Navia Monthly Market Spotlights- October 2023

Indian Market Performance

In October, Indian stocks faced significant challenges due to a confluence of factors, which included the ongoing Israel-Palestine conflict, outflows of foreign portfolio investments (FPI), rising US bond yields, and the strengthening of the US dollar.

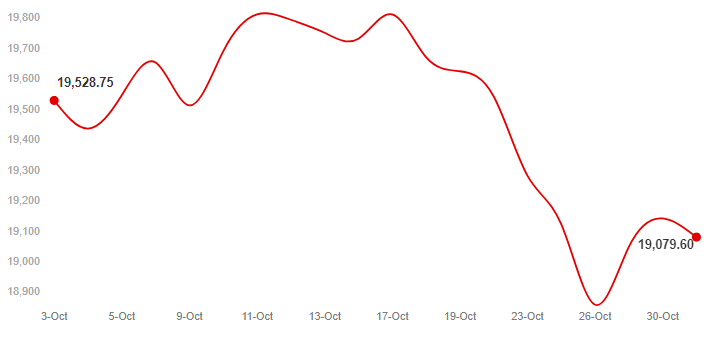

The benchmark NSE Nifty 50 fell 2.84 percent to 19,079, while the S&P BSE Sensex settled 2.97 percent lower at 63,874. They have lost nearly 3 percent each in October.

For any further queries, you can now reach out to us on Whatsapp!

