Navia Weekly Roundup (Dec 08 – 12, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian benchmark indices ended marginally lower for the week with heightened volatility from the US Federal Reserve’s rate cut decision and mixed global cues.

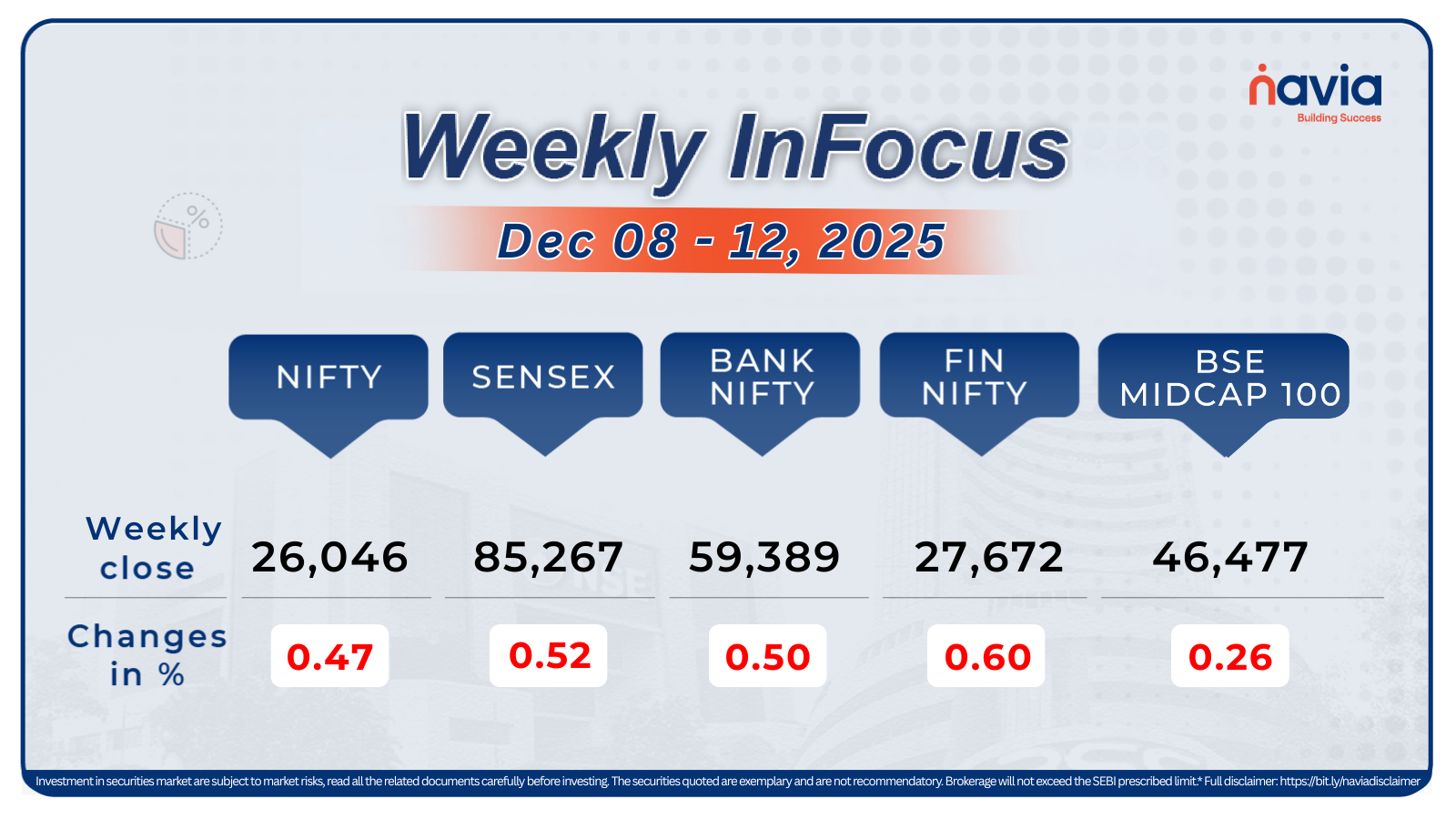

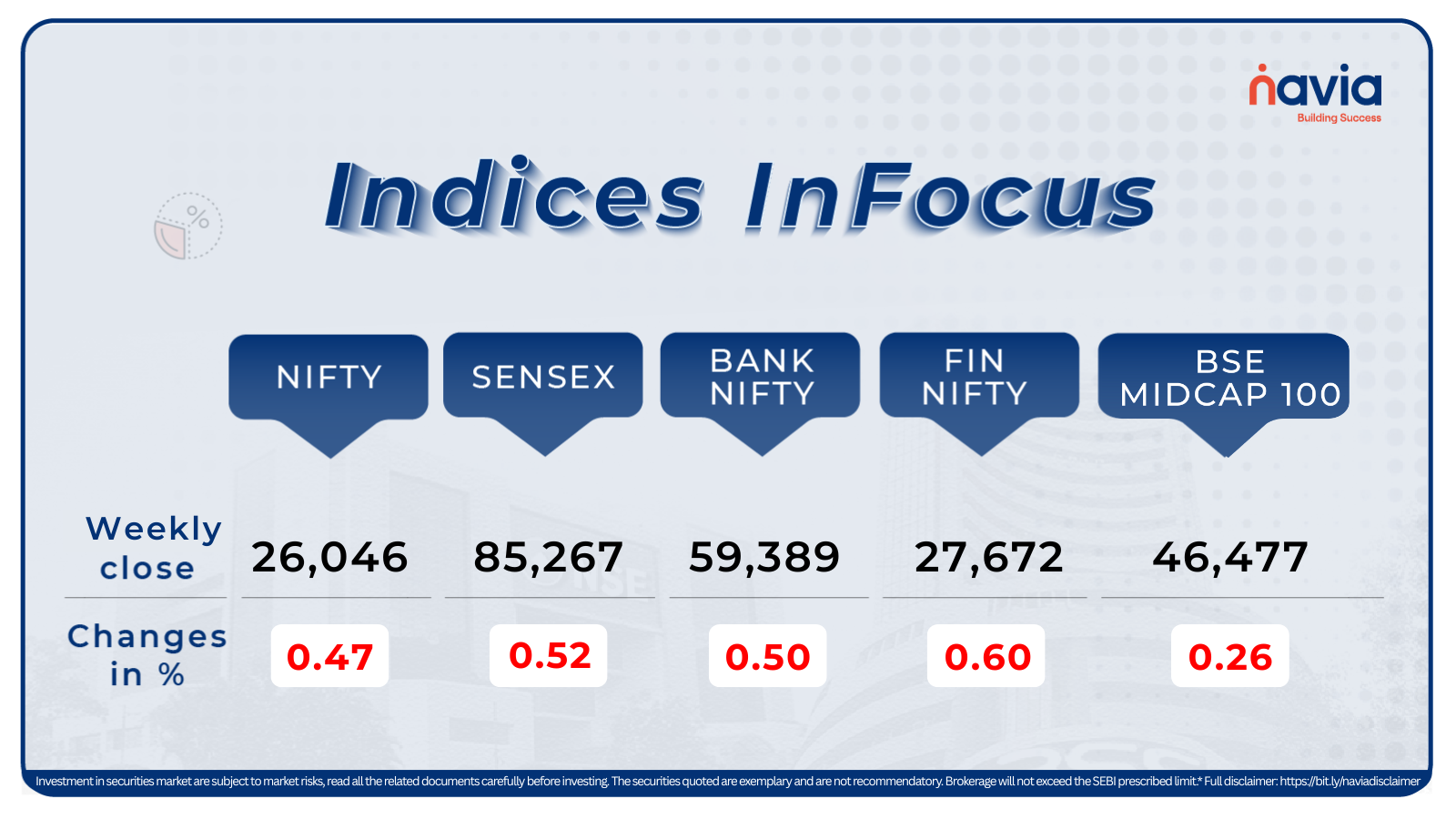

Indices Analysis

The Nifty50 index ended the week lower by 0.47% at 26,046, while the BSE Sensex index also closed down by 0.52% at 85,267.

The BSE Large-cap Index shed nearly 0.5 percent dragged by Hindustan Unilever, Sun Pharmaceuticals, Asian Paints, ITC, and Bharti Airtel, while Tata Steel, UltraTech Cement, Eternal Limited, Larsen & Toubro, and Maruti Suzuki gained between 1.5-3.4 percent.

BSE Mid-cap Index declined 0.2 percent dragged by select IT and consumer stocks amid profit booking, however Kotak Mahindra Bank, Jio Financial, Grasim Industries, and Ola Electric Mobility gained between 2-4 percent.

