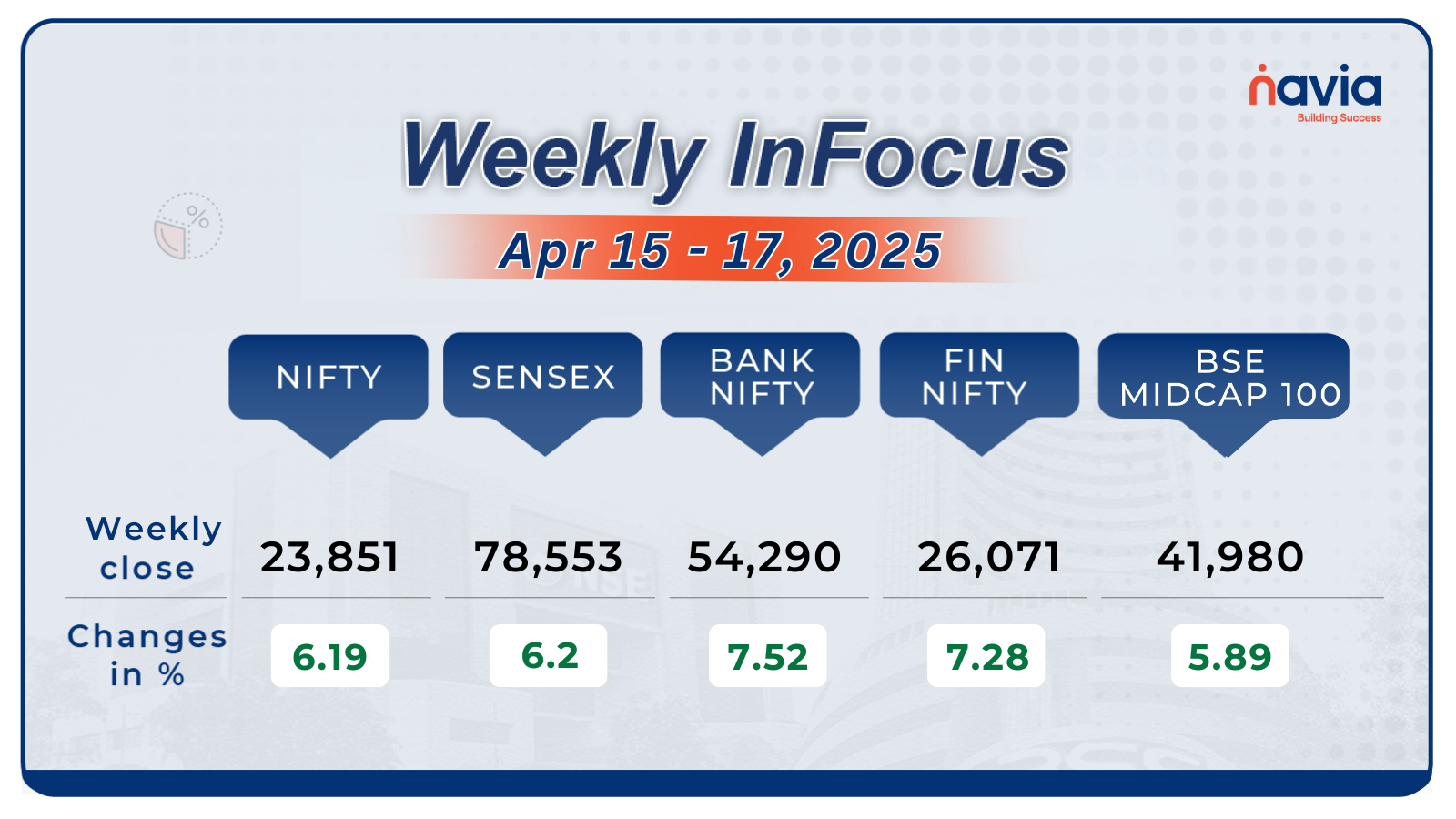

Navia Weekly Roundup (Apr 15 – 17, 2025)

Week in the Review

The Indian market posted biggest weekly gains since February 2021 led by buying across the sectors amid continued FII inflows, 5-year low inflation, soft crude oil prices, hopes of above-normal monsoon and no harm from the escalating US-China trade war.

