Navia Weekly Roundup (August 25 – 29, 2025)

Week in the Review

The Indian market snapped two-week gaining streak and lost nearly 2 percent as the investors remained cautions over fresh US tariffs on Indian exports and continued FII selling, however, expectations of GST rate cut in the upcoming GST council meeting provided some support.

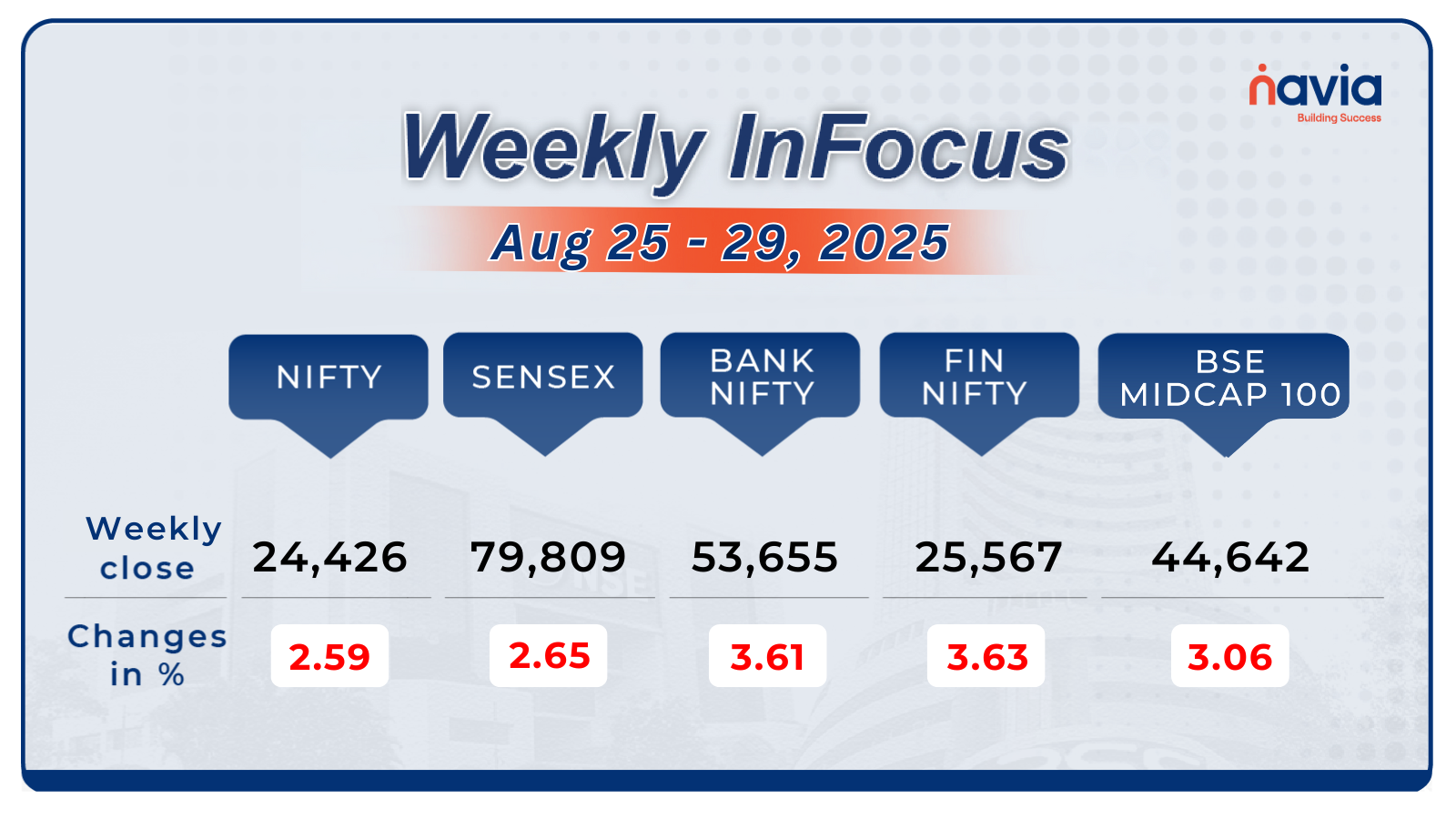

Indices Analysis

For the week, the BSE Sensex index shed 2.65 percent to close at 79,809.65 and Nifty50 lost 2.59 percent to end at 24,426.85. However, in the month of August, Sensex fell 1.06 percent and Nifty index was down 0.79 percent.

The BSE Large-cap Index declined 2 percent. Losers were IDBI Bank, Interglobe Aviation, Union Bank of India, Cholamandalam Investment and Finance Company, REC, HDFC Asset Management Company, Mahindra and Mahindra. However, losers included Waaree Energies, Britannia Industries, Hyundai Motor India, Maruti Suzuki India.

BSE Mid-cap Index fell nearly 3 percent dragged by Nippon Life India Asset Management, PB Fintech, Solar Industries India, Emcure Pharmaceuticals, Max Healthcare Institute, Bandhan Bank, Rail Vikas Nigam, CRISIL, Emami, Tata Elxsi, Ajanta Pharma. However, gainers were Ola Electric Mobility, Crompton Greaves Consumer Electrical, Dalmia Bharat, Kansai Nerolac Paints.

The BSE Small-cap index shed 3 percent with Blue Jet Healthcare, Vishnu Prakash R Punglia, Angel One, Sterlite Technologies, Panama Petrochem, Ethos, Shankara Building Products, Shiva Cement, Sai Life Sciences, Nelcast, Technocraft Industries (India), Gokaldas Exports, GOCL Corporation, Faze Three, Ramky Infrastructure falling between 10-13%. On the other hand, Sadhana Nitrochem, Kabra Extrusion Technik, Rattanindia Enterprises, Permanent Magnets, Jindal Poly Films, Timex Group India, Edelweiss Financial Services, Advanced Enzyme Technologies, Apollo Micro Systems, Kolte-Patil Developers, S H Kelkar & Company, Seamec added between 10-21%.

The Foreign Institutional Investors (FIIs) extended their selling on 9th consecutive week, as they sold equities worth Rs 21,151.90 crore. On the other hand, Domestic Institutional Investors (DII) continued their buying in 20th consecutive week, as they bought equities worth Rs 28,645.04 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