The BSE Small-cap index fell 0.8 percent with defence and logistics names like Sona BLW and Kaynes Technology under pressure, while select financials and metals such as Eternal and Tata Steel-linked smallcaps added between 3-5 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

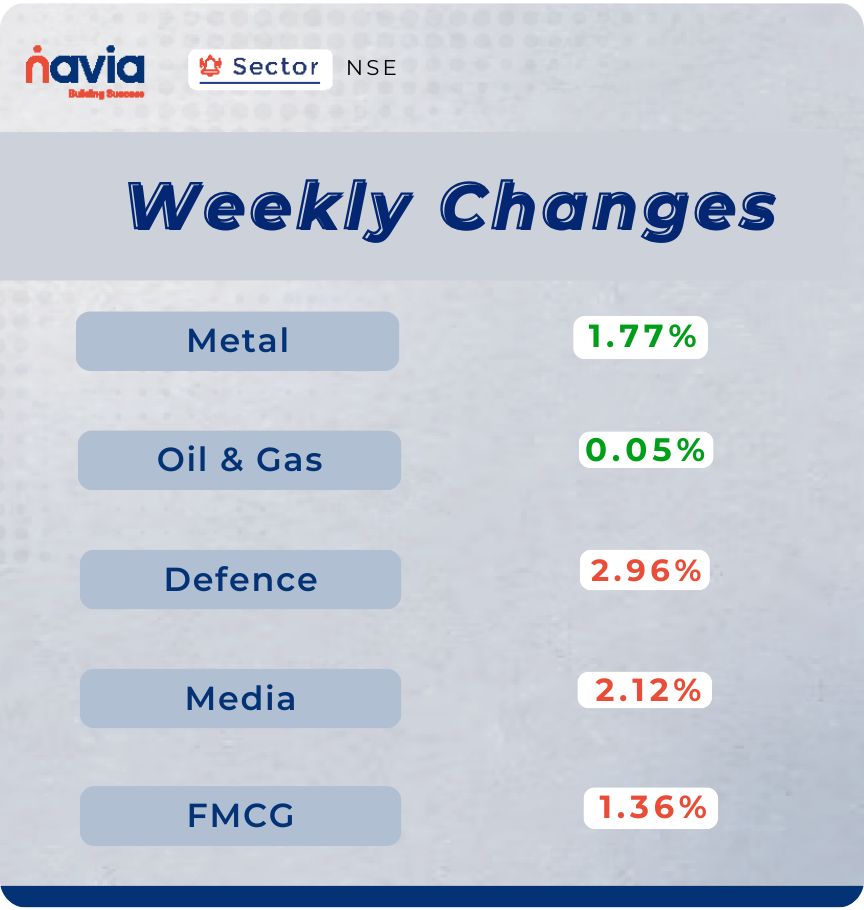

On the sectoral front, the market showed a divergence between rising and falling indices. The Nifty Metal index led the gains, rising 1.77 percent, followed by a fractional increase in Nifty Oil & Gas (up 0.05 percent). This contrasted sharply with sectors facing selling pressure. Leading the decline was Nifty Defence, which shed nearly 3 percent (down 2.96 percent), followed by Nifty Media, losing 2.12 percent. Nifty FMCG rounded out the losers with a decline of 1.36 percent.

