Navia Monthly Market Spotlights- November 2023

Indian Market Performance

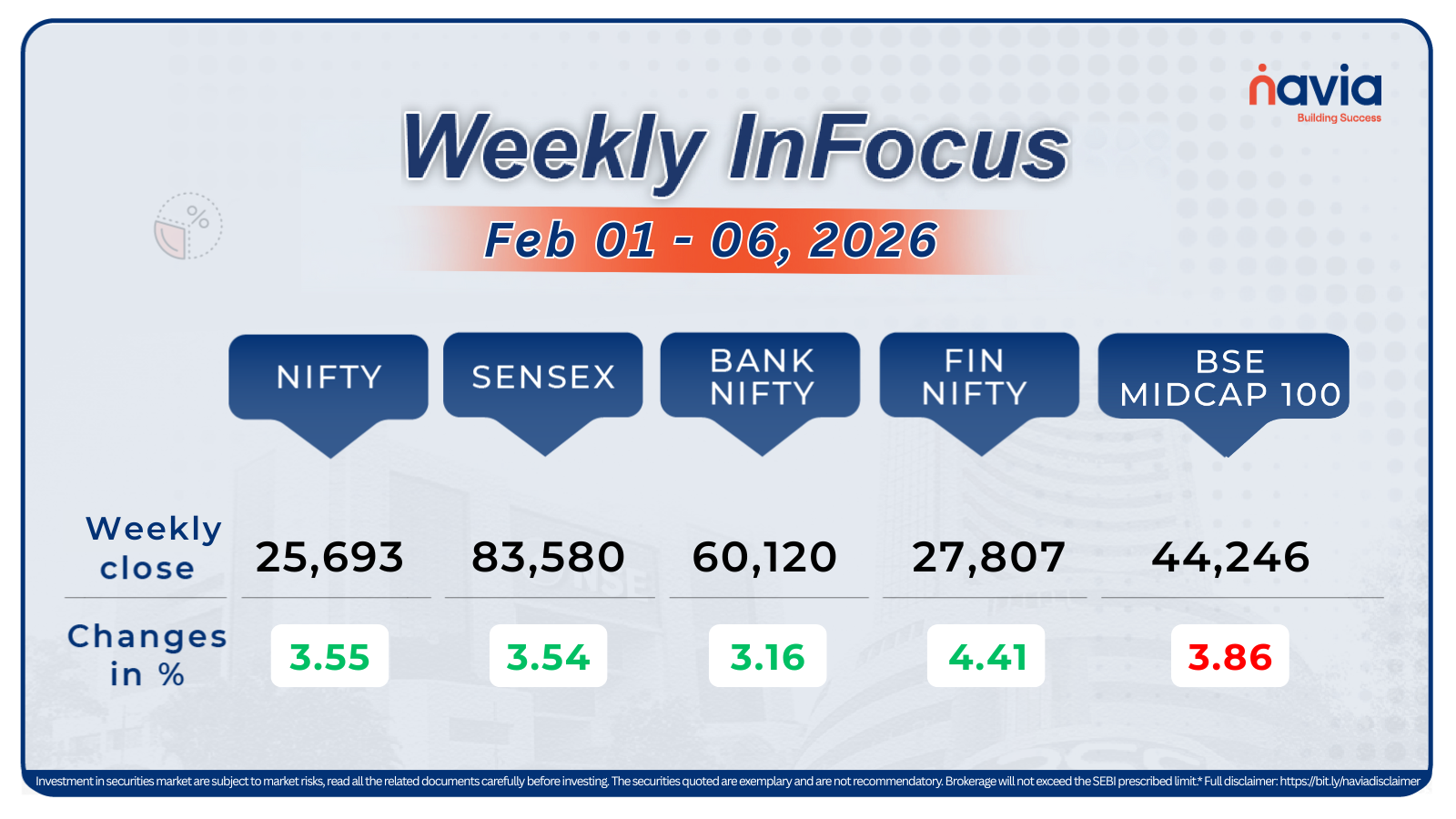

In November, the Sensex rose nearly 4.87 percent and Nifty50 rose 5.52 percent.

The Indian equity market surged, propelling the Nifty50 to reach a new record high of 20,291.55 in the month’s closing session. This upward trend was fueled by favorable global and domestic economic data, sustained support from foreign institutional investors (FIIs), and diminishing worries about potential interest rate hikes by the Federal Reserve (Fed) and the European Central Bank (ECB) in the future.

Indices Analysis

NIFTY 50 :- Nifty 50 has shown a aggressive upside movement after getting corrected for 3 months from It’s demand zone of 18,900~19,000 from the start of month . Nifty large cap stocks if we observe are away from the their previous all time highs.

BANK NIFTY :-The BN indices have consistently displayed a recurring pattern on a month-on-month basis, maintaining levels above the crucial institutional threshold of 43,200. Throughout the month, buying pressure has remained on the rise for BN, with the added boost of the public sector undertaking (PSU) sector bolstering the overall strength of the banking segment.

Sector Performance

The sectors were strengthened as we can observe the rally of Mid and small cap currently going on.

Nifty Chart

The Nifty continues to ascend as the bulls maintain control. A consolidation breakout on the weekly time frame seems probable, paving the way for a further rally in the index.

The sentiment remains upbeat, marked by a bullish crossover in the weekly RSI. At the lower end, support stands firm at 20,200; any declines could be seen as buying opportunities as long as it holds above this level. On the higher end, resistance is anticipated around 20,450-20,500

FII & DII Activity

Overall FIIS have been net buyers in market by being positive on all segment excluding options and has sold highest value of Index options.

Refer your Friends & Family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

Volatility Index

India VIX at 12.69 reflects low volatility, experiencing a monthly change of 7.32.

Global Market

GIFT NIFTY : GIFT nifty has provided a breakout from ATH ( all time high) and now its sustaining above previous ATH Levels.

Dow zones: Dow has followed the same structure as other indices . The index has sustained above previous month’s low and formed a higher bottom.

S&P 500 : Index after correction of 3 months has sustained above 4,187.84 levels which is major demand zone .

Nasdaq: Nasdaq has sustained above previous month low from 14,058 forming a higher bottom this month.

Currency Indices

The rupee ended at 83.33 against the US dollar, lower by 0.08 percent, The local unit posted a slight monthly loss of 0.13 percent.

Commodity Market

Oil prices are recovering from a decline of 5.90% last on investor skepticism about the depth of supply cuts by the Organization of the Petroleum Exporting Countries and allies including Russia, together called OPEC+, and concern about sluggish global manufacturing activity.

Key blogs for November

Refer your Friends & Family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

Happy Learning,

Team Navia

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.