Navia Mobile: Trade Better with Our Latest Update!

Navia, has just received its latest update! Check out Now!

We are thrilled to announce that our premier trading platform, Navia, has just received its latest update! Our dedicated team has worked tirelessly to implement a range of new features that are designed to enhance your trading and investment experience.

We’ve listened carefully to the feedback and suggestions provided by our customers, and have used this invaluable information to create features that are tailored to your needs. This update is a testament to our commitment to delivering the best possible service to our customers.

Navia is pleased to bring the following updates:

(i) Transparent Trading Charges with Navia

(ii) New Easy Screener

(iii) Simplified Charts for Clear Insights

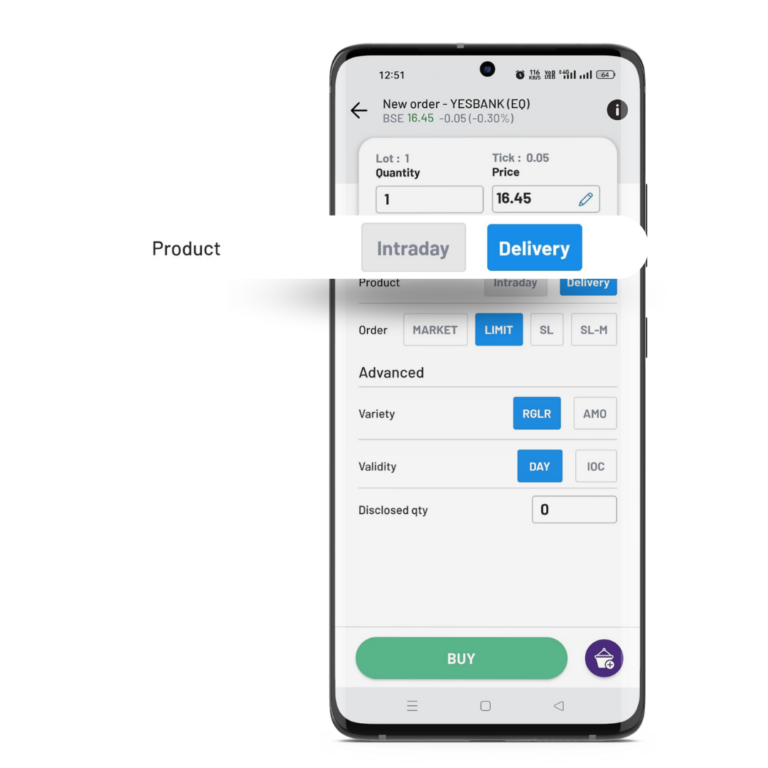

(iv) Intra-day option auto disabled in Order form for securities where intra-day order is not allowed.

(v) Wider range of Options Strikes and Expiry to Trade with.