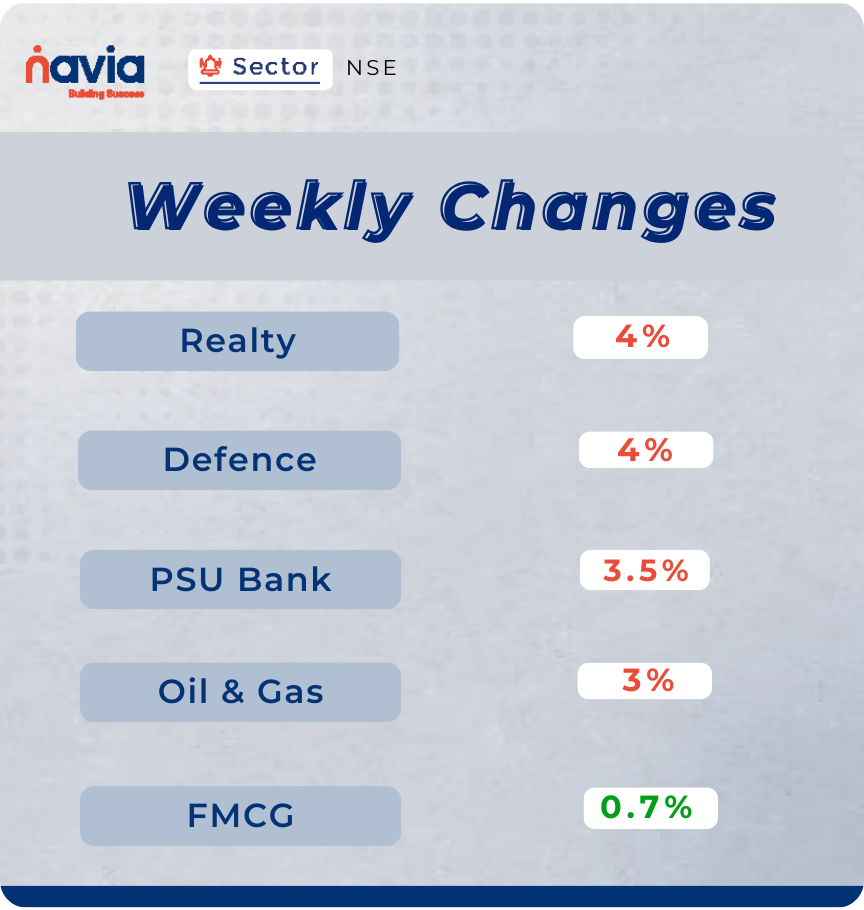

Sector Spotlight

On the sectoral front, Nifty Realty index shed more than 4 percent, Nifty Defence index fell 4 percent, Nifty PSU Bank index shed 3.5 percent, Nifty Oil & Gas index slipped 3 percent. On the other hand, Nifty FMCG index added 0.7 percent.

