Navia Weekly Roundup (August 18 – 22, 2025)

Week in the Review

The Indian equity market extended the gains in the second consecutive week ended August 22 on hopes of GST rationalisation by government, good monsoon, lower oil prices, however, ahead of deadline (August 27) of US tariffs, the investors book some profit at higher levels.

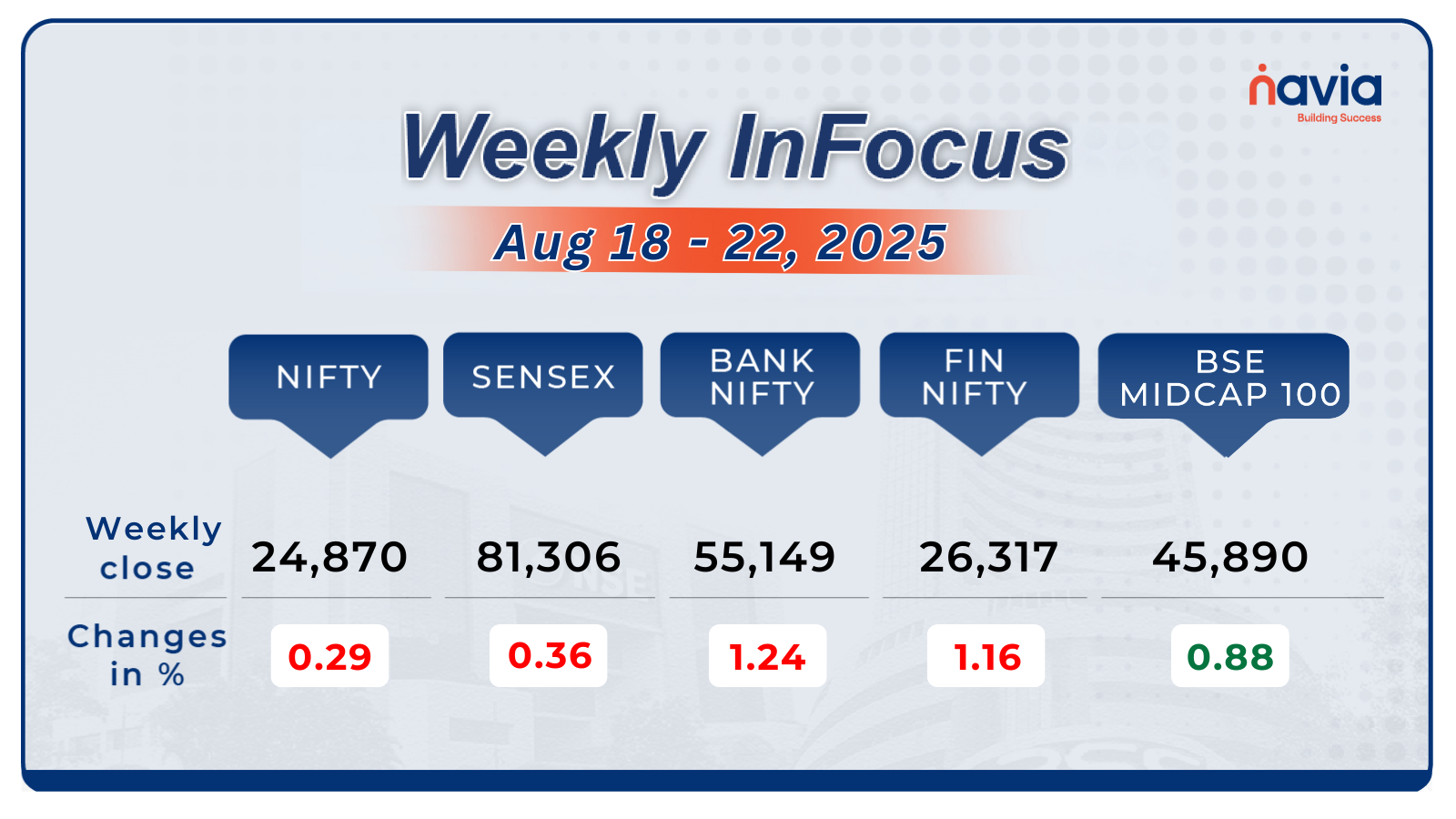

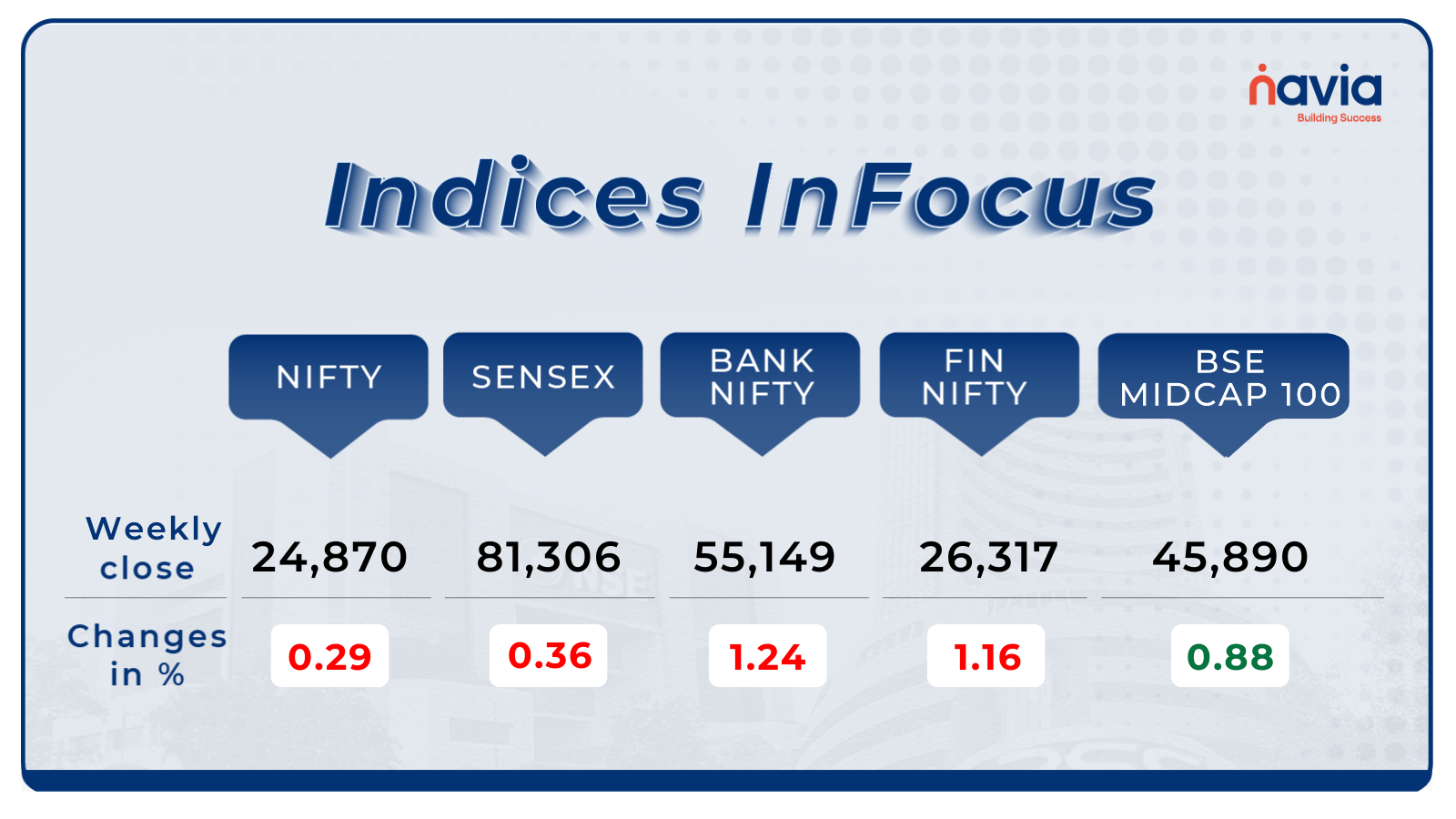

Indices Analysis

For the week, the BSE Sensex index lose 0.36 percent to end at 81,306.85 and Nifty50 decreased 0.29 percent to finish at 24,870.10.

The BSE Large-cap Index jumped 1 percent supported by Maruti Suzuki India, Waaree Energies, TVS Motor Company, IDBI Bank, Avenue Supermarts, Swiggy.

BSE Mid-cap Index added 2 percent led by Ola Electric Mobility, Astral Limited, Phoenix Mills, UNO Minda, L&T Finance, while losers included Glenmark Pharma, Tata Communications, Bharat Forge, Kalyan Jewellers India, Abbott India, Torrent Power, Aurobindo Pharma.

