Navia Weekly Roundup ( Dec 09 – Dec 13, 2024)

Week in the Review

The Indian benchmark indices ended higher for the fourth consecutive week ended December 13 amid volatility, led by mixed global cues ahead of Fed policy outcome next week, while FIIs buying, better Indian CPI and IIP data helped the indices to reduce the weekly losses.

Indices Analysis

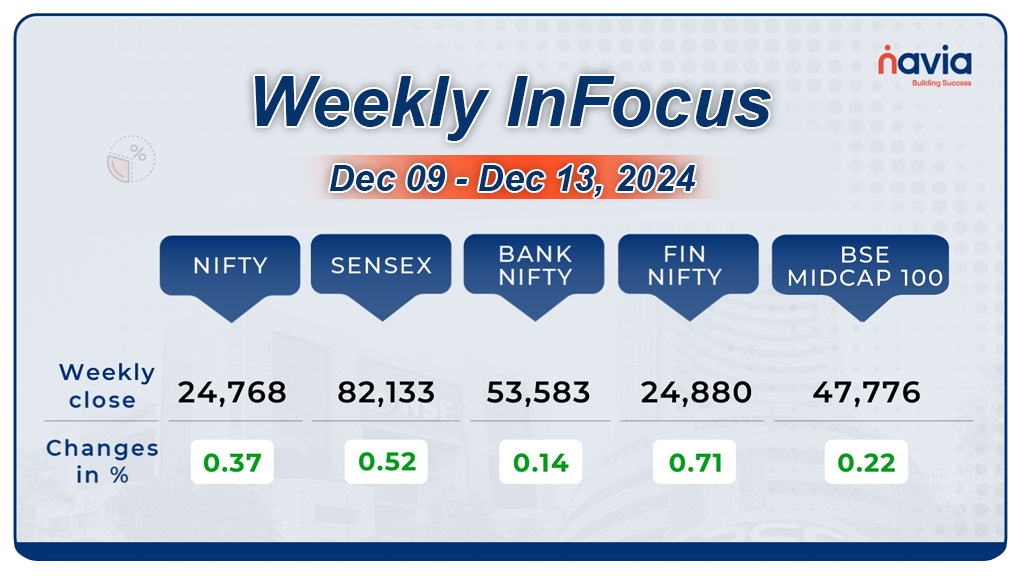

This week, BSE Sensex rose 623.07 points or 0.52 percent to end at 82,133.12, while the Nifty50 index gained 90.5 points or 0.37 percent to close at 24,768.30.

BSE Mid-cap Index was up 0.2 percent. Major gainers were Delhivery, Clean Science & Technology, CRISIL, Max Healthcare Institute, Nippon Life India Asset Management, Muthoot Finance, while losers were Emami, Zee Entertainment Enterprises, Biocon, Go Digit General Insurance, UCO Bank, Sun TV Network, Sona BLW Precision Forgings, Kansai Nerolac Paints, Castrol India.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

On the sectoral front, BSE Information Technology index rose 2.6 percent, BSE Telecom index was up 1.7 percent, BSE Realty index rose 0.6 percent. On the other hand, BSE Energy and FMCG indices shed 1.5 percent each, and BSE Oil & Gas index slipped nearly 1 percent.

Top Gainers and Losers

Currency Chronicles

USD/INR:

The Indian rupee hit fresh record low of 84.86 during the week ended December 13. However, domestic currency extended the losses as it ended 10 paise lower at 84.79 per dollar on December 13.

EUR/INR:

The euro hit a weekly low of ₹88.934 during the week ended, declining by 0.72%. The EUR/INR market sentiment remains cautious, reflecting subdued support for the euro.

JPY/INR:

The Japanese yen dropped to ₹0.5526 during the week ended, registering a decline of 1.77%. Market sentiment remains neutral, indicating a balanced outlook amid shifting global currency dynamics.

Stay tuned for more currency insights next week!

Commodity Corner

Crude oil closed at 5,943, up 44 points, retesting the support zone of a broken symmetrical triangle, indicating potential for further upward momentum. A move above 6,000 could signal a bullish trend, while dropping below 5,950 may lead to an intraday decline.

Recent developments include the International Energy Agency’s forecast of a 2025 supply surplus, which has tempered price gains. Additionally, Saudi Arabia plans to increase crude oil supply to China in January, marking the highest volume since October.While the forecasted supply surplus creates a bearish outlook, strong demand signals from China could balance or offset some of the bearish pressure

Gold experienced close at 76,735 after three consecutive bullish sessions. This downturn occurred as the price encountered resistance at the upper boundary of a rising channel, leading to a bearish close.

The decline is attributed to profit-taking following a recent rally that pushed gold to a one-month high. Investors booked profits in anticipation of the U.S. Federal Reserve’s upcoming meeting, where a 25-basis-point interest rate cut is widely expected

Natural gas prices surged by 4.50% in the last trading session, closing at 293.2. This bullish movement is primarily due to increased demand driven by colder weather conditions, leading to higher heating requirements.

Technically, another move is expected above 300, while a break below 296.5 should be monitored closely.

Silver experienced a significant decline, dropping 3,169 points to close at 89,893. This sharp downturn is primarily attributed to profit-taking following a recent rally that had pushed silver prices higher. Additionally, expectations of a U.S. rate cut and a stronger U.S. dollar have exerted downward pressure on silver, as commodities priced in dollars become more expensive for holders of other currencies, reducing demand.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Mainboard IPO performance 2023

Delve into the remarkable performance of 2023’s mainboard IPOs, where 4 out of 5 delivered listing day gains—a striking 80% win rate. This blog highlights the trends, top performers, and key insights from one of the most dynamic IPO years in recent history. Don’t miss the detailed month-by-month breakdown!

Myths, Markets, and Mastery: Salim and Devi’s Tale

Follow the inspiring journey of Salim and Devi as they uncover the truth behind stock market myths and embrace informed investing. What starts as a pursuit of quick gains evolves into a lesson on patience, long-term strategies, and the power of making educated decisions. With Navia’s Zero Brokerage Plan, they discover a transparent, cost-effective way to transform their investment journey into a path of financial empowerment

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?