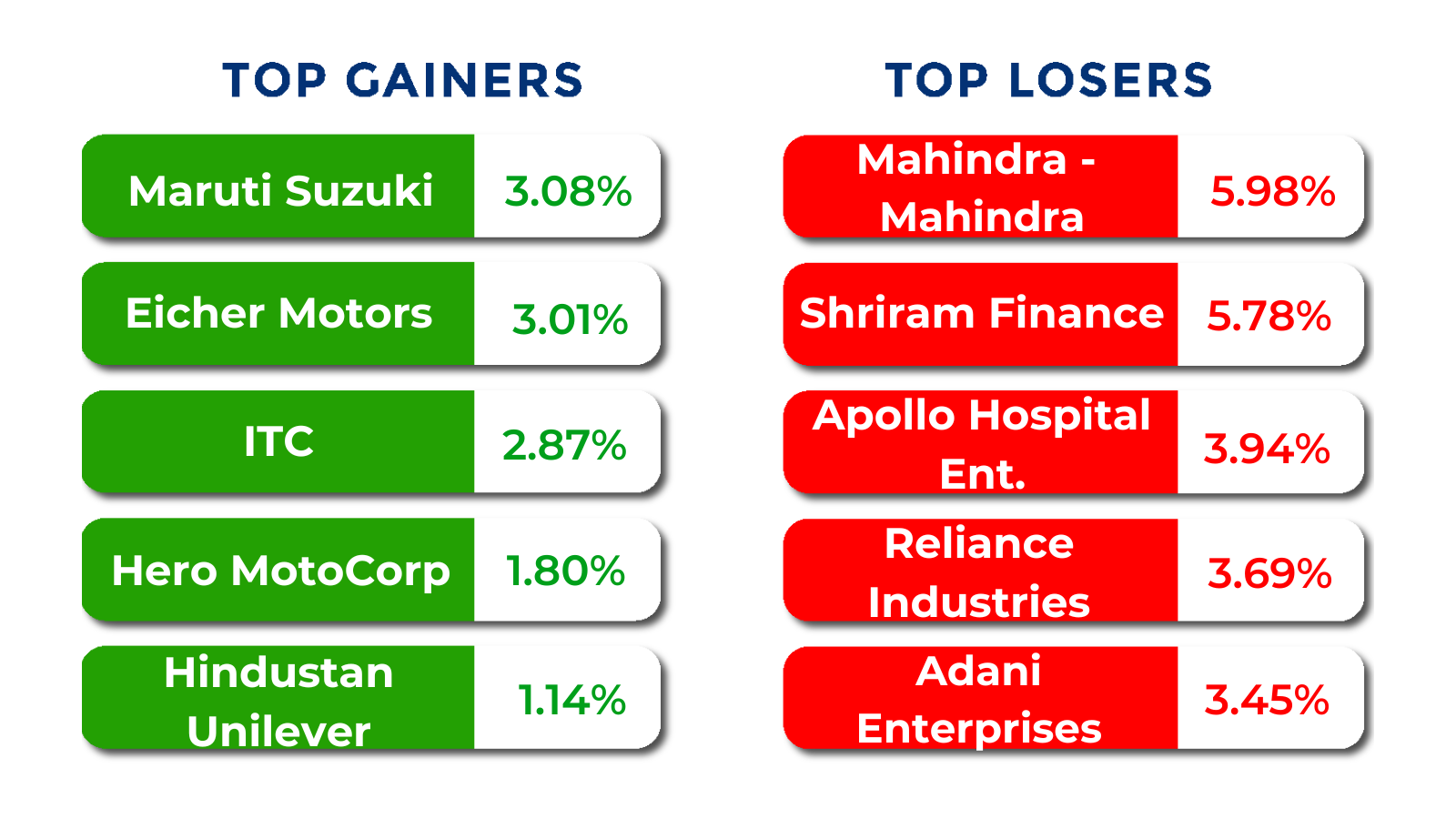

Top Gainers and Losers

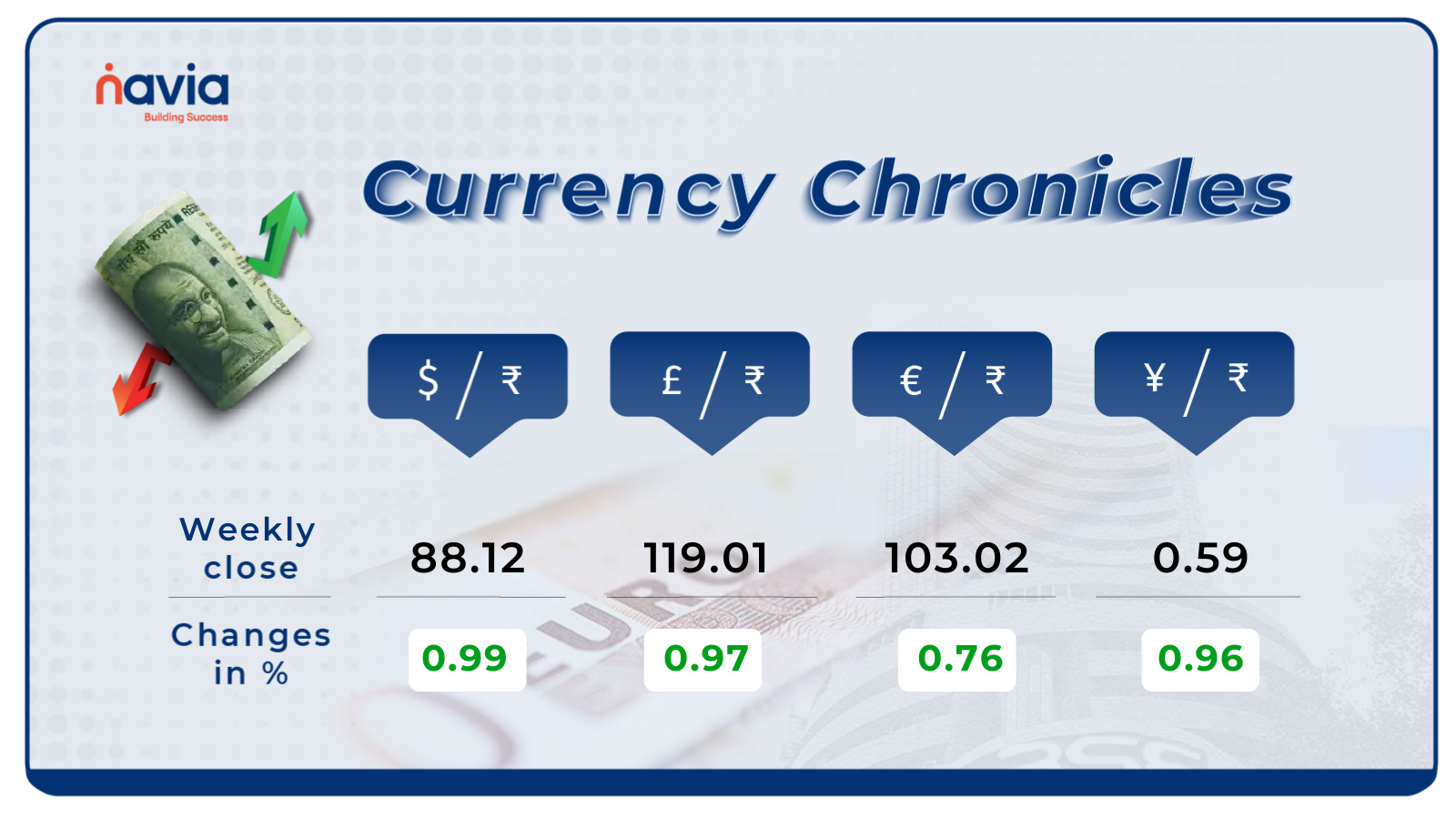

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.12 per dollar, gaining 0.99% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹103.02 per euro, gaining 0.76% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining by 0.96% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

