Navia Weekly Roundup (Dec 29 2025 – Jan 02 2026)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

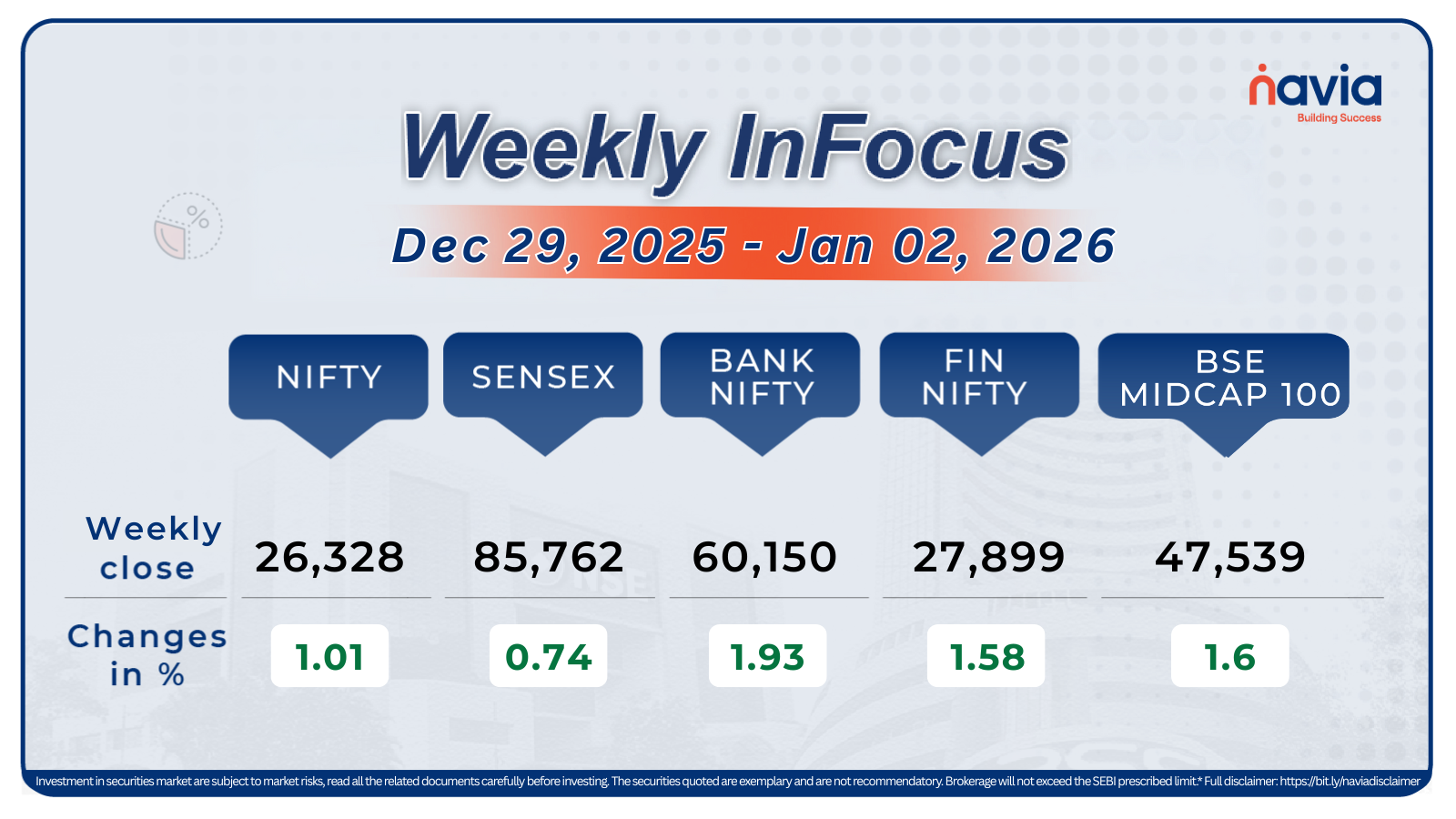

The Indian equity indices finished the first week of 2026 with notable market activity, with the Nifty 50 hitting a fresh all-time intraday high of 26,328 during the Friday, January 2 session. Market recorded gains for the second consecutive week led by strong auto sales numbers, and enthusiasm around better earnings outlook, despite ongoing geopolitical developments and persistent FII selling.

