Navia Weekly Roundup (AUGUST 05 – AUGUST 09, 2024)

Week in the Review

The market continued its decline for the second consecutive week ending August 9, driven by high volatility due to fears of a U.S. recession, the unwinding of yen carry trade, geopolitical tensions in the Middle East, a consistent RBI policy outcome, and mixed earnings from Indian companies.

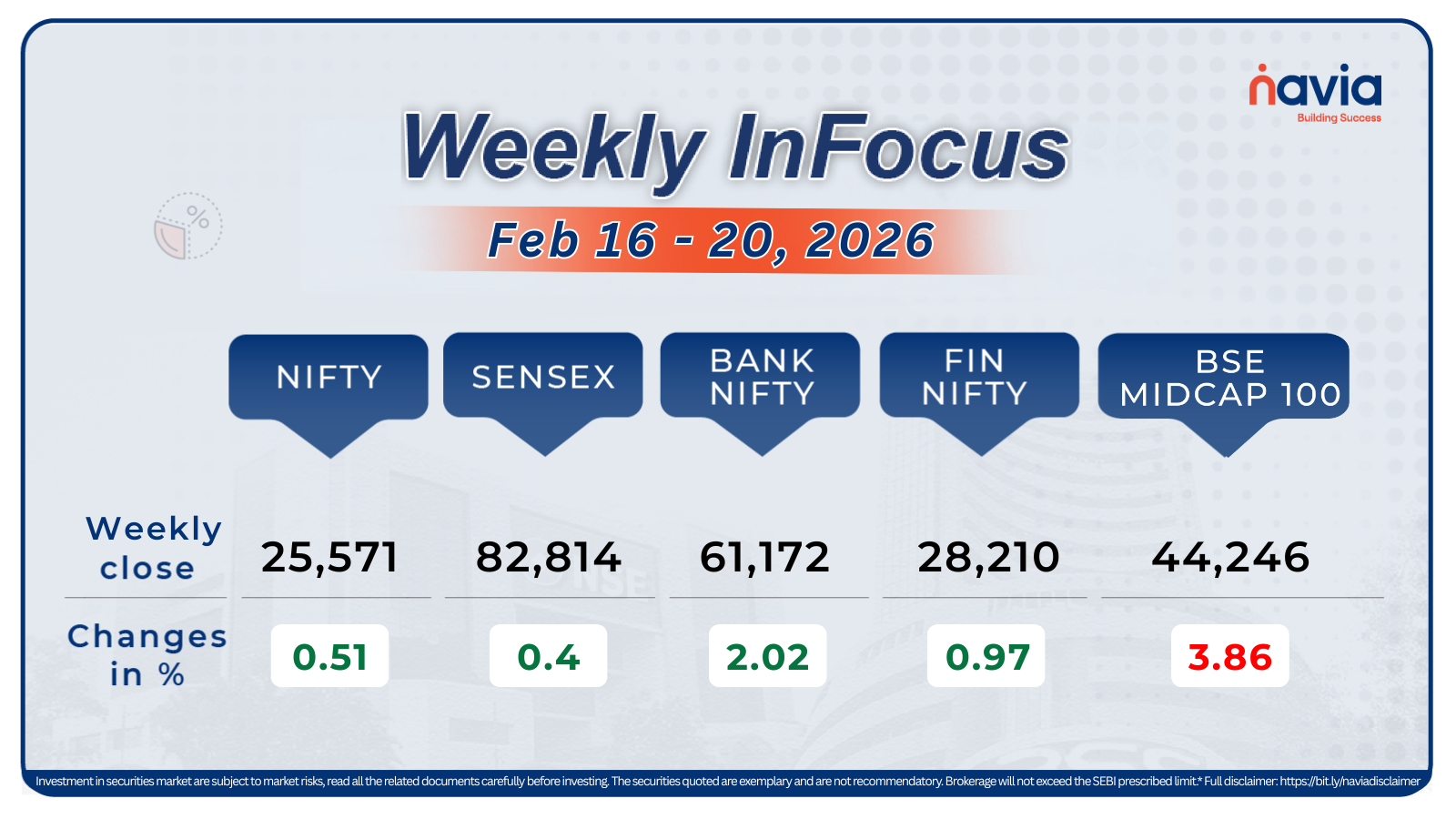

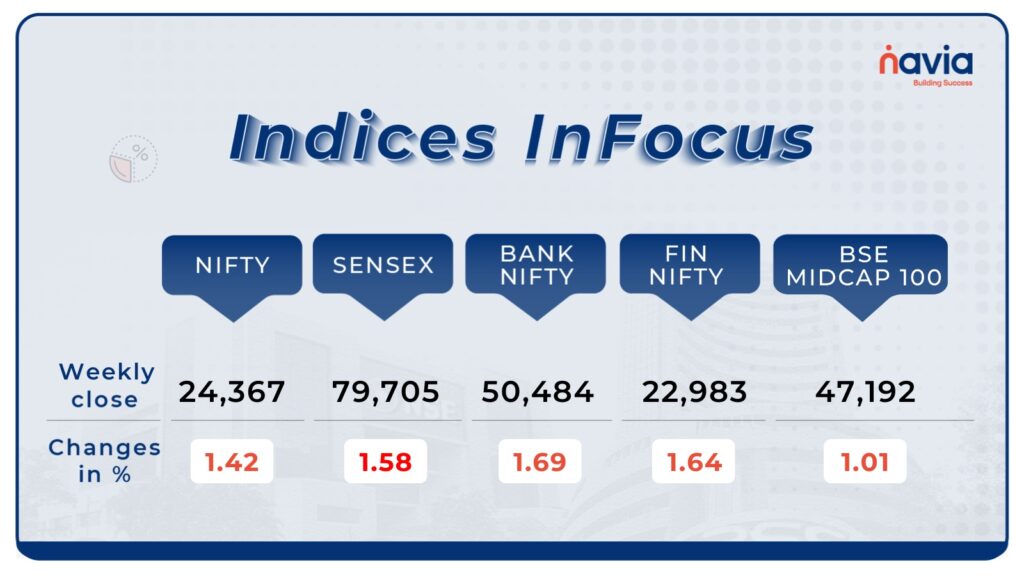

Indices Analysis

This week, BSE Sensex declined 1.58 percent to close at 79,705.91, while the Nifty50 index shed 1.42 percent to finish at 24,367.50.

BSE Mid-cap Index declined 1.01 percent with LIC Housing Finance, Steel Authority of India, New India Assurance Company, Union Bank of India, Balkrishna Industries falling between 7-14 percent. However, Alkem Laboratories, Lupin, Oil India, Ajanta Pharma, Cummins India, PI Industries gained between 5-9 percent.

Interactive Zone!

Last week’s poll:

Q) Which of the below statements regarding the Securities and Exchange Board of India (SEBI) is not correct?

a) It is a legal entity

b) In 1992, an ordinance granted it statutory authority

c) It is a non-statutory organisation

d) None of the above

Last week’s poll Answer: c) It is a non-statutory organisation

Poll for the week: In India, which of the below alternatives is not accessible?

