Navia Weekly Roundup (Dec 15 – 19, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian benchmark indices ended volatile for the week amid broad sectoral recovery, positive global cues from US market rallies, and renewed FII buying post-Fed stability signals.

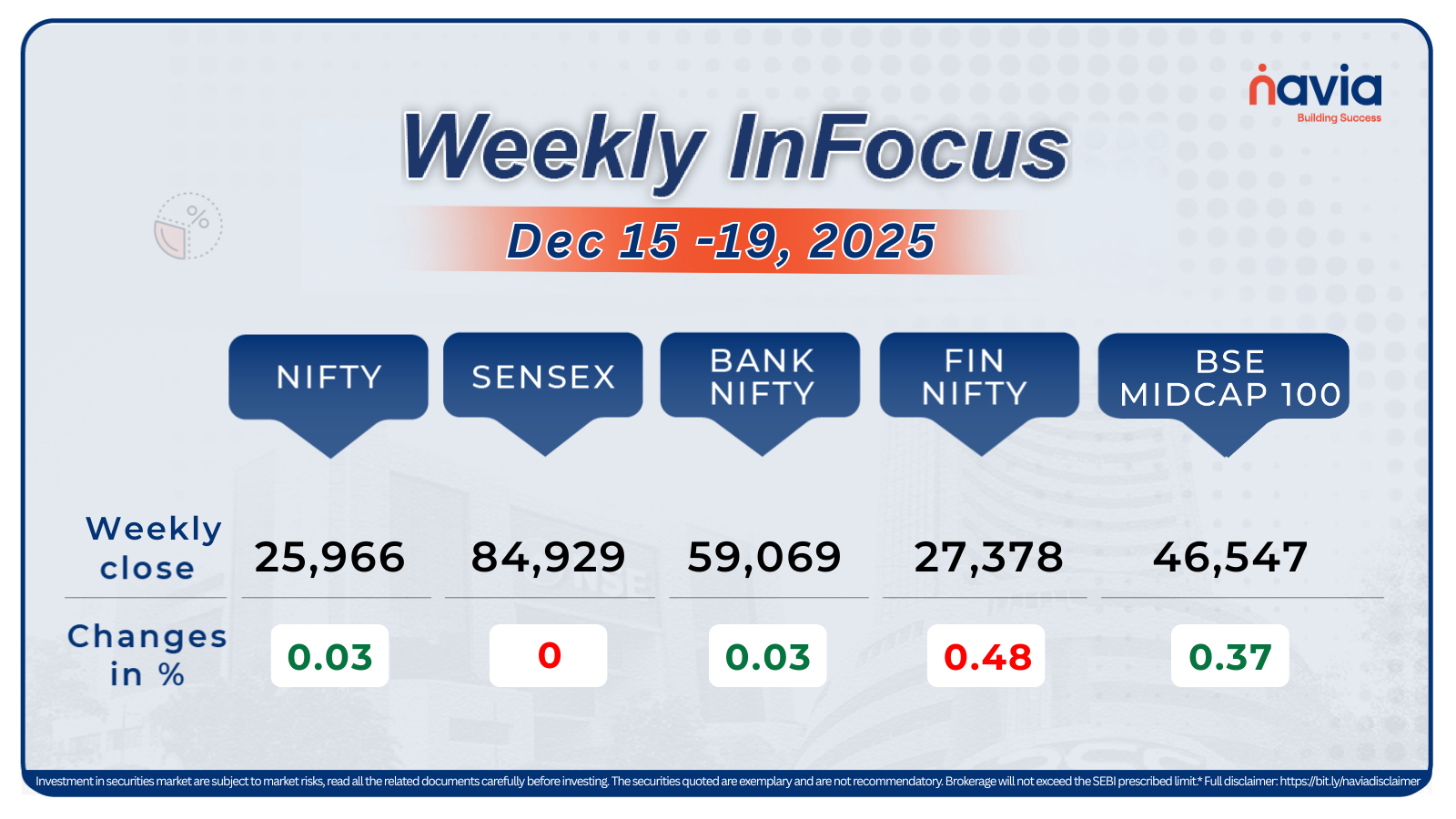

Indices Analysis

For the week, BSE Sensex index shed 0 percent to end at 84,929.36 and Nifty50 gained 0.03 percent to close at 25,966.40.

The BSE Large-cap Index shed nearly 0.4 percent dragged by HCL Technologies, Kotak Mahindra Bank, ICICI Bank, Sun Pharmaceuticals, and Asian Paints, while Tata Motors, Power Grid Corporation, Bharat Electronics, Reliance Industries, and Larsen & Toubro gained between 1.5-2.4 percent.