Indices Analysis

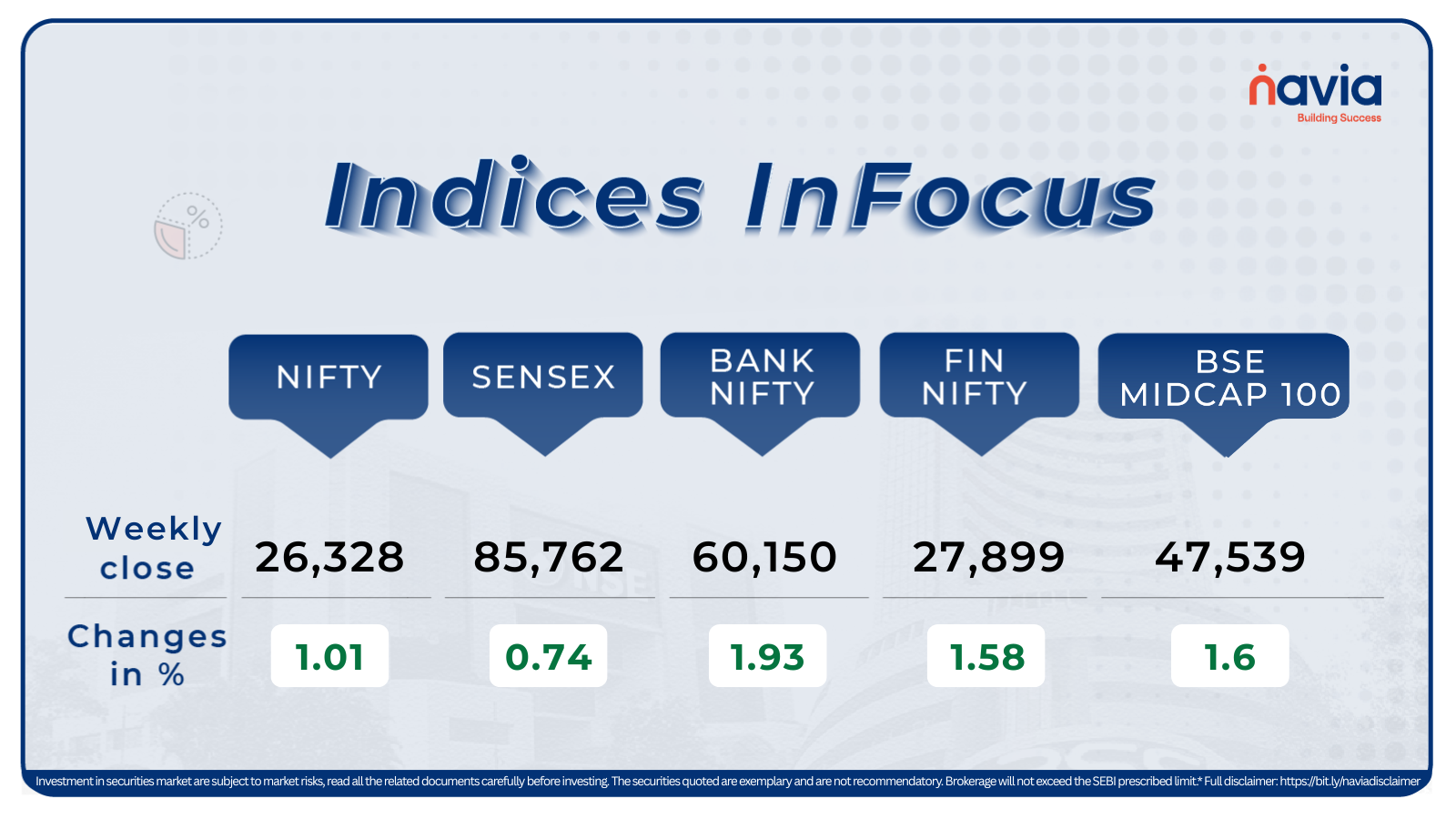

BSE Sensex index jumped 0.74 percent at 85,762.01, while Nifty50 index added 1.01 percent at 26,328.55.

The BSE Large-cap Index gained 1.3 percent supported by IDBI Bank, Bosch, Indian Overseas Bank, Jindal Steel, NTPC, Tata Steel, while ITC, Waaree Energies, Indian Railway Finance Corporation, Berger Paints India, United Spirits fell between 3-13 percent.