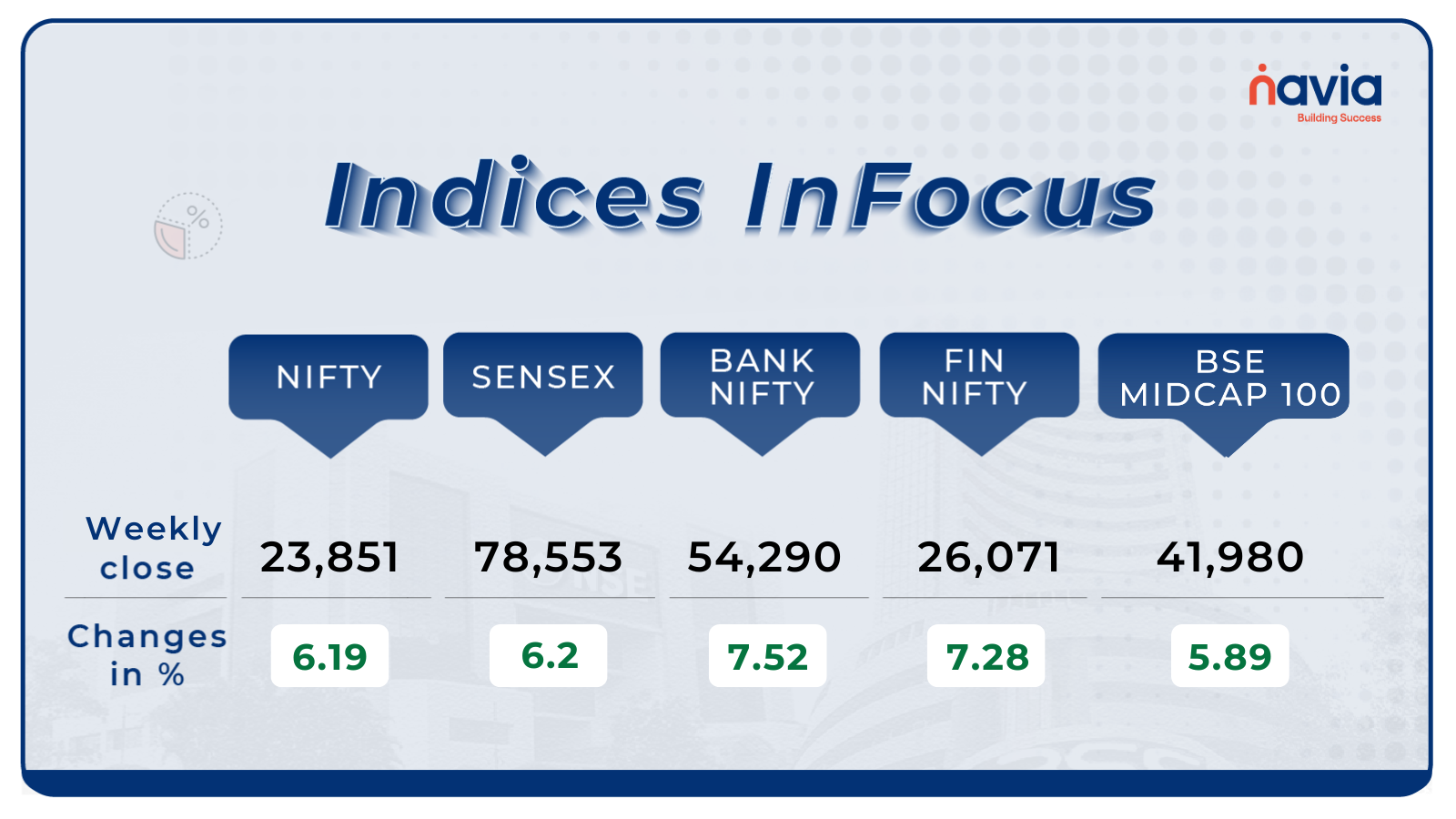

Indices Analysis

For the week, the BSE Sensex index surged 6.2 percent to finish at 78,553.20, and Nifty50 added 6.19 percent to end at 23,851.65.

