Navia Weekly Roundup (Apr 28 – May 02, 2025)

Week in the Review

The Indian stock indices extended the gaining momentum in the third straight week, registering the longest streak since December 2024 in the volatile week ended April 27 despite geopolitical tensions. However, sustained FII inflows, mixed Q4 earnings, expectation of further de-escalation in the tariff war, record GST collections, and upbeat global markets helped the Indian market to record more than 1 percent weekly gains.

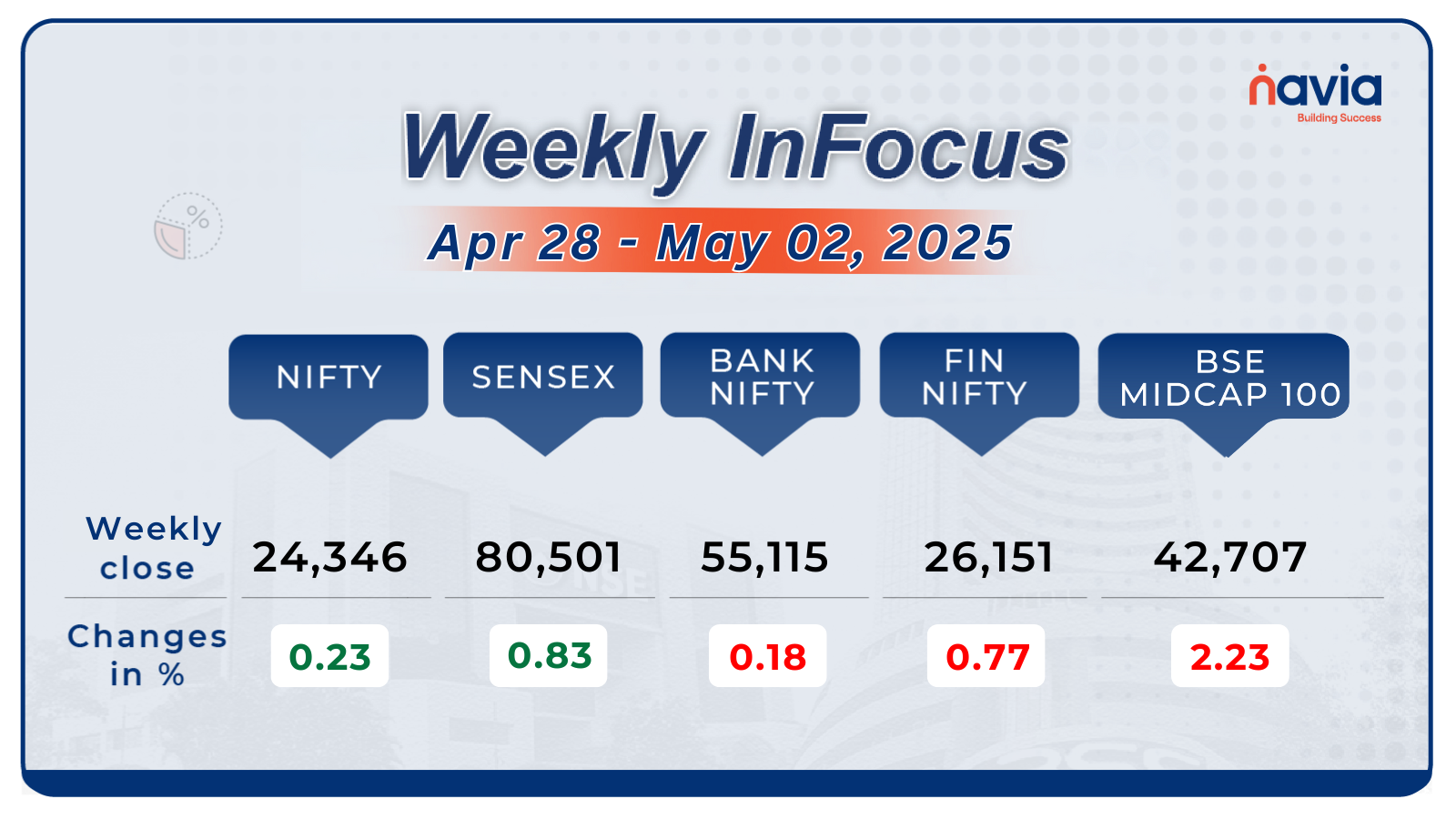

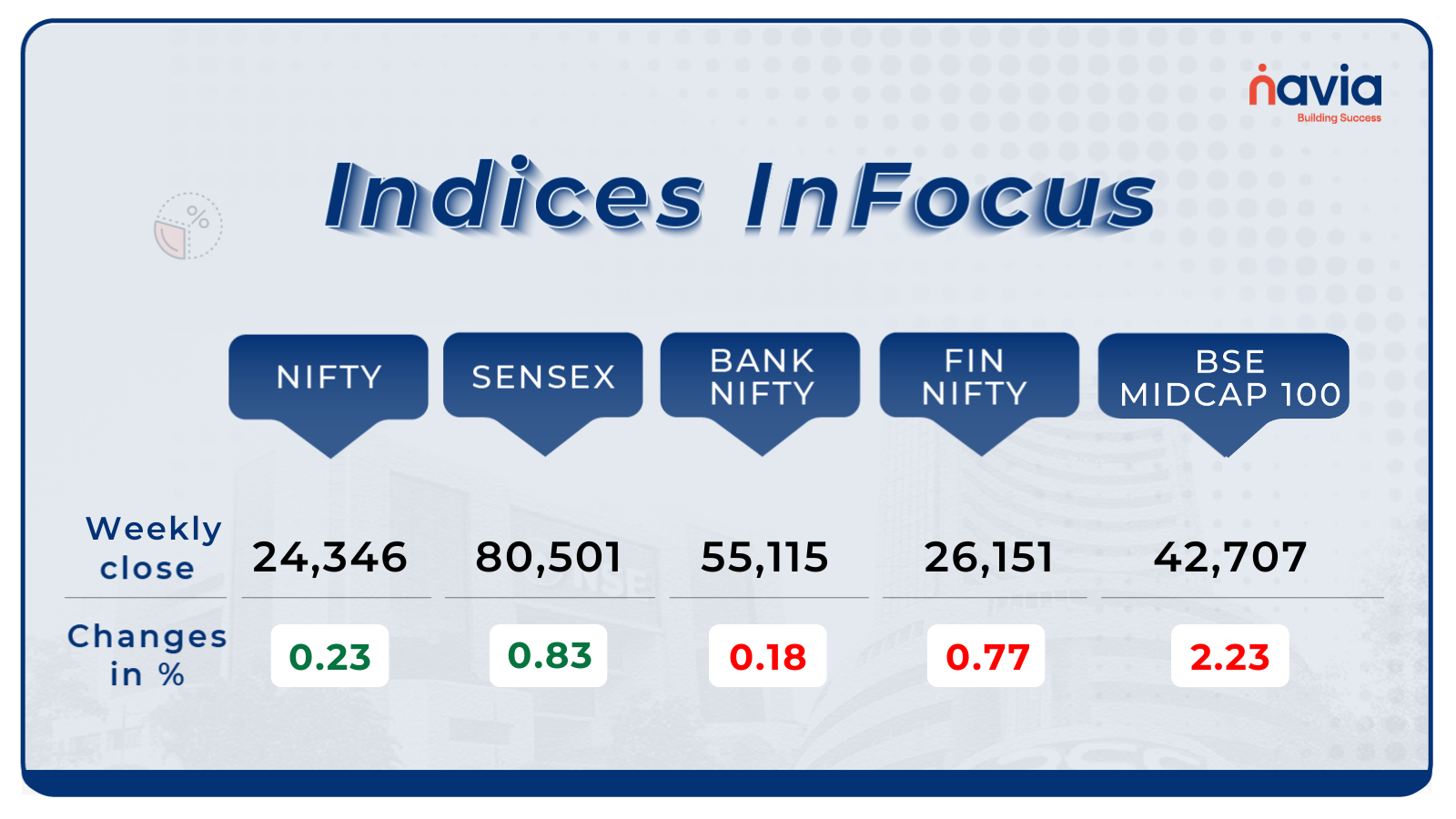

Indices Analysis

For the week, the BSE Sensex index jumped 0.83 percent to finish at 80,501.99, and Nifty50 gained 0.23 percent to end at 24,346.70. However, for the month of April, both the main indices added 3.5 percent each.