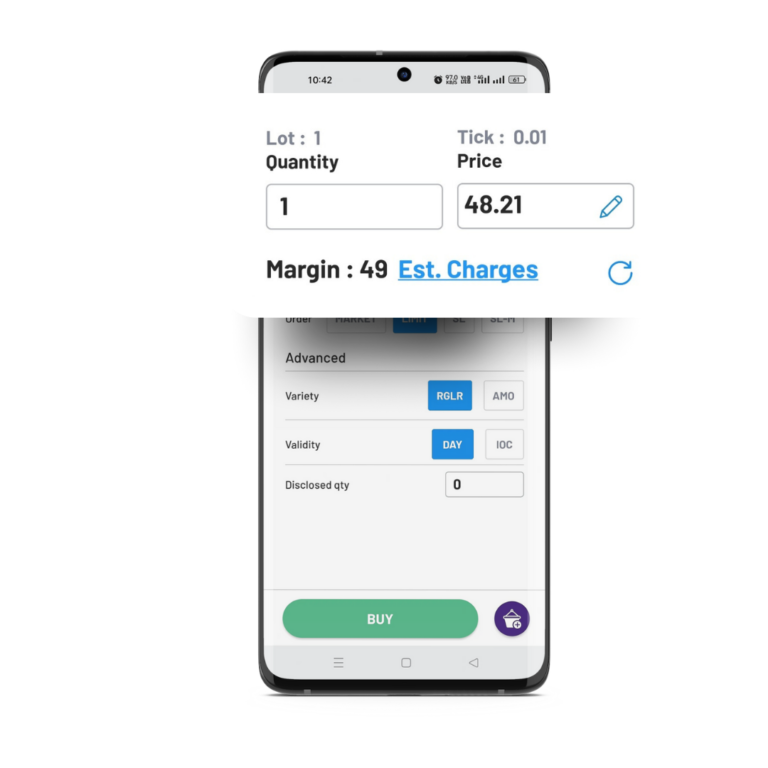

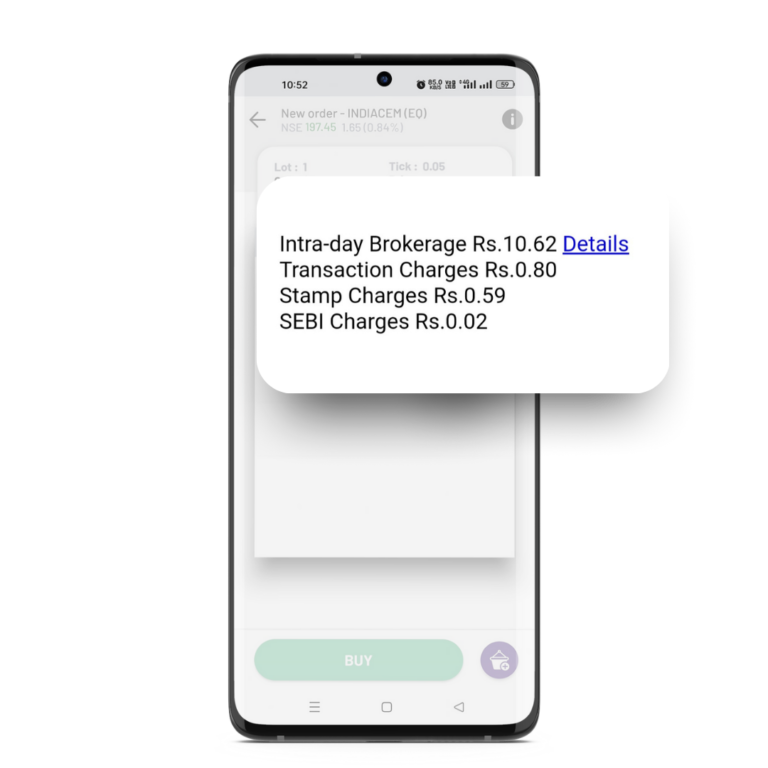

Transparent Trading Charges with Navia

The Regulators had recently mandated all brokers to display the charges in the trade screen at the time of placing orders to ensure transparency to clients. At Navia we strive to comply with all Regulatory Requirements and in pursuant to that, we’ve introduced a new feature that allows you to get a clear idea of your trading charges before you make a trade.

No more guesswork or unexpected surprises when it comes to trading costs. With this feature, you can see exactly what fees and charges you’ll incur, helping you to plan your trades and manage your investments with confidence. Please note that charges are near approximations. Refer to your contract note for the exact charges.

