Navia Weekly Roundup (Feb 26 – Mar 02, 2024)

Week in the Review

Extending its upward trajectory for the third consecutive week, the Nifty 50 index achieved a record-breaking high of 22,419.55 on March 2, 2024, setting the stage for a fresh bullish trend in the March series. In contrast to the trading session on January 20, marked by sudden spikes and arbitrage opportunities, this Saturday’s session unfolded more smoothly, witnessing only a marginal increase in volume during the initial hour. The subsequent session saw a sideways movement within the range of 22,410 to 22,350.

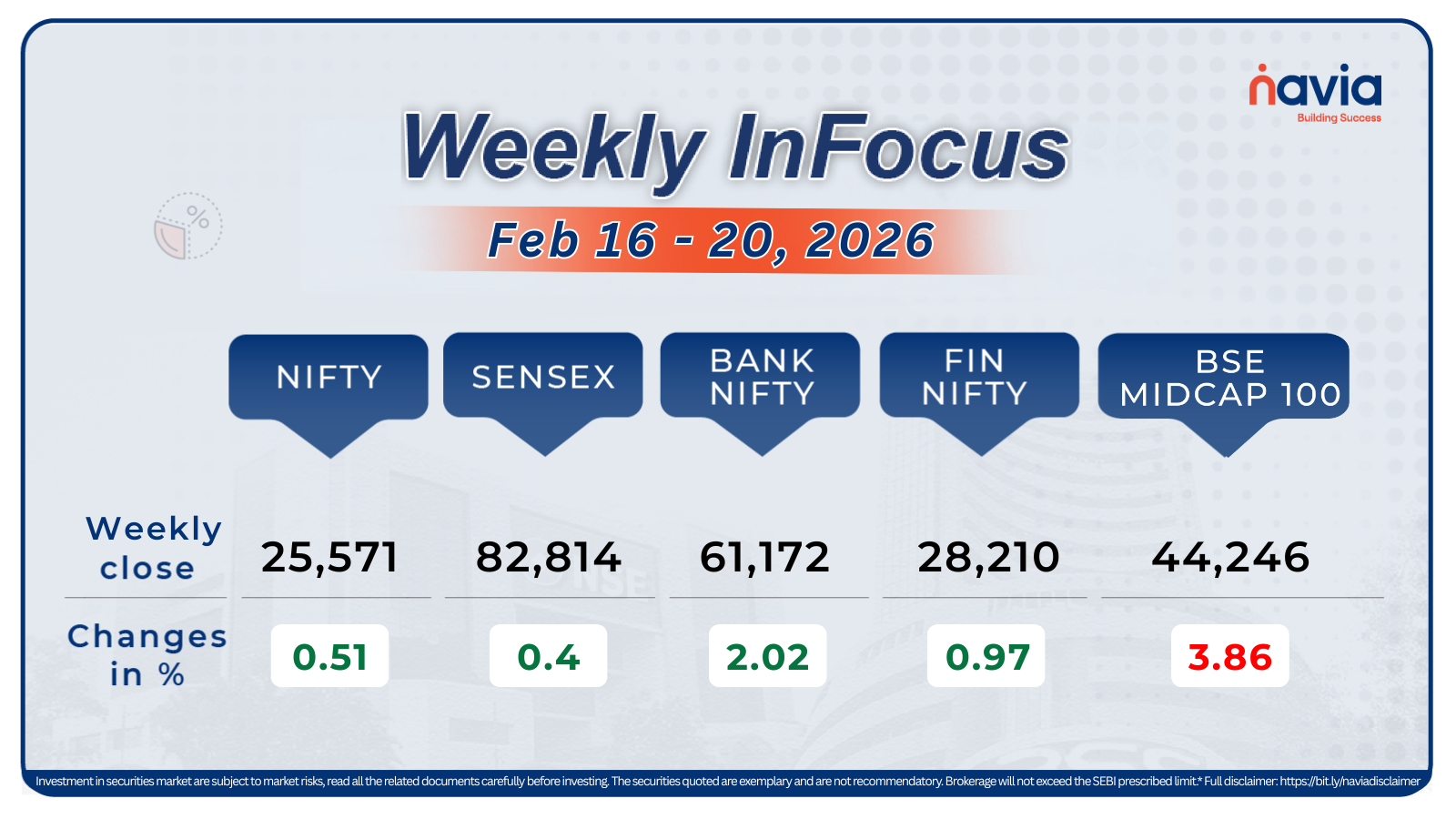

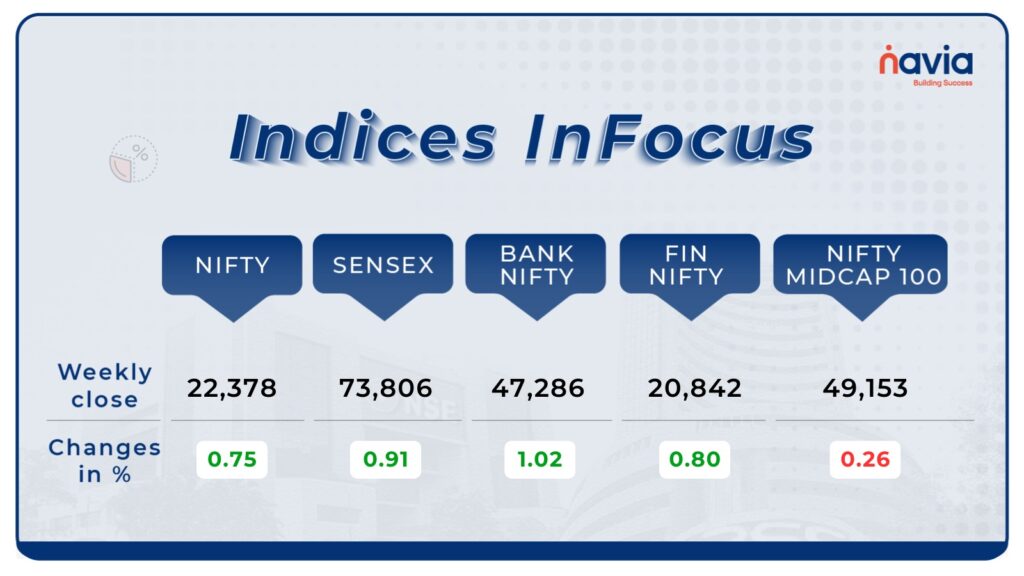

Indices Analysis

The Nifty started March series on a positive note and extended the gains as the day progressed, hitting a record high by crossing 22,377.45 for the first time.

At close, the Sensex was up 0.91 percent, at 73,806, and the Nifty was up 0.75 percent, at 22,378 Their best closing, so far.

For any further queries, you can now contact us on WhatsApp!

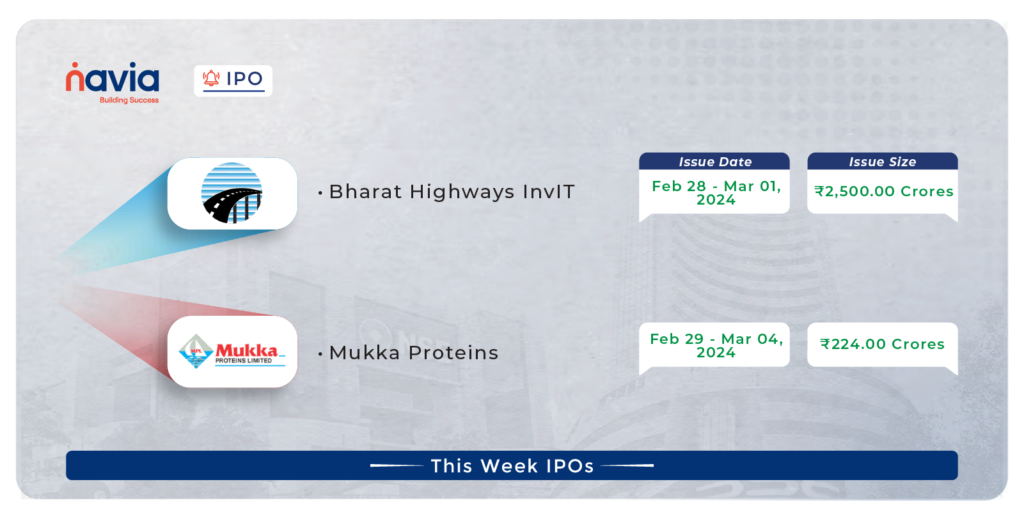

IPO Corner

Mukka Proteins IPO: Skyrocketing Subscriptions Show Massive Interest!