The BSE Small-cap index added 4.7 percent with Mercury Ev-Tech, Cupid, Goldiam International, Magellanic Cloud, Fino Payments Bank, Rajoo Engineers, Optiemus Infracom, Gujarat Themis Biosyn, Garware Hi-Tech Films, Shilchar Technologies, Krystal Integrated Services gaining between 18-28 percent. However, losers included Gensol Engineering, Easy Trip Planners, Valiant Organics, Sai Silks Kalamandir, Hampton Sky Realty, KR Rail Engineering.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

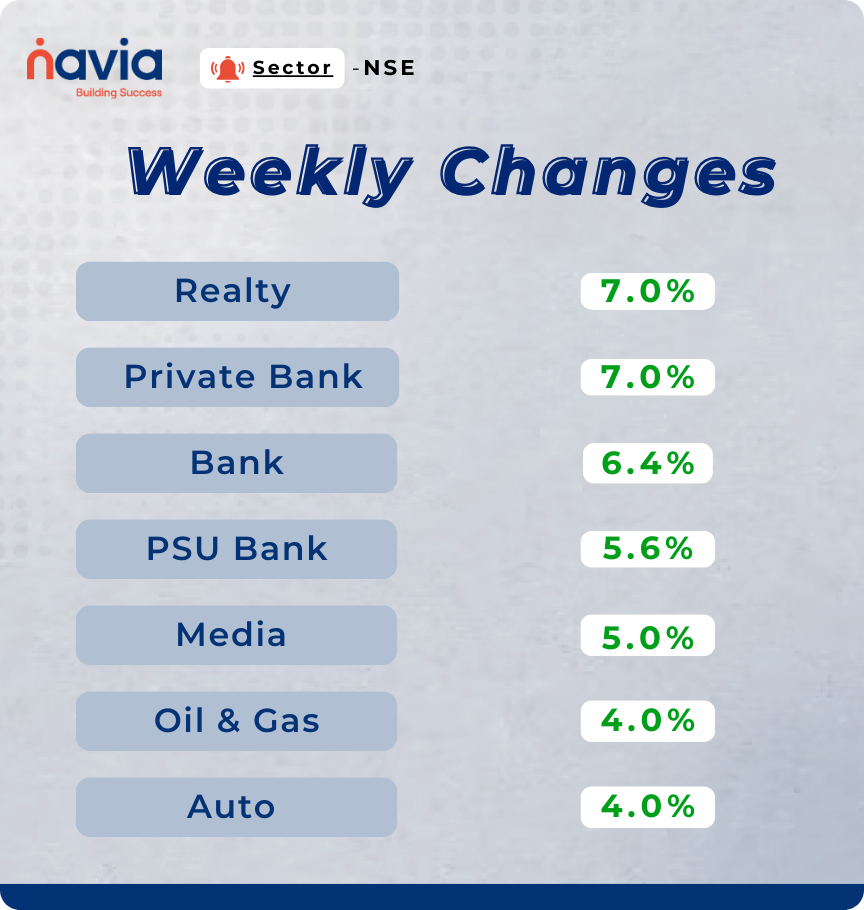

Sector Spotlight

All the sectoral indices ended in positive territory with Nifty Realty and Private Bank indices surged 7 percent each, Nifty Bank index added 6.4 percent, Nifty PSU Bank index rose 5.6 percent, Nifty Media index jumped 5 percent and Nifty Oil & Gas and Auto indices were up 4 percent each.