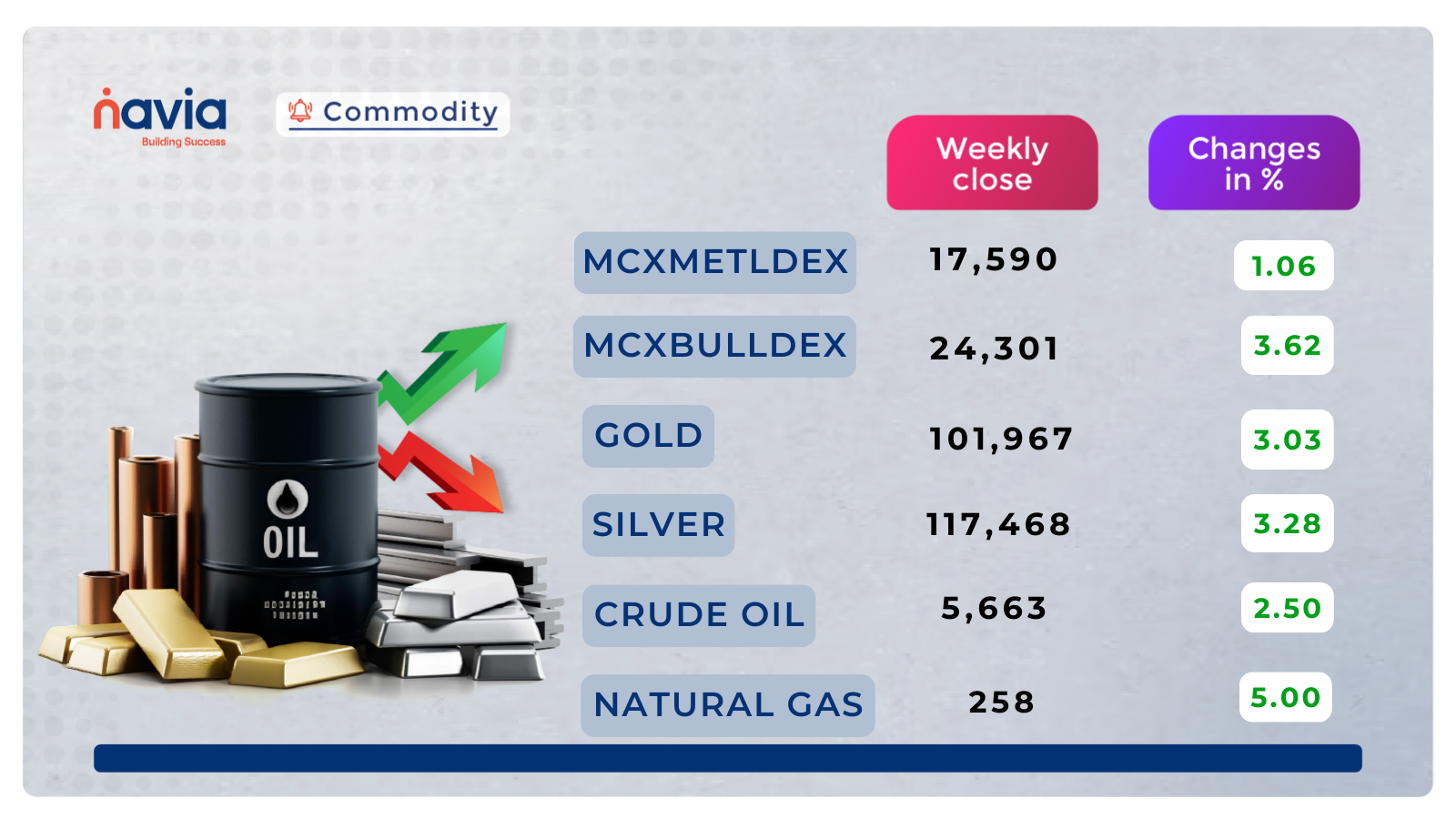

Commodity Corner

MCX crude oil shows an overall downtrend with a short-term uptrend within broader timeframes. The market sentiment remains cautiously bearish, especially if prices fall below 5,400, favoring sell-on-rallies. However, a breakout above 5,480 could trigger a limited counter-trend buying opportunity if supported by strong confirmation signals. Analysts expect crude oil to remain range-bound between 5,500 and 6,000, with a sell-on-rise strategy preferred. Crude oil is facing resistance near 5,850 and support near 5,500. Price action around these levels will determine the next move.

In the last session, Gold closed at 101,967. MCX Gold futures have recently broken through significant levels on August 28, 2025, October contracts climbed above 1,01,000 per 10g, driven by strong bullish sentiment. Analysts suggest maintaining a cautious but optimistic “buy-on-dips” strategy to align with the prevailing momentum. Earlier in mid-August, gold prices rallied by nearly 2,430 during the month, though they witnessed a brief intraday pullback. Despite this correction, market experts remain confident about further upside potential. Around August 21, prices tested the 97,000 support zone, which could pave the way for a short-term rebound if the level continues to hold.

MCX Natural gas fundamentals globally remain challenging—pressure from strong supply and weak demand could weigh on price recovery attempts. For example, U.S. storage levels remain elevated, though short-term rebounds are possible as technical indicators start showing waning bearish momentum. A break above 256.5 opens the path to a bullish move toward 279.1. Conversely, a break below 246.5 could drive action down to 227.2. Stick to defined risk metrics and stay alert to price action around these pivot thresholds.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Simultaneous Access to Navia App on Web and Mobile

Navia’s QR Login makes trading faster, smarter, and more flexible. With seamless web–mobile access, traders can switch devices instantly, enjoy secure logins, and never miss an opportunity in the market.

Get 24/7 Smarter Support with Navia’s AI WhatsApp Chatbot

Navia’s AI-powered WhatsApp Chatbot is your 24/7 trading assistant, offering instant solutions for queries, reports, and account updates—all inside WhatsApp. Simple, secure, and always available, it makes trading smarter and stress-free.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.