Navia Weekly Roundup ( Feb 24 – 28, 2025)

Week in the Review

The Indian market extended the losing streak in the third consecutive week ended February 28 amid concerns about an escalating global trade war after US President Donald Trump’s fresh comments on tariffs.

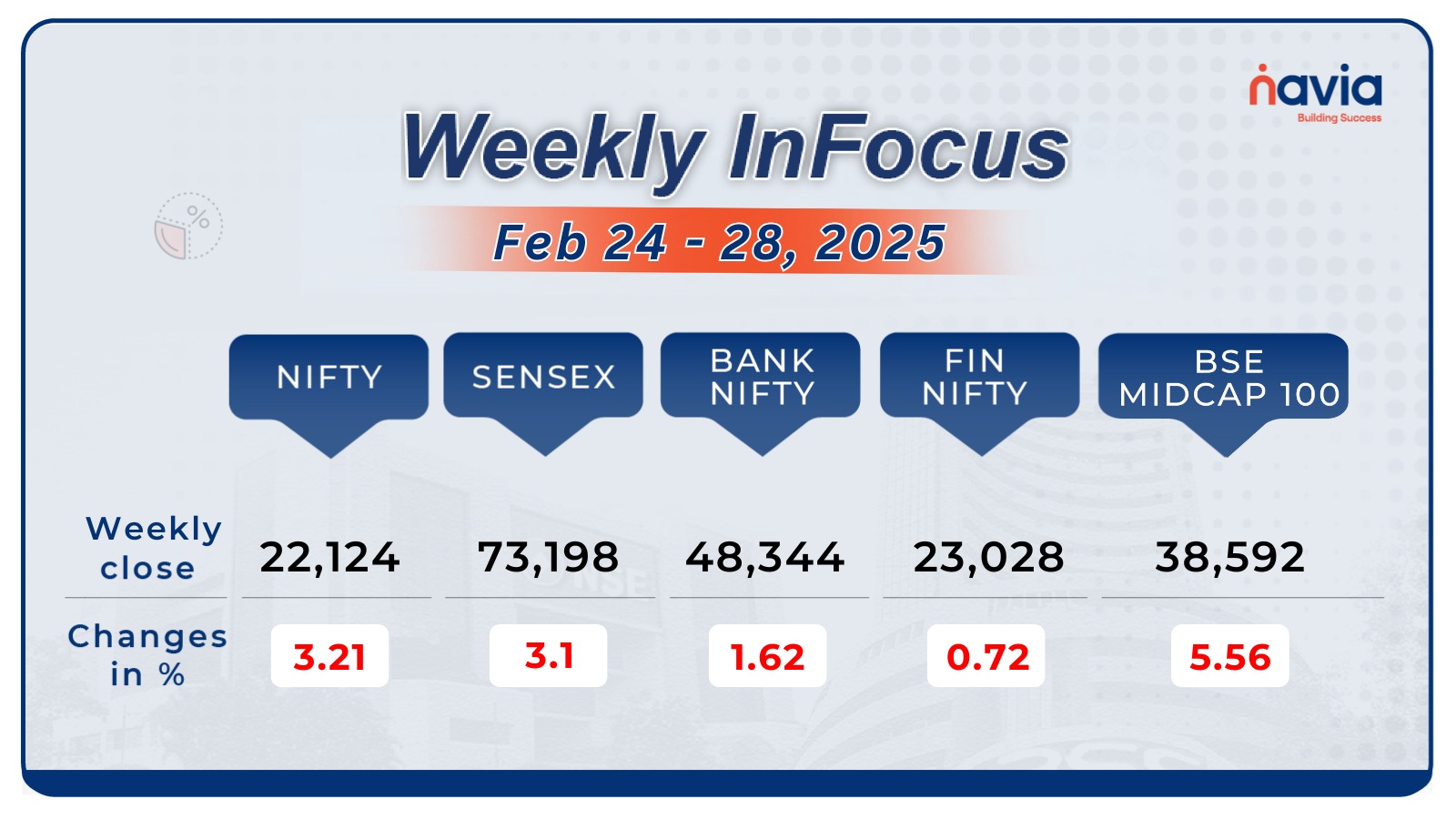

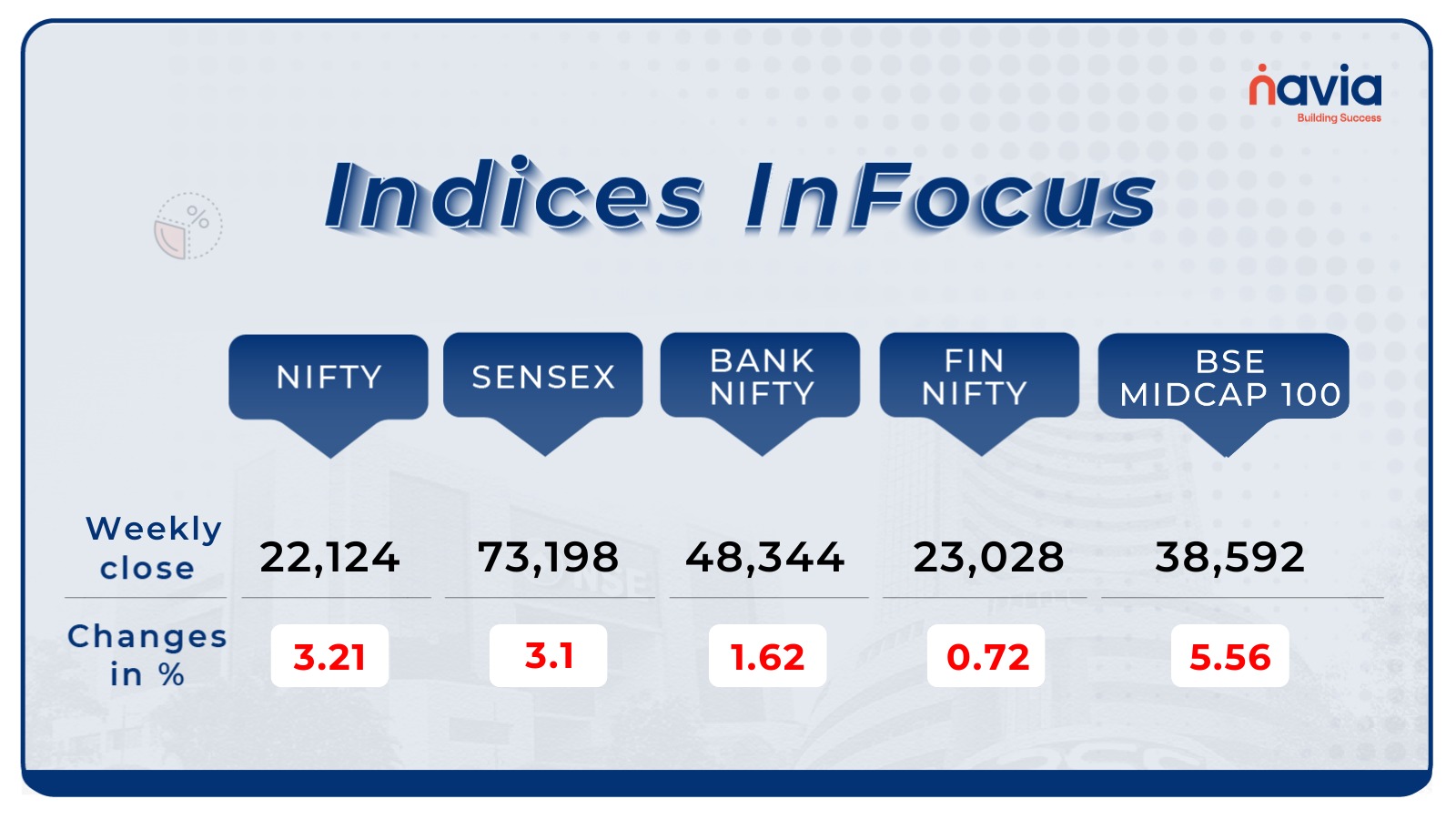

Indices Analysis

This week, the Nifty50 index shed 671.2 points or 3.21 percent to close at 22,124.7 and BSE Sensex declined 2,112.96 points or 3.1 percent to close at 73,198.1.