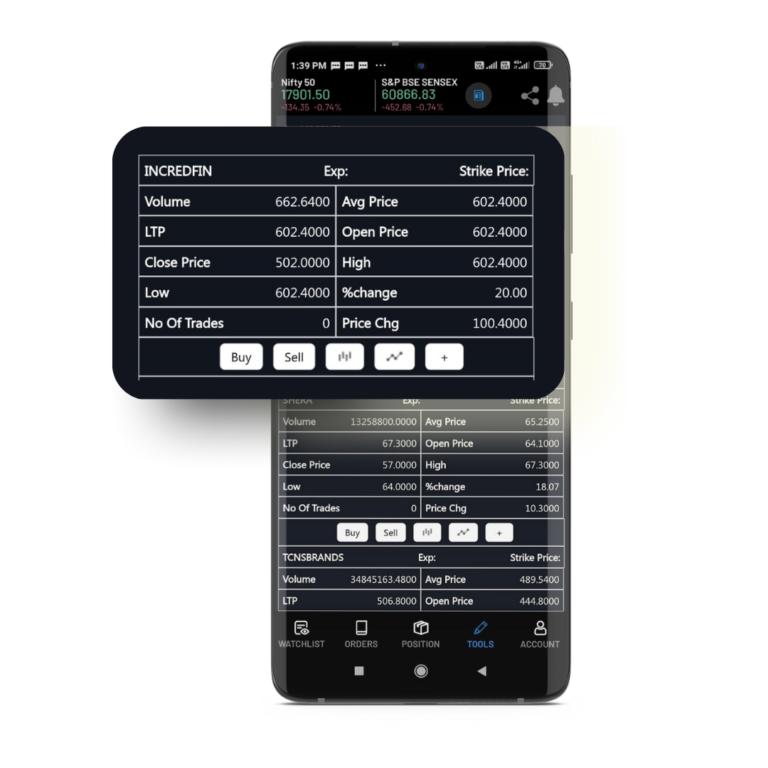

New Easy Screener

One of the key updates we have introduced is a new and improved screener UI. This feature is designed to provide an intuitive and user-friendly way to scan for stocks based on various criteria, making it easier for you to identify trading opportunities that align with your investment strategy.

With the updated Screener, you can easily track top gainers and losers across exchanges and market segments, giving you the knowledge and insight needed to make informed investment decisions. We’re dedicated to providing the best possible experience for our users, and this easy & modern design ensures a seamless and enjoyable experience.

Investing in the stock market can be an exciting and profitable venture, and we’re thrilled to offer a platform that makes it accessible and approachable for all. With our user-friendly interface and advanced tools, you’ll be able to make informed investment decisions and maximize your earning potential.

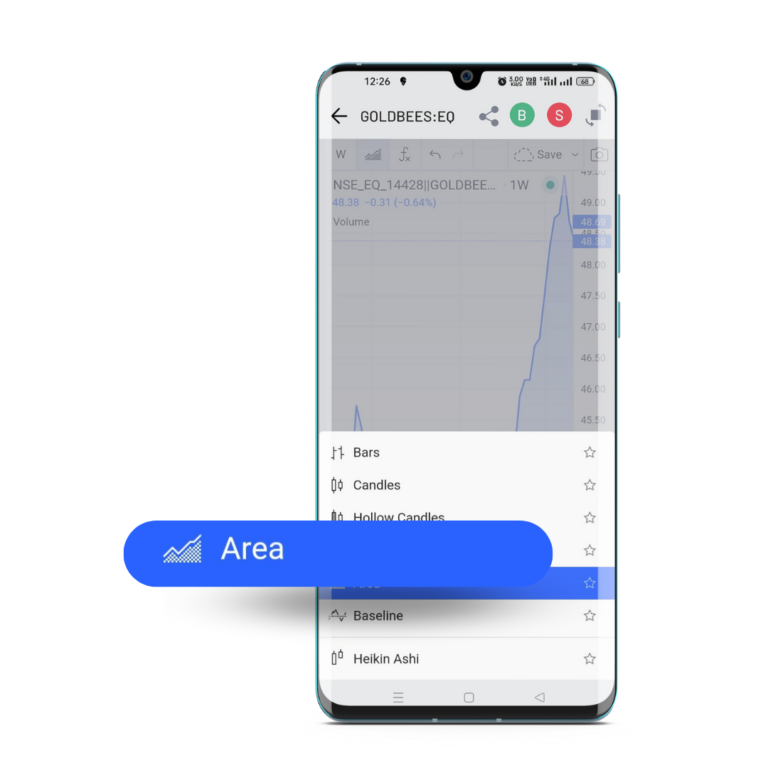

Simplified Charts for Clear Insights

In addition, we have modified our charts to provide a more comprehensive analysis of market trends. With new charting tools and features, you can gain a deeper understanding of the movements of the market and make informed investment decisions.

We’ve made it even easier to monitor market trends with our latest update. Area charts have been set as the default chart type, providing a quick and easy way to stay on top of price movements. But don’t worry – if you prefer a different chart type, it’s simple to switch to your preferred layout with just a few clicks. At Navia, we’re committed to providing the best possible trading experience, and that includes giving you the tools you need to monitor the market with ease.

Intra-day option auto disabled in Order form for securities where intra-day order is not allowed

As per our Risk Management Policy intra-day orders are allowed in the EQUITY segment only for stocks on which there are derivatives. There are currently about 198 stocks that have derivatives and hence intra-day equity orders are allowed only for these stocks where the margin is 20%.