The BSE Small-cap index rose 1 percent supported by Silver Touch Technologies, Orient Technologies, Shalimar Paints, Veranda Learning Solutions, Integrated Industries, Nazara Technologies, Entero Healthcare Solutions, Stallion India Fluorochemicals, Transformers and Rectifiers India, KPI Green Energy, IIFL Capital Services, InfoBeans Technologies, Indo Farm Equipment, United Foodbrands. On the other hand, Godfrey Phillips India, Indo Thai Securities, Rajesh Exports, Privi Speciality Chemicals, Kothari Industrial Corporation, Tourism Finance Corp of India, Vishnu Prakash R Punglia, Cupid, Bhagiradh Chemicals and Industries, Wardwizard Innovations and Mobility, Deccan Gold Mines shed between 10-20 percent.

BSE Mid-cap Index jumped 1.7 percent with Ola Electric Mobility, Bank of Maharashtra, SJVN, Steel Authority of India, Gujarat Gas, Indian Bank rising over 10 percent each. However, PB Fintech, Rail Vikas Nigam, KPIT Technologies, Premier Energies, Coromandel International, Deepak Nitrite losing between 3-6 percent.

Despite turning net buyers in the Friday’s session, the Foreign Institutional Investors (FIIs) remained net sellers the Indian equity markets during the first week of 2026, as they sold equities worth Rs 13,180.09 crore. On the other hand, Domestic Institutional Investors (DIIs) continued net buying activity as they bought equities worth Rs 17,766.57 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

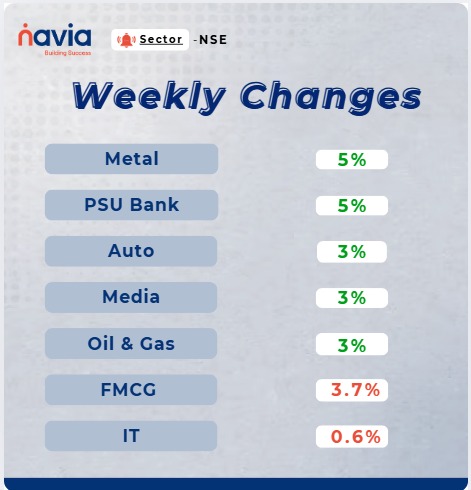

Among sectors, Nifty Metal and PSU Bank indices registered gains of around 5 percent during the week, while Nifty Auto, Media, Oil & Gas rose 3 percent each. However, Nifty FMCG index shed 3.7 percent, and Nifty IT index fell 0.6%.