The BSE Small-cap index rose more than 2 percent led by Foseco India, KIOCL, KR Rail Enginerring, Apollo Micro Systems, HLE Glascoat, Jai Corp, Pennar Industries, Rishabh Instruments, while losers were Nazara Technologies, Agarwal Industrial Corporation, Thyrocare Technologies, Ethos, Master Trust, Share India Securities, GVK Power & Infrastructure, Suratwwala Business Group, Shilpa Medicare, Uflex, Valiant Organics.

The pace of Foreign Institutional Investors (FIIs) selling declined but remained net sellers in 8th week, as they offload equities worth Rs 1,559.51 crore. On the other hand, Domestic Institutional Investors (DII) extended their buying in 18th consecutive week, as they purchased equities worth Rs 10,388.23 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

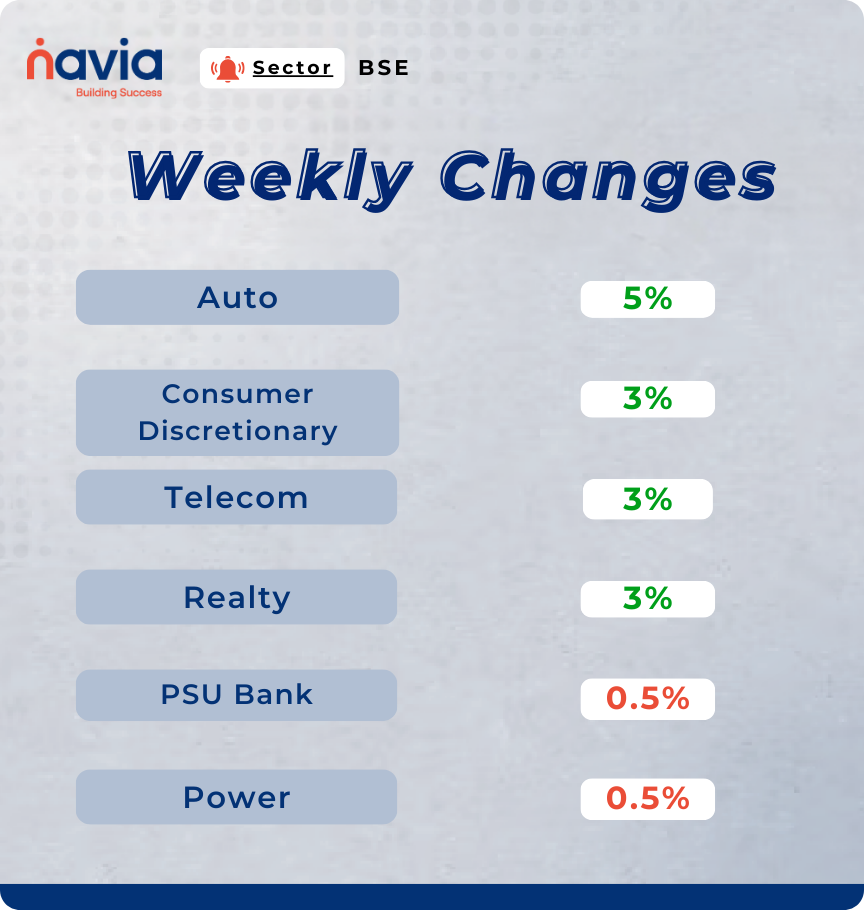

Sector Spotlight

On the sectoral front, BSE Auto index rose 5 percent each, BSE Consumer Discretionary, Telecom, realty indices rose more than 3 percent each, while BSE PSU and Power indices down 0.5 percent each.