The BSE Large-cap Index plunged 3.4 percent Polycab India, LTIMindtree, Jio Financial Services, REC, Indian Railway Finance Corporation fell between 10-19 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

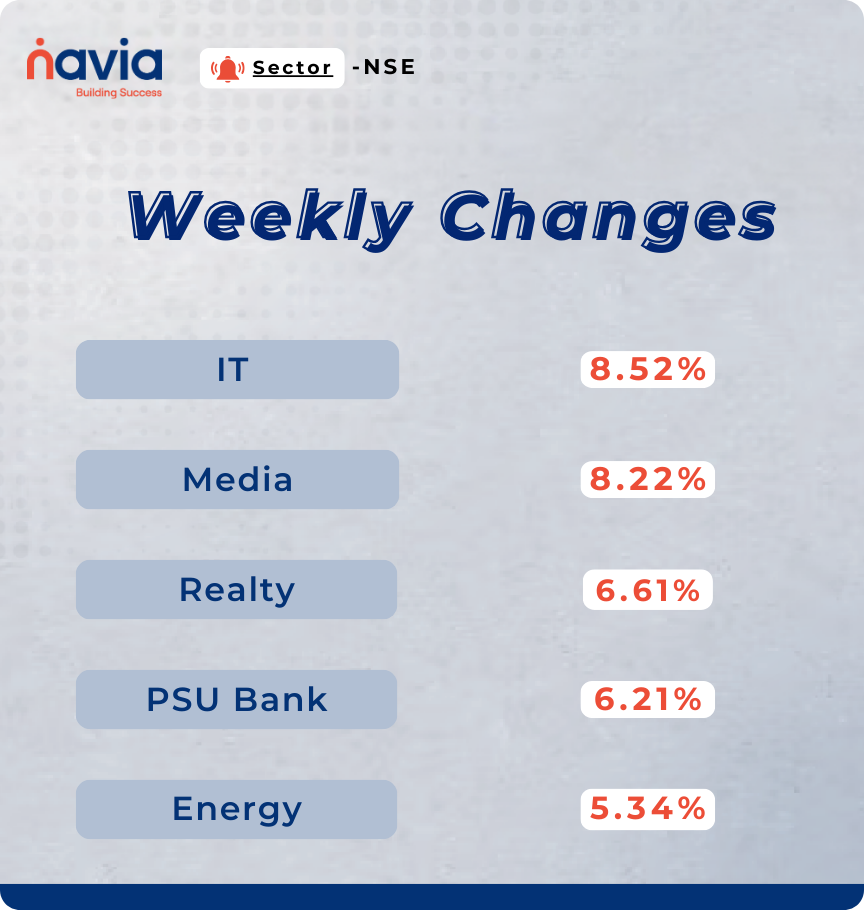

Sector Spotlight

All the sectoral indices ended in the red with Nifty IT index shed 8 percent, Nifty Media index declined 8.2 percent, Nifty Realty index shed 6.5 percent, Nifty PSU Bank index shed 6 percent and Nifty Energy index fell 5 percent.

