Mutual Funds or Buying Stocks: Which Is Better for You?

Deciding between mutual funds and individual stocks is like choosing a path toward your money goals. Mutual funds are like a mix of different investments that can give you stable growth and help handle ups and downs in the market. If you dream of steady and safe progress toward your financial goals, mutual funds might be a good choice. Just know that the gains might not be super high, and there could be some fees.

On the flip side, individual stocks let you invest directly in specific companies. If you dream of big returns and enjoy the excitement of company success, stocks might be for you. But be ready for the ups and downs because the stock market can be a bit like a rollercoaster. Your choice depends on what you dream of – steady growth with mutual funds or the potential for big wins with individual stocks. Let your dreams guide your decision, and you’ll be on your way to making the right investment choice for you.

Understanding Mutual Funds

Mutual funds, issued by various mutual fund houses, serve as collective investment vehicles pooling money from individual investors. These funds are then expertly managed by professionals who allocate the pooled resources across diverse financial instruments to potentially yield substantial returns. As an investor, you own units representing your share of the fund, with returns distributed proportionally among unit holders after deducting expenses.

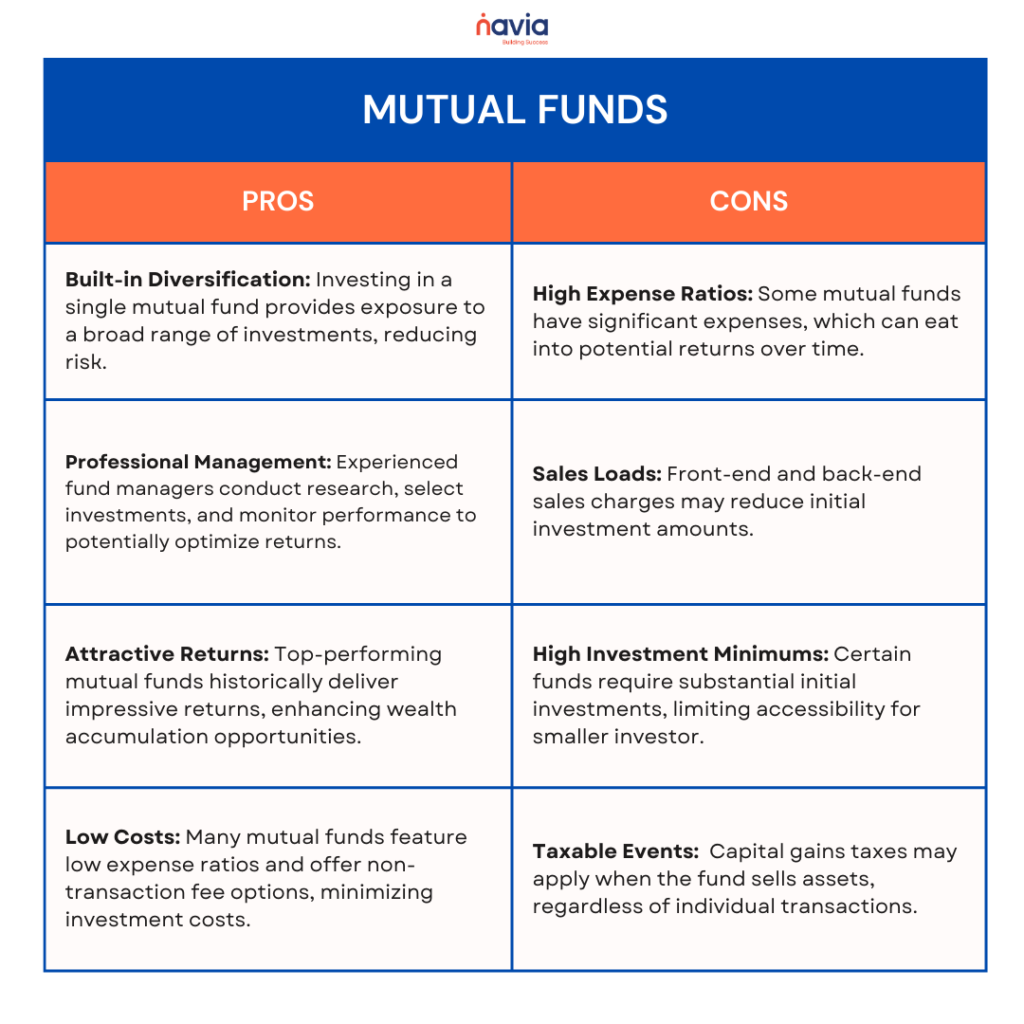

Pros and Cons of Mutual Funds:

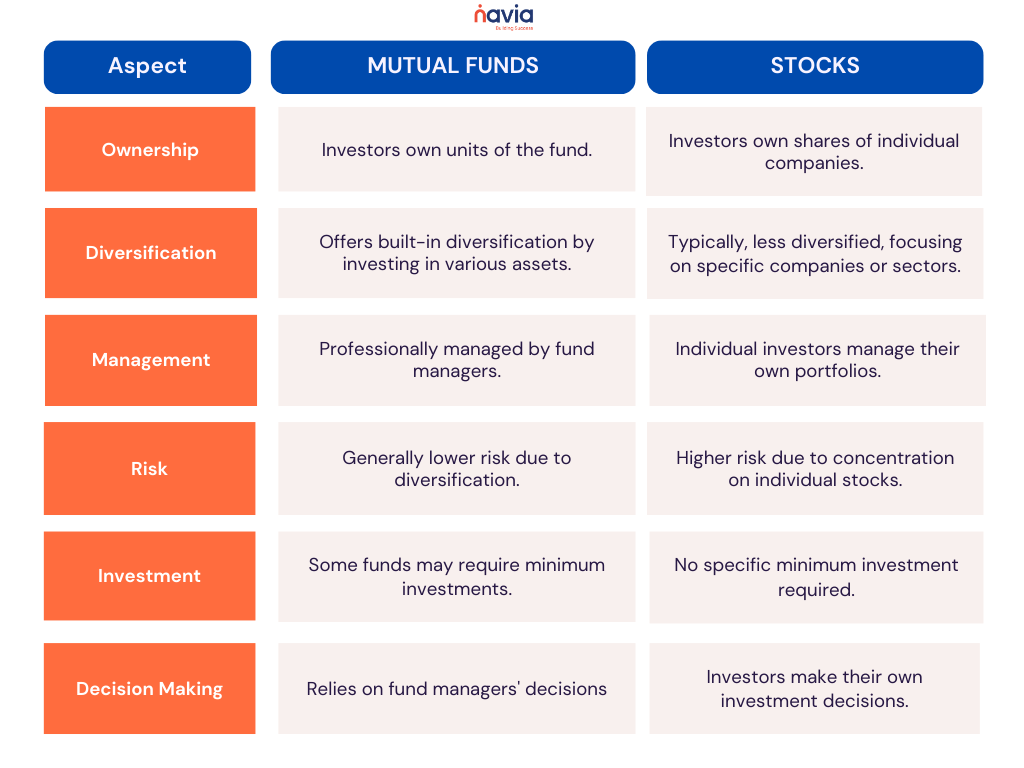

Mutual Funds vs. Stocks

Mutual funds offer diversification and professional management, ideal for risk-averse investors seeking stable returns. Conversely, stocks involve higher risk and require substantial research into individual companies. While stocks may yield greater potential returns, they demand diligent monitoring and entail higher volatility.

Pros and Cons of Stocks:

Are Mutual Funds Safe?

While no investment is entirely risk-free, mutual funds aim to mitigate risk through diversification. Their professionally managed nature and diversified portfolios often render them less volatile than buying stocks.

Wrapping Up: Stocks Vs. Mutual Funds

In conclusion, the choice between mutual funds and individual stocks demands a strategic approach, particularly for traders and investors aiming to optimize returns while managing risks effectively. Delving into the specifics, it’s essential to consider the potential returns and risks associated with each option.

Mutual funds, characterized by diversification across a range of assets, offer investors the prospect of stable, albeit potentially moderate, returns. This strategy tends to mitigate the impact of poor-performing assets on the overall portfolio. However, the flip side involves limited control over individual stock selection and the presence of management fees, impacting potential returns.

On the other hand, individual stocks provide the allure of high returns driven by the success of specific companies. The potential for significant gains comes with an inherent risk, as the fortunes of a single stock can be unpredictable and volatile. The onus is on the trader or investor to conduct thorough research, staying informed about market trends and company performance.

Both options can coexist within a diversified portfolio, offering you complementary benefits. Moreover, you may explore exchange-traded funds (ETFs) as an alternative low risk investment avenue, combining features of mutual funds and individual stocks. They often track specific indices, which are like groups of stocks representing the overall market or a particular sector. When you invest in an ETF, you’re essentially buying a share of a fund that holds a collection of stocks designed to mirror the performance of a specific index, like the S&P 500.

This can offer a lower-risk alternative, as it spreads your investment across various companies, like mutual funds. Exploring ETFs could add more diversity to your investment strategy, combining elements of both mutual funds and individual stocks while being based on the performance of broader market indices

Navigating this decision requires a keen understanding of personal financial goals and risk tolerance. For those seeking a hands-on approach and willing to put in the effort for in-depth research and analysis, individual stocks might be a suitable choice. Conversely, those preferring a more diversified and hands-off approach may find mutual funds align better with their goals.

In summary, traders and investors must weigh the potential returns, risks, and their own risk appetite when deciding between mutual funds and individual stocks. By tailoring their investment strategies to align with these factors, individuals can strive for a balanced and well-informed approach in the pursuit of their financial objectives.

We’d Love to hear from you