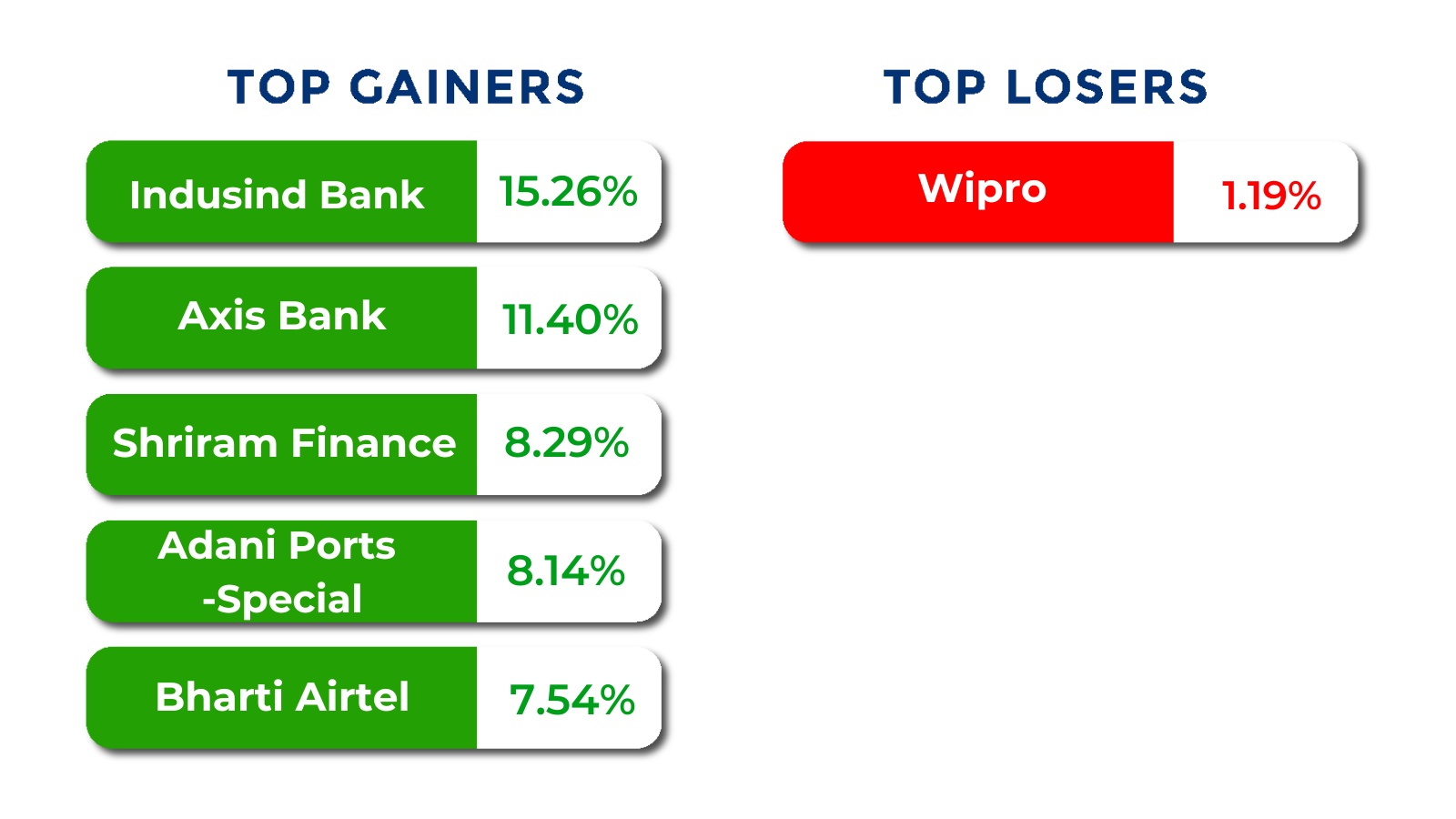

Top Gainers and Losers

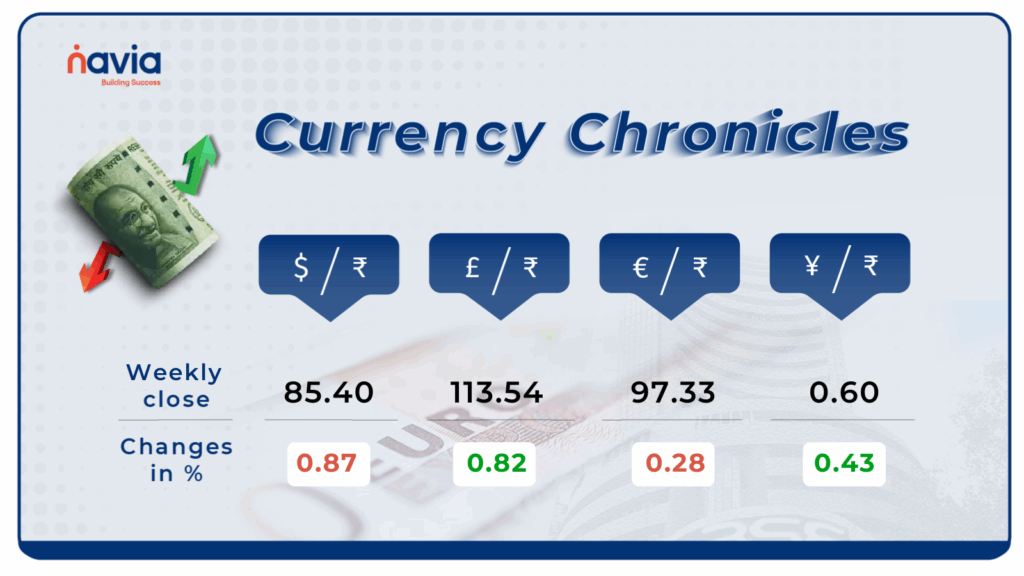

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹85.40 per dollar on April 17. The rate declined by 0.87% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹97.33 per euro, declining by 0.28% during the week, reflecting a neutral market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.60 per yen, gaining 0.43% during the week, reflecting a neutral market sentiment.

Stay tuned for more currency insights next week!

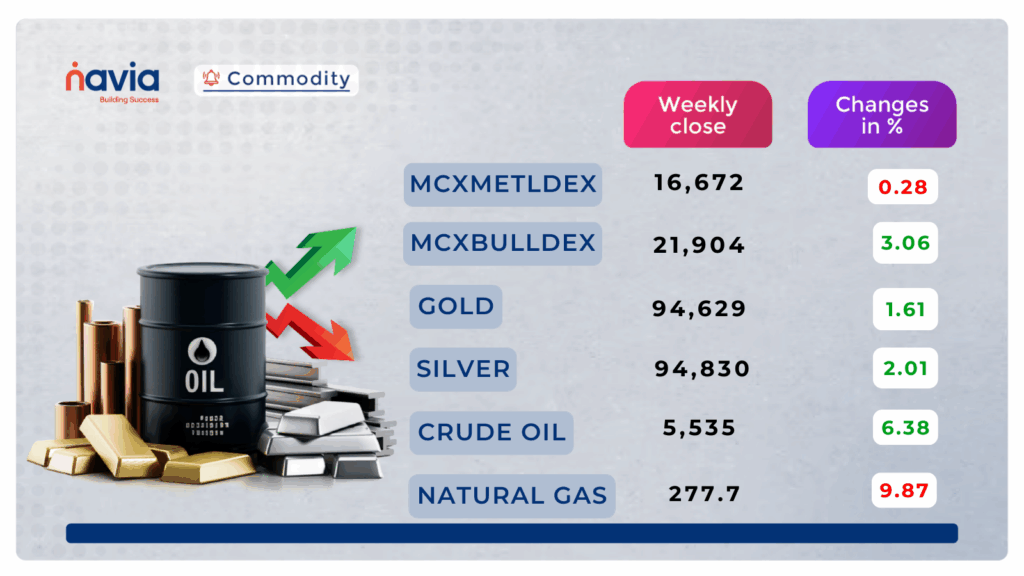

Commodity Corner

Crude Oil has been experiencing a strong sell-off over the last few sessions, closing at 5,535. Further momentum is expected above 5,375 for an upside move or below 5,295 for a downside move. If Crude Oil sustains above 5,390, upward momentum can be expected.

Gold experienced significant volatility in the last session, trading within an ascending channel on the 4-hour chart. It closed at 94,629 trading at an all-time high. Currently, it is trading near the ascending channel breakout zone. If it sustains above the 94,000 level, further upward momentum is expected. For intraday trades, a move above 95,887 may signal upside potential, while a dip below 95,119 could indicate further downside.

Natural Gas traded within a descending channel on the 15-minute chart and is currently at 277.7. If it sustains above 288, further positive momentum could follow. An intraday move can be expected above 284 for upside momentum or below 275 for downside momentum. The last session closed down settling at 277.7.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Gold Discount Sale – SGB

Several Sovereign Gold Bond (SGB) series are currently trading below the spot price of gold—offering up to 6.74% discount. This allows investors to gain gold exposure at a lower cost while earning 2.5% annual interest. It’s a smart move for those looking to diversify beyond physical gold or ETFs.

Understanding Tariff Wars: What They Are and How They Impact Economies?

Tariff wars arise when countries impose import taxes on each other’s goods, leading to trade disruptions, higher prices, and economic uncertainty. While they hurt global supply chains, India could benefit in areas like pharmaceuticals and textiles as global companies seek alternatives to China.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?