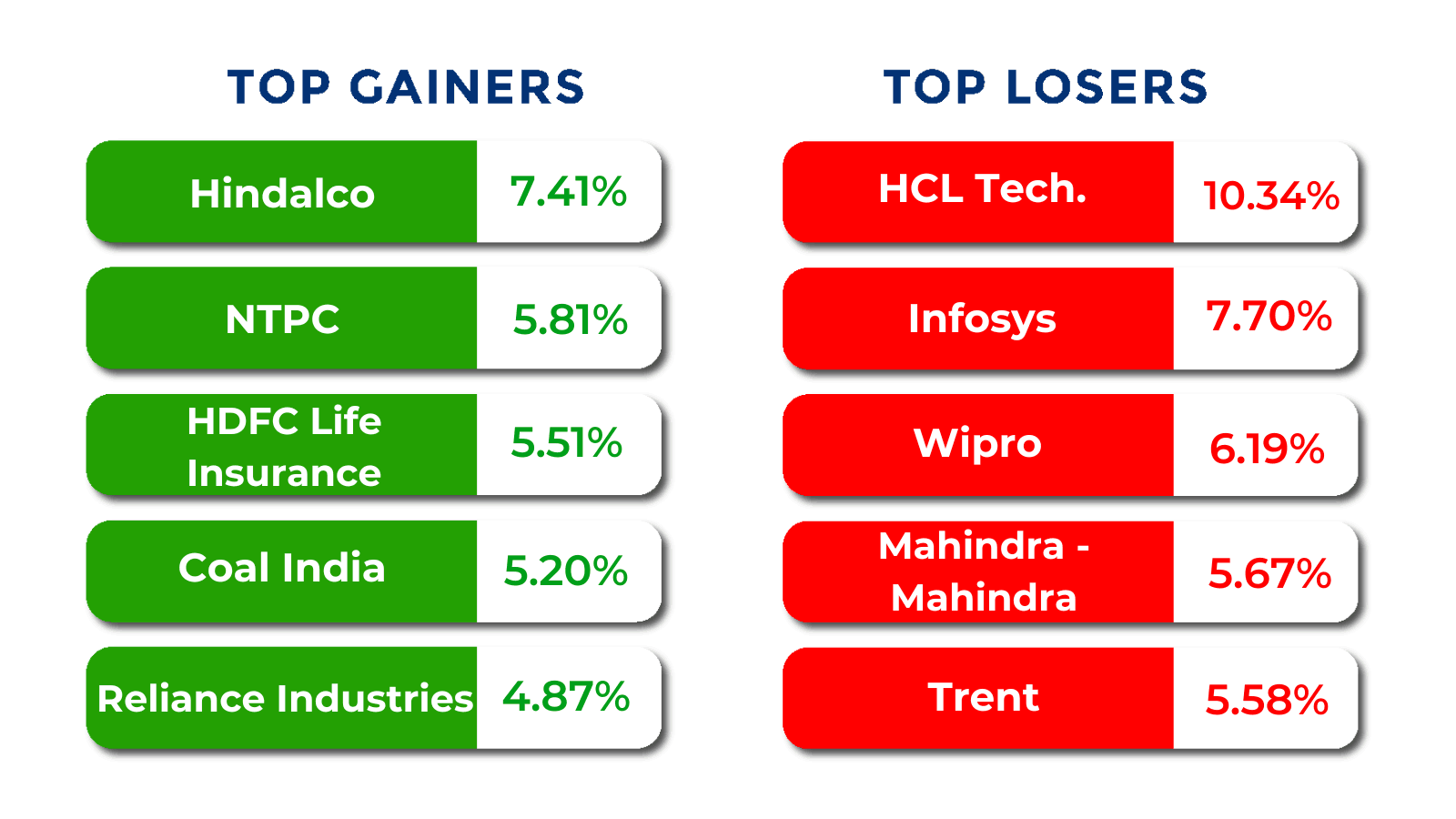

The BSE Large-cap Index fell 0.5 percent with HCL Technologies, Macrotech Developers, Infosys, United Spirits, Varun Beverages, Wipro, Mahindra and Mahindra, Trent falling 5-10 percent, while IDBI Bank, Adani Green Energy, Indus Towers, Adani Power, Adani Energy Solutions adding 10-21 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

Among sectors, Nifty Information Technology index shed nearly 6 percent, Nifty Realty down 1.23 percent, Nifty Healthcare, Media, FMCG indices fell nearly 2 percent each, while Nifty PSU Bank rose 4 percent.