The BSE Small-cap index declined 1.3 percent with Lloyds Engineering Works, Gensol Engineering, Tanfac Industries, Rajoo Engineers, Tejas Networks, Sterling and Wilson Renewable Energy, KR Rail Engineering, ISGEC Heavy Engineering, Sterlite Technologies, Godrej Agrovet, Repro India, Five-Star Business Finance, and SML Isuzu falling 12-25 percent. However, Paras Defence and Space Technologies, Sonata Software, Sportking India, Barbeque Nation Hospitality, Krystal Integrated Services, Prime Focus, Go Fashion India, Garden Reach Shipbuilders & Engineers, and Jayaswal Neco Industries rising between 15-29 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

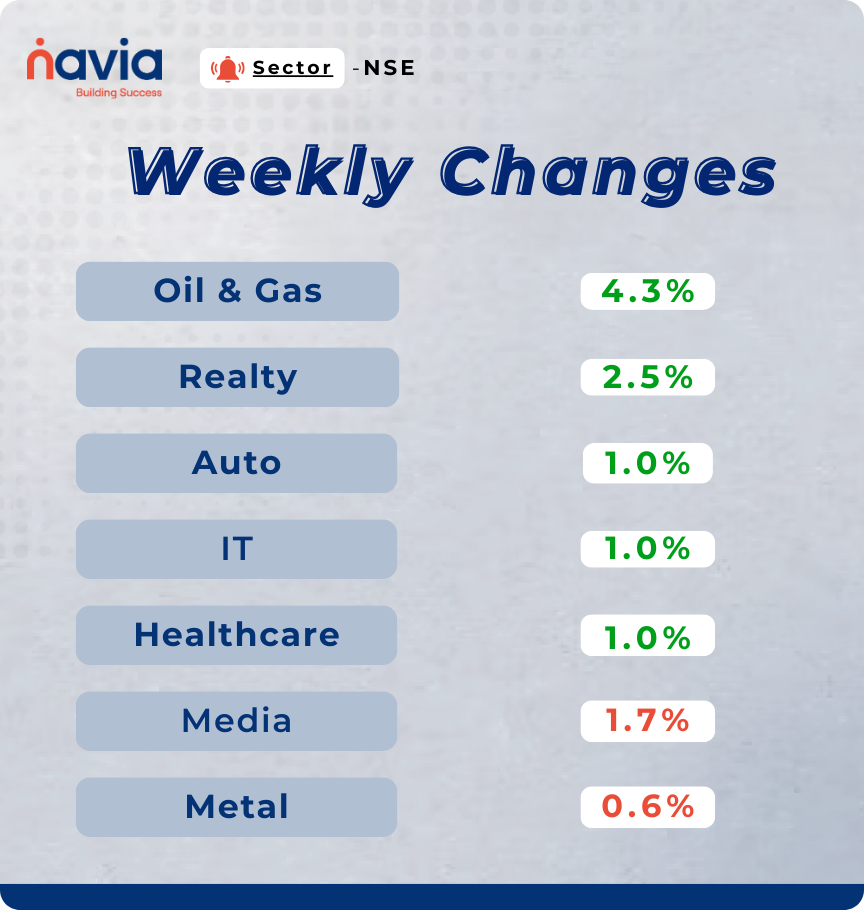

Sector Spotlight

Among sectors, Nifty Oil & Gas index added 4.3 percent, Nifty Realty index rose 2.5 percent, Nifty Auto, IT and Healthcare indices rose 1 percent each. However, Nifty Media index shed 1.7 percent and Nifty Metal index shed 0.6 percent.