Mukka Proteins’ IPO is making headlines with an incredible subscription rate of 6.97 times on the second day of bidding! Retail investors are especially eager, subscribing a whopping 10.21 times, while non-institutional investors follow closely at 6.22 times, and qualified institutional buyers show solid interest at 1.86 times. With such overwhelming demand, Mukka Proteins is set for an exciting journey ahead.

Bharat Highways IPO and InvIT IPO: Mixed Responses Create Buzz!

Bharat Highways’ IPO is stirring up mixed reactions. On the second day of bidding, it was subscribed 1.03 times, showing moderate interest. Meanwhile, Bharat Highways InvIT IPO saw a subscription rate of 37% on day one, with a price band set at ₹98 to ₹100 per equity share.

However, the real drama unfolded on the last day of bidding for Bharat Highways InvIT IPO, with subscriptions shooting up to 8 times! The institutional investors’ portion was oversubscribed at 8.92 times, while other investors’ portion saw a subscription rate of 6.93 times. The proceeds from this offering will be utilized to provide loans to project Special Purpose Vehicles for repayment of their outstanding loans.

Stay tuned as we continue to track the exciting developments in the world of IPOs. Don’t miss out on the latest updates and market trends – subscribe to our newsletter today! 📈📊

Now with N Coins, Navia customers can #Trade4Free.

Sector Spotlight

In this week’s edition of “Sector Spotlights,” we witnessed divergent performances across various indices. The Nifty Metal and Nifty Consumer Durables indices took center stage, showcasing impressive gains in the past week. Conversely, Nifty Media and Nifty Healthcare experienced significant downturns, emerging as the primary underperformers in the market.

Unlock the Power: Explore Our Features!

Strategy Builder

Tailor your options strategy based on market sentiment – bullish, bearish, or neutral, ensuring precision in every trade.

Payoff Chart

Visualize potential profits and losses with an intuitive chart, empowering you to adjust and predict outcomes effortlessly.

Square of All Option

Streamline your trading process. With a single tap, square off all open positions, optimizing efficiency in managing your options portfolio.

Multiple Charts on Rocket Web

Elevate your trading experience by viewing spot and strike charts simultaneously, enabling quick decisions and seamless order execution.

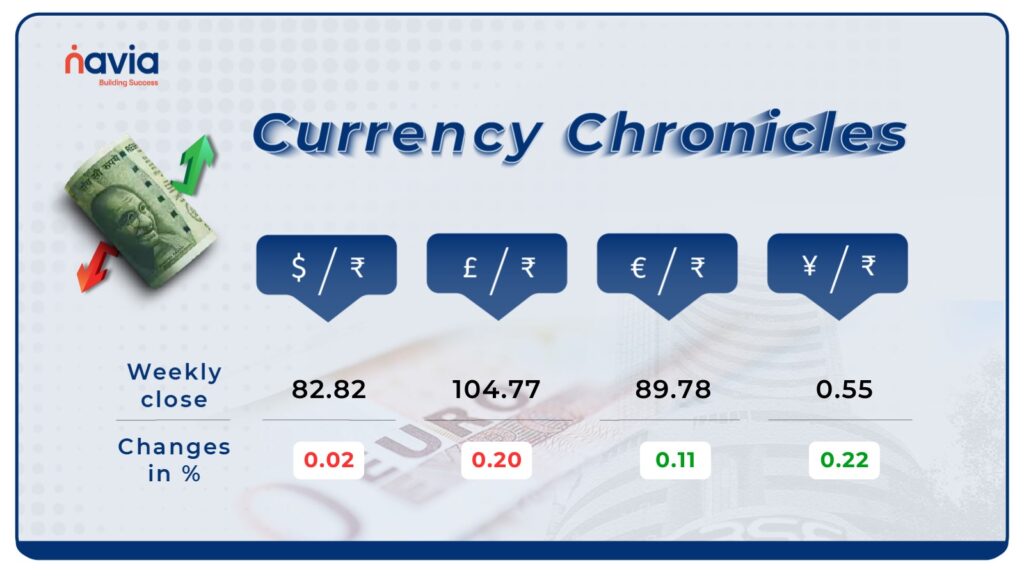

Currency Chronicles

USD/INR:

The rupee concluded the week on a slightly lower note, settling at 82.82 (provisional) against the US dollar on Friday. This dip was attributed to the uptick in crude oil prices in the global market and heightened demand for the American currency from importers. However, the local currency found support from a rally in equity markets and robust domestic macroeconomic data, which helped mitigate the decline.