Top Gainers and Losers

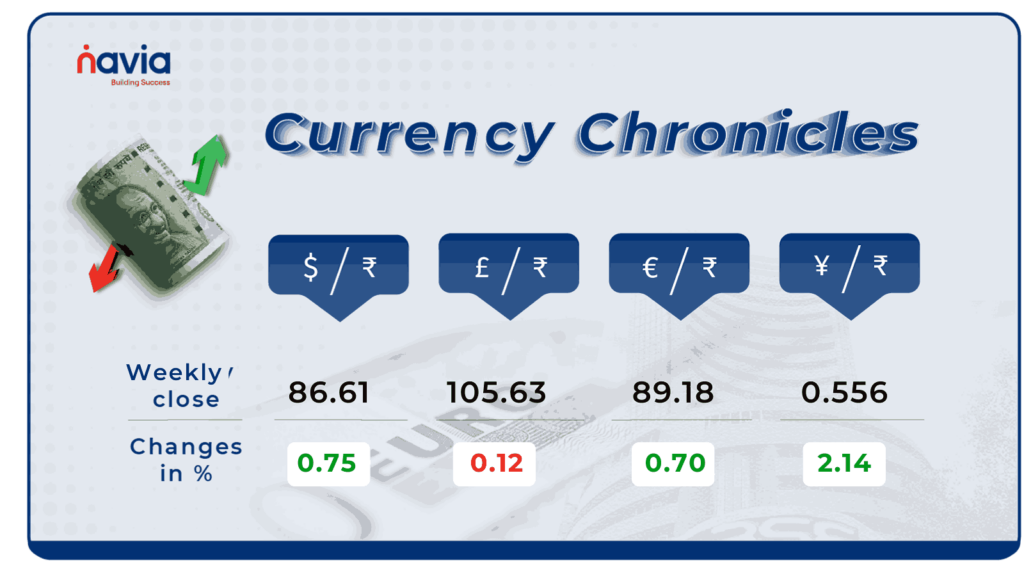

Currency Chronicles

USD/INR:

The India rupee touched fresh record low of 86.70 during the week and closed lower by 64 paise to end at 86.61 per dollar on January 17 against the January 10 closing of 85.97.

EUR/INR:

The euro touched a weekly high of ₹89.18, gaining 0.70% during the week. It closed higher, reflecting positive momentum in the EUR/INR market.

JPY/INR:

The Japanese yen surged this week, gaining 2.14% to close at ₹0.5562. Sentiment in the JPY/INR market has turned positive, indicating renewed strength in the yen.

Stay tuned for more currency insights next week!

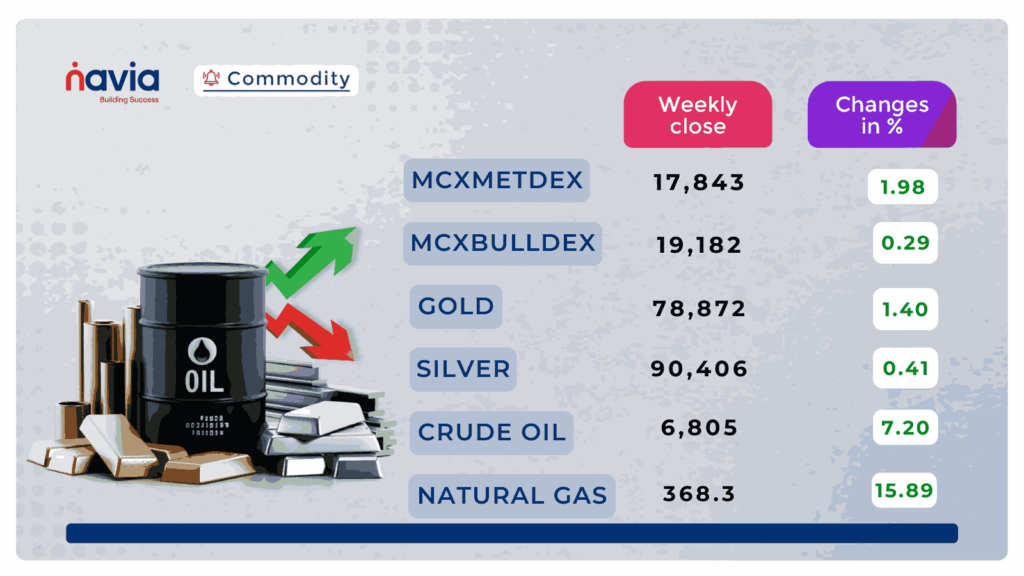

Commodity Corner

Crude oil is trading in an ascending channel pattern, consistently testing its resistance and support levels. The last session closed at 6,805, down by 66 points, after taking support from the 6,750-6,760 range. Strong momentum is anticipated on a breakout above 6,980 or below 6,760. Brent crude oil is currently trading at $81.54, up by 0.31 points.

Recent factors influencing crude oil prices include U.S. sanctions on Russian tankers, which are tightening supply and supporting prices. Additionally, a decline in U.S. crude inventories has heightened supply concerns, while Qatar’s price hike for al-Shaheen crude highlights strong demand in the Middle East. However, China’s oil demand concerns may limit long-term price gains, creating a mixed outlook for crude oil momentum in the near term.

Gold is trading in an ascending channel on the 3-hour time frame. The last session closed at 78,872 up by 516 points, after taking resistance from the rising trendline in the 79,250-79,350 range. A strong breakout above this level could push gold to higher levels, while a move below 78,650 would be bearish.A decline in the US dollar and Treasury yields could further add positivity to gold

Natural gas is trading in an ascending broadening wedge pattern on the 4-hour time frame. The last session closed up by 7.6 points at 368.3. Additional momentum can be expected above the 361.5 range and below 352.

The trendline resistance is placed in the 372-374 range. Natural gas could face resistance from this range.

Silver formed a descending channel on the 4-hour chart and a rising channel on a shorter time frame, as shown in the chart. The last session closed at 90,406 down by 53 points.

A decline in the US dollar and Treasury yields could further support bullish momentum in silver.

Technically, momentum is expected above 93,250 and below 92,700. The descending channel resistance is placed in the 93,900-94,200 range. Keep these levels in mind before considering an entry.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Which SIP Frequency to Select?

Curious about which SIP frequency—daily, weekly, or monthly—is best for your investments? This blog dives into decades of data to reveal surprising insights about returns, cost averaging, and simplicity. Discover why the frequency you choose matters less than staying disciplined and consistent. Don’t miss this must-read guide for smarter SIP planning!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?