We found many clients trying to place intra-day orders on stocks which are not having derivatives I.e. apart from the 198 Derivative stocks. Such orders were accepted by the front-end platform but rejected by our RMS systems in the backend. We have now brought this check to the front-end system itself to save our clients the hassle of such rejections. Now the Intraday option for equity orders would only be enabled in the front end only for Stocks that have derivatives otherwise it would be auto-disabled in the order form.

A wider range of Options Strike and Expiry to Trade with

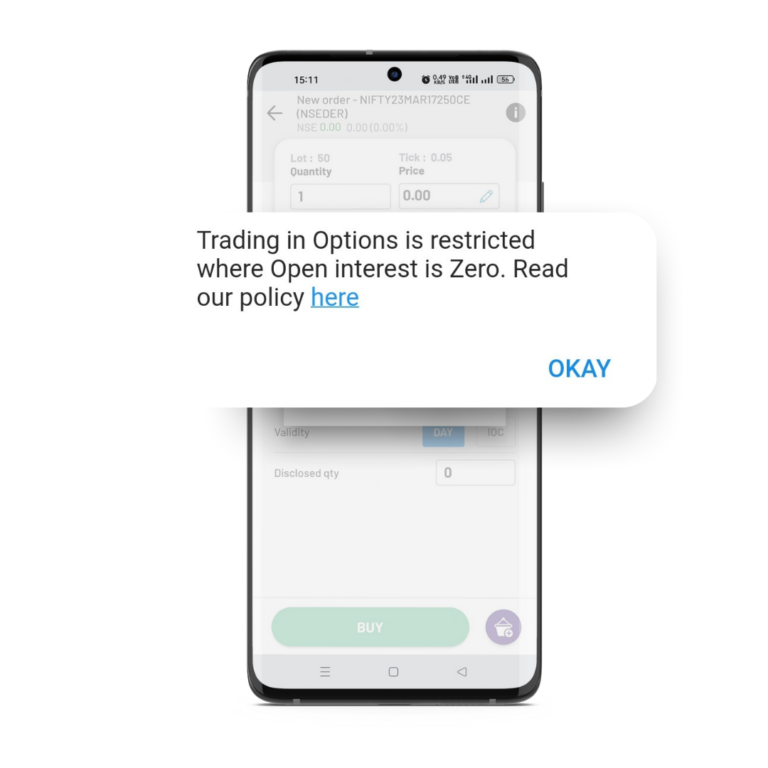

We have been receiving feedback from our options traders to enable them to trade in wider/more Options strikes instead of restricting them from trading within a narrow range. While we took their feedback we also combined it with certain checks to ensure that they get an opportunity to trade in wider strikes and at the same time protect themselves from diving into illiquid contracts which have the risk of non-transparent price discovery.

You may now Sell Options in the range of up to 15% OTM and 15% ITM. Within this 15% range, Options with Zero Volume and Zero Open Interest will be dynamically blocked.

Market Orders are blocked for Option Purchases. Now that that range is higher, blocking market orders will protect you from accidental purchases of illiquid options at non-transparent or non-theoretical prices. You can still simulate a market order by placing a limit buy order at a slightly higher price than the best ask price.

