Navia Weekly Roundup ( Dec 16 – Dec 20, 2024)

Week in the Review

The Indian markets erased all the last four weeks gains and posted biggest weekly fall in more than 2 years. The benchmark indices ended in red for all the trading sessions of the week amid global sell-off post US Fed cautious stance on the pace of future rate cuts, which led to huge FIIs selling.

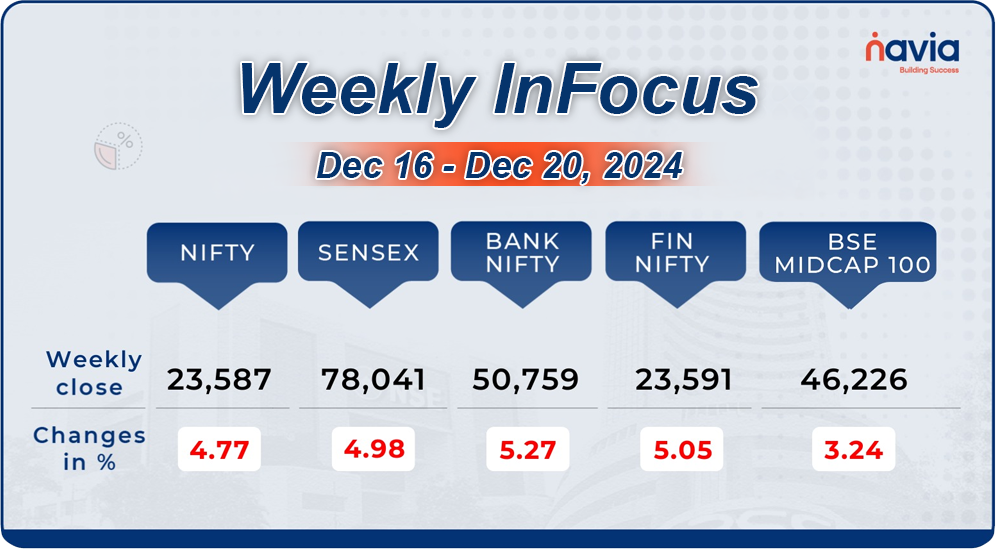

Indices Analysis

This week, BSE Sensex shed 4,091.53 points or 4.98 percent to close at 78,041.59, while the Nifty50 index fell 1,180.8 points or 4.76 percent to finish at 23,587.50.

BSE Mid-cap Index was down more than 3 percent with Piramal Enterprises, Torrent Power, Delhivery, L&T Technology Services, Phoenix Mills, Federal Bank, Bank Of India, NMDC, UPL, ACC, Cummins India, AU Small Finance Bank, Escorts Kubota falling 8-12 percent. On the other hand, General Insurance Corporation of India, Oberoi Realty, New India Assurance Company, Go Digit General Insurance, Godrej Industries, Star Health & Allied Insurance Company added 4-16 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

All the sectoral indices ended in the red with BSE Power and Metal indices shed nearly 7 percent each, BSE Capital Goods index was down 6 percent, BSE Telecom index slipped 5.9 percent.

Top Gainers and Losers

Currency Chronicles

USD/INR:

The Indian rupee slipped further, hitting a fresh record low of ₹85.10 during the week. It closed at ₹85.02 on December 20, down by 23 paise from its previous week’s closing of ₹84.79.

EUR/INR:

The euro lost ground, declining by 0.77% for the week to settle at ₹88.24. Sentiment in the EUR/INR market remains bearish, signaling continued pressure on the euro.

JPY/INR:

The Japanese yen also faced a decline, dropping 1.86% to close at ₹0.544581. Sentiment in the JPY/INR market is bearish, reflecting a cautious outlook for the yen.

Stay tuned for more currency insights next week!

Commodity Corner

Crude oil broke down from its rising channel, closing at 5933, down by 1.40%. Geopolitical tensions in the Middle East and global demand dynamics, particularly from China, may have influenced investor sentiment.From a technical perspective, a close below 5895 could indicate weakness in crude oil on an intraday basis, while holding above 5949 may signal strength.

Gold closed at 75,233, down 1.31%. The decline may be attributed to the influence of the U.S. Federal Reserve’s policy on investor sentiment, leading to increased volatility.Currently, gold has broken down from its rising channel. A sustained drop below 75,500 could indicate further weakness, while a breakout above 76,100 may signal potential upward momentum.The hawkish stance strengthened the U.S. dollar and increased bond yields, reducing gold’s appeal as a safe-haven asset and adding to the ongoing price volatility.

Natural gas prices surged 4.54% yesterday, closing at 305, driven by multiple positive factors. Colder weather forecasts in key markets like Europe and Asia boosted demand, while India reported a 12% rise in natural gas consumption and an 18% increase in LNG imports. These developments highlight strong global demand, supporting the upward momentum in prices. On the technical front, natural gas is trading within an ascending broadening wedge pattern. Further momentum is expected if prices surpass 299, while a break below 295 could signal additional downside

Silver closed at 85,146 and down 3.53%. This decline may be due to the influence of U.S. Federal Reserve policy on investor sentiment, contributing to volatility.Currently, silver is respecting its previous support and resistance channel. A drop below 86,500 would indicate weakness, while a rise above 88,300 could signal a potential upward movement.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Master the Pennant Pattern: Your Guide to Smarter Trades!

Discover the art of identifying and trading the Pennant Pattern—a dynamic continuation signal in technical analysis. Learn its key traits, the role of volume, and actionable strategies to capitalize on bullish and bearish breakouts. Take your trading skills to the next level with this essential guide!

SEBI’s Proposal: ITM Stock Options to Futures – What It Means for You

Discover SEBI’s innovative proposal to convert ITM stock options into futures before expiry, reducing settlement risks and simplifying trading. Read the blog to understand the impact and key takeaways!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?