Navia Weekly Roundup ( Jan 06 – Jan 10, 2025)

Week in the Review

The Indian market snapped two-week gaining streak and posted biggest weekly fall in last 2 months amid selling across the sectors barring IT, persistent FII selling, mixed global markets ahead of uncertainty around US Federal Reserve rate plans going ahead and rupee depreciation.

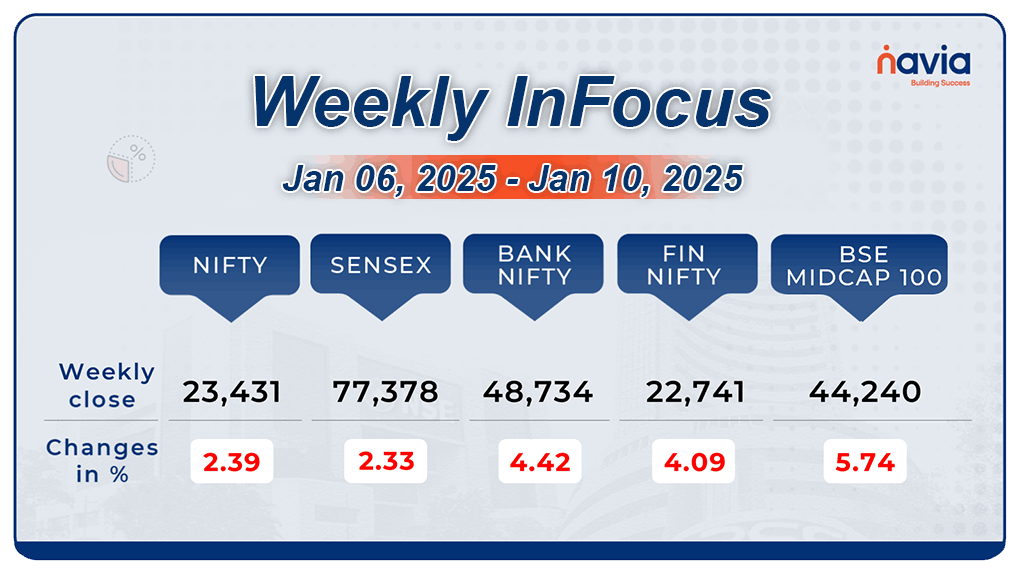

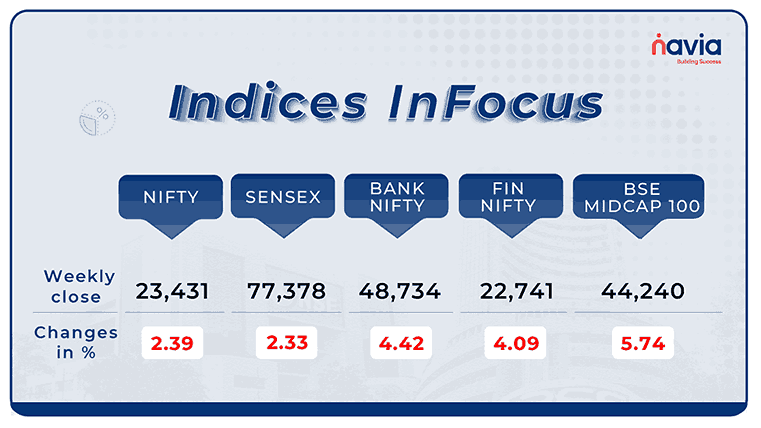

Indices Analysis

This week, BSE Sensex shed 1844.2 points or 2.33 percent to end at 77,378.91, while the Nifty50 index plunged 573.25 points or 2.39 percent to close at 23,431.50.

The BSE Large-cap Index shed 3.2 percent with Union Bank of India, JSW Energy, REC, Info Edge India, Power Finance Corporation, Shriram Finance, Indian Railway Finance Corporation, Adani Energy Solutions, Zomato, IDBI Bank, The Tata Power Company lost between 10-16 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