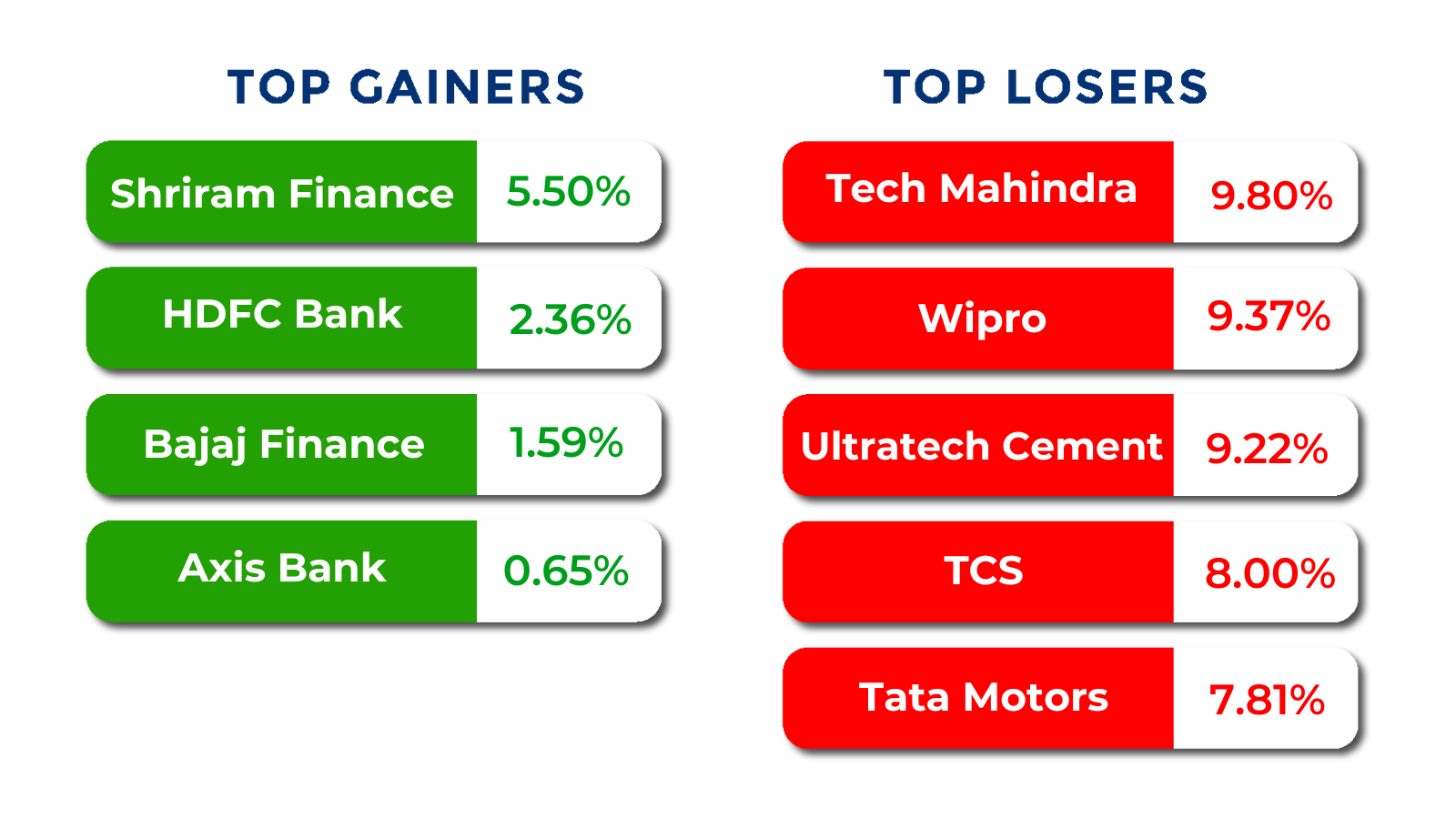

Top Gainers and Losers

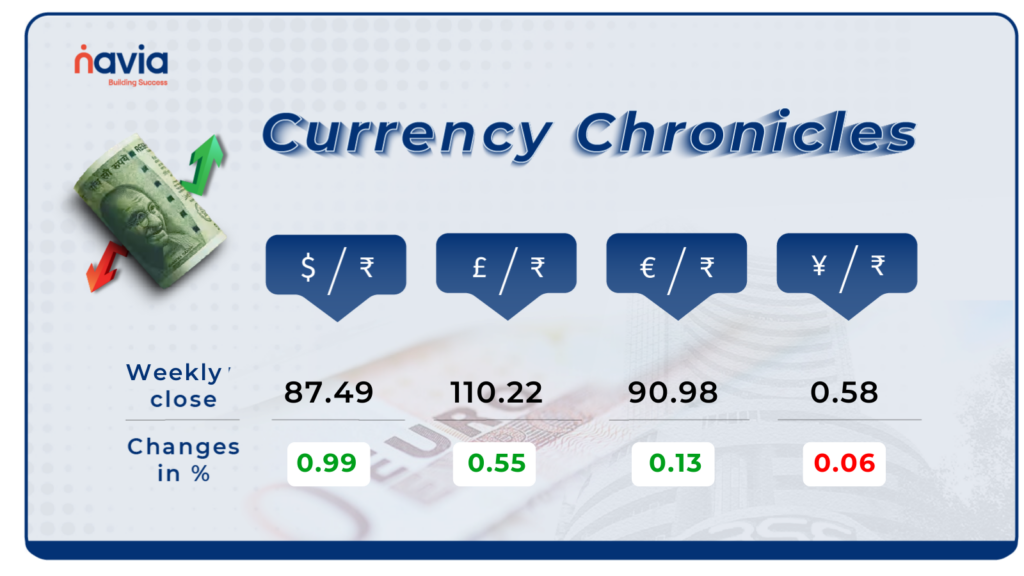

Currency Chronicles

USD/INR:

The Indian rupee weakened against the US dollar this week, close at ₹87.49 per dollar on February 28, compared to ₹86.71 on February 21. The USD/INR rate rose by 0.99% during the week, reflecting a bullish market sentiment.