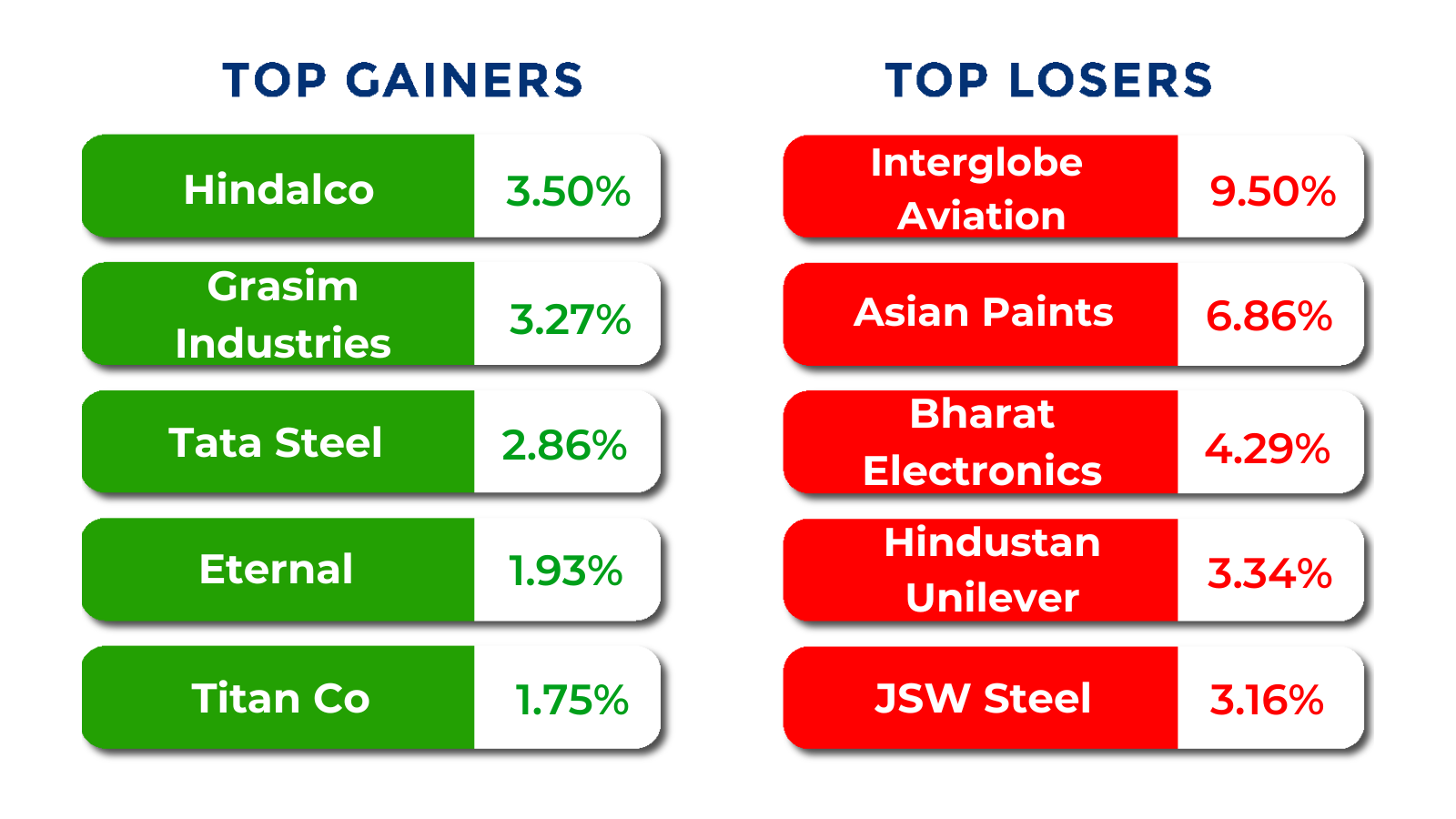

Top Gainers and Losers

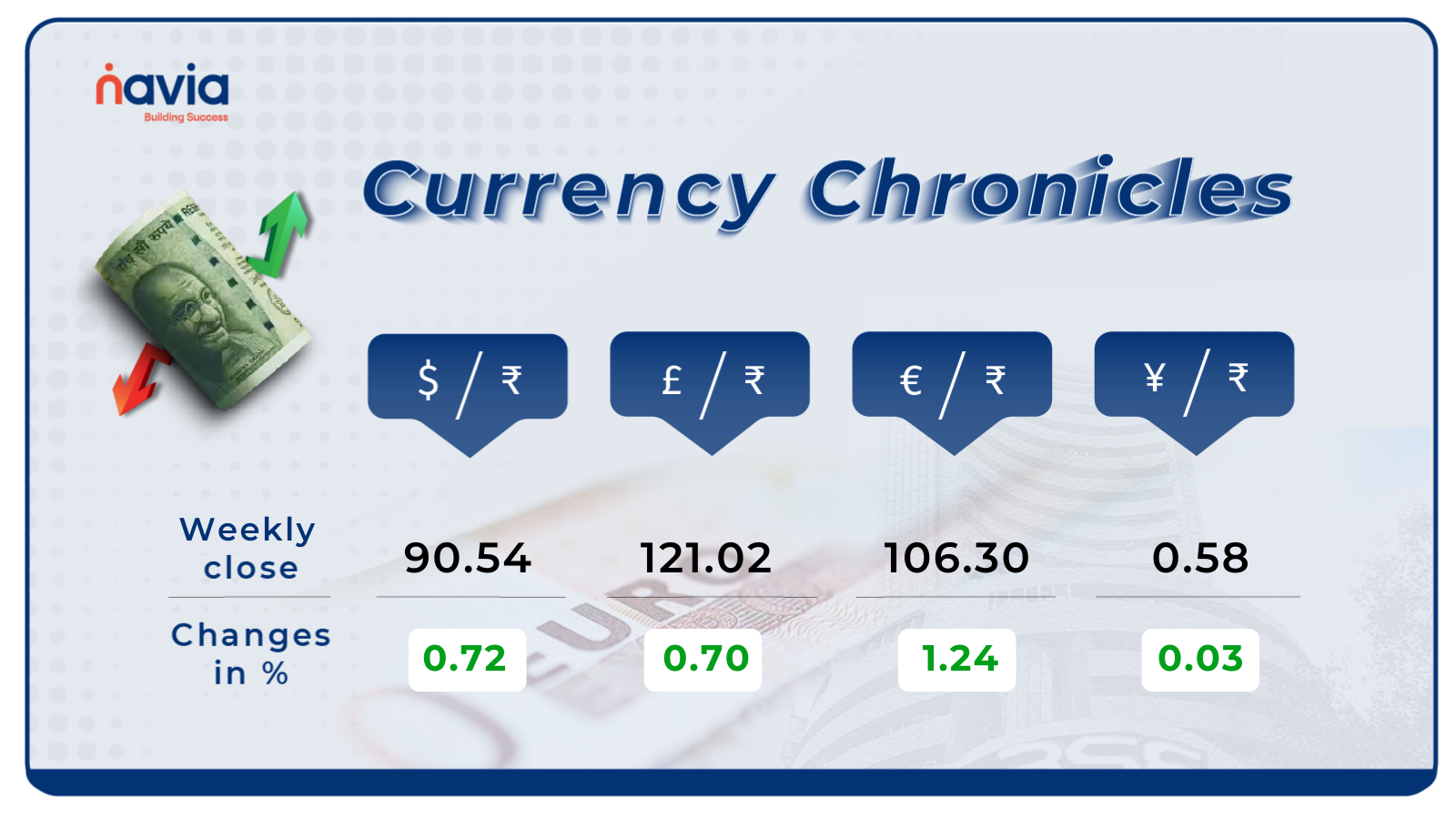

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹90.54 per dollar, gaining 0.72% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹106.30 per euro, gaining 1.24% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.58 per yen, gaining 0.03% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