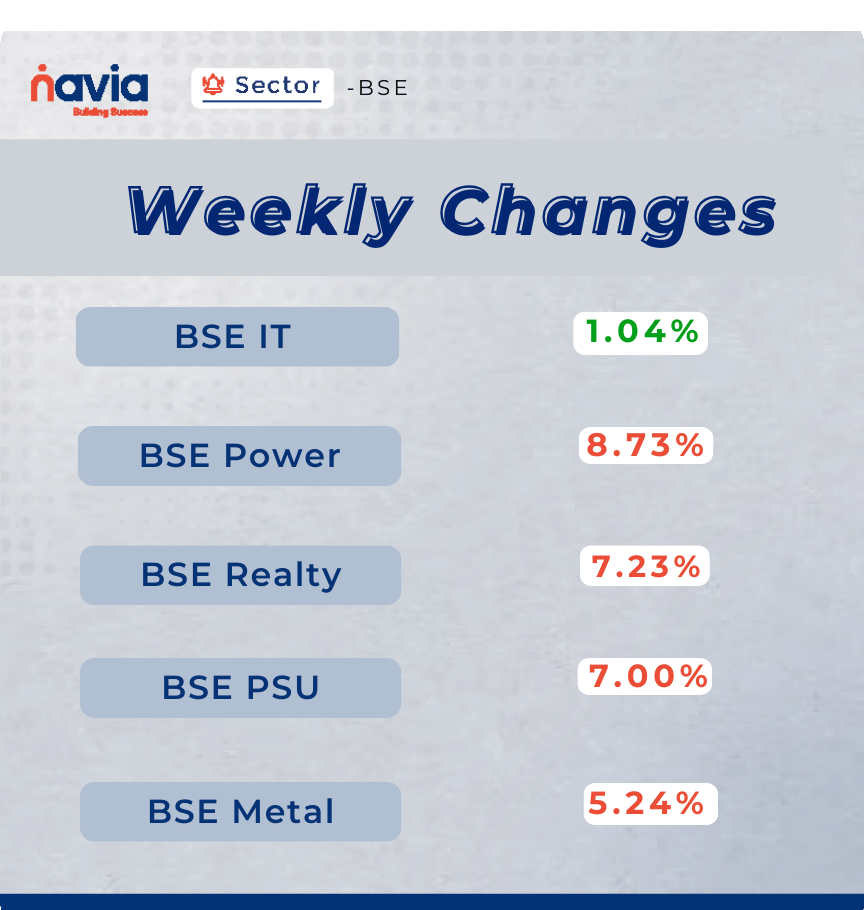

Sector Spotlight

On the sectoral front, except BSE Information Technology index (up 1 percent), all other indices ended in the red with BSE Power index shed nearly 9 percent, BSE Realty slipped more than 7 percent, BSE PSU index shed 7 percent, BSE Capital Goods and Metal indices declined 5 percent each.

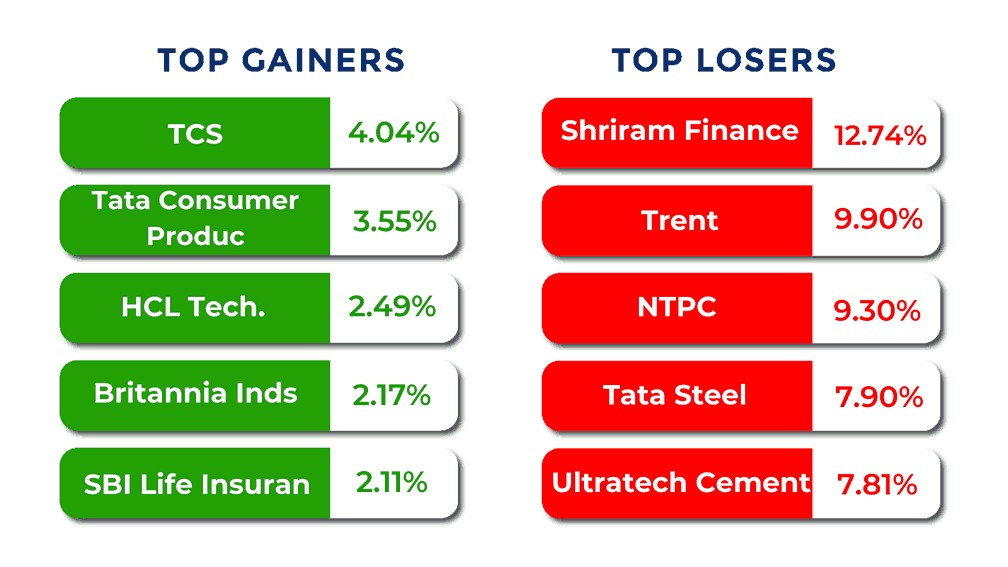

Top Gainers and Losers

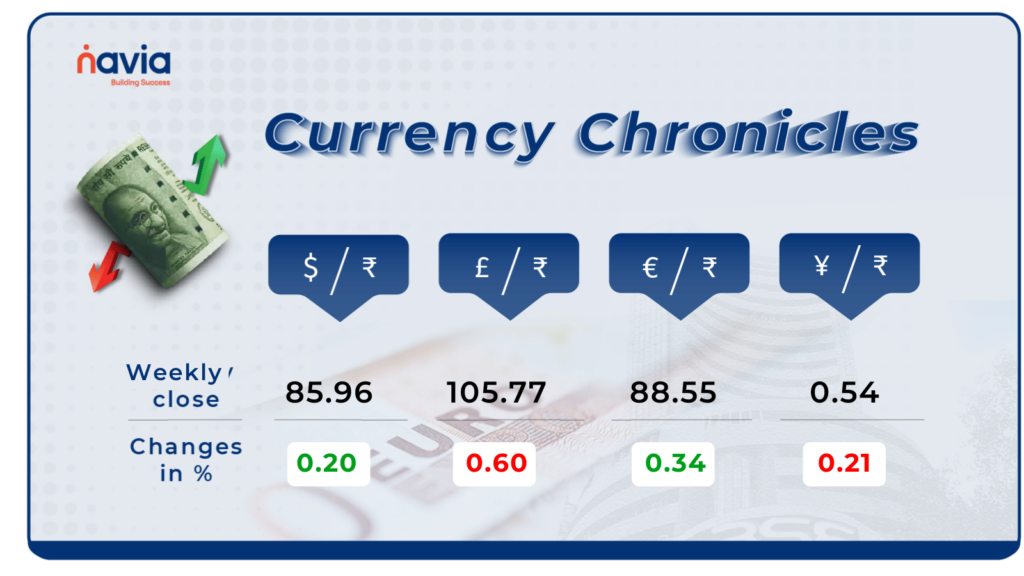

Currency Chronicles

USD/INR:

The Indian rupee remained under pressure this week, hitting a fresh record low of ₹85.98 during Friday’s session. The currency slipped 19 paise to close at ₹85.96 per dollar on January 10, compared to ₹85.78 on January 3.

EUR/INR:

The euro gained momentum this week, rising by 0.34% to close at ₹88.55. Sentiment in the EUR/INR market remains positive, reflecting steady support for the euro.

JPY/INR:

The Japanese yen faced a decline this week, dropping by 0.21% to close at ₹0.5445. Sentiment in the JPY/INR market remains cautious, reflecting continued pressure on the yen.

Stay tuned for more currency insights next week!

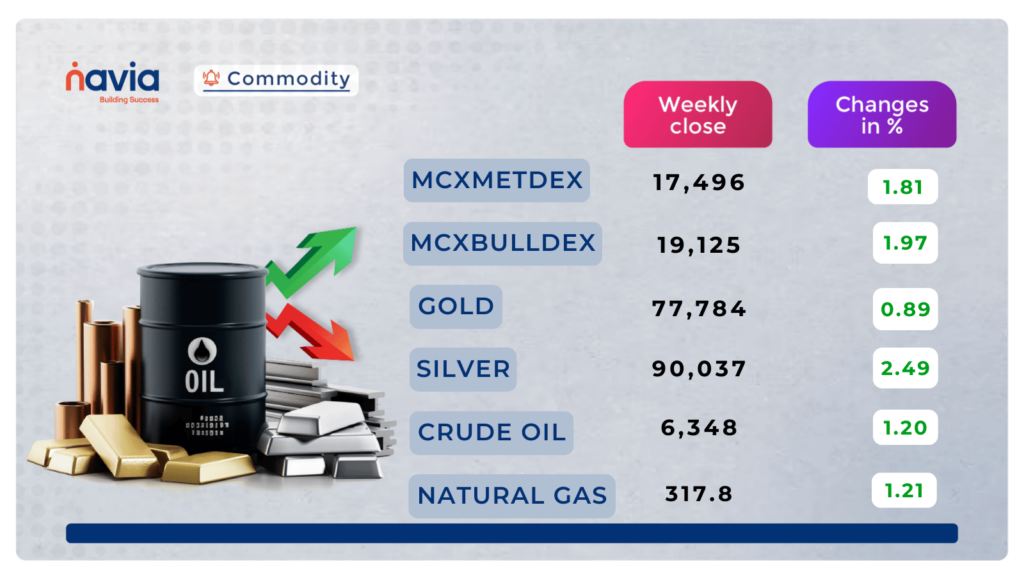

Commodity Corner

Crude oil closed in the green in the last session, gaining 65 points to close at 6,348, and is trading within an ascending broadening wedge. The resistance for the wedge is placed in the 6,530–6,540 range, with momentum expected toward this level in the coming days. The increasing demand for crude oil, driven by rising heating fuel needs due to colder weather in the U.S. and Europe, continues to support higher prices. Brent crude is currently trading at $77.16, up by 0.03%.

Gold is trading within an ascending channel while respecting a rising trendline within the channel. The price has been consolidating near the trendline resistance and channel support. A strong momentum above 78,200 or below 77,800 could present an intraday trading opportunity. The ascending channel support is positioned in the 76,500-76,800 range, while the trendline resistance is located in the 78,400-78,600 range.

As shown in the chart, natural gas is trading in an ascending broadening wedge pattern, respecting its support and resistance channels. In the last session, it took support from the channel and closed at 317, up by 11.90. Further momentum can be expected above 328 or below 318.5.The increasing cold weather conditions could drive higher demand for natural gas.

Silver is currently trading within a descending channel and closed the previous session at 90,037, gaining 773 points. A recent breakout near the 90,250 level signals potential for further upward movement. A bullish trend is likely to continue above the 92,400 level, with targets set at 93,460 and 94,200, while a decline could occur if Silver drops below 90,900

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

What Is the Ideal Investment Time Horizon for SIP?

Wondering how long you should stay invested in your SIPs to truly reap the benefits? Discover the power of time in minimizing risk, balancing market cycles, and maximizing returns. This blog breaks down historical data and key insights to help you determine the ideal investment time horizon for achieving your financial goals.

Time in the market matters far more than timing the market

Is timing the market truly the key to better returns? Or does starting your SIP early and staying invested hold the real magic? This insightful blog dives into 27+ years of market data to uncover surprising truths about market timing versus time in the market. Whether you’re an experienced investor or just starting out, this read will challenge what you think you know about SIP success.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?