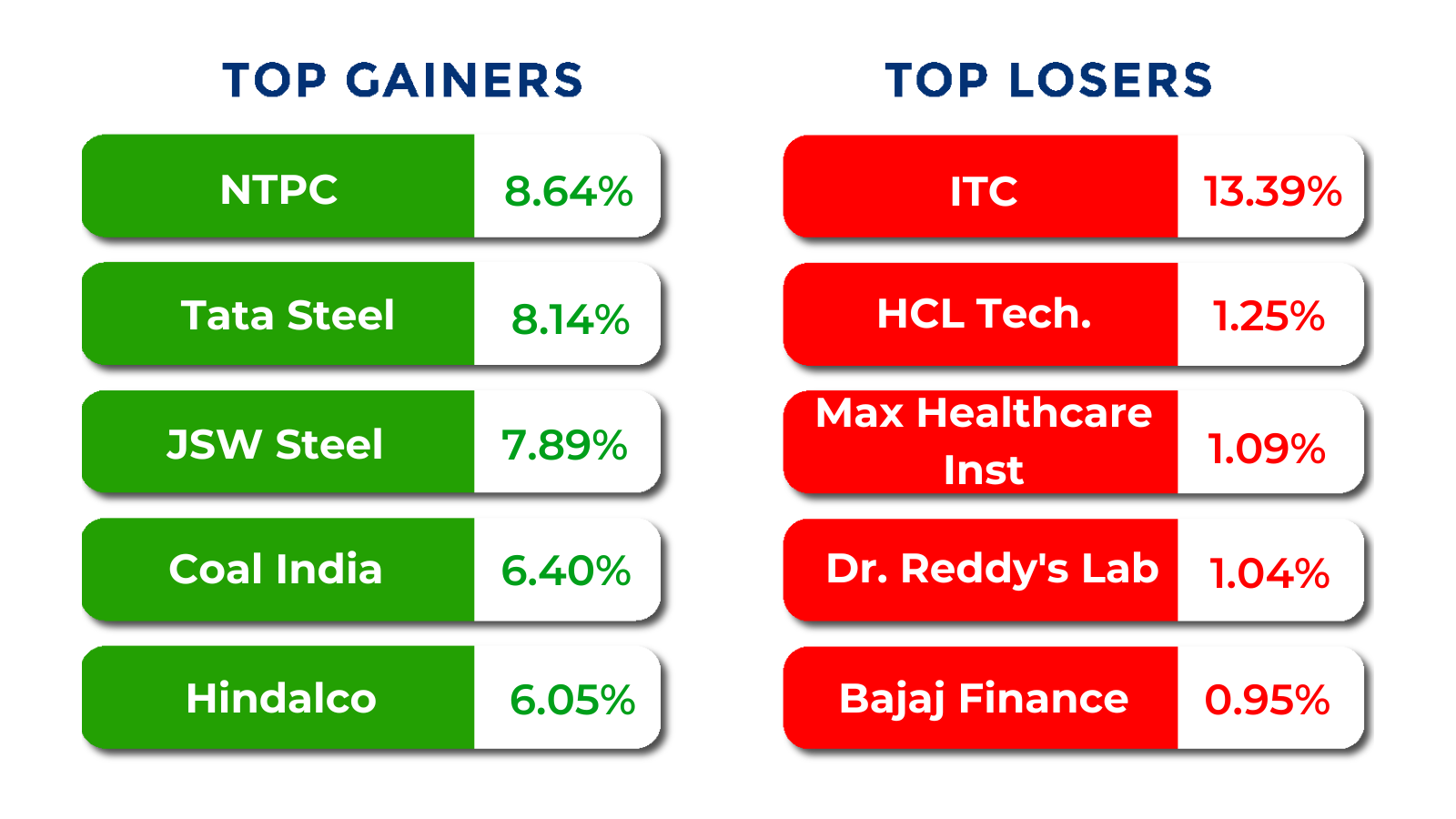

Top Gainers and Losers

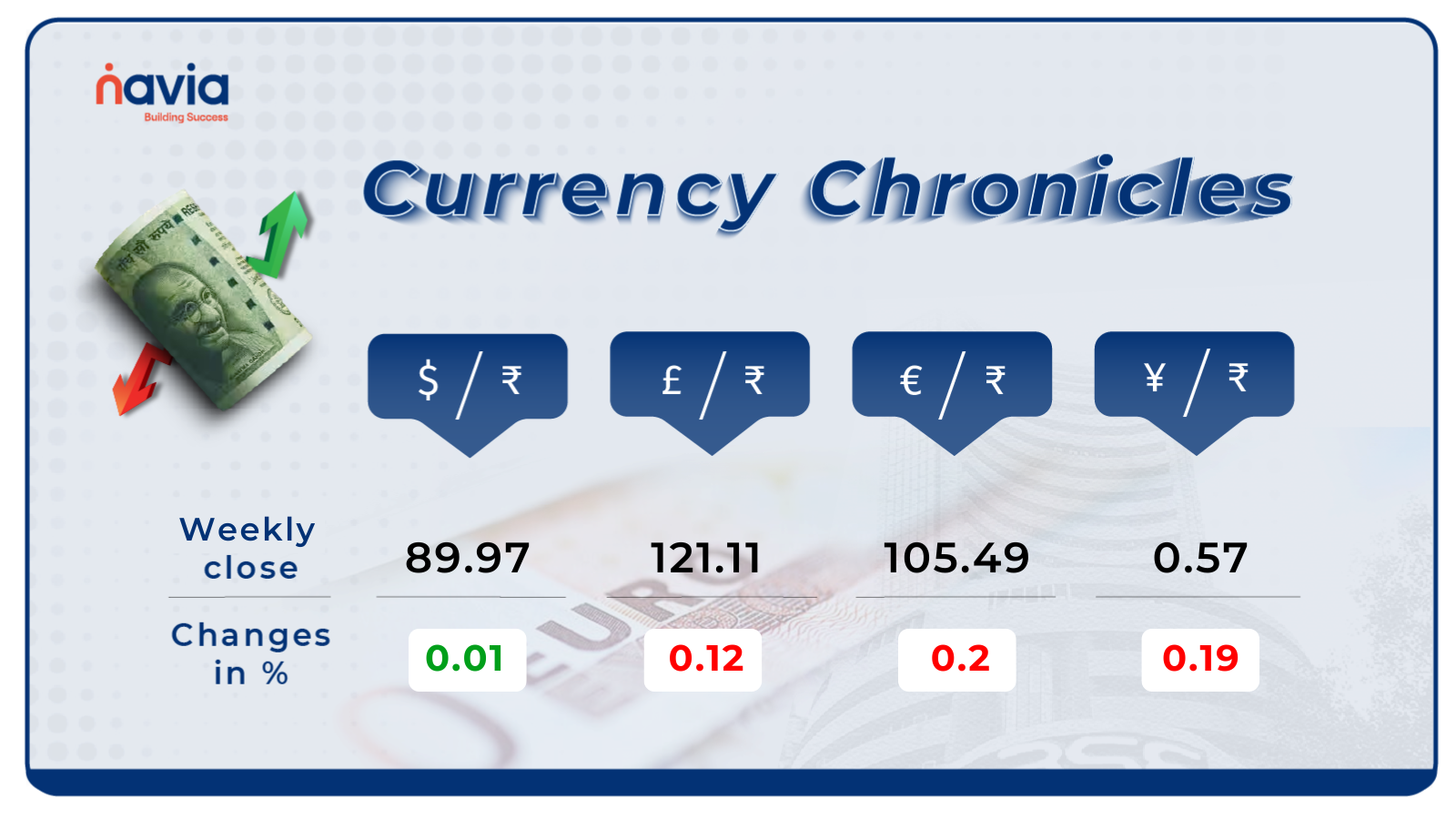

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹89.97 per dollar, gaining 0.01% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹105.49 per euro, losing 0.2% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.57 per yen, losing 0.19% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