BSE Mid-cap Index declined 0.3 percent dragged by select IT and consumer names like Jio Financial and Grasim amid profit booking, however Eternal Limited, UltraTech Cement, and Kotak Mahindra Bank-linked midcaps gained between 2-3.5 percent.

The BSE Small-cap index fell 0.6 percent with logistics and defence stocks like Sona BLW and Kaynes Technology under pressure shedding 2-4 percent, while metals and financial smallcaps such as Tata Steel associates and select power names added between 3-5 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

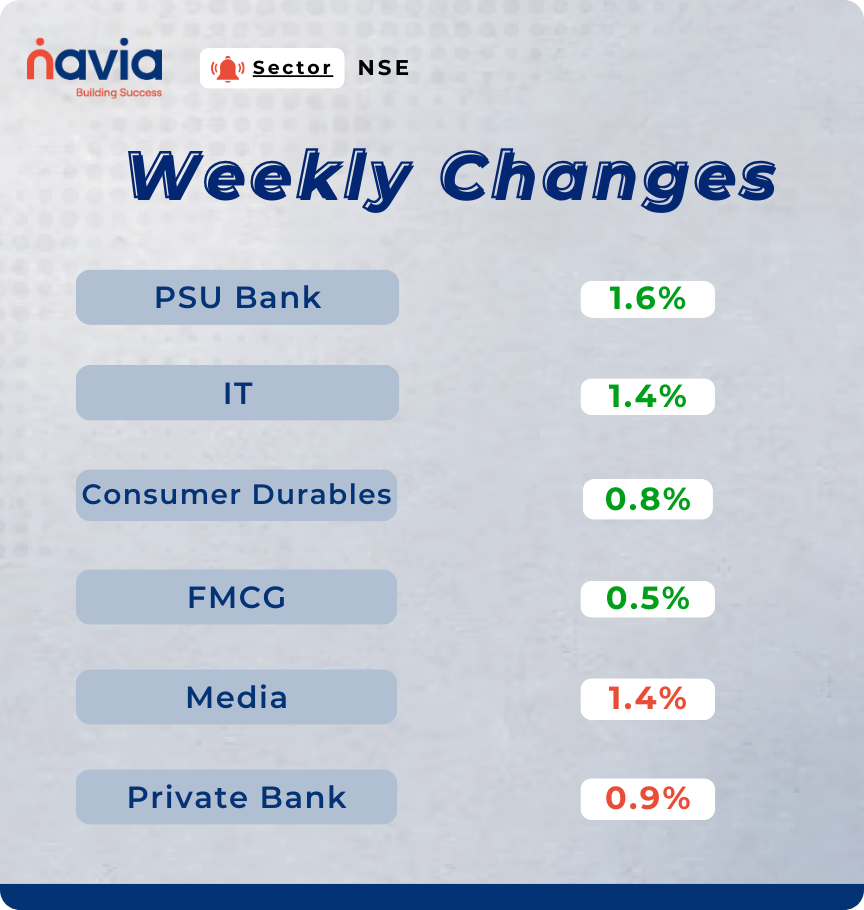

Sector Spotlight

The Nifty PSU Bank index topped the gainers with a 1.6% rise, followed by Nifty IT, which advanced 1.4%. Nifty Consumer Durables posted gains of 0.8% and Nifty FMCG rose 0.5%. The Nifty Media index was the biggest laggard, sliding 1.4%, followed by Nifty Private Bank, which fell 0.9%.