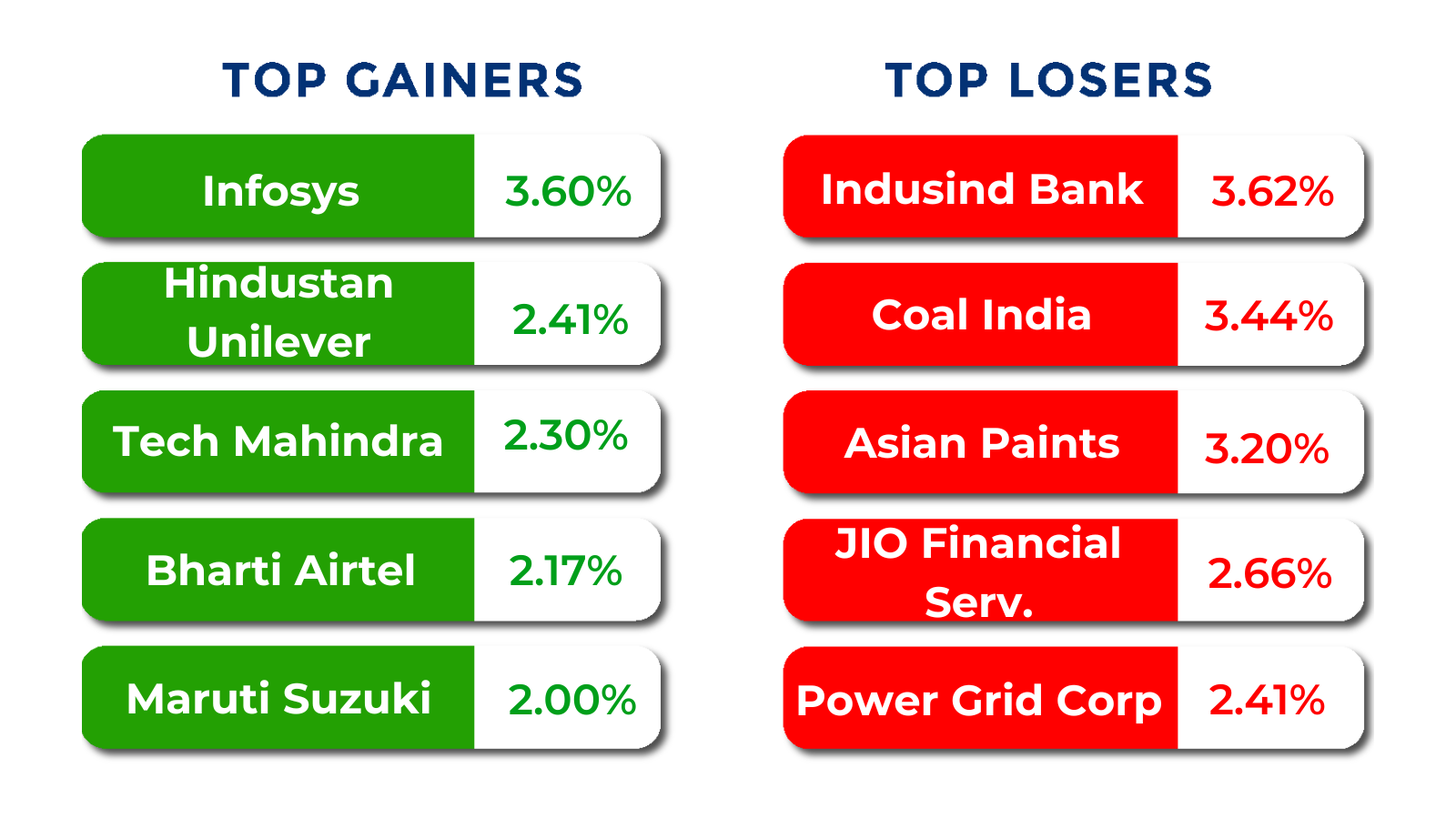

Top Gainers and Losers

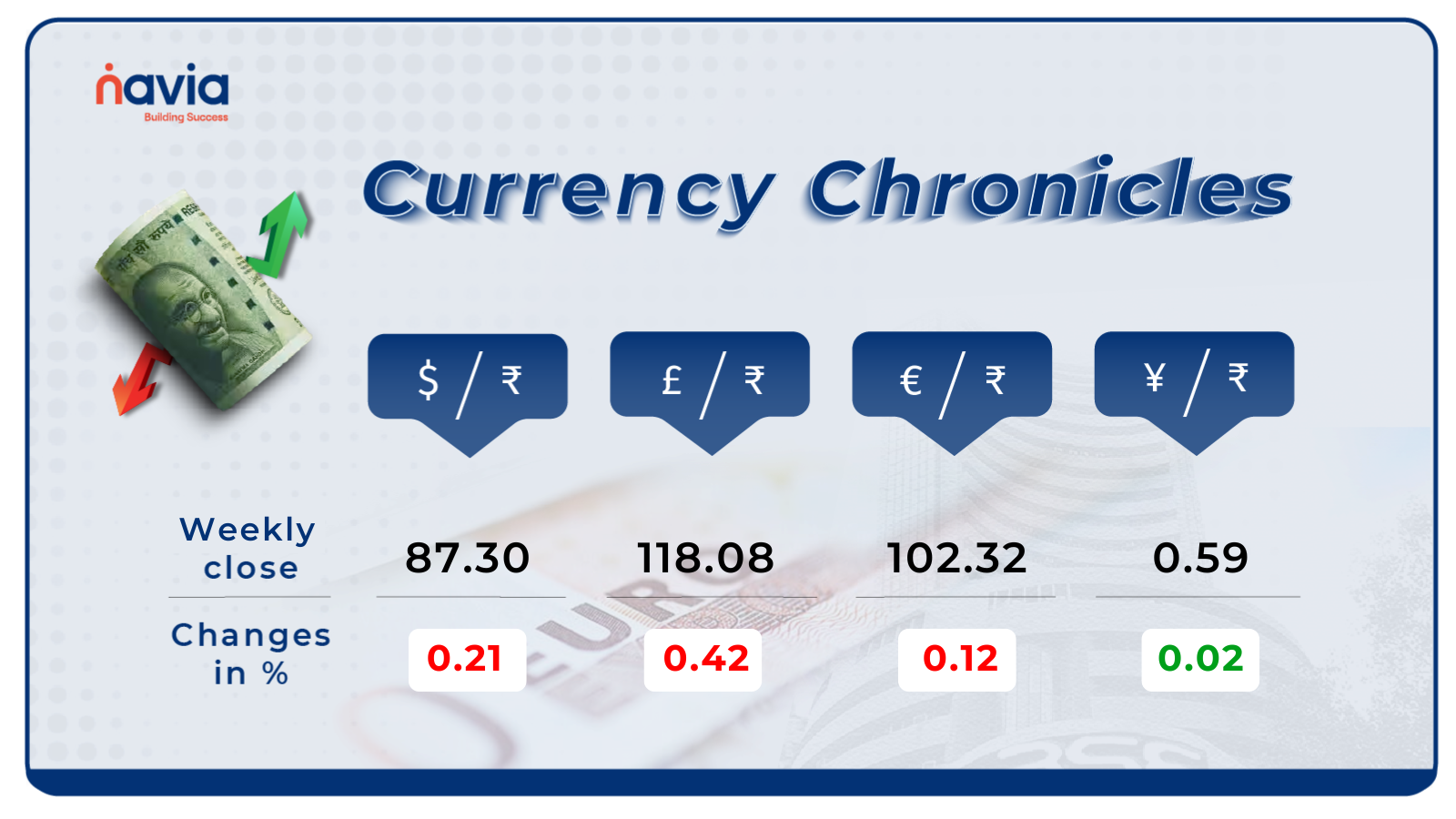

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹87.30 per dollar, losing 0.21% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹102.32 per euro, losing 0.12% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, gaining by 0.02% during the week, reflecting a bullish market sentiment.

Stay tuned for more currency insights next week!