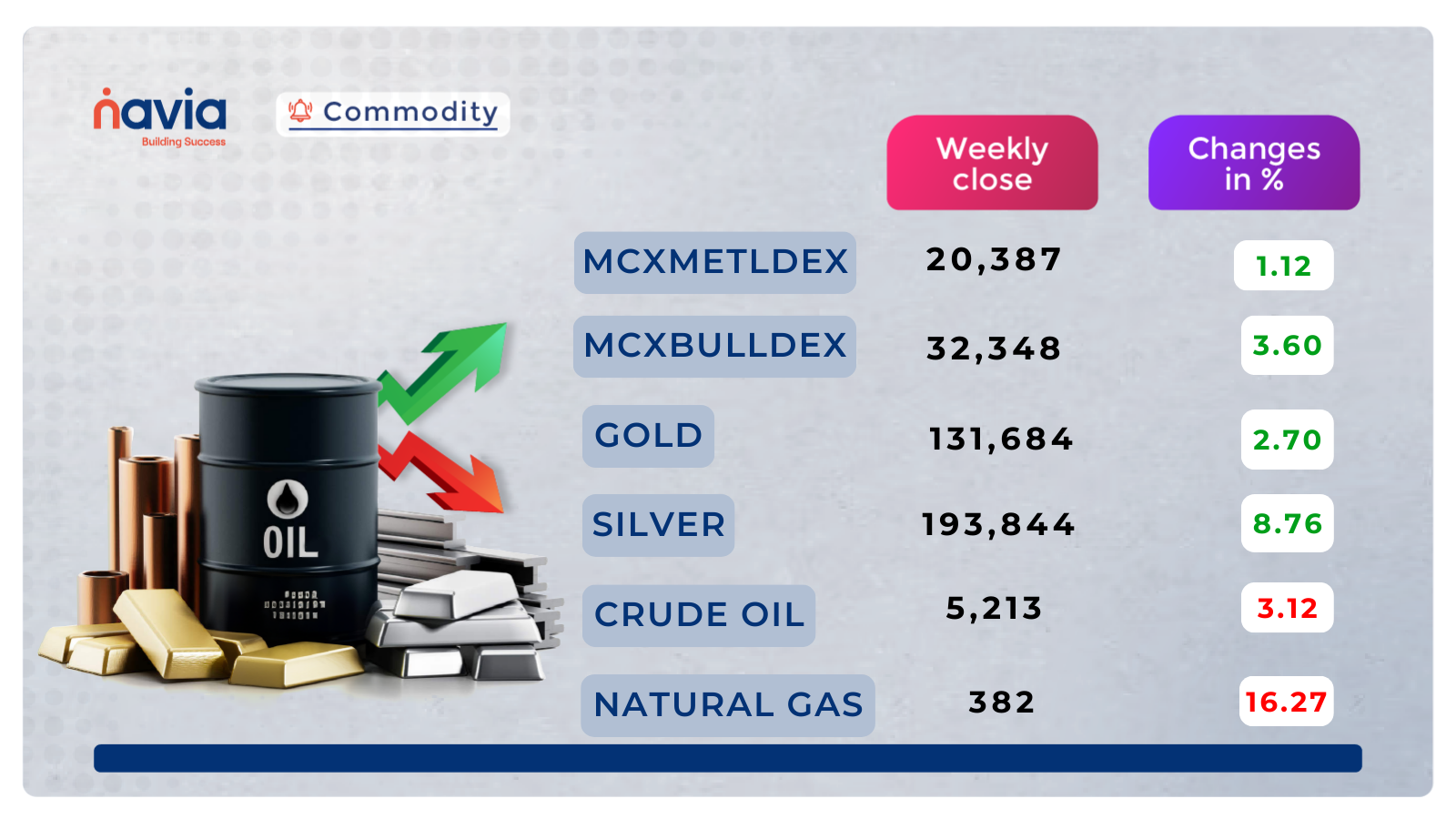

Commodity Corner

Crude Oil continues to trade weak near 5,180, slipping further after repeated rejections from the 5,303 horizontal resistance and the downward sloping trendline that has dominated the market since early October. Price is now compressing into the apex of a descending triangle pattern, with support at 5,120–5,140 acting as the last near-term defence. A breakdown below this support zone may trigger extended selling pressure toward 5,010, the major swing low and a strong structural demand area. The broader trend remains bearish as long as crude stays below the trendline and key resistance at 5,303, with intermediate hurdles at 5,433 and 5,602. Only a decisive breakout above 5,303 would signal short-term recovery, shifting momentum toward 5,433 or higher.

In the last session, Gold closed at 131,684. Gold has broken out strongly above its major downward channel and has also sustained above the rising channel structure, indicating a firm shift in momentum toward the upside. The breakout above the key horizontal resistance around 132,000 confirms renewed bullish strength, supported by strong impulsive candles and consistent higher–high formations. As long as Gold trades above the breakout zone of 131,800–132,000, the overall trend remains decisively positive. Any pullback into this region is likely to act as a retest and attract renewed buying interest. A sustained move above 132,600 may open the gates for a continuation rally toward 133,500 followed by 134,200. On the downside, failure to hold the breakout zone would signal exhaustion, potentially dragging prices back toward 130,400, which serves as the next crucial demand level. Until a breakdown occurs, momentum clearly favors buyers, and upward continuation remains the dominant scenario.

Natural Gas has broken decisively below its rising channel structure, signaling a strong shift in momentum toward the downside. The recent breakdown accelerated selling pressure, dragging prices sharply lower toward the major horizontal support near 381–385, which aligns with previous consolidation zones. This zone is acting as the last immediate demand area, and a sustained close below it could trigger a deeper decline toward 365, followed by 350 as the next bearish extension levels. The bias remains strongly negative as long as price trades below the former support trendline and the mid-range resistance around 410–415, which now acts as a supply zone. Any short-term bounce is likely to be limited unless Natural Gas reclaims 415, which would signal a possible recovery toward 430. Until then, momentum favors sellers, and breakdown continuation remains the dominant scenario.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Breaking Through the Gloom: Decoding the Bullish Piercing Line Pattern

The Piercing Line Pattern is a powerful bullish reversal candlestick pattern that appears at the bottom of a downtrend, signaling a shift in momentum from sellers to aggressive buyers.

Hanging by a Thread: Mastering the Bearish Hanging Man Pattern

The Hanging Man Pattern is a powerful single-candlestick bearish reversal pattern that forms only at the peak of an established uptrend.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.