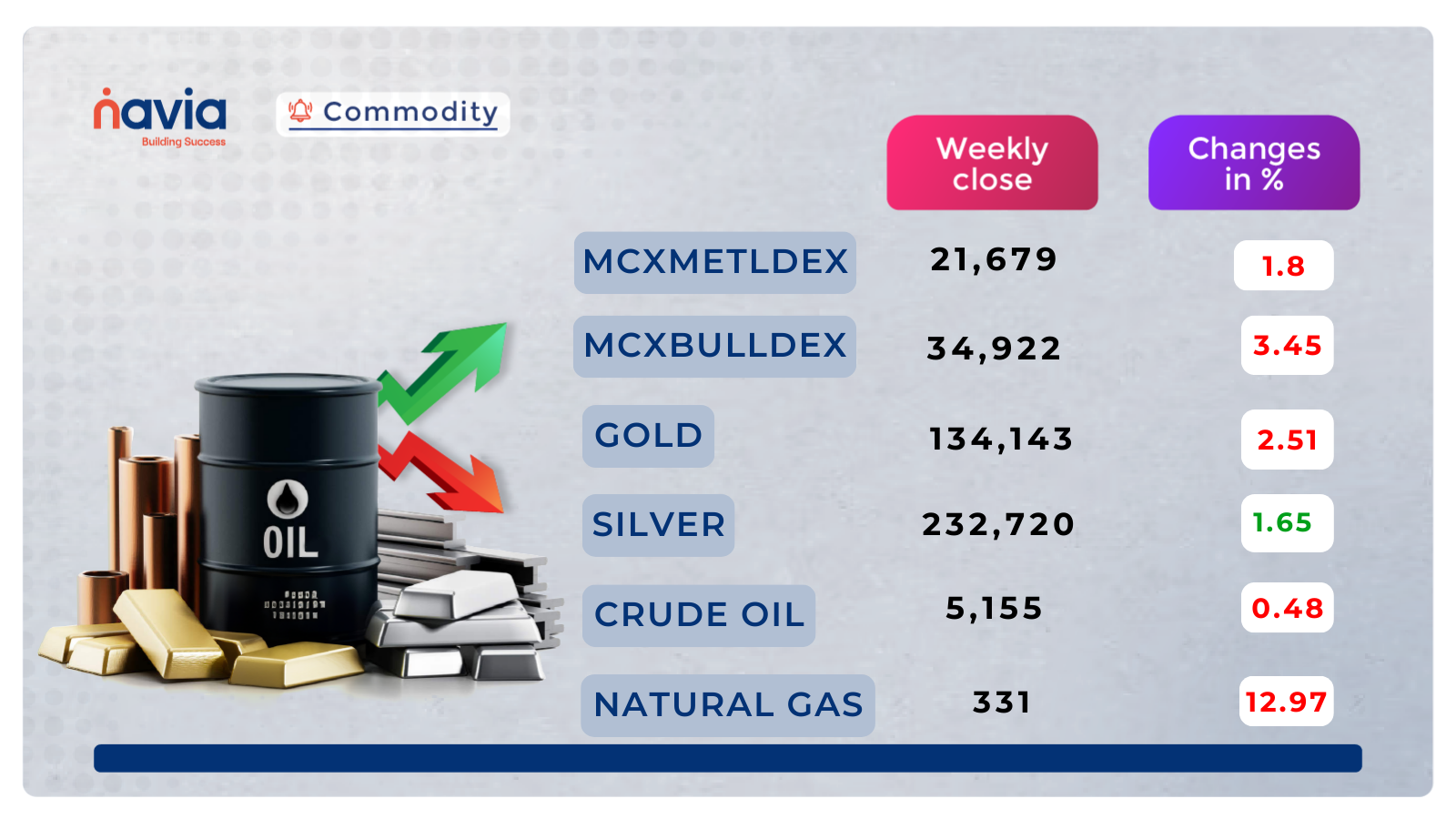

Commodity Corner

Crude Oil Futures continue to trade within a broader corrective structure after failing to sustain above the key supply zone near 5430–5450. The price action shows repeated rejection from the descending trendline, confirming persistent selling pressure on rallies. Although a short-term recovery emerged from the 5010–5050 demand zone, the rebound has stalled near 5300, which now acts as a crucial resistance and trend-defining level. As long as price remains below the falling trendline and the 5300–5330 resistance band, the price structure currently reflects a neutral to weak technical setup. The current structure suggests consolidation with a downside risk, where a failure to hold above 5120 could reintroduce lower levels such as 5010 and 4920 remain key reference zones. On the upside, only a decisive breakout and sustained close above 5330 could alter the prevailing technical structure toward 5450 and 5600. Overall, price action remains range-bound with a bearish tilt unless key resistance levels are reclaimed.

Gold Futures are currently in a corrective phase after facing rejection from the upper boundary of the rising channel. The sharp pullback from near the channel high has brought price back into the mid-channel region, where it is now stabilizing above a crucial horizontal support around 133,400–133,500. This zone is technically significant, as it aligns with the previous breakout base and has acted as a demand area during the recent consolidation. As long as Gold continues to hold above 133,500, the broader trend structure remains unchanged based on current levels, and the ongoing move can be treated as a healthy pullback within an uptrend. A sustained recovery above 136,000 could trigger renewed upside momentum toward 138,500, followed by a retest of the channel resistance near 140,000–141,000. However, a decisive breakdown below 133,400 would weaken the bullish bias and expose deeper downside levels near 131,000 and 129,200, where the next major demand zones are placed. Overall, the trend remains cautiously bullish, with near-term direction dependent on price behavior around the 133,500 support zone.

Natural Gas Futures remain in a strong bearish corrective structure after a decisive breakdown from the rising channel. The sharp rejection near the channel top was followed by an aggressive sell-off, suggesting a shift in short-term momentum. Price has now slipped below multiple short-term recovery channels and is trading near a crucial horizontal demand zone around 330–325, which coincides with the prior base formed before the last impulsive rally. This zone is technically important, as a sustained hold here could trigger a short-term stabilization or a corrective bounce. However, the overall structure continues to favor sellers as long as price remains below the broken channel support and the key supply area near 370–380. Any rebound toward 360–370 is likely to face selling pressure unless price reclaims 380 on a closing basis. A decisive breakdown below 325 would confirm continuation of the bearish trend and open the door for deeper downside toward 313, followed by 300. Overall, the trend bias remains bearish, with price action around the 325–330 zone acting as the immediate decision point.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

CEO’s Annual Round-Up – 2025

In 2025 round-up, CEO S K Hozefa highlights Navia’s successful rebranding and the launch of a self-reliant, in-house trading platform designed to offer clients enhanced control and operational reliability.

SCAM ALERT: How Fraudsters are Using Navia’s Name to Steal Your Money

Fraudsters are using sophisticated tactics—including fake social media groups, forged executive identities, and deceptive portals—to impersonate Navia and steal sensitive investor data.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.