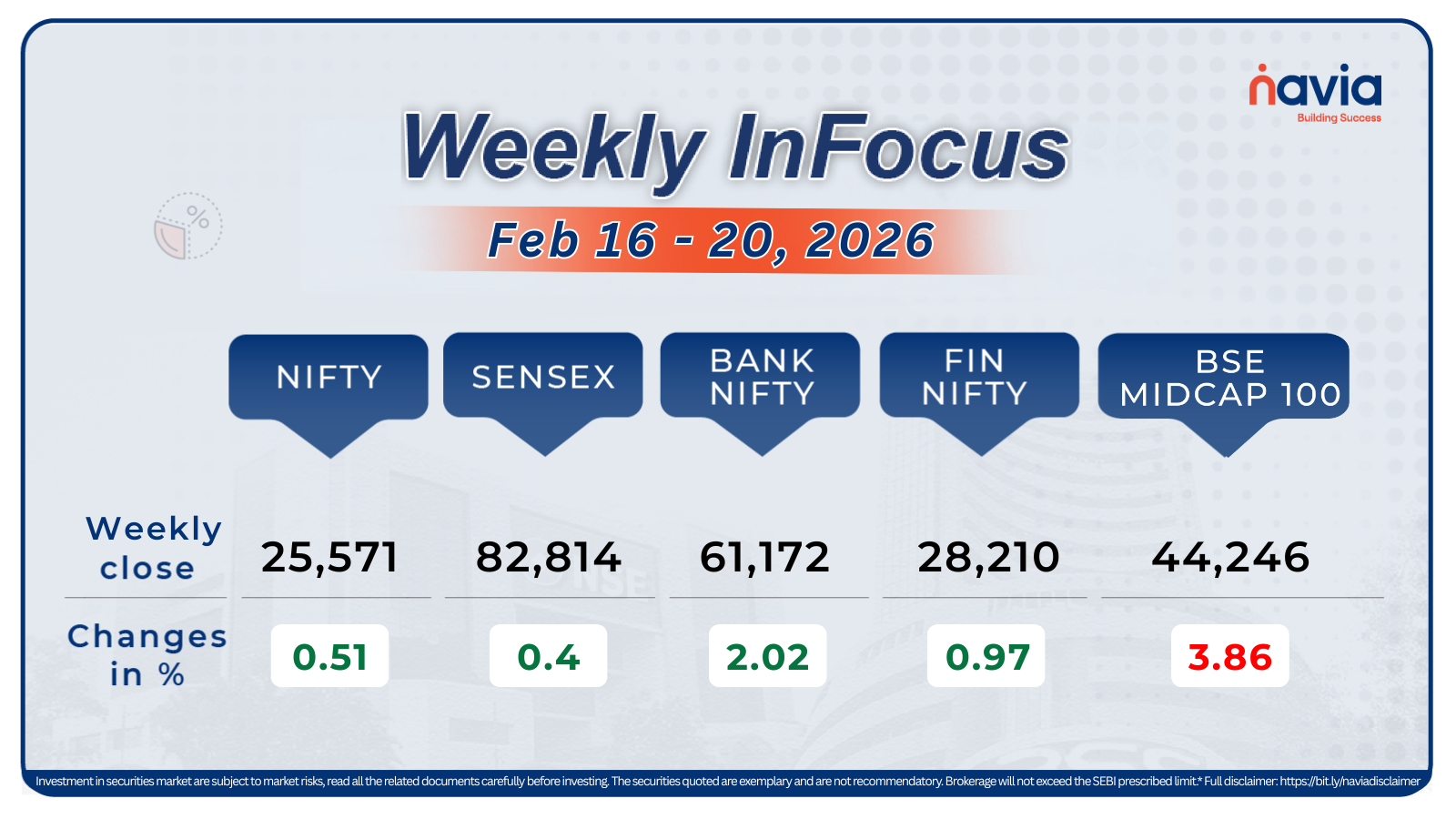

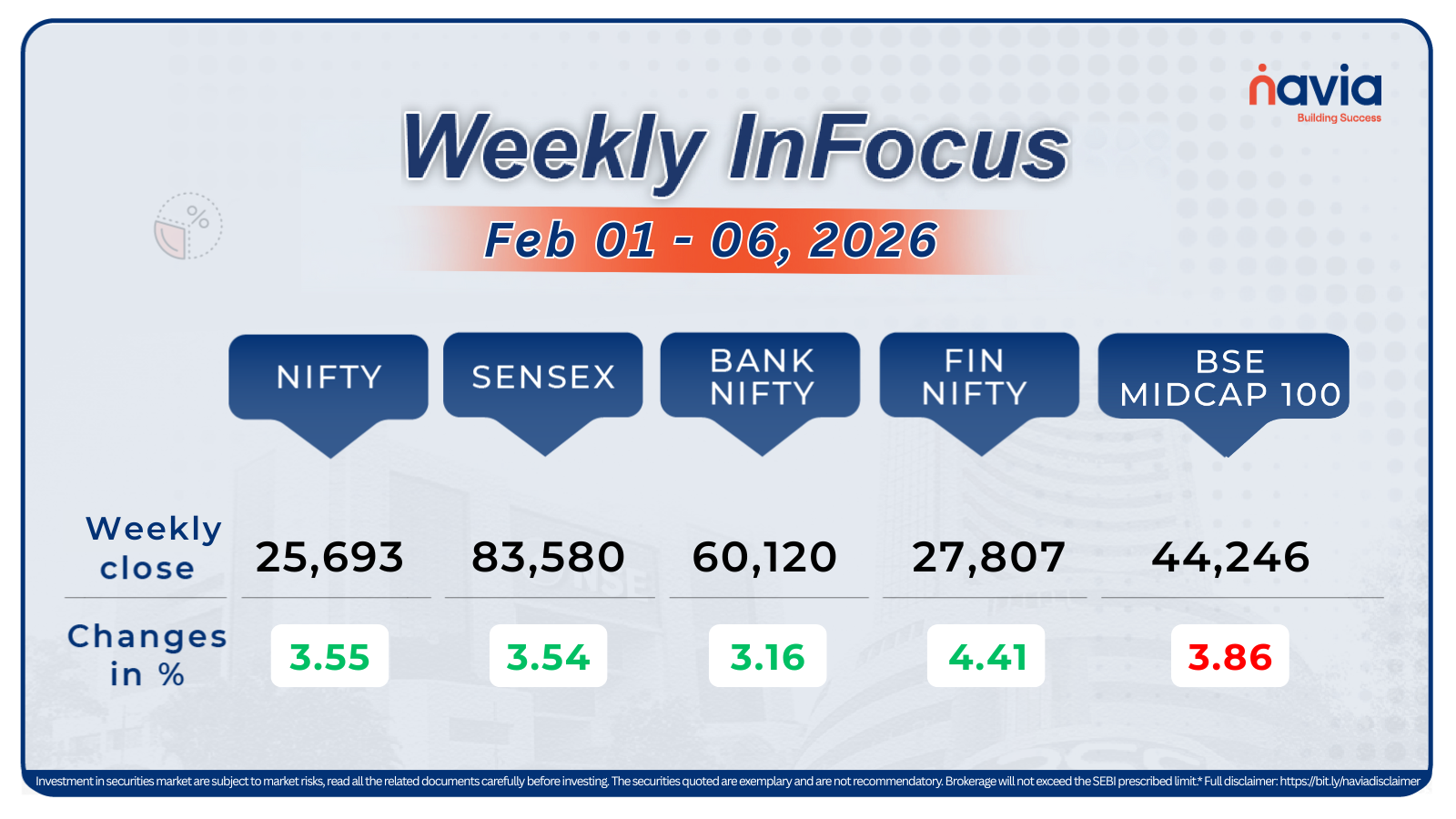

Indices Analysis

Nifty 50 as of start of month opened flat and then during the first half of the month INDICES have been observed providing gaps in the market by moving upside by giving gap up and trading sideways during the day . Overall Index after second half of the month failed to break 19,800 and faced a rejection from the levels and provided a 1000 points net loss. Now nifty has took support form 200 Ma plot on daily timeframe 18,800 can be considered as crucial support during the month. Any close below the levels can provide a move till 18060 levels

Banknifty has provided the same gaps as nifty trying to breach 44,800 levels acting as a crucial resistance in banking sectors. After facing rejection BN from second half of the month provided 1700 points downfall . Now BN has crucial support at 42,000 any close below the levels can create more selling pressure.