EUR/INR:

The euro edged higher against the Indian rupee this week, gaining 0.13% to settle at ₹90.98. EUR/INR fluctuated between ₹90.83 and ₹92.62, with market sentiment remaining neutral.

JPY/INR:

The Japanese yen saw a slight decline of 0.06% this week, settling at ₹0.58 against the Indian rupee. Market sentiment for JPY/INR remains neutral.

Stay tuned for more currency insights next week!

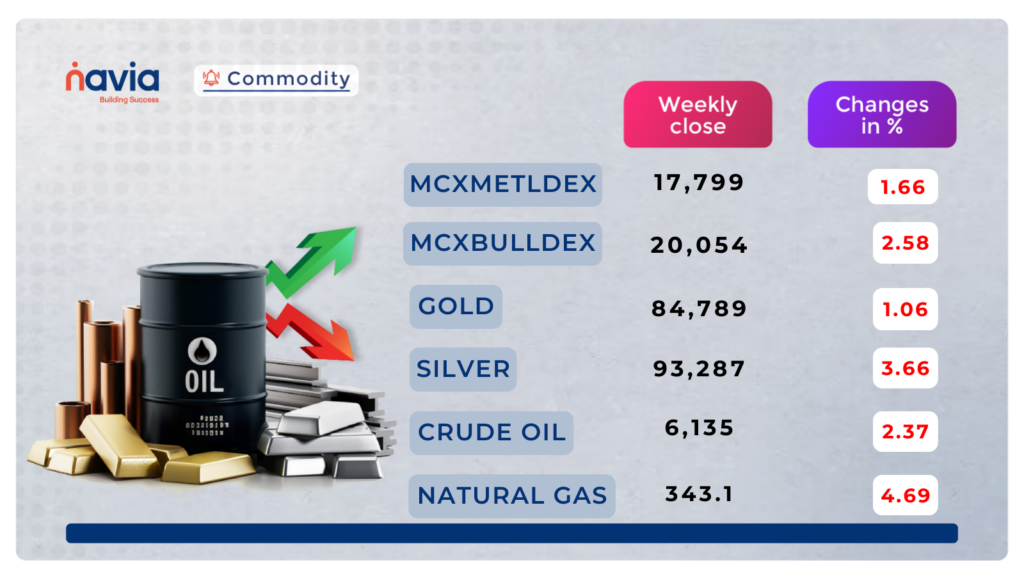

Commodity Corner

Crude oil is trading within a descending channel on the 30-minute chart, closing marginally negative at 6,135, up by 135 points. It took support from the 6,000-5,980 range, which is the support zone of the descending channel, and closed at a higher level. The descending channel’s resistance is positioned at 6,270-6,280. Another intraday momentum can be expected above 6,170 and below 6,090. A strong close above 6,247 could lead to a breakout of the descending channel.

Gold prices have broken down from an ascending triangle pattern on the 30-minute chart, while an ascending channel is also visible in the larger time frame. Gold has been consolidating over the past few sessions, and the last session resulted in a breakout. It closed at 84,789 down by 678 points.

Another intraday momentum move can be expected above 85,910 or below 85,700. If gold sustains above 86,350, it could reach new highs. The ascending triangle’s support is placed at 85,380–85,400. Another intraday momentum move can be expected above 85,545 and below 84,961.

Natural gas is trading in a rising wedge pattern on the 3-hour chart, closing at 343, down by 2 points in the last session. A close above 381 could trigger bullish momentum, while intraday movement above 361 may push prices higher. Conversely, a break below 347 could indicate further downside. The rising wedge support is positioned in the 340-342 range, and a breakdown below this level could create negative sentiment, as prices are currently trading near this range.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

