Navia Weekly Roundup (Apr 21 – 25, 2025)

Week in the Review

The Indian equity indices extended the gain in the second consecutive week ended April 27 amid volatility led by persistent FII buying, expectations of a positive outcome from US-India trade talks, mixed Q4 earnings and geopolitical tensions post Pahalgam terror attack.

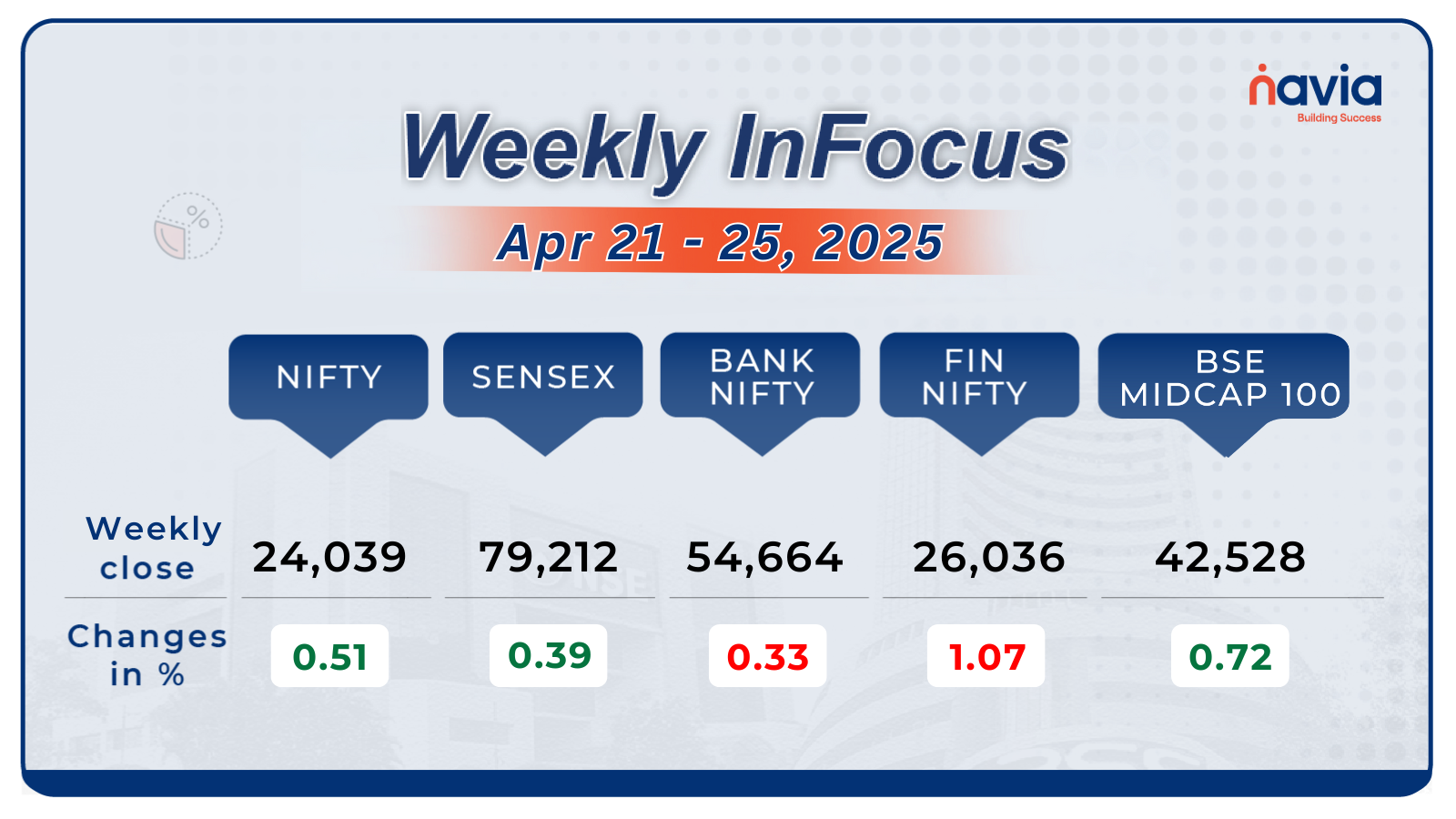

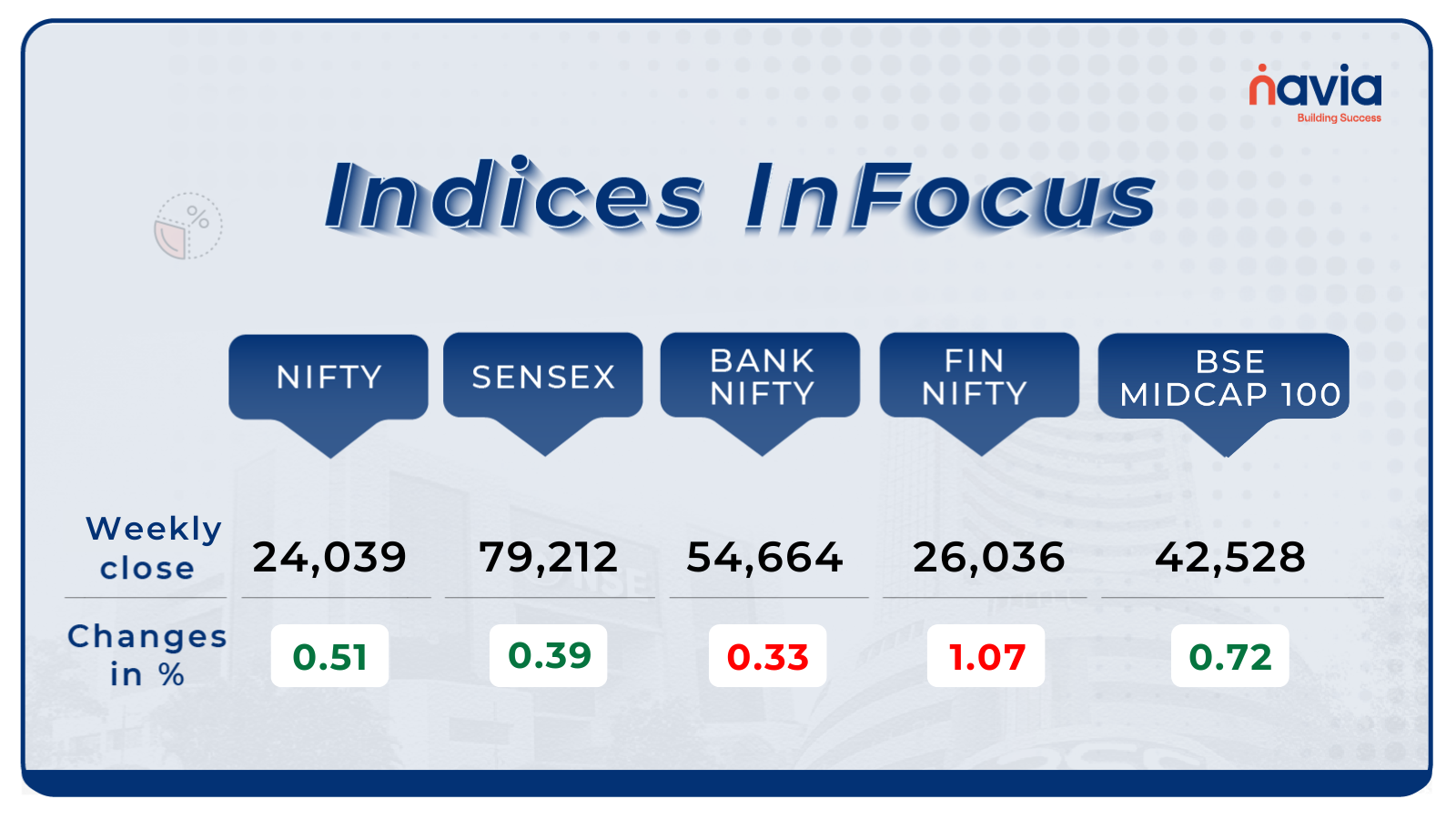

Indices Analysis

For the week, the BSE Sensex index added 0.39 percent to close at 79,212.53, and Nifty50 rose 0.51 percent to close at 24,039.35. In the month of April till now, both the main indices rose more than 2 percent each.

