Navia Weekly Roundup ( Dec 02- Dec 6, 2024)

Week in the Review

The bulls dominated Dalal Street on the third consecutive week ended December 6, as the benchmark indices post biggest weekly gains in last six months amid positive global markets, falling crude oil prices, and inline RBI policy announcement.

Indices Analysis

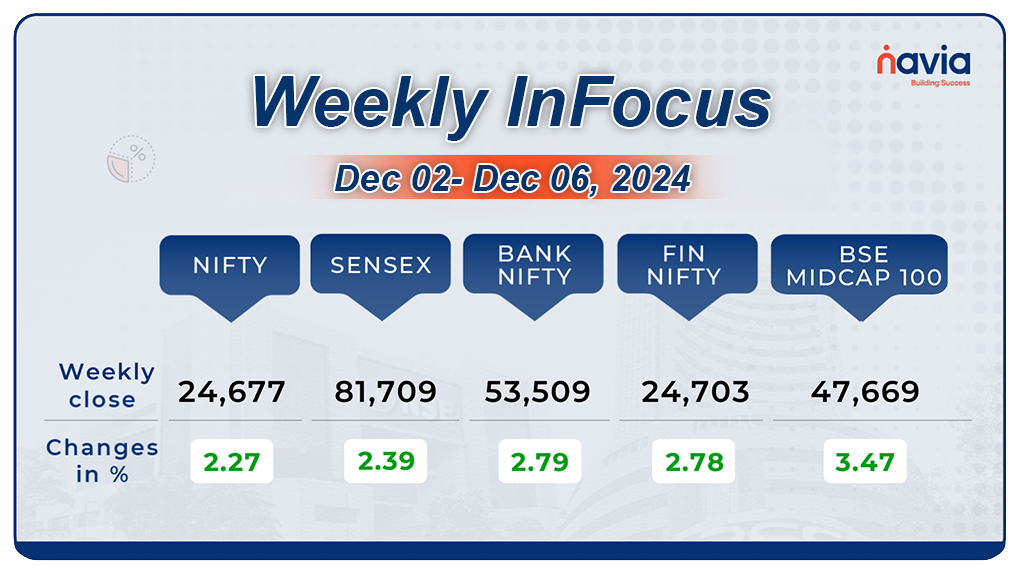

This week, BSE Sensex surged 1,906.33 points or 2.38 percent to end at 81,709.12, while the Nifty50 index added 546.7 points or 2.27 percent to close at 24,677.8.

BSE Mid-cap Index added 3.5 percent supported by Indraprastha Gas, PB Fintech, UCO Bank, Max Healthcare Institute, Zee Entertainment Enterprises, Castrol India, Tata Elxsi, Dixon Technologies, Gujarat Fluorochemicals. However, losers included Vedant Fashions, Emami, Ajanta Pharma, GlaxoSmithKline Pharmaceuticals, FSN E-Commerce Ventures (Nykaa) and Oil India.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

On the sectoral front, Nifty Realty and PSU Bank indices added 5 percent each, Nifty Metal added 4 percent. Nifty Media and Nifty IT index was up nearly 4 percent.

Top Gainers and Losers

Currency Chronicles

USD/INR:

The Indian rupee touched fresh record low of 84.73 and ended 20 paise lower at 84.69 per dollar on December 6 against the November 29 closing of 84.49.

EUR/INR:

The euro saw a modest gain this week, rising by 0.41% to close at ₹89.5870. Sentiment in the EUR/INR market remains cautiously optimistic, reflecting steady support for the euro.

JPY/INR:

The Japanese yen remained steady this week, edging down by 0.01% to close at ₹0.56. Sentiment in the market continues to be neutral, reflecting a balanced outlook amid global currency dynamics.

Stay tuned for more currency insights next week!

Commodity Corner

Crude oil ended in negligible red at 5,787 down by 0.31% after the OPEC meeting.Technically, crude oil formed a descending triangle in the higher time frame and a symmetrical triangle in the smaller time frame. A breakout above 5,870 could push crude towards 5,960, while a breakdown below 5,750 may result in an intraday fall.

Gold prices declined by 0.64% closing at 75,910 in the last trading day. This downturn caused gold to break below its raising channel, as indicated in charts. The decline is primarily attributed to investor caution ahead of the U.S. non-farm payroll data release scheduled for December 6, 2024, which could influence the Federal Reserve’s interest rate decisions. Both events are generally unfavorable for gold prices.

From a technical perspective, if gold sustains levels below 76,400, it may exhibit further weakness. Conversely, maintaining levels above 76,555 could indicate a slight recovery.

Natural gas is trading in an ascending, broadening wedge pattern. In the last trading session, it attempted to take support in the 258-260 range. If natural gas holds above the 263 range, an upward momentum could be observed in the coming days. Conversely, a break below 257 may result in an intraday decline.

On yesterday’s trading session, silver prices gained by 1.63%, closing at 90,813. This downturn was primarily attributed to investor caution ahead of the U.S. non-farm payroll data release, which could influence the Federal Reserve’s interest rate decisions. Traders are advised to consider levels above 92,800 for an upward move and below 92,000 for slight downside momentum.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Investing in Nippon India Gilt 5-Year Benchmark G-Sec ETF (GILT5YBEES)

Looking for a low-risk investment option with the stability of government bonds? This week, explore the Nippon India Gilt 5-Year Benchmark G-Sec ETF (GILT5YBEES). Discover its features, performance, and benefits, and learn how to set up a SIP using the Navia app for a hassle-free investing experience

SME IPO Performance Summary for 2023

Curious about the performance of SME IPOs in 2023? This week, dive into the highlights of a record-breaking year, featuring top-performing IPOs, robust listing gains, and insights for savvy investors. Discover how the SME IPO market is shaping India’s economic landscape with Navia.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?