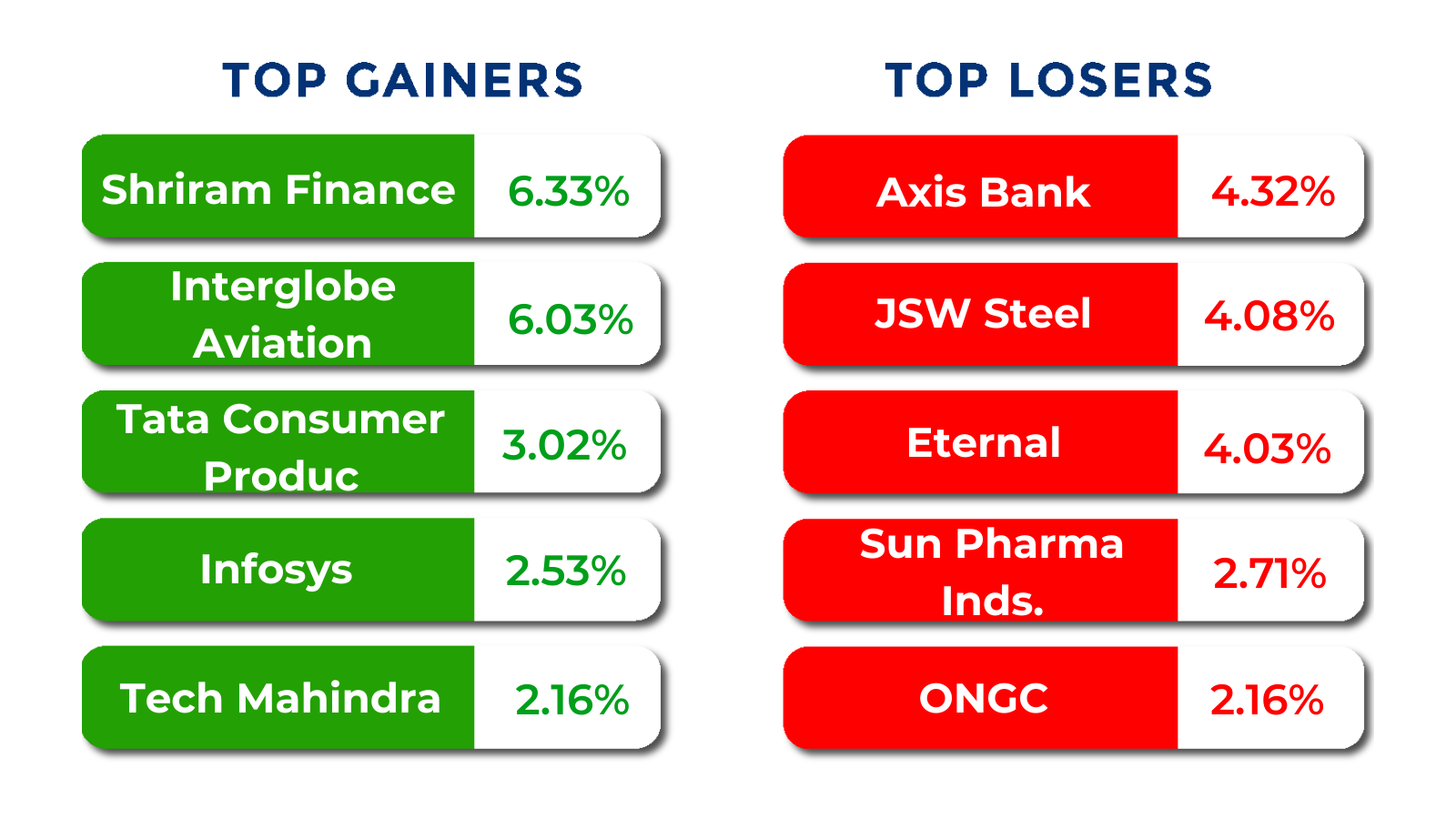

Top Gainers and Losers

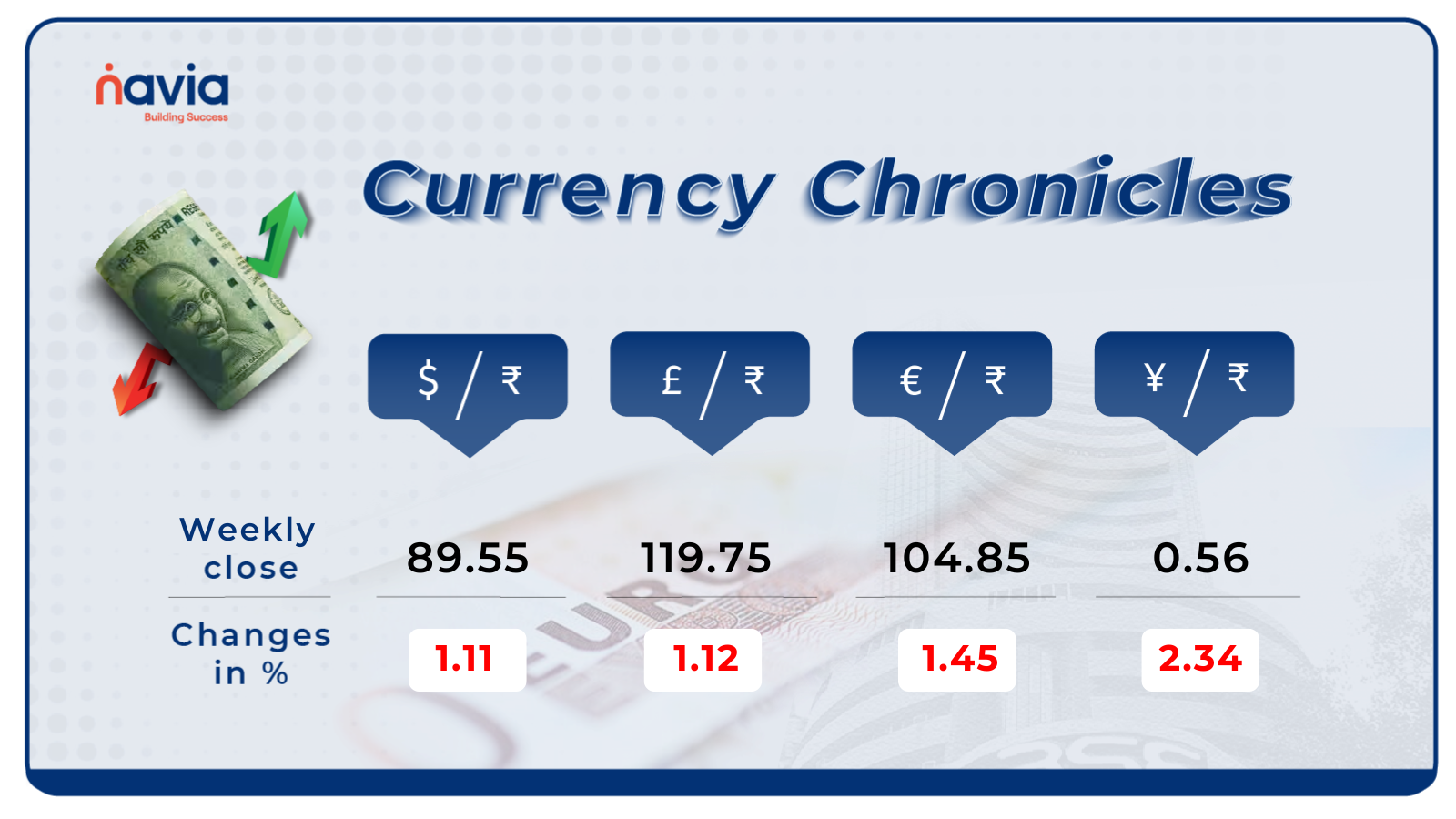

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹89.55 per dollar, losing 1.11% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹104.85 per euro, losing 1.45% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.56 per yen, losing 2.34% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