The BSE Small-cap index ended with marginal gains. Rajratan Global Wire, Thyrocare Technologies, Best Agrolife Peninsula Land, Carraro India, Aptech, Deccan Gold Mines, and Vardhman Special Steels added between 21-32 percent. On the other hand, Gensol Engineering, Sterlite Technologies, Pearl Global Industries, Blue Star, Syngene International, Unimech Aerospace and Manufacturing, KR Rail Engineering, EPack Durables, Ramkrishna Forgings, PCBL Chemical, NELCO, Gujarat Themis Biosyn fell between 10-22 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

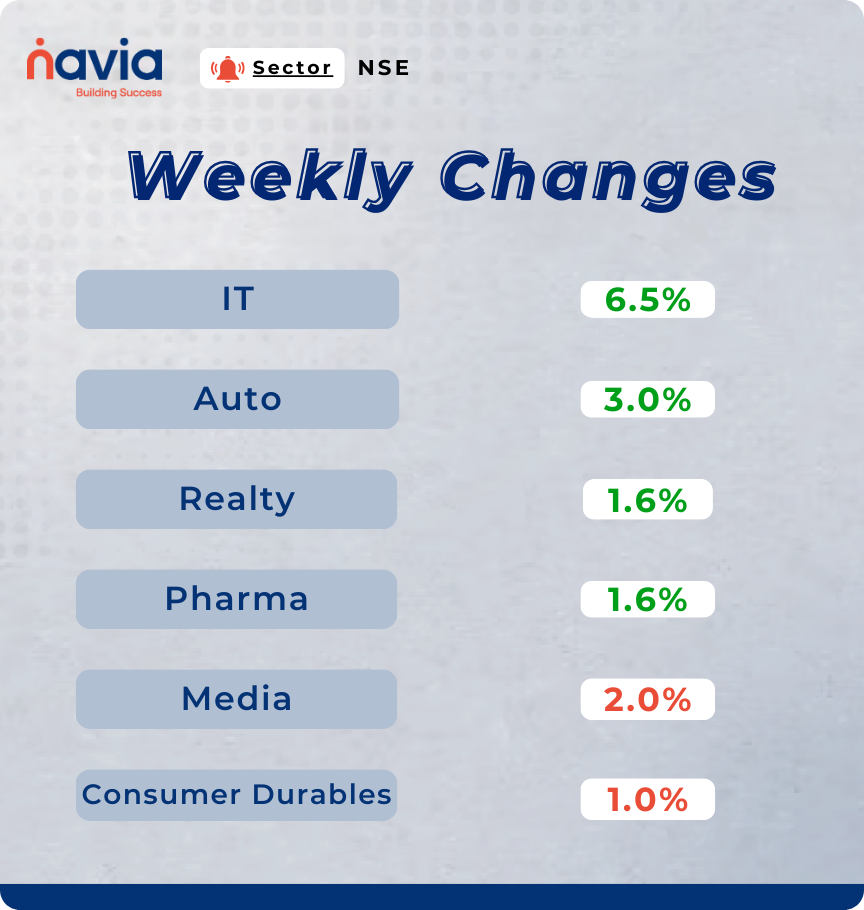

Sector Spotlight

Among sectors, the Nifty Information Technology index rose 6.5 percent, the Nifty Auto index added 3 percent, Nifty Realty and Pharma indices rose 1.6 percent each. However, the Nifty Media index fell 2 percent, and the Nifty Consumer Durables index shed nearly 1 percent.