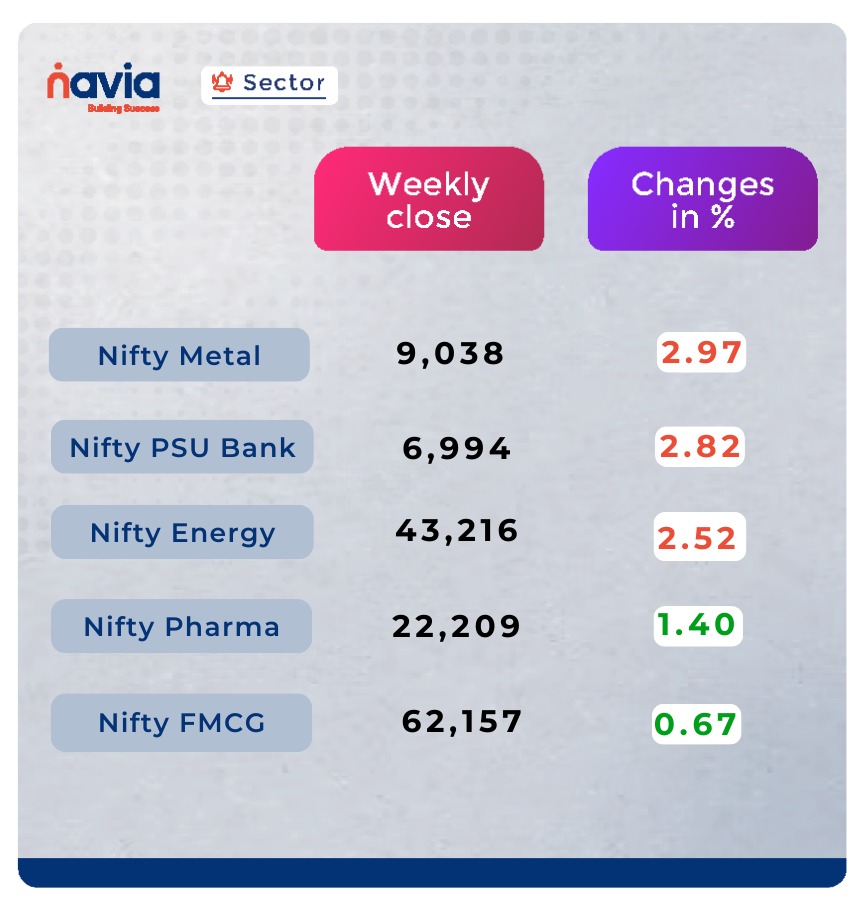

Sector Spotlight

On the sectoral front, Nifty Metal down nearly 2.97 percent, Nifty PSU bank down 2.82 percent, Nifty Energy index shed 2.5 percent ,On the other hand, Nifty Pharma index added 1.40 percent and Nifty FMCG indices rose 0.67 percent.

Explore Our Features!

Get a Sneak Peek into Navia App’s Price Alert!

Unlock the power of smart investing with Navia App’s Price Alert feature! Discover how this powerful tool can help you stay on top of market movements and make timely decisions.