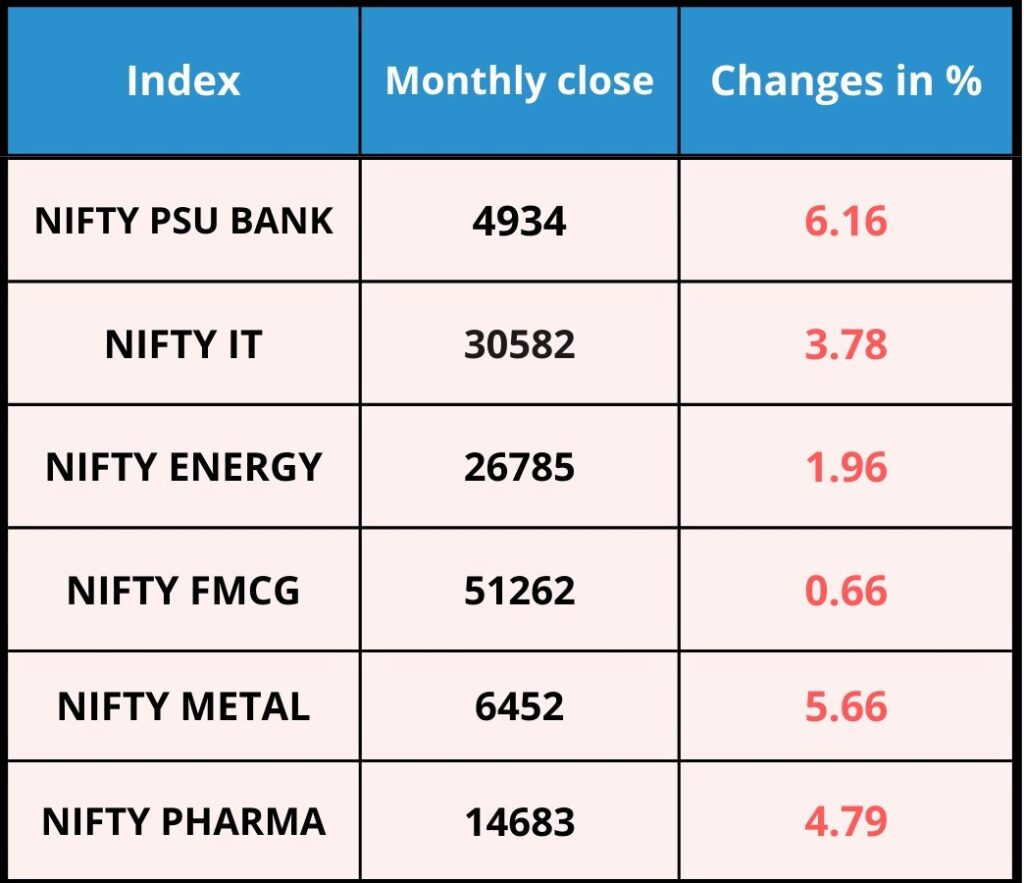

Sector Performance

In October, the Nifty PSU Bank experienced a significant 6.16% decline, marking its most substantial monthly drop since February 2023. Similarly, the Nifty Metal also recorded a fall of 5.66% during the same period. Additionally, the Nifty Pharma and Nifty IT indices experienced declines of 4.79% and 3.78%, respectively.

Nifty Chart

The Nifty 50 tumbled 2.84% in October, marking the largest monthly drop in CY23. From its all-time high of 20,222 points, the index is currently down by 6.04%.