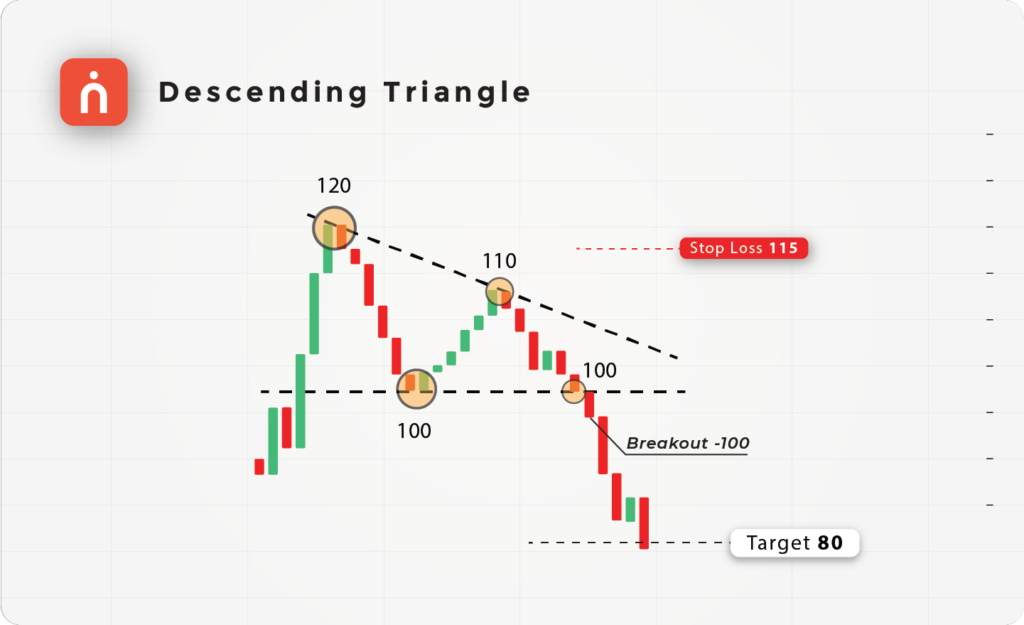

Understanding the Descending Triangle Pattern in Technical Analysis

Is the market gearing up for a breakdown? The Descending Triangle Pattern could be your early warning sign! This bearish continuation pattern signals growing selling pressure and potential price drops. Learn how to spot, trade, and capitalize on it in this in-depth guide!

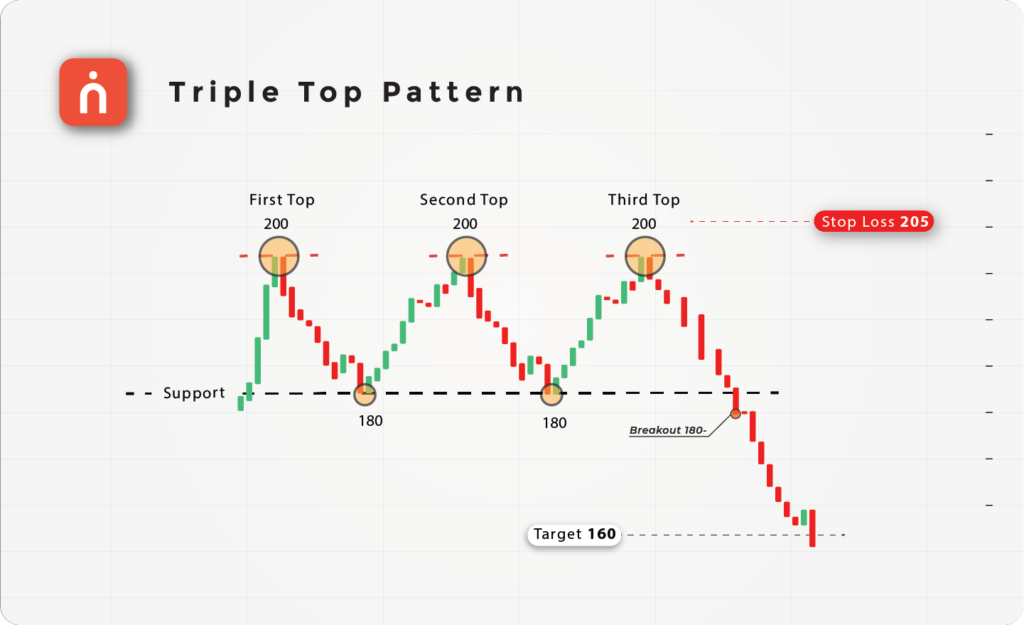

Understanding the Triple Top Pattern in Technical Analysis

Is the rally running out of steam? The Triple Top Pattern could be flashing a major reversal signal! When buyers fail to break past resistance three times, a bearish move often follows. Discover how to spot, trade, and profit from this pattern in our expert guide!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?