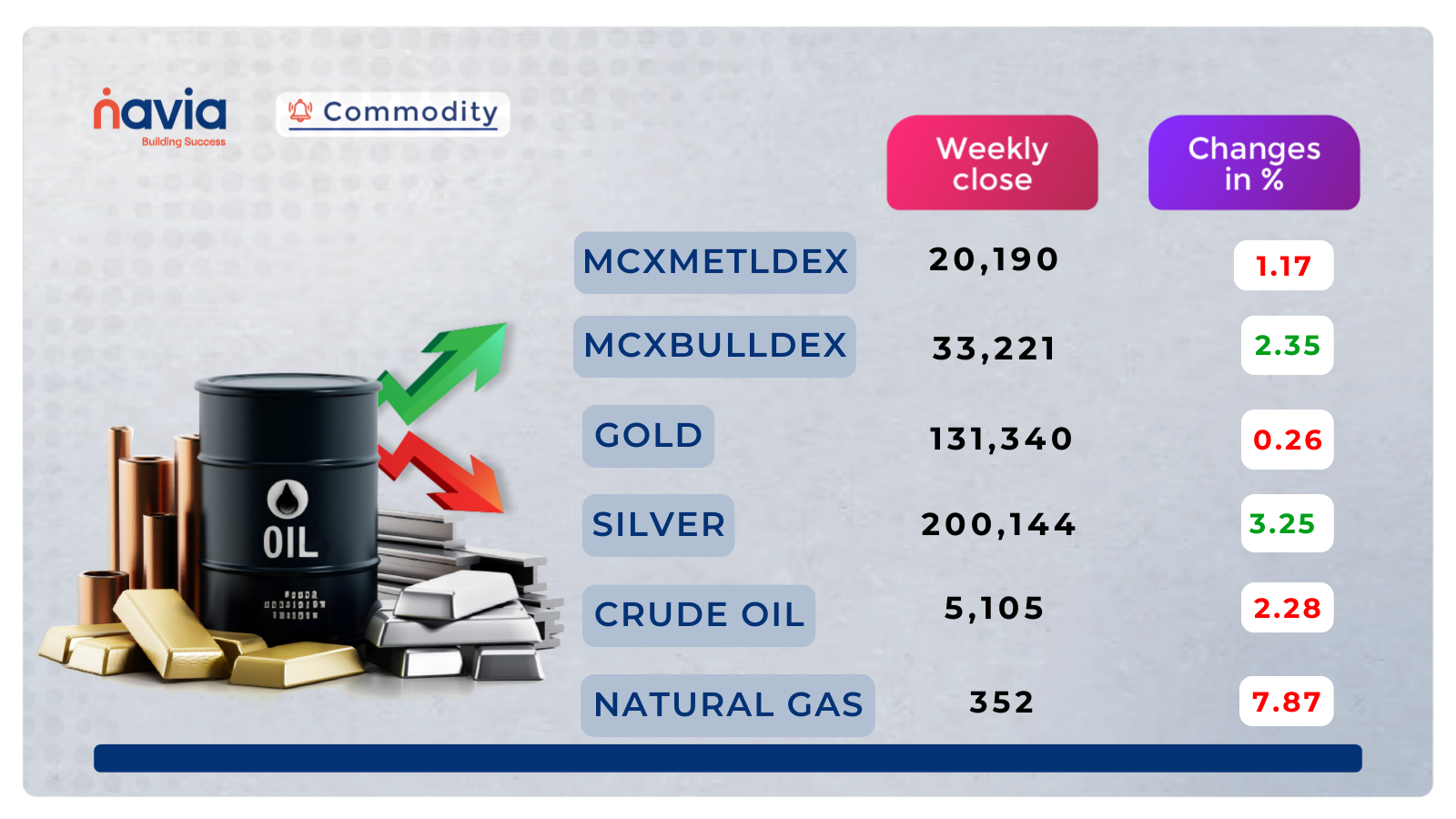

Commodity Corner

MCX Crude Oil remains in a weak to bearish phase on the medium-term chart. The earlier rising trendline has been decisively broken, confirming a shift from an uptrend to a distribution-to-downtrend structure. Price has failed to reclaim the previous breakout support near 5,400, which has now turned into a strong resistance zone. The market continues to form lower highs and lower lows, indicating persistent selling pressure. The sharp fall from the 5,850–5,900 region marked a trend reversal, followed by range-bound consolidation and another leg lower. A breakdown below 5,000 could accelerate declines toward 4,900–4,850. Sustaining above 5,400 is crucial to neutralize bearish pressure. As long as crude trades below 5,400, the risk remains skewed to the downside. Only a decisive breakout above 5,400–5,450 could signal stabilization and open room for a recovery toward 5,600.

Gold traded near elevated levels in the last session, easing slightly on profit-taking and a stronger U.S. dollar, yet remaining on track for weekly gains amid safe-haven demand and macro uncertainty. The broader technical structure stays constructive, supported by recent record highs and strong momentum in Indian markets. Immediate support lies just below current levels where buying interest may emerge, while near-term resistance is placed at recent highs. A breakout above resistance could extend gains, whereas a break below support may trigger a deeper correction. Buy-on-dips strategies remain favorable as long as the medium-term trend holds.

MCX Natural Gas has seen a sharp trend reversal after failing to sustain above the rising channel, shifting the near-term structure from bullish to corrective–bearish. Price has broken down decisively below the rising channel, confirming exhaustion at higher levels near 480–490. The sequence of lower highs and lower lows since the breakdown signals increasing selling pressure. The strong up-move has been completely retraced into a distribution-to-correction phase. A break below 334 could extend the fall toward 320–300. Major Resistance: 392–400 (previous support turned resistance). Below 392–400, the path of least resistance remains lower. Only a sustained recovery above 400 would stabilize the structure and open scope for a move back toward 430–450. Short-term traders may prefer a sell-on-rise approach near resistance, while positional traders should wait for either a base formation near 334 or a decisive reclaim of 400 before considering fresh long exposure.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

The White Metal: Why Silver’s Dual Role Makes it a Timeless Investment

Silver stands as a unique “dual-purpose” asset, acting simultaneously as a timeless store of value and an indispensable industrial engine for the green energy revolution.

Dawn of Profits: Your Simple Guide to the Morning Star Candlestick Pattern

The Morning Star is a highly reliable three-candle bullish reversal pattern that signals the end of a downtrend and the beginning of a new “dawn” of upward momentum.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.