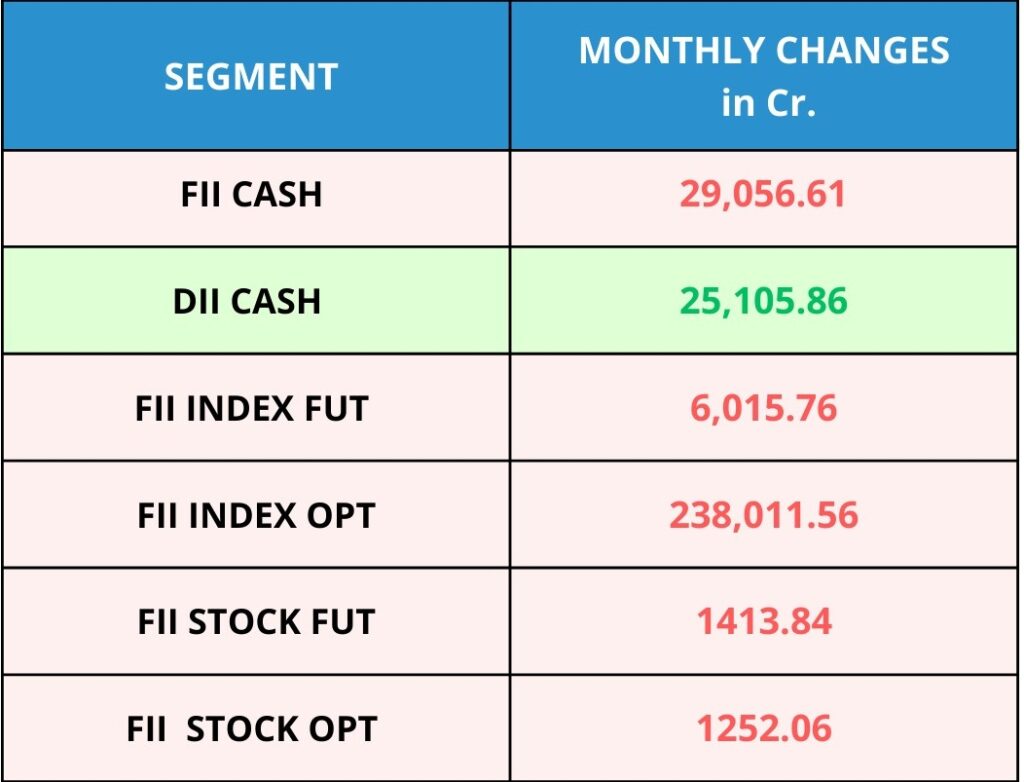

FII & DII Activity

Overall FIIS have been net sellers in market by being negative on every segment and has sold highest value of Index options. In other side DIIS are strengthening the markets buy being net buyers in the market. An FII VS DII fight is visible here due to global News & Impact

Refer your Friends & Family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

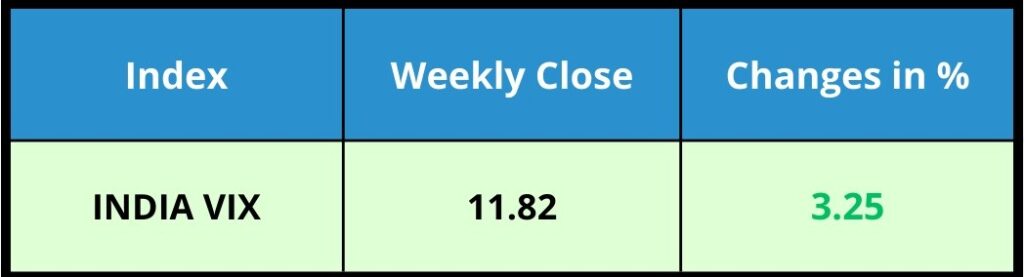

Volatility Index

Market volatility saw a decrease, with India VIX up by 3.25 percent.

Global Market

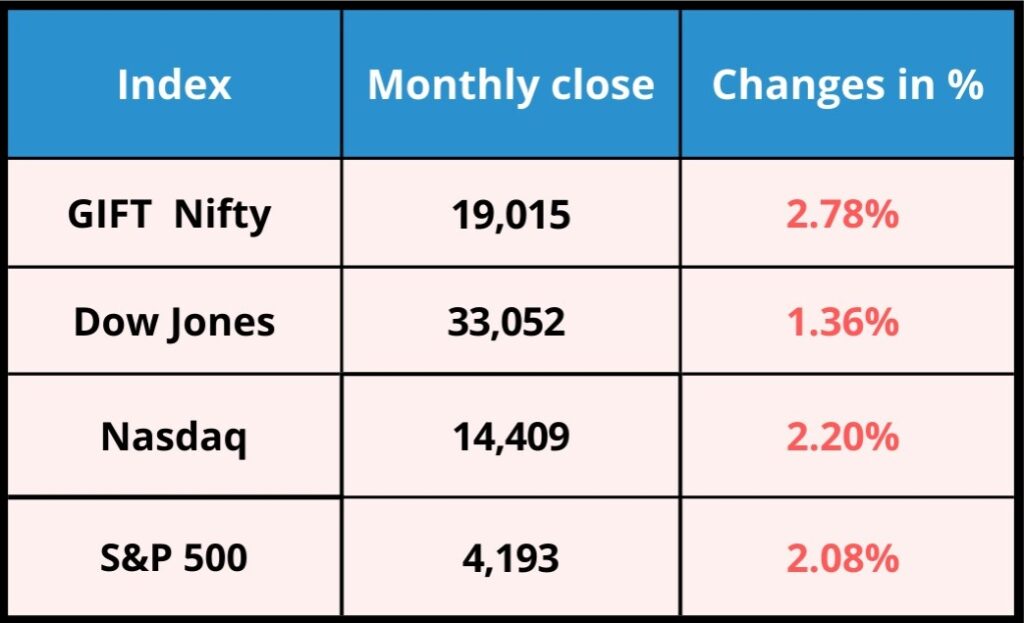

GIFT NIFTY:- 19,015

GIFT nifty is consolidating in the range of 1000 points since last 4 months

DOW JONES:- 33,052

DJI has a base support at 32,450 any close below levels can create chaos in Index

S&P 500 :- 4,193

Index after providing a rally now it is been sustaining its retest level at 4,200

Nasdaq:- 14,409.78

Nasdaq may sustain above 14,000 levels.