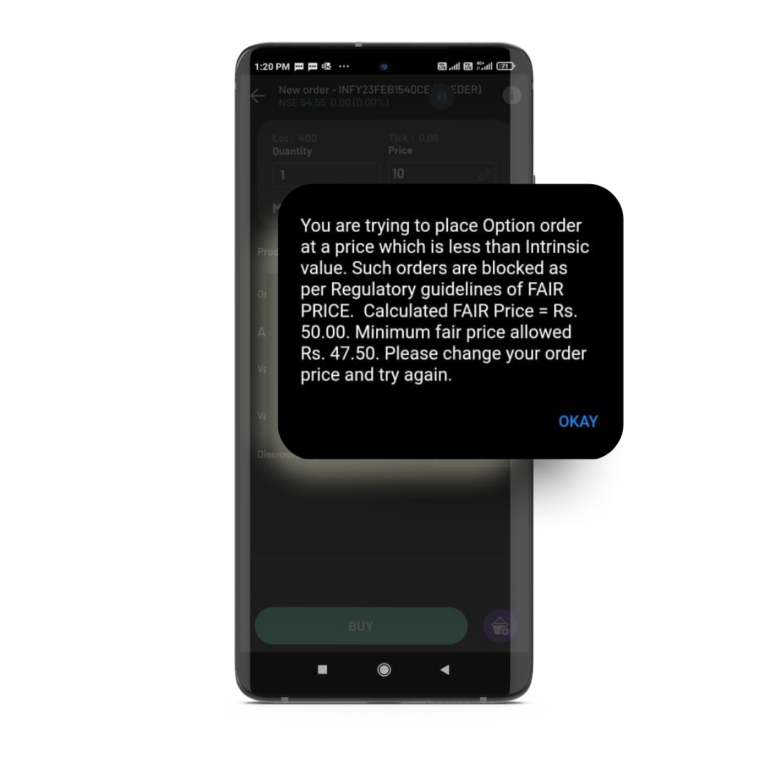

Fair Price Mechanism – Now you would have noticed a message popping up each time you place an order for an ITM option where the price entered by you is less than the Intrinsic value. In fact, it is a Regulatory requirement to ensure that orders placed by clients are not far from their Intrinsic Value. We will allow a 5% deviation from Fair price or Intrinsic Value.

Interested to know more about Intrinsic value? Check here

Market Orders are blocked for Option Purchases. Now that that range is higher, blocking market orders will protect you from accidental purchases of illiquid options at non-transparent or non-theoretical prices. You can still simulate a market order by placing a limit buy order at a slightly higher price than the best ask price.

Fair Price Mechanism – Now you would have noticed a message popping up each time you place an order for an ITM option where the price entered by you is less than the Intrinsic value. In fact, it is a Regulatory requirement to ensure that orders placed by clients are not far from their Intrinsic Value. We will allow a 5% deviation from Fair price or Intrinsic Value.

Interested to know more about Intrinsic value? Check here

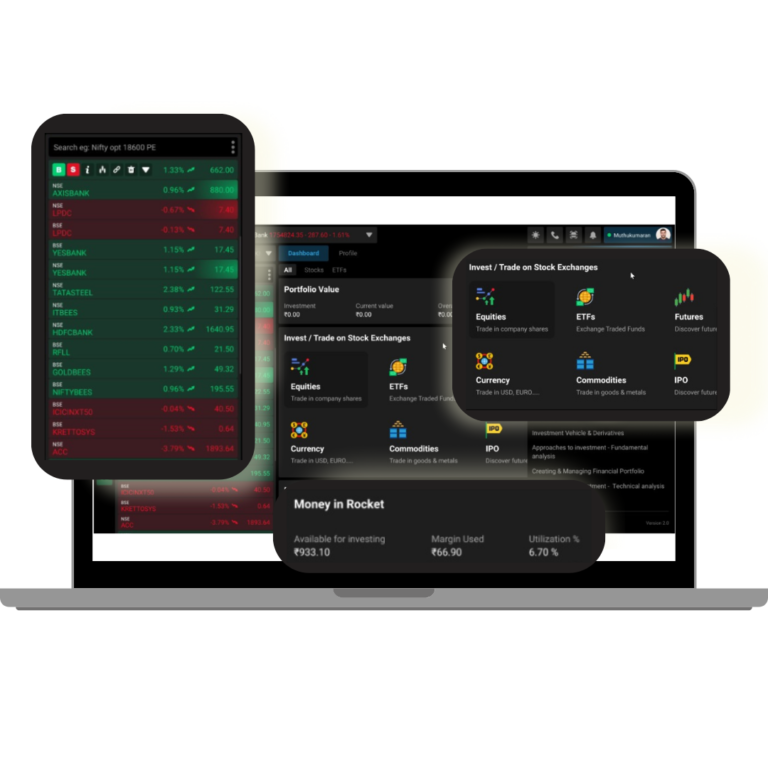

Coming Soon

Rocket Web with a refreshing UI

At Navia, we’re dedicated to providing you the best possible trading experience. We’re proud of the hard work that’s gone into the latest update to Rocket, and we’re confident that these changes will make it easier for you to navigate the world of trading and help you to achieve your investment goals.

Happy Trading,

Team Navia

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.