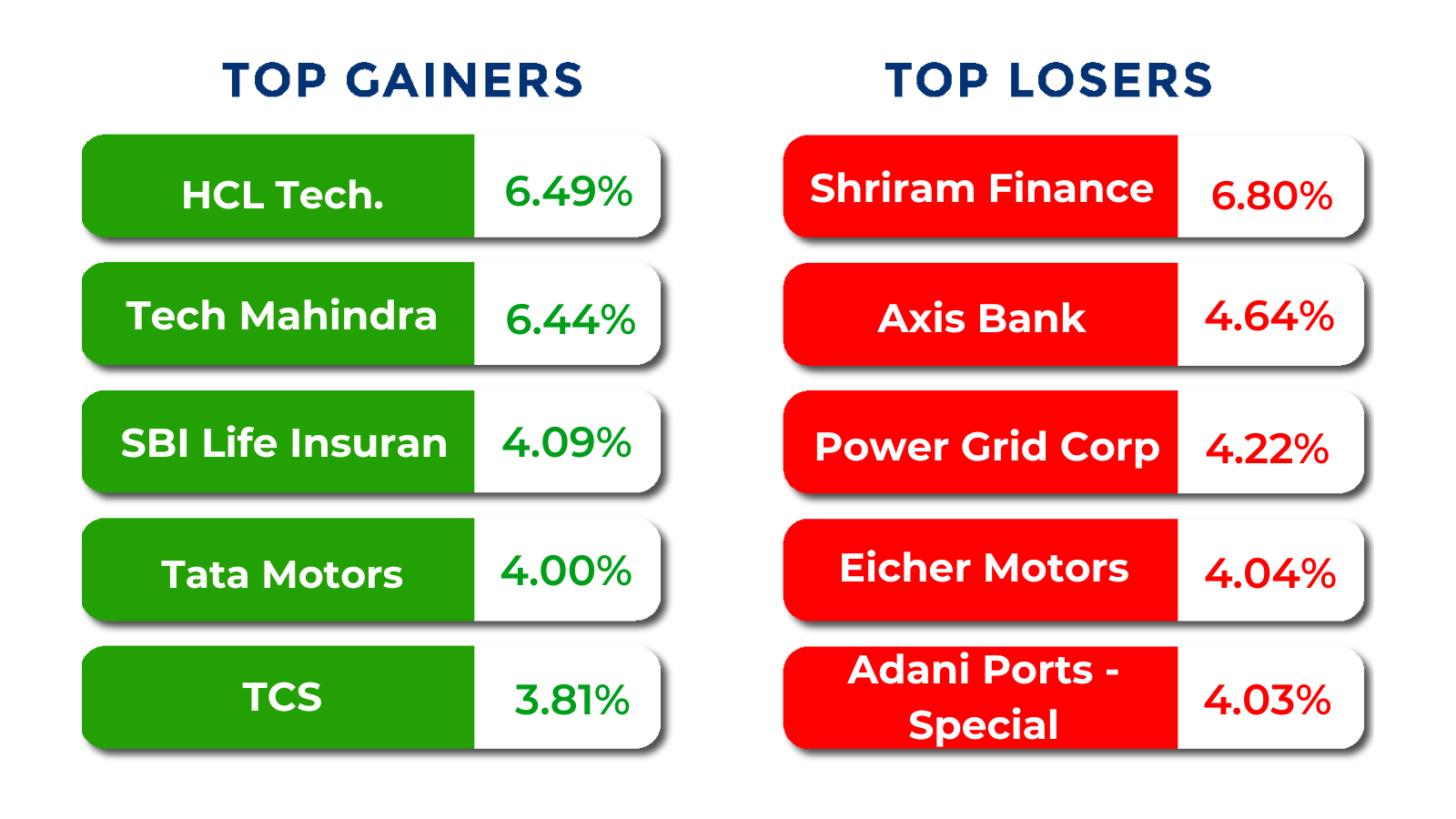

Top Gainers and Losers

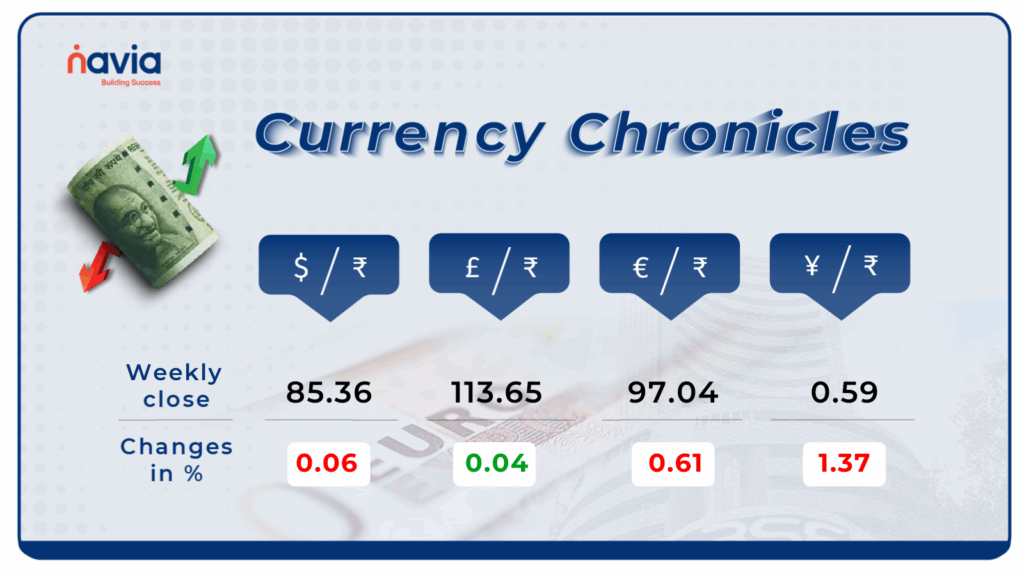

Currency Chronicles

USD/INR:

The Indian rupee ended marginally lower against the US dollar at 85.36 per dollar on April 25 declining by 0.06%.

EUR/INR:

The Indian rupee ended marginally lower against the euro at 97.04 per euro on April 25, declining by 0.61%.

JPY/INR:

The Indian rupee ended lower against the Japanese yen at 0.59 per yen on April 25, declining by 1.37%.

Stay tuned for more currency insights next week!