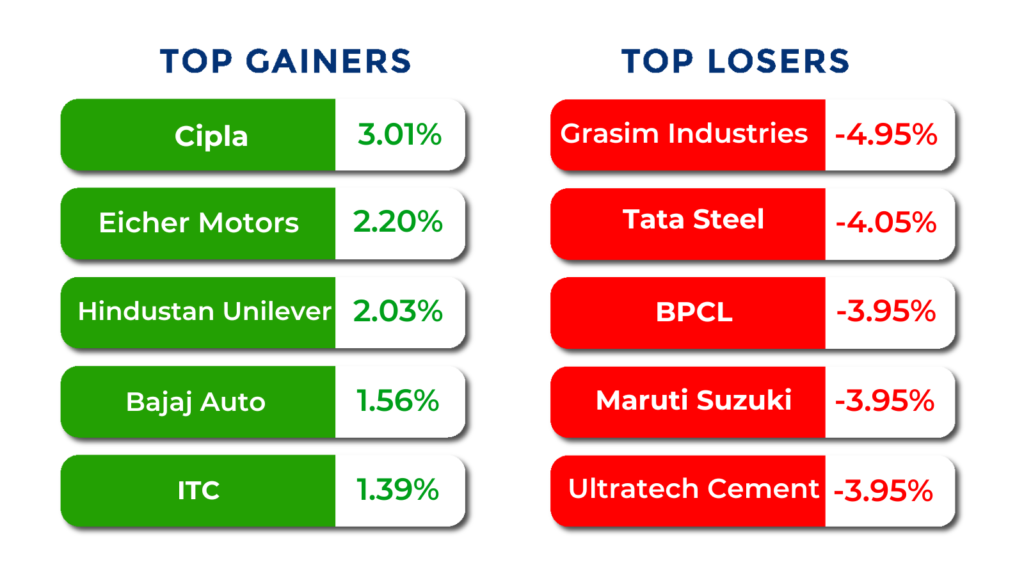

Top Gainers and Losers

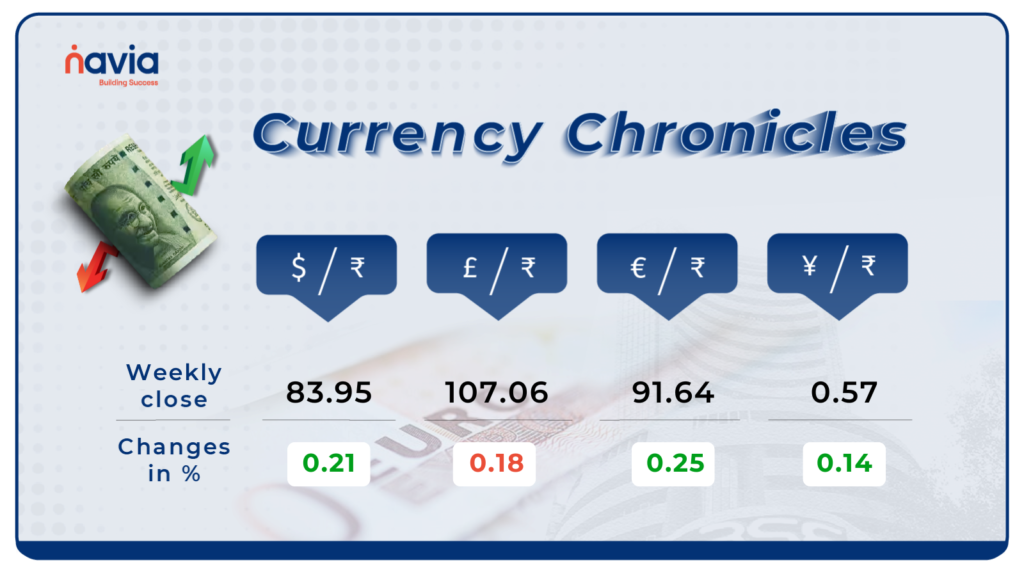

Currency Chronicles

USD/INR:

The Indian rupee hit a new record low of 83.96 during the week and ended 21 paise lower at 83.95 on August 9, compared to 83.74 on August 2. This decline reflects ongoing pressure on the rupee against the US dollar.

EUR/INR:

The EUR to INR exchange rate saw a modest increase of 0.25% over the week, closing at ₹91.64. Despite a slight rise, the market sentiment remains bullish, reflecting ongoing strength and confidence in the euro against the Indian rupee.

JPY/INR:

The JPY to INR exchange rate rose by 0.14% over the week, ending at ₹0.5749. The market sentiment remains bullish, showcasing continued confidence in the Japanese yen’s performance against the Indian rupee.

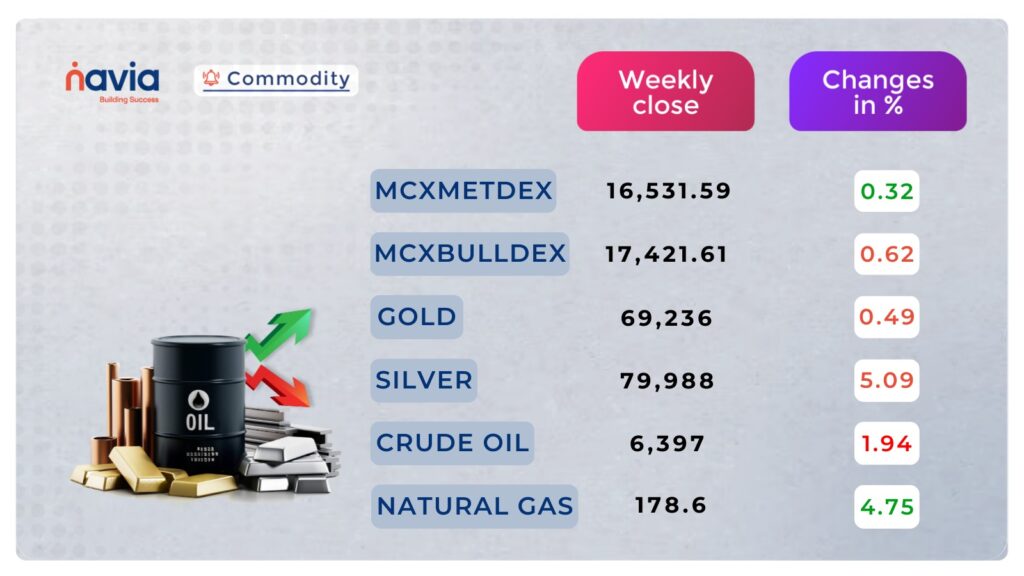

Commodity Corner

Gold traded with negative momentum, weighed down by outflows to bond ETFs. The sudden shift in the outlook for U.S. interest rates has signaled to markets a preference for bonds and bond ETFs. The current resistance level (R1) is at 70970 and the support level (S1) is at 68178

Amid ongoing demand worries stemming from weaker economic data from the three most important demand regions—the U.S., China, and Europe—the current resistance level (R1) is placed at 6,547, and the support level (S1) is placed at 6,240.

Forecasts for warmer-than-usual weather in the coming weeks could increase gas demand for power generation, prompting some short covering from traders. The current resistance level (R1) is at 184, while the support level (S1) is at 170.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Surfing Market Sentiment: Anika and Ria’s Stock Adventure

Join Anika and Ria on their stock market adventure! 🌊 Discover how understanding market sentiment can shape your investment decisions. Dive into their journey and learn how to ride the waves of the market with confidence.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?