Currency Indices

Indian rupee lost some ground against the US dollar as it ended 21 paise higher in October at 83.23 versus its November closing of 83.02

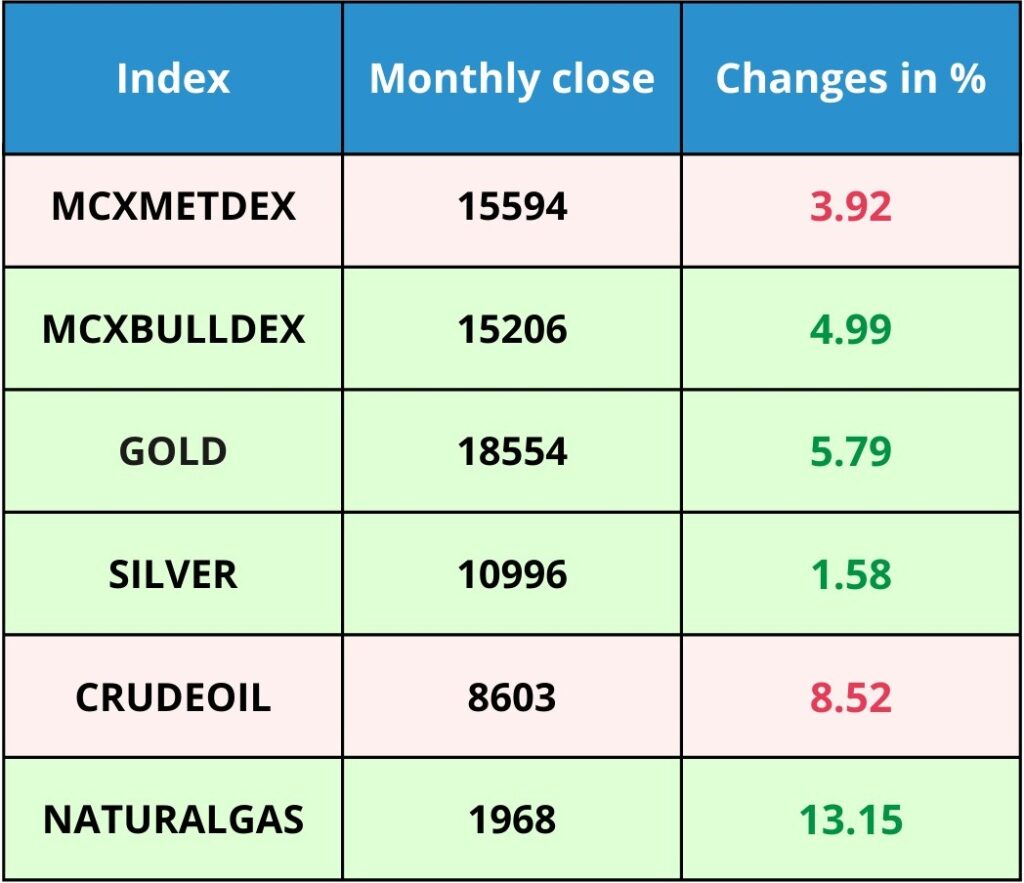

Commodity Market

Gold has been exhibiting an upward trend over the past month, closing at 18554 with an increase of 5.79%

Crude oil futures have shown an increase in first half of October in Asian trading. Geopolitical tensions in the Middle East are contributing to oil price volatility.

Upcoming Webinar

Key blogs for November

Refer your Friends & Family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

Happy Learning,

Team Navia

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.