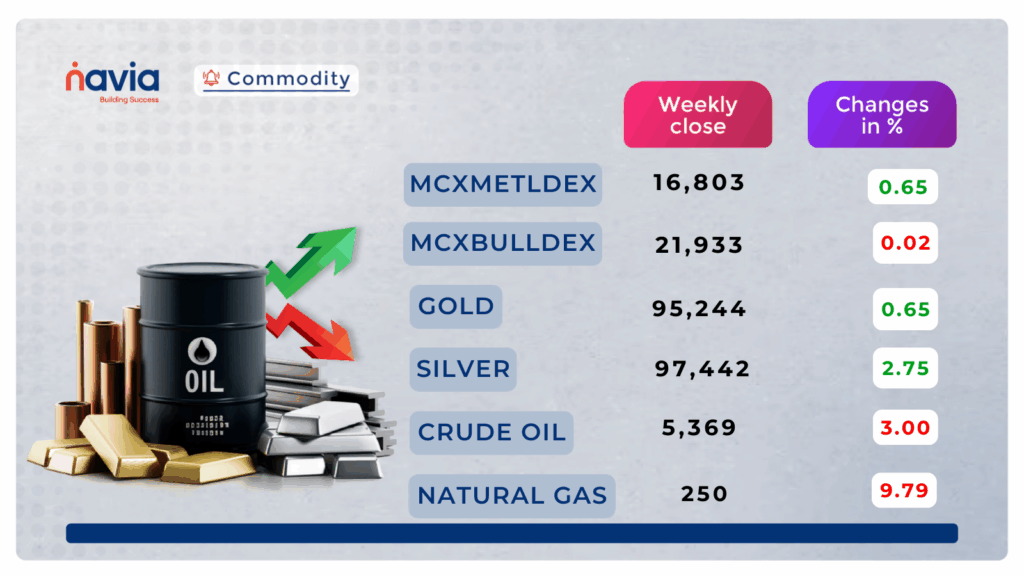

Commodity Corner

Crude Oil closed at 5,369, indicating renewed buying interest at lower levels. As long as it stays within this pattern, a move toward the upside is expected in the coming days. Further momentum is likely above 5,420. However, a breakdown below 5,275 could trigger downside pressure. A confirmed breakdown below 5,270 would invalidate the bullish structure and suggest further weakness.

Gold closed at 95,244 in the last session. A breakout on either side is needed to confirm momentum. However, holding above the 94,000 mark could be supportive for Gold in the short term. For intraday traders, a move above 96,200 may indicate upside potential, while a dip below 95,000 could trigger further downside.

Natural Gas closed at 250, in the last session. However, if it sustains above 262, further positive momentum could unfold in the short term. An intraday move is likely above 262, which may open the way for targets of 264, 267, and 275. On the downside, a break below 254 could trigger selling pressure and lead prices toward 251, 247, and 243.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

The Case for Investment in Gold

This blog explains why gold remains a strong, long-term investment by showcasing its performance during inflation, financial crises, and market volatility. Discover how gold can diversify your portfolio, preserve wealth, and offer stability in uncertain economic times.

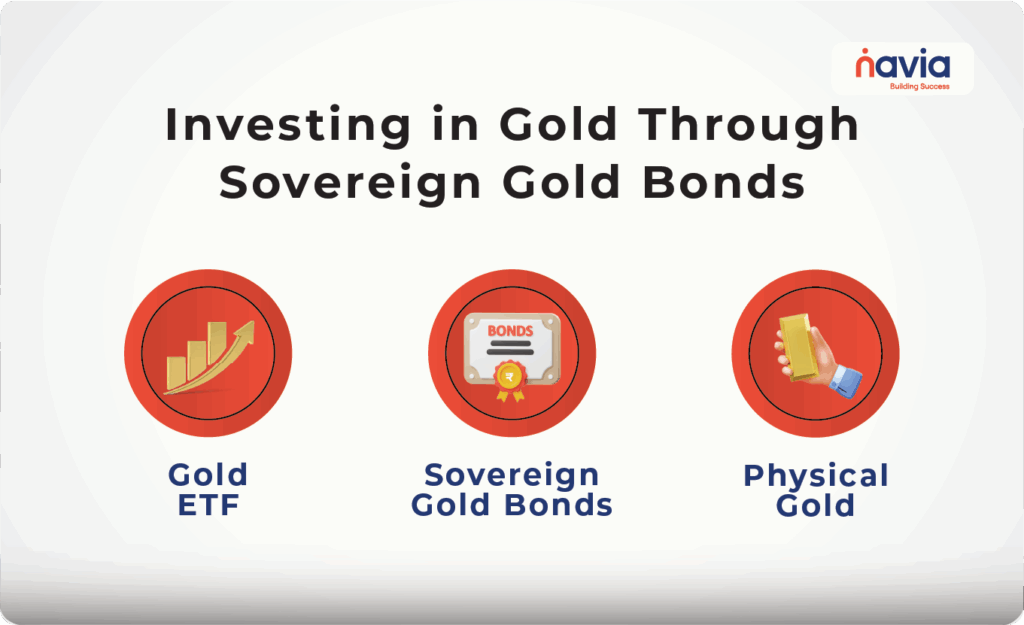

Investing in Gold Through Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) are government-backed securities that offer a secure and tax-efficient way to invest in gold, with added benefits like 2.5% annual interest, no storage risk, and capital gains tax exemption if held till maturity.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?