EUR/INR:

As of March 2nd, 2024, 1 Euro is equivalent to 89.78 Indian Rupees. Analysts have identified a range for the EUR to INR, reflecting a minimal change of 0.11% compared to the previous week. Despite minor fluctuations, the Euro continues to hold its ground against the Indian Rupee.

JPY/INR:

Forecasts suggest a modest increase of 0.22% in the JPY to INR exchange rate over the week, with the rate expected to rise from the current ₹ 0.551904 to ₹ 0.552596. Market sentiment within the JPY/INR segment remains bullish, indicating positive prospects for the Japanese yen against the Indian rupee in the near term.

Commodity Corner

Gold:

Last week, the price of gold went up by 2.66%, closing at 62408 levels. This was driven by positive news about inflation in the US. Keep an eye on Resistance 1 (R1) at 62700 and Support 1 (S1) at 62600.

Crude Oil:

Crude oil prices also saw a rise of 2.61% last week. Investors are waiting to see what decisions OPEC+ makes about supply agreements for the next quarter. Look out for Resistance 1 (R1) at 6550 and Support 1 (S1) at 6500.

Blog of the Week

Set sail through uncharted waters: Dive into NSE and BSE’s Special Live Trading Session on March 2nd, 2024. Read more to chart your course!

Interactive Zone

Last week’s poll:

Q) What does the S&P 500 index measure?

a) 500 largest publicly traded companies in the US

b) 100 largest companies in the US

c) 30 industrial stocks

Last week’s poll answer: a) 500 largest publicly traded companies in the US

N Coins Rewards

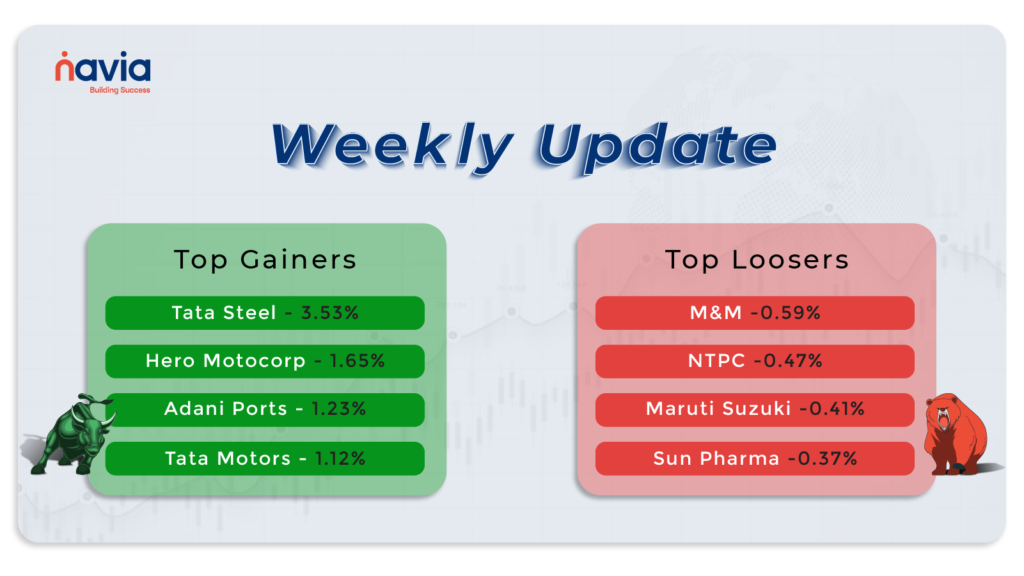

Top Gainers and Losers

Navia Corner

Join Navia and trade like a pro!

Unlock the power of Navia and INX Global for a game-changing investment journey in our latest video!

Refer your Friends & Family and GET 500 N Coins.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?

Happy Learning,

Team Navia

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.