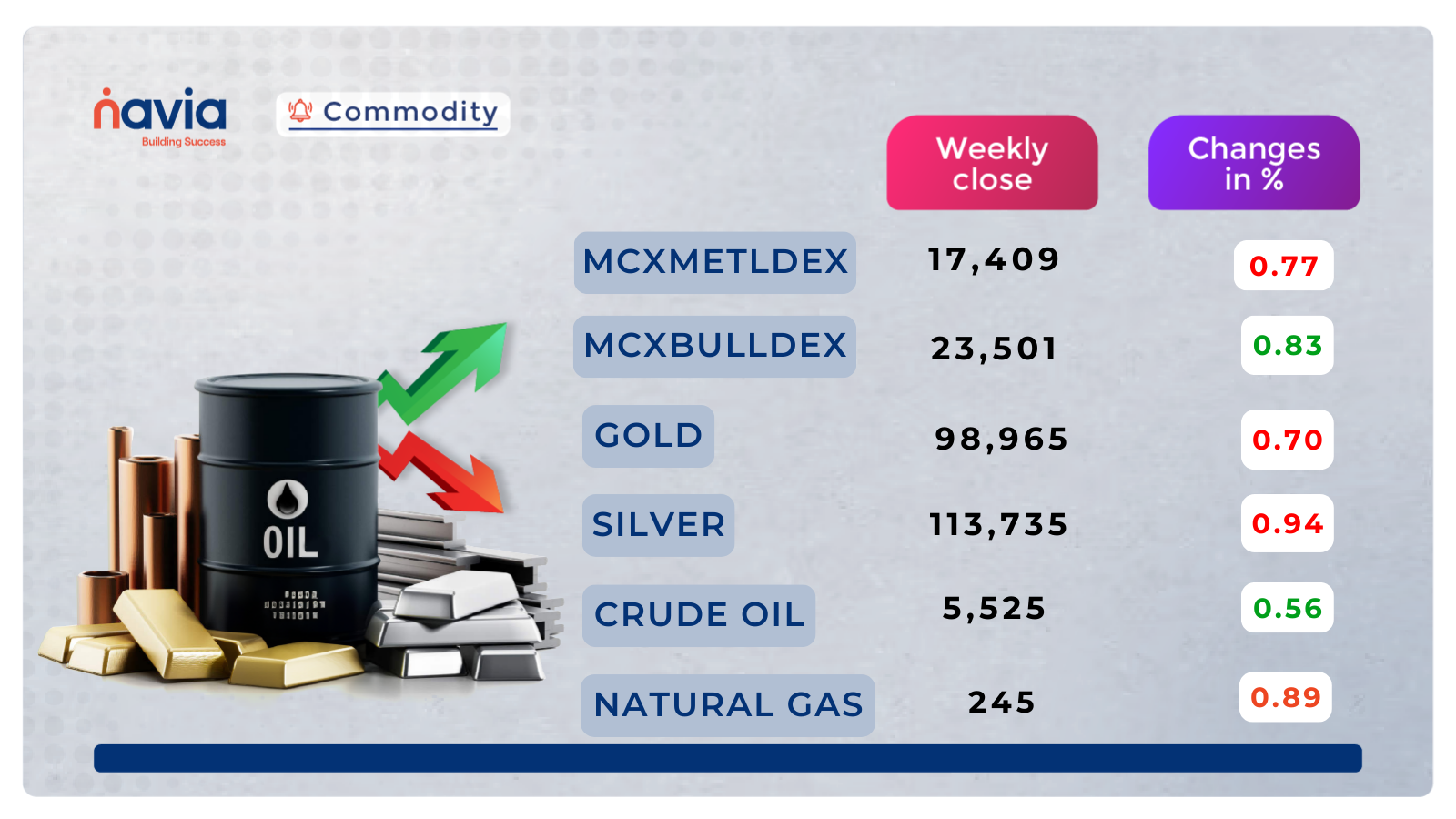

Commodity Corner

MCX Crude Oil remains firmly bullish, Price has been in a falling wedge, which is typically a bullish reversal pattern, Currently, crude oil is attempting to break out of the upper trendline of the wedge. It is testing resistance near 5,600; a move above this level may indicate strength, while a drop below 5,400 could suggest weakness.

In the last session, Gold closed at 98,965. The price was moving in an upward channel, but it recently broke below the channel, indicating loss of bullish momentum. Currently, Gold is consolidating near the 99,300 level after a pullback from support. Trend is neutral to slightly bearish unless it reclaims key resistances. If Gold sustains above 99,800, then momentum can take it towards 101,000. If it breaks below 98,650, then it may slide further towards 97,800.

MCX Natural Gas price has been in a downtrend channel. The last session closed at 245. Recently, it bounced from the support zone near 239, showing some short-term strength. Trend is still bearish overall, but a channel breakout could trigger a trend reversal. If Natural Gas sustains above 250–255, a breakout rally can target 276-307. If price fails at resistance and breaks below 239, it may extend the fall towards 225-210. Currently, price is testing the channel resistance – the next move depends on whether it breaks above or gets rejected.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Portfolio Diversification in 2025: Smart Ways to Build a Winning Stock Market Portfolio

In today’s fast-changing markets, a well-diversified stock portfolio is key to balancing risk and maximizing returns. By spreading investments across sectors, geographies, and asset classes, you protect yourself from market shocks while unlocking long-term growth opportunities. Avoid over-diversification and emotional decisions—review, adapt, and build a winning portfolio in 2025.

Understanding NSE and BSE: Key Differences Every Investor Should Know

India’s two major stock exchanges—NSE (National Stock Exchange) and BSE (Bombay Stock Exchange)—form the backbone of the country’s financial markets. While NSE is known for speed, high liquidity, and popularity among traders, BSE stands out for its legacy, vast listings, and small-to-mid-cap opportunities. Understanding their key differences helps investors choose the right platform for their trading and investment goals.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.