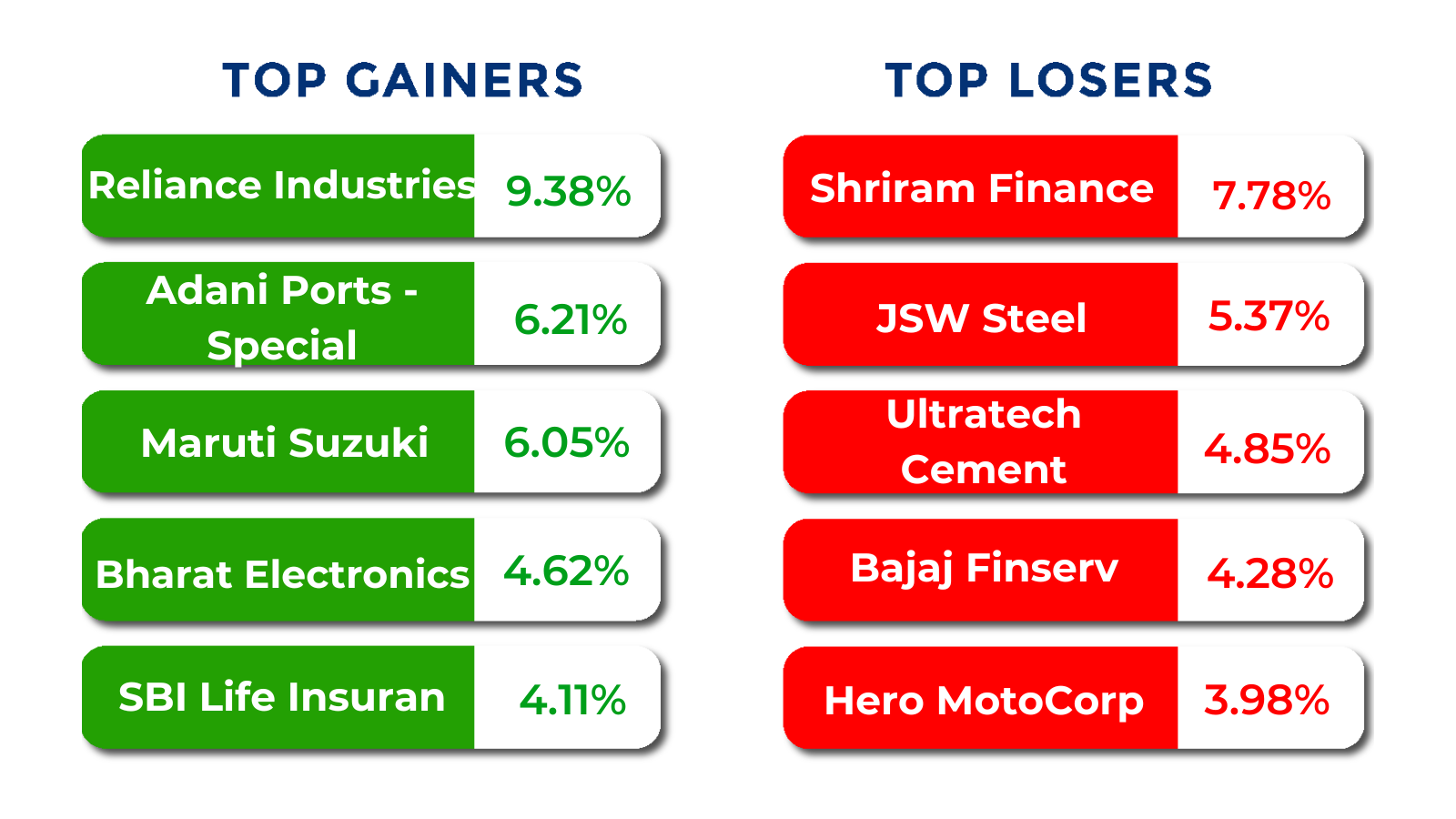

Top Gainers and Losers

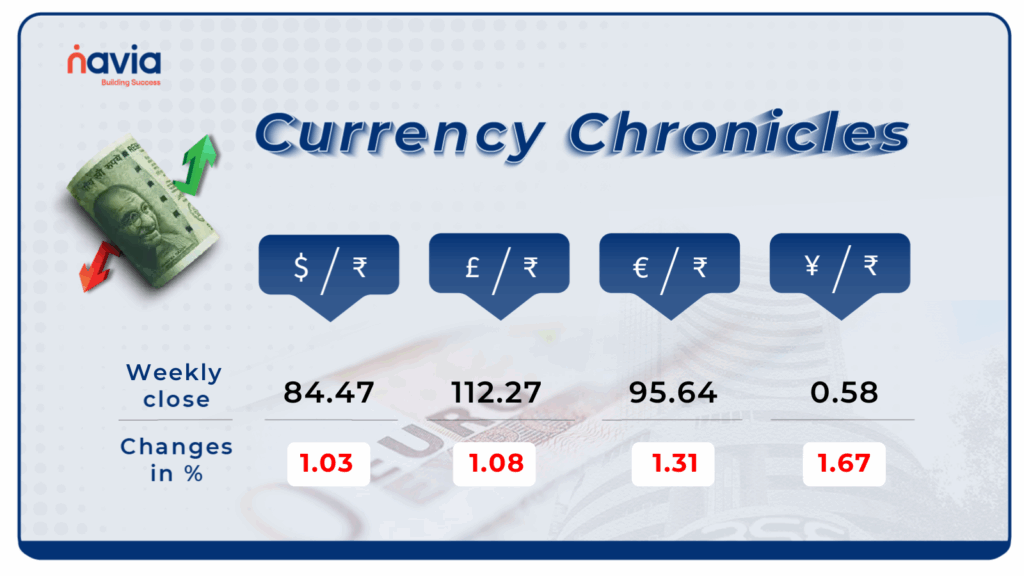

Currency Chronicles

USD/INR:

The Indian rupee ended marginally lower against the US dollar at 84.47 per dollar on May 2.

EUR/INR:

The Indian rupee ended marginally lower against the euro at 95.64 per euro on May 2, declining by 1.31%.

JPY/INR:

The Indian rupee ended lower against the Japanese yen at 0.58 per yen on May 2, declining by 1.67%.

Stay tuned for more currency insights next week!

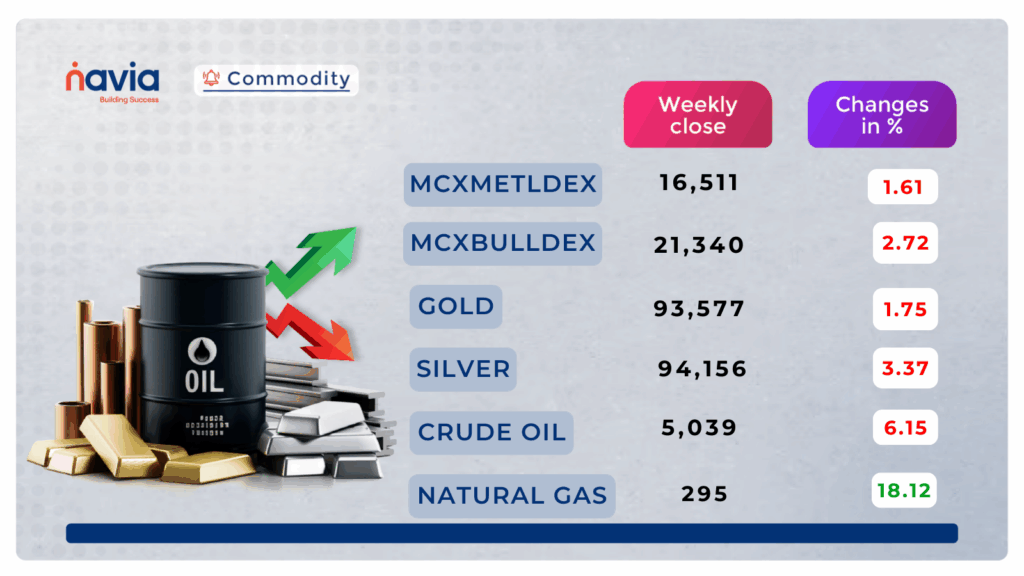

Commodity Corner

Crude Oil closed at 5,039 down by 6.15%, indicating a possible breakdown toward lower levels. Downside is expected in the coming days. Further momentum is likely above 5000; however, a breakdown below 4954 could trigger additional downside pressure. Holding below 5100 could lead to further weakness.

Gold closed at 93,557, down by 1.75%. It experienced strong volatility throughout the session. Trading below 93,000 could add further weakness to Gold. There is also a chance it may take support near the 91,517 level. For intraday traders, a move above 92,740 may indicate upside potential, while a dip below 92,100 could trigger further downside.

Natural Gas closed at 295, up by 18.12%. Technically, Natural Gas is entering a bullish trend. Another intraday move is likely above 292, while downside pressure could emerge below 282. It is currently facing resistance in the 292–293 range.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Trading Crude Oil on MCX: Key Specs, Insights & Market Dynamics

Trade WTI-based crude oil futures and options on MCX with Navia. Understand key differences between WTI and Brent, price spreads, and detailed specs for crude oil and mini contracts to make informed decisions in a dynamic market.

Be Alert: Safeguard Yourself Against Merge Call Scams

Scammers use merge calls to trick victims into revealing OTPs, enabling unauthorized financial access. Never merge calls with unknown numbers, share